Ethereum

U.S ETH spot ETFs lose $36M for 2nd straight day – What’s fueling the outflows?

Credit : ambcrypto.com

- Ethereum ETFs registered $ 10 million, in order that the full outskirts of $ 100 million previously two days

- Is the falling CME ETH yield behind the fixed outflow?

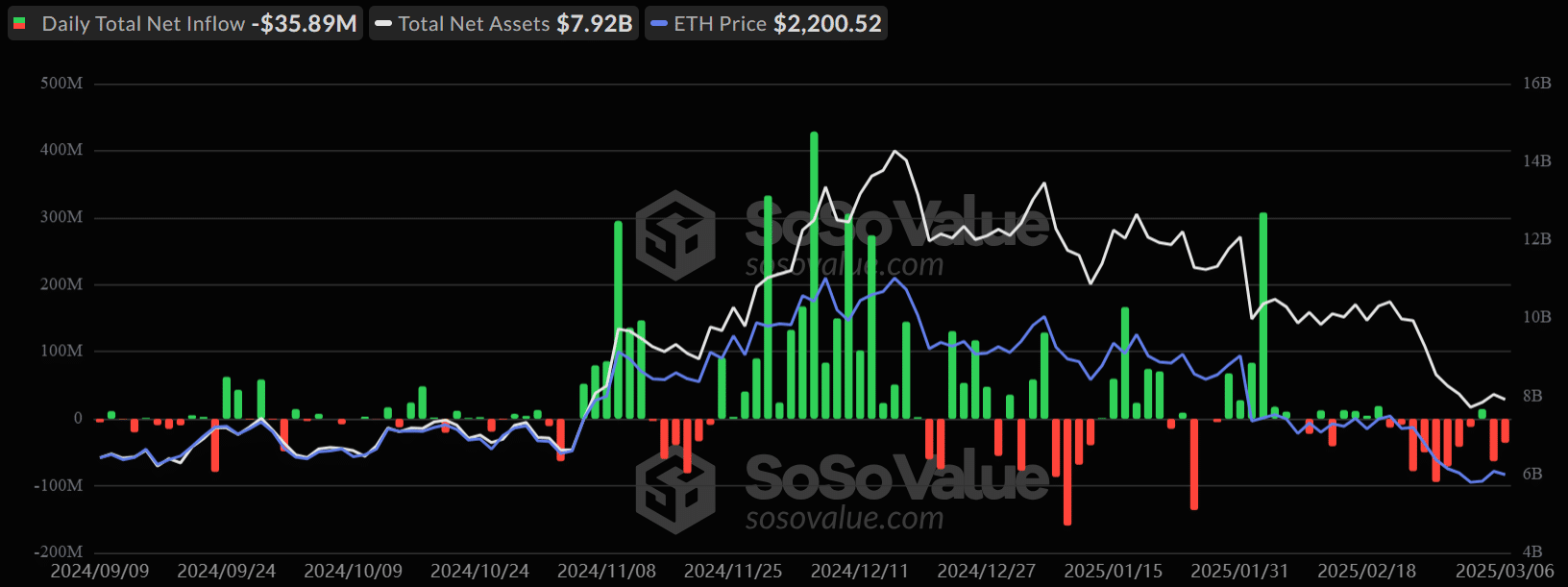

The US Ethereum [ETH] ETFs registered one other $ 35.89 million every day outflow on March 6, which marked the second day of venting. The renewed risk-off sentiment adopted a brief break on Tuesday, after 8-day consecutive movement.

Supply: SOSO worth

Typically, ETF traders have eliminated greater than $ 400 million from the product previously two weeks.

This differed enormously from the secure influx that was seen originally of February. Particularly when the market route was deepened in the midst of the present Trump fee.

