Policy & Regulation

U.S. Senate Passes GENIUS Act to Regulate Stablecoins, Marking Crypto Industry Win

Credit : cryptonews.net

The overwhelming twin passage of the Stablecoin Invoice of the US Senate, with a 68-30 definitive vote through which an enormous improve in Democrats on Tuesday got here to their Republican counterparts, a brand new high-water marking of crypto coverage efforts within the US now because the laws now units the home of representatives.

A very powerful democratic help for main and figuring out nationwide innovation for the US Stablecoins of 2025 (Genius) ACT helps to present the momentum whereas it lands within the different Chamber, the place home legislators can vote on it as written or to pursue modifications {that a} closing spherical within the Senate can go earlier than it could go to President Donald Trump’s workplace.

As written, the payments would arrange guardrails on the approval and supervision of American emennials from Stablecoins, the dollar-based tokens akin to these by Circle, Ripple and Tether. Firms that make these digital property out there to US customers ought to meet strict reserve necessities, transparency necessities, compliance with cash houses and authorized supervision that may most likely additionally embody new capital guidelines.

Ji Kim, the appearing CEO of the Crypto Council for Innovation, known as it a “historic step ahead for the digital property trade” in a ready assertion shared previous to the vote

“It is a victory for the US, a victory for innovation and a monumental step in the direction of the proper laws for digital property in the US,” stated Amanda Tuminelli, govt director and chief authorized officer of the Defi Training Fund, in a comparable assertion.

Though it has not been profitable to persuade a number of the most vocal democratic critics akin to Senator Elizabeth Warren, who say that it permits mazen for international tokens akin to Tether’s

USDT$ 1.00

Doesn’t cope with conflicts offered by the private crypto involvement of President Trump and knew a path for technological giants akin to Amazon to publish their very own cash, the backers in her social gathering have basically argued that doing nothing is just not an possibility.

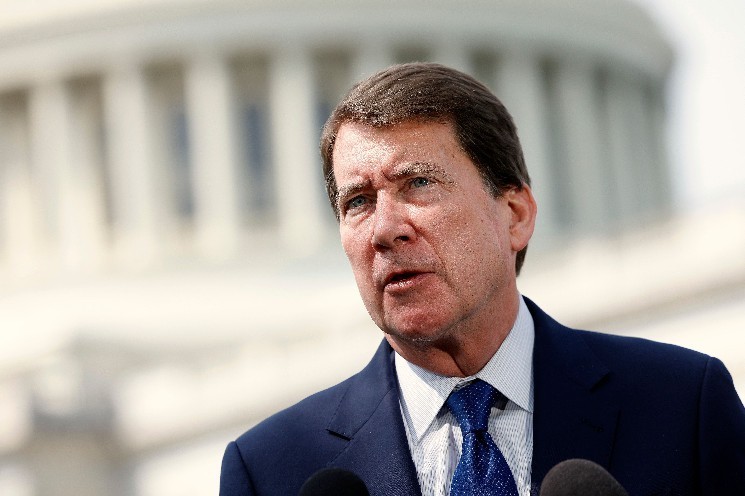

“With this invoice, the US is a step nearer to changing into the world chief in Crypto,” stated Senator Invoice Hagerty, the Tennessee Republican who sponsored the invoice, whereas the Senate ready itself on Tuesday. “The worth of stablecoins will probably be linked to the US greenback and will probably be supported one on one by money and short-term American treasury. This can supply certainty and confidence for a extra large-scale acceptance of this transformational know-how.”

Though that is the primary vital crypto invoice that the Senate knew, it is usually the primary time {that a} Stablecoin account has been adopted each rooms, regardless of years of negotiation within the Home Monetary Companies Committee that succeeded in producing different vital crypto laws within the earlier congress session.

The Future of the Genius Act can also be carefully linked to its personal digital property -the legislation of the home, the extra radical crypto account that may set up the authorized foot of the broader American cryptom markets. The Stablecoin effort is barely forward of the larger process of the market construction account, however the trade and their legislative union fellow college students declare that they’re inextricably linked and should change into straight collectively. Thus far, the Readability Act has been deleted by the related home committees and is ready for ground promotion.

The lobbyists of the crypto trade now flip to the home on each points. A brand new report on Tuesday from TRM Labs says that Stablecoins signify greater than 60% of the present crypto transactions, and greater than 90% of these cash are linked to the US greenback – dominated by USDC and USDT.

“Though TRM estimates that 99% of Stablecoin exercise is licit, their pace, scale and liquidity have made them engaging for unlawful use, together with ransomware funds, fraud and terrorist financing,” the analytical group famous.

Illicit Finance represents one of the vital vital complaints of critics within the congress.

Learn extra: Can Tether survive the American Stablecoin Invoice?

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024