Altcoin

Understanding the impact of the recent cooldown in BNB Open Interest

Credit : ambcrypto.com

- Futures Open Curiosity pulled again from the $1 billion mark

- Liquidation patterns indicated balanced market sentiment

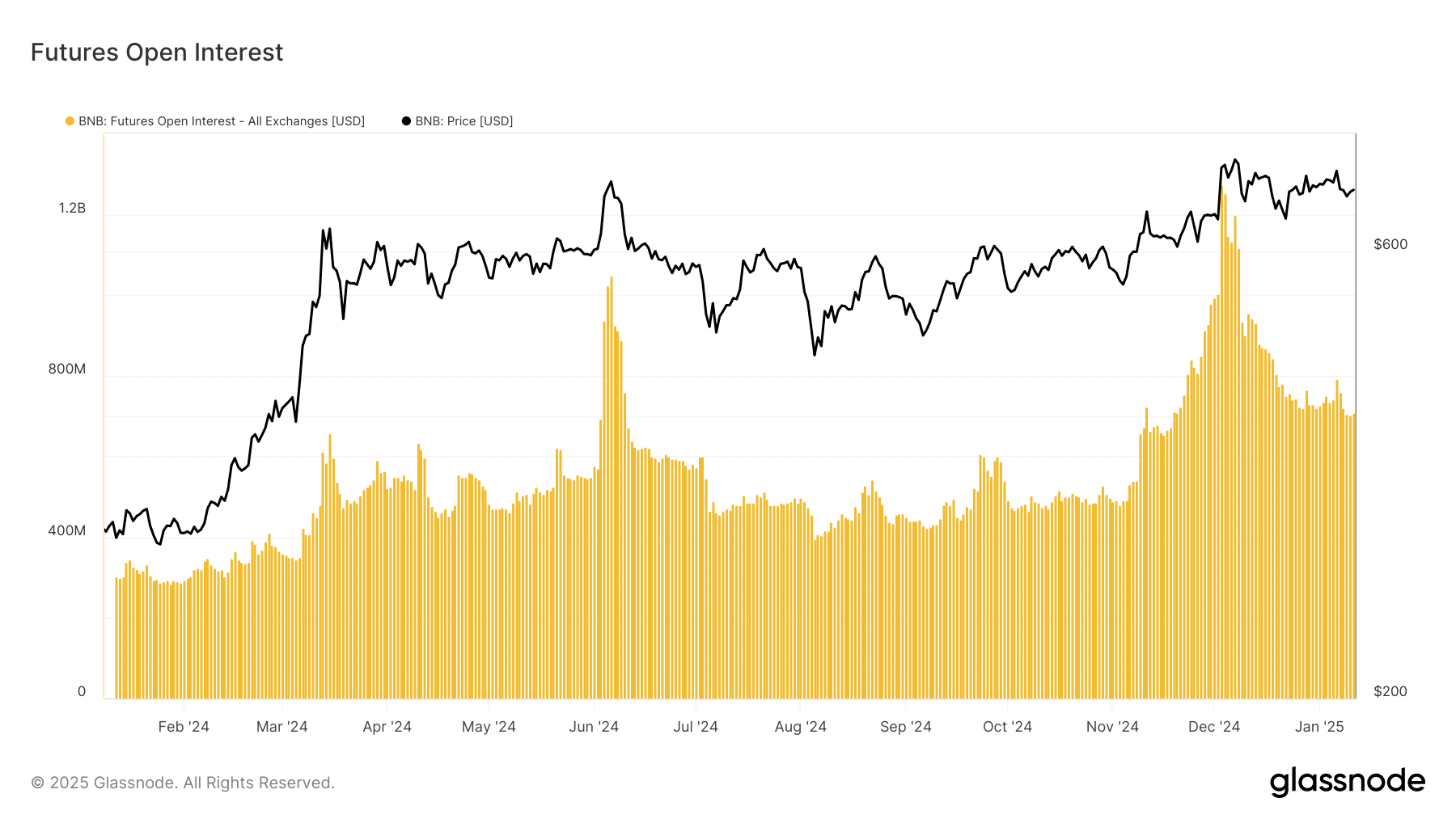

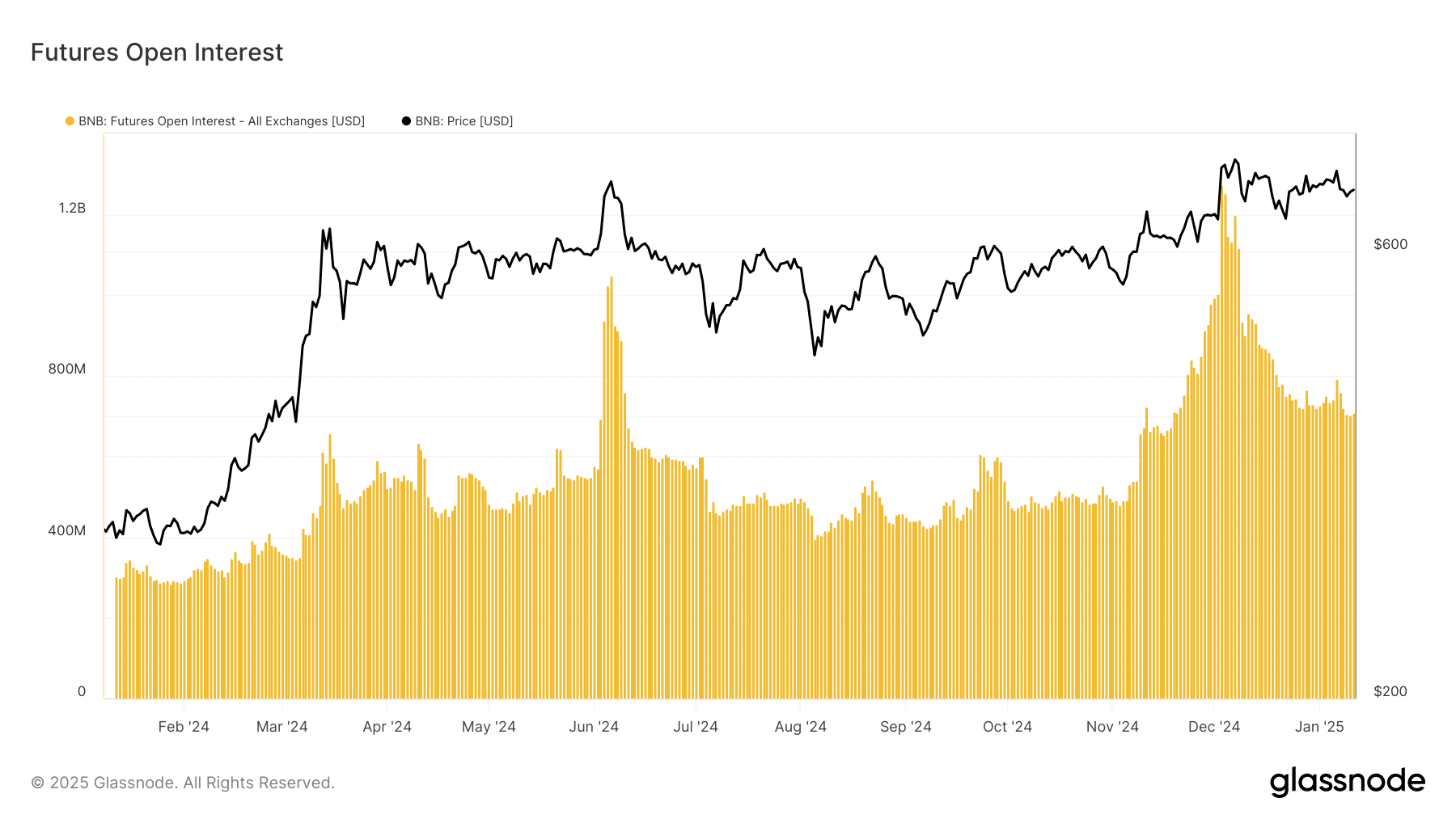

The derivatives panorama for Binance Coin (BNB) revealed important shifts in market positioning, with futures open curiosity retreating from the $1 billion mark in December. With institutional gamers recalibrating their positions, the market construction revealed attention-grabbing patterns that had been value exploring on the time of writing.