ETH CME -PRODUCT PROPPLESS

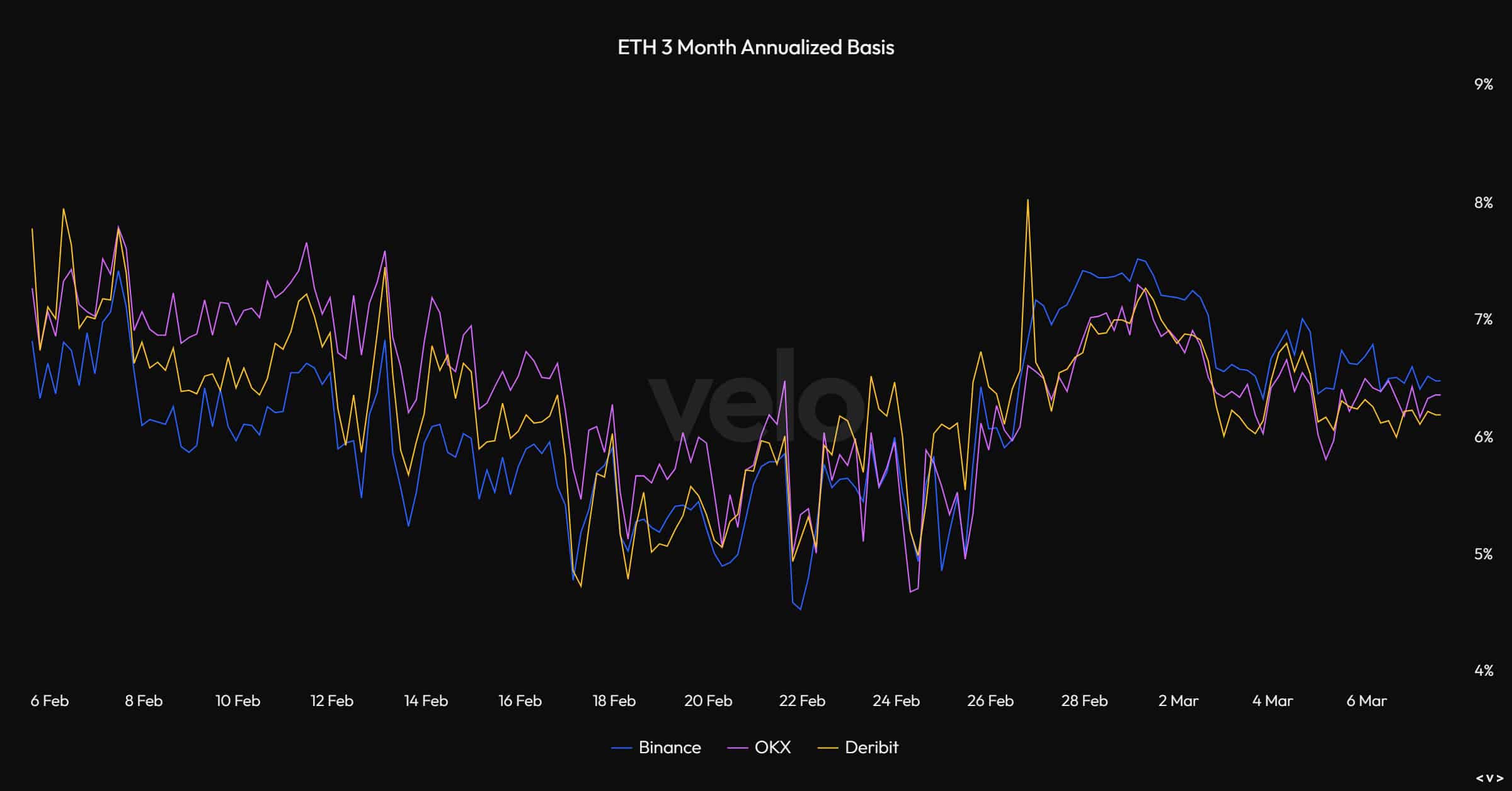

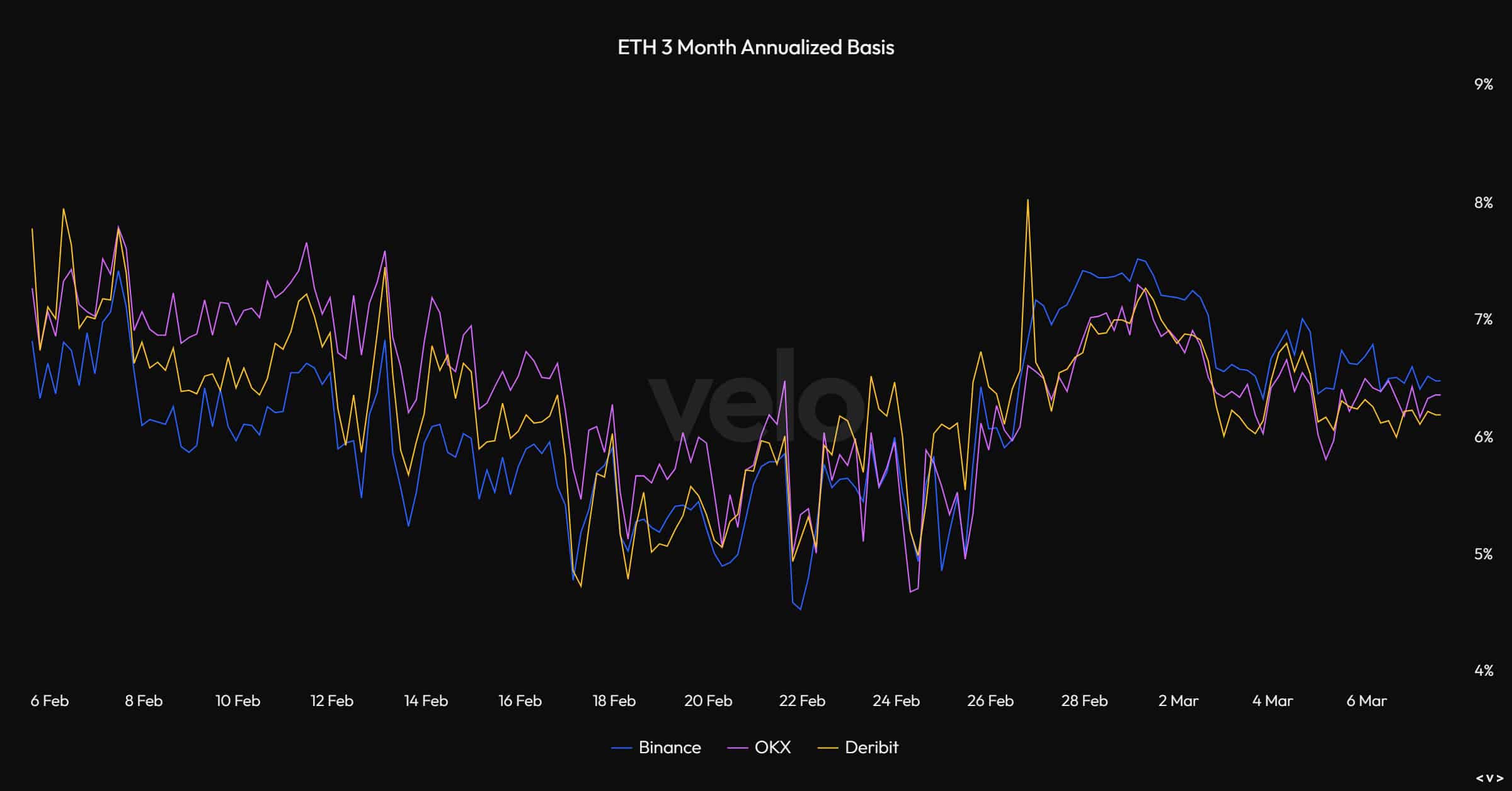

In February, ETFs noticed comparatively larger elevating than BTC ETFs – a trendcoinbase analysts linked to irresistible excessive yield from CME ETH Fundamental Commerce.

For the unknown, the commerce in that establishments retains spot ETF shopping for and opening a corresponding low cost on CME Futures to enterprise the worth distinction (income).

Supply: VELO

In response to Velo, the ETH yield elevated to eight% by the top of February and was characterised by robust ETF flows.

