Bitcoin

U.S. government moves $8M in Bitcoin – Are major crypto shifts coming?

Credit : ambcrypto.com

- The US authorities has transferred $ 8.46 million to Bitcoin from Sae-Heng taken funds.

- The aftermath of the big switch was mirrored within the quick time period, however the lengthy -term emotions stay bullish.

The US authorities has once more transferred an enormous quantity of confiscated bitcoin [BTC]Producing hypothesis within the crypto world.

In line with a current tweet From a famend analyst, $ 8.46 million was transferred to BTC from Sae-Heng seized funds. Specifically, the funds had been transferred to 2 totally different portfolios.

Traditionally, BTC transactions of excessive worth by governments led to cost fluctuations within the quick time period. Though such transactions mirror the liquidation plans, the direct affirmation of any outright sale has not but been noticed.

Nevertheless, the statistics stay unstable if the market responds to the transaction.

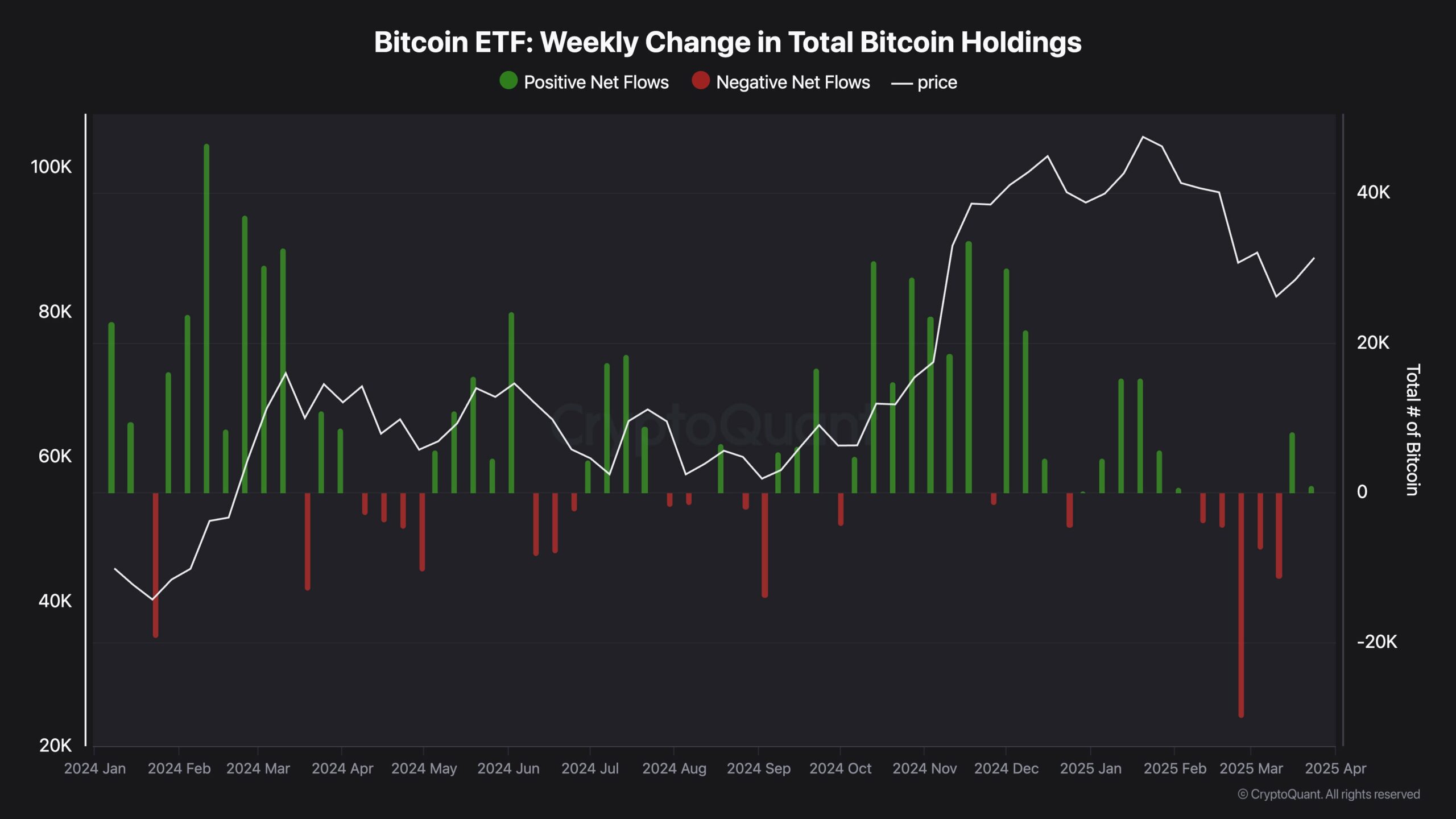

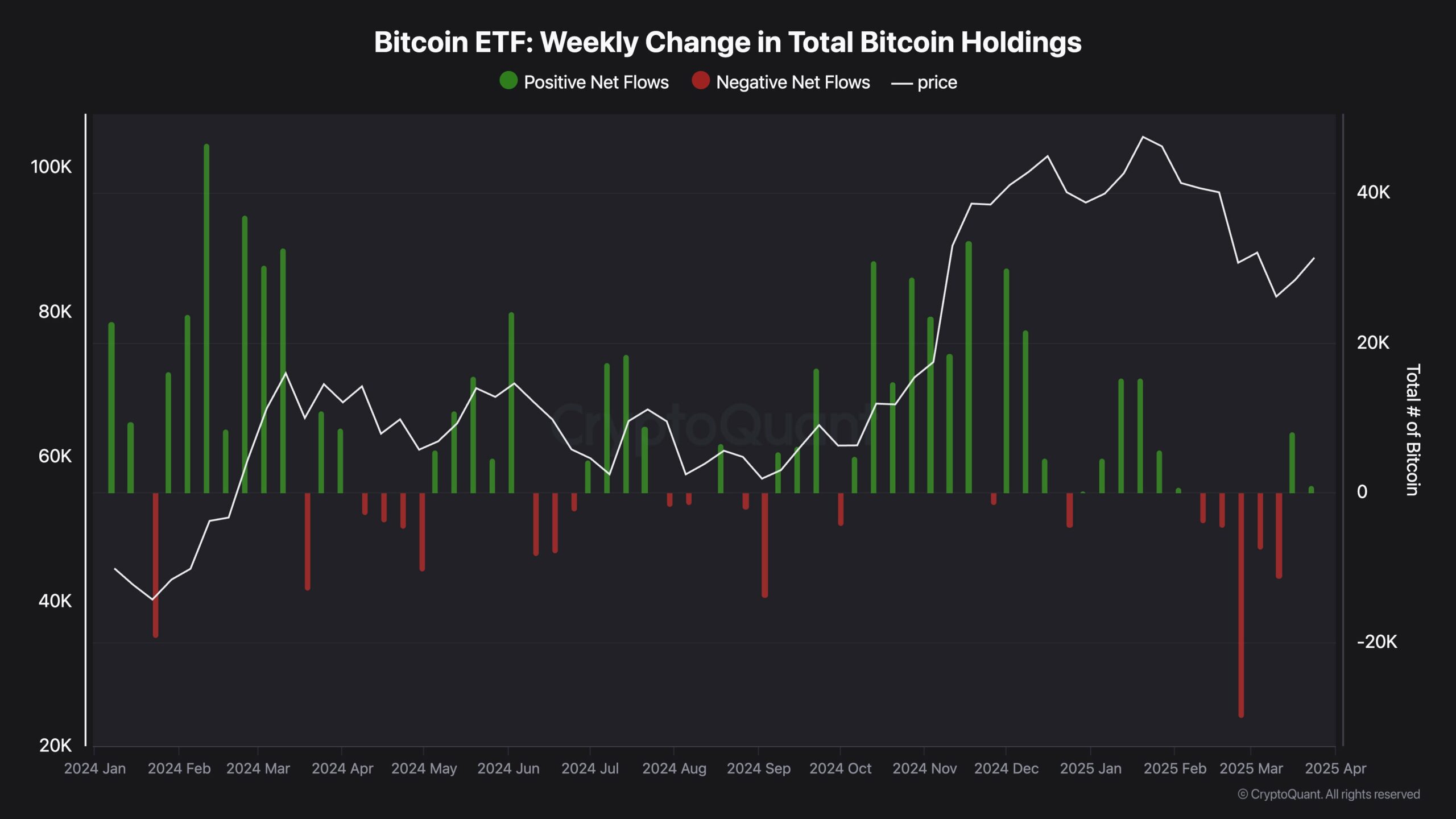

Bitcoin ETFs at an intersection

Bitcoin exchange-related funds (ETFs) are at a turning level. Ambcryptos evaluation of cryptoquant information reveals weekly outflow, since settings alter their portfolios.