Derivatives market alerts combined sentiment

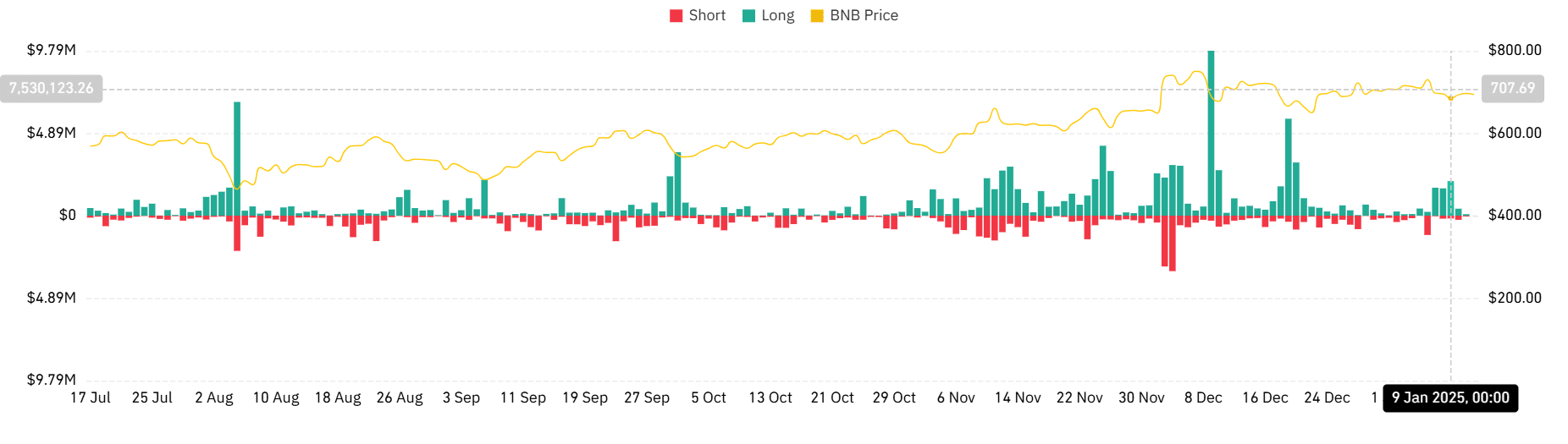

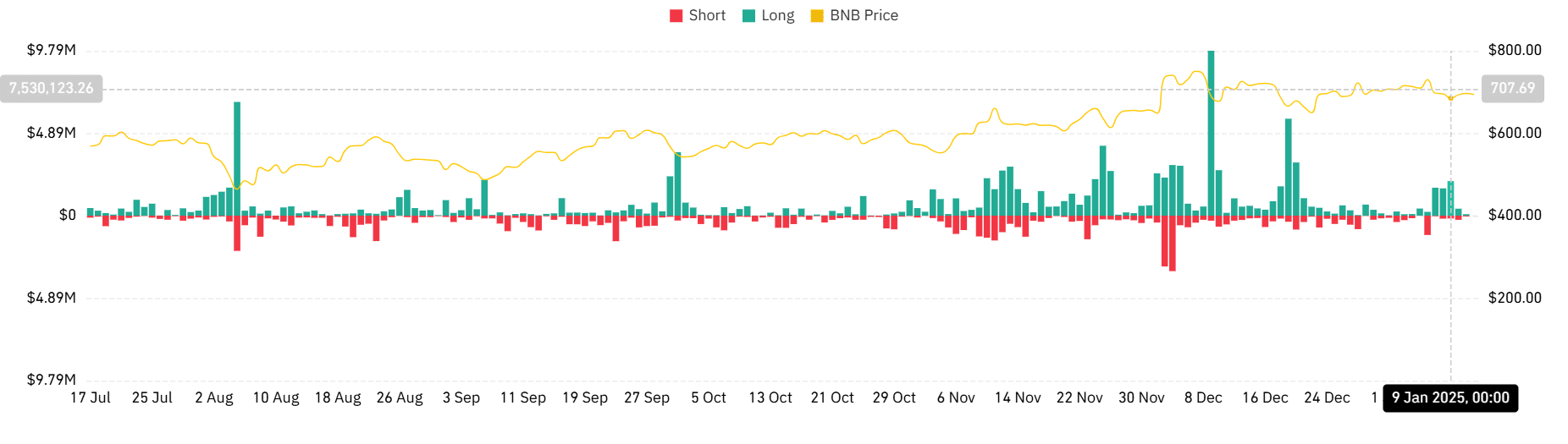

Based on Glassnode, BNBs Futures open interest declined after reaching peak ranges, with a transparent decline within the whole worth in futures contracts. Whereas lengthy liquidations dominated in December, reaching $9.79 million at their peak, current weeks have seen extra balanced liquidation patterns between longs and shorts – an indication of a impartial market place.

Supply: Glassnode

Buying and selling volumes introduced an attention-grabbing image, with continued exercise regardless of the decline in OI. The connection between long and short liquidations has additionally normalized, indicating decreased leverage within the system – a probably wholesome growth for BNB’s market construction.

Supply: Coinglass

BNB’s value motion stays secure regardless of the drop in OI

BNB’s spot value has proven exceptional resilience regardless of the cooling derivatives market.

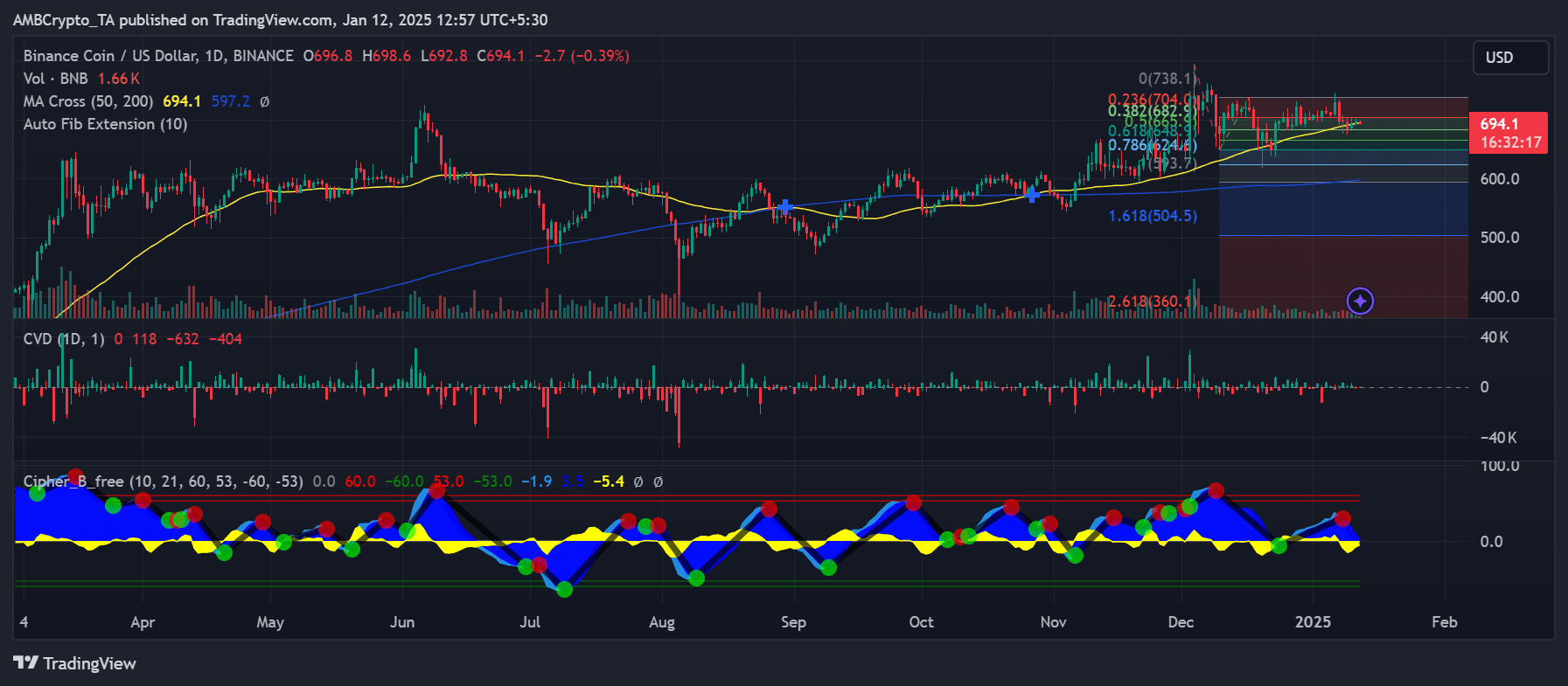