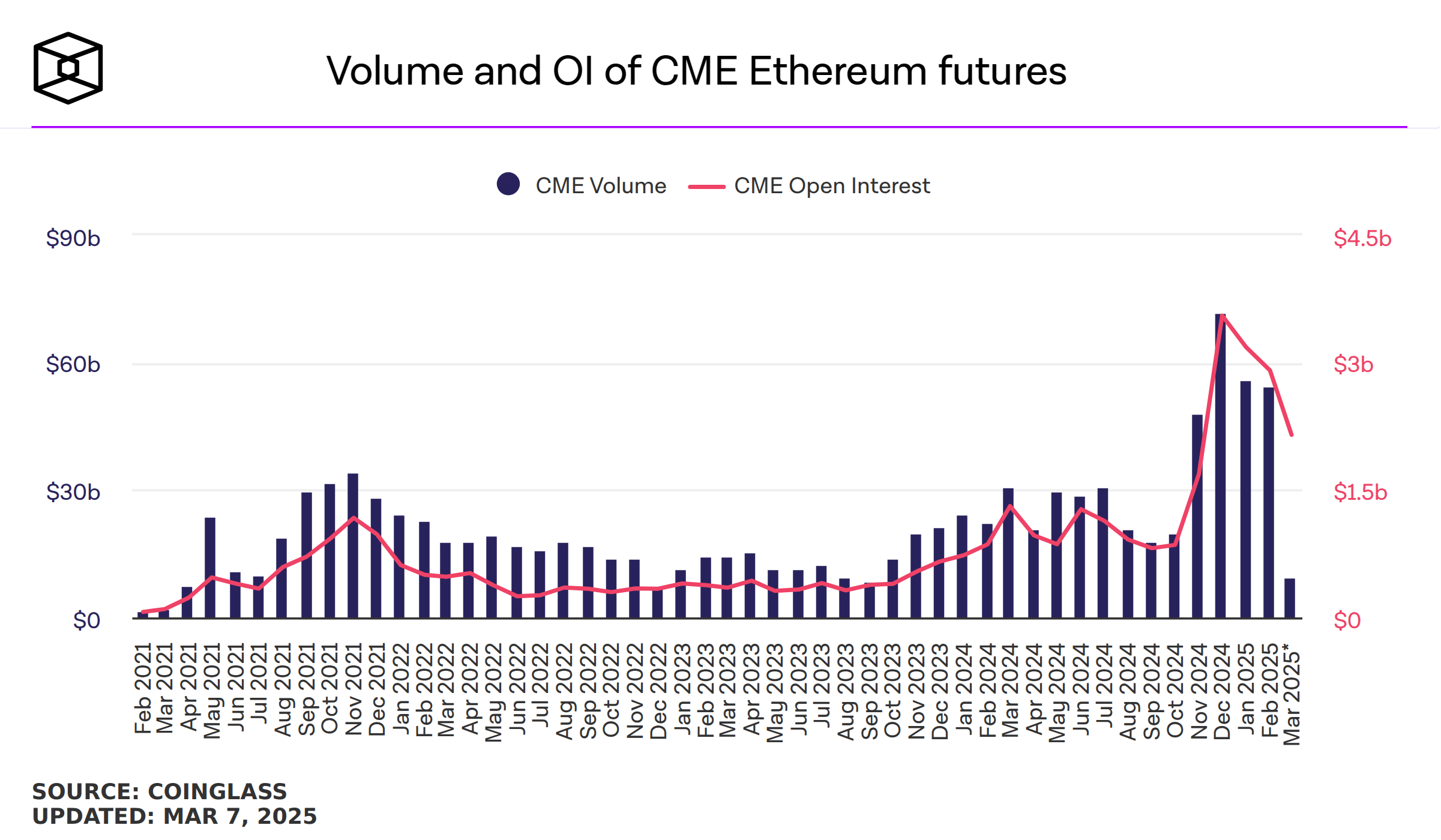

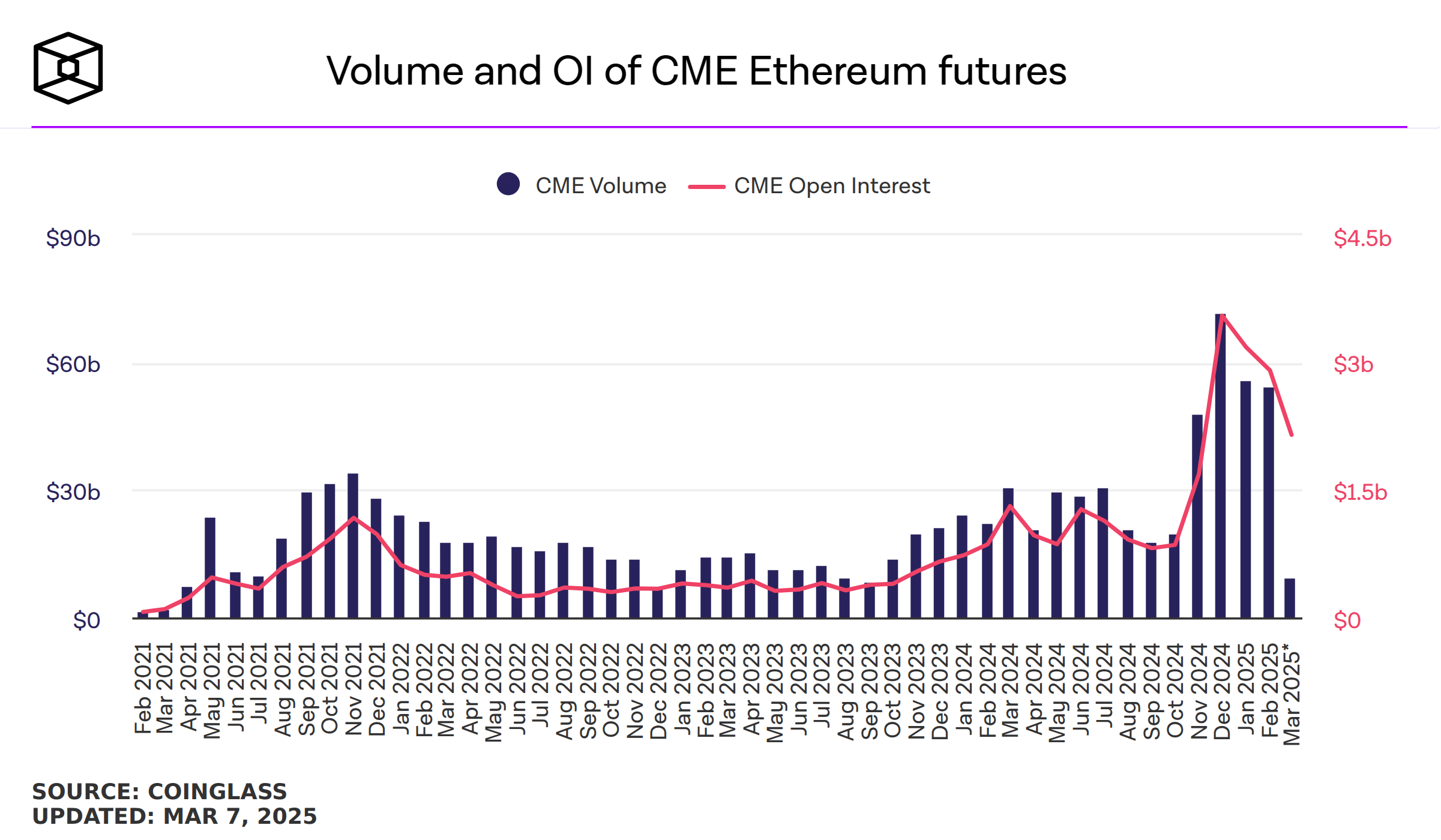

Nonetheless, the proceeds fell to sixpercentin March. This may be the trek of commerce and ETFs dented. In reality, the thought was additionally strengthened by the CME Futures Open Curiosity (OI) fee.

The OI was steadily declined in 2025 and slips from $ 3.18 billion to $ 2.15 billion in March, suggesting {that a} slight settlement or Carry-Commerce gamers lock positions.

Supply: The Block

Nonetheless, the broader weak market sentiment didn’t make issues higher for the King Altcoin. As such, the adjoining danger of the Altcoin generally can stay.