Macroeconomic uncertainty has led to dangerous buyers lowering BTC publicity and balancing their participations.

This shift has led to a lower in Bitcoin ETF pursuits, which signifies potential short-term volatility.

Establishments can cowl their crypto investments towards broader financial dangers, which might affect the value actions of BTC within the coming weeks.

Supply: Cryptuquant

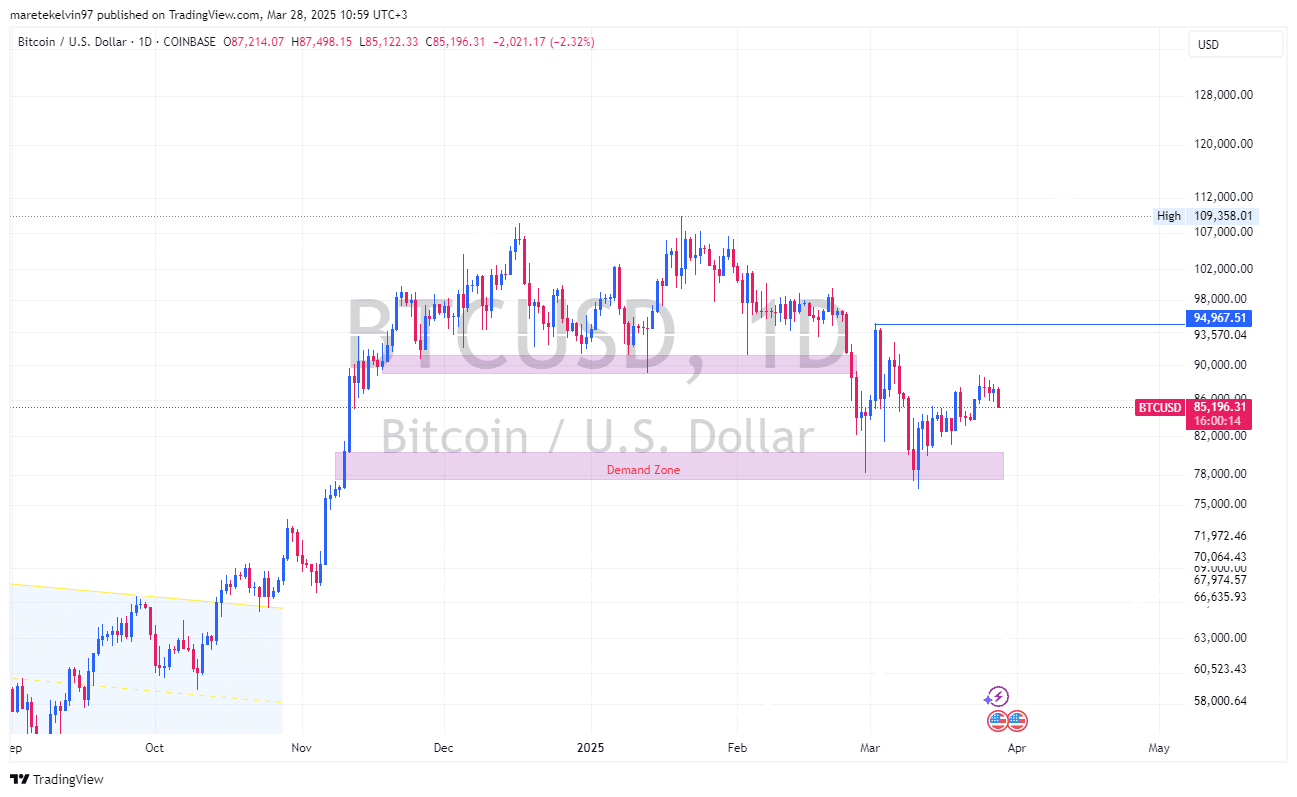

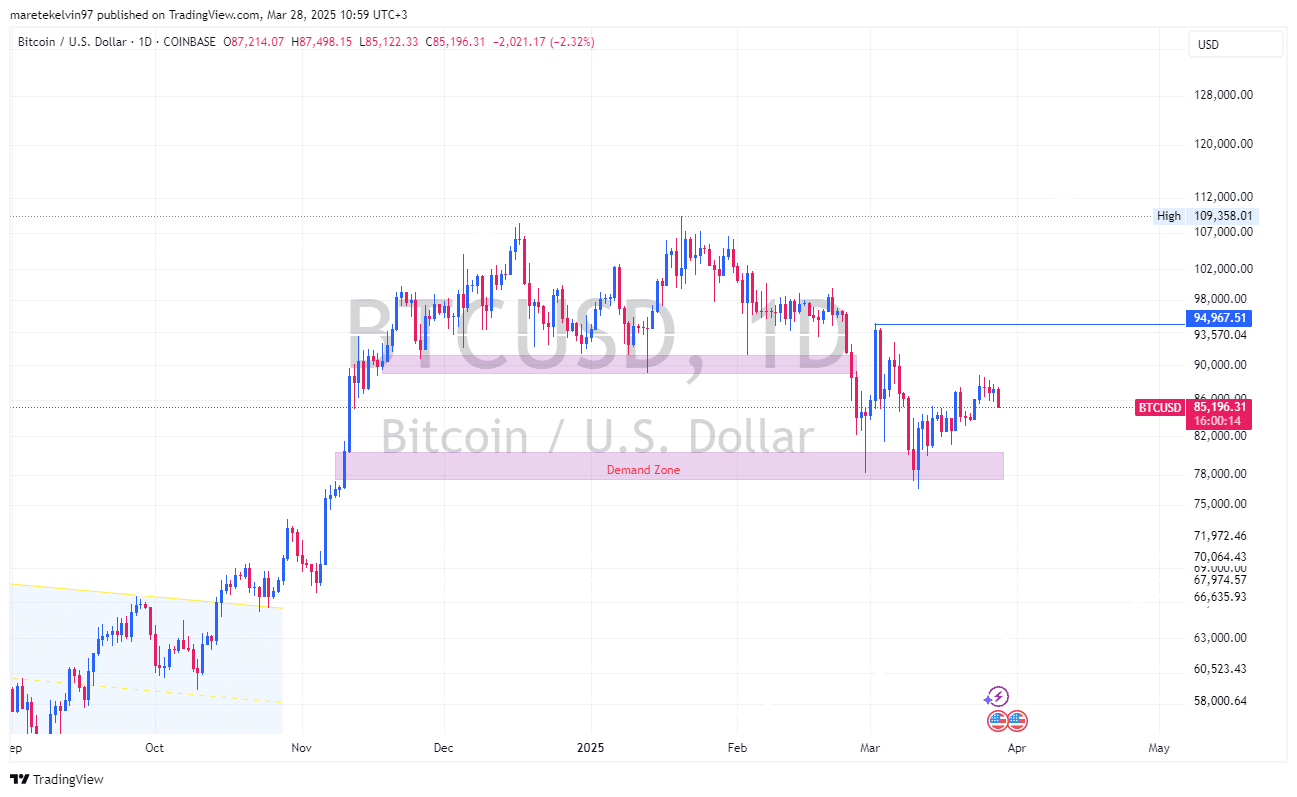

BTC costs align

The affect of the current Bitcoin motion is clearly on the charts. Within the final 24 hours alone, the BTC costs have fallen by greater than 2percenton the time of printing.

This decline is rubbing shoulders with ETF outflows and the Bitcoin switch from the US authorities, which pertains to merchants.

Supply: TradingView

Regardless of the current dip, the overall pattern of Bitcoin Bullish, pushed by robust foundations and growing acceptance, stays. BTC costs have demonstrated resilience in current months, in order that their standing is maintained as a number one financially energetic.

Though volatility persists within the quick time period, the lengthy -term prospects for Bitcoin seem promising. As institutional buyers alter their methods, the value conduct of BTC might be influenced by macro -economic elements.

Market consensus suggests a gradual pattern for the entrance except influenced by vital exterior occasions. Contributors should verify institutional flows and authorities actions involving Bitcoin to raised perceive the value path.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now