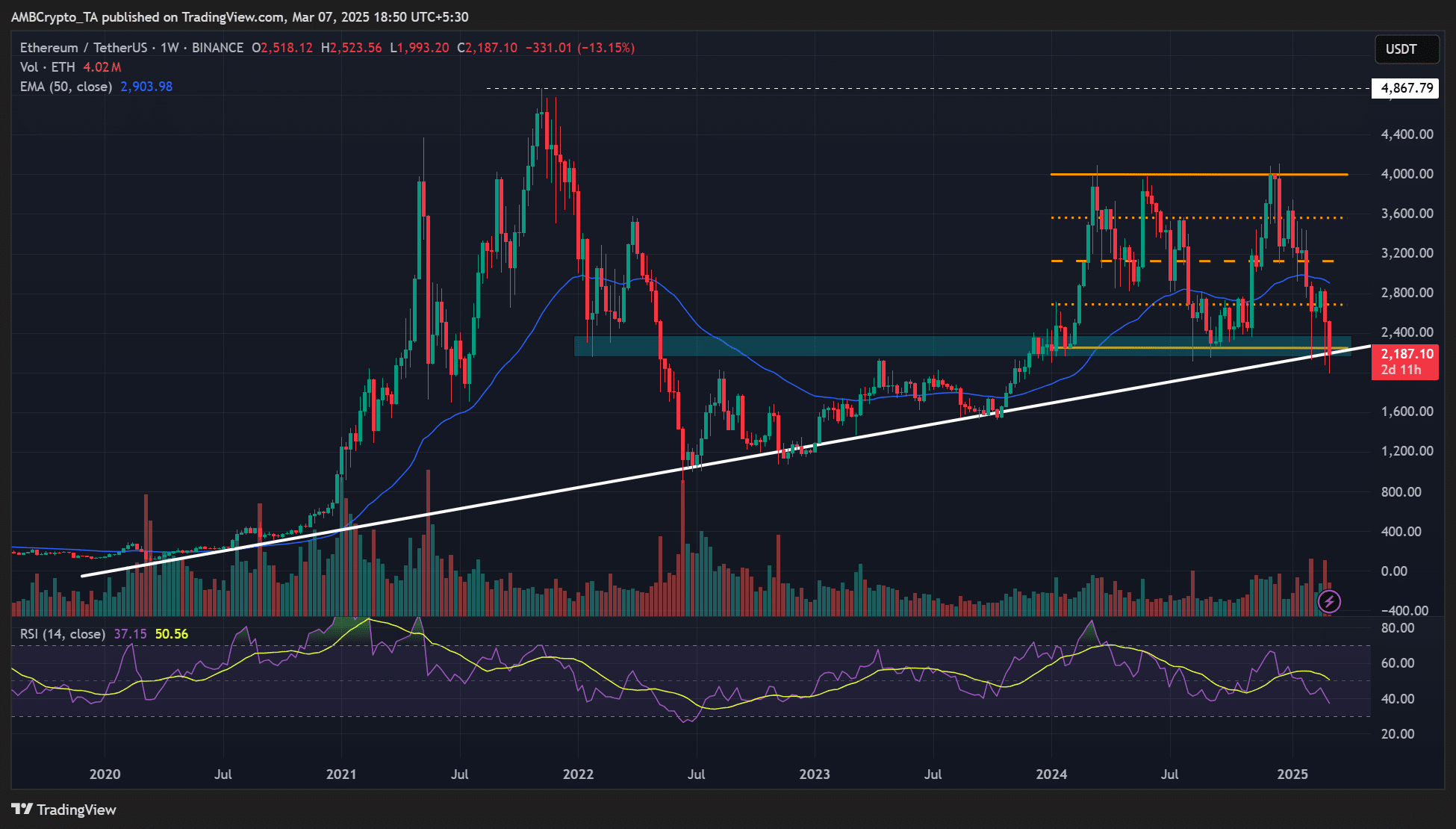

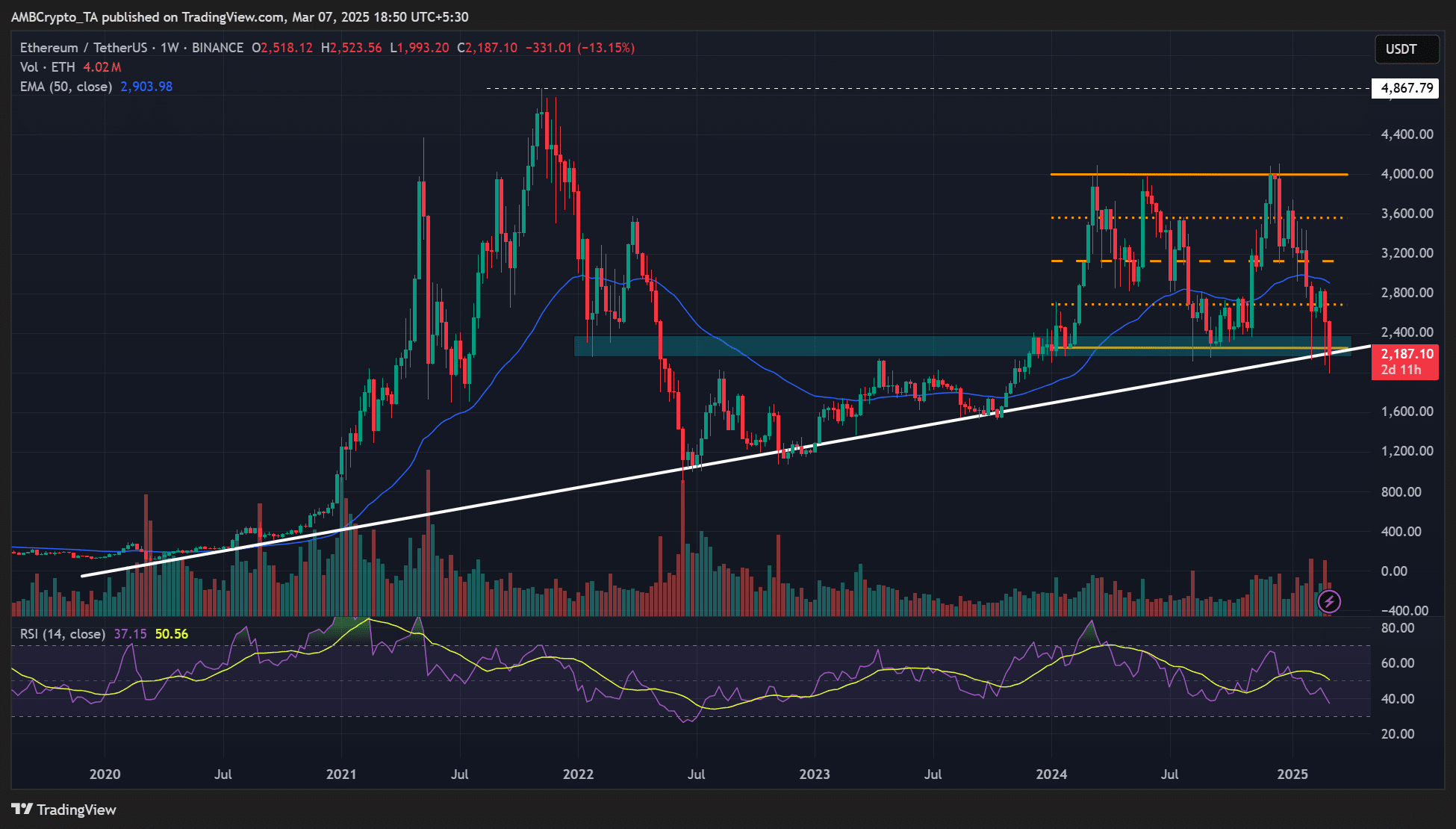

From a technical perspective, ETH appeared to be above $ 2000 at a vital intersection of vary and long-term trendline help. A infringement beneath the extent might change the market construction of the upper time frame and the curiosity of merchants within the Altcoin.

Supply: Eth/USDT, TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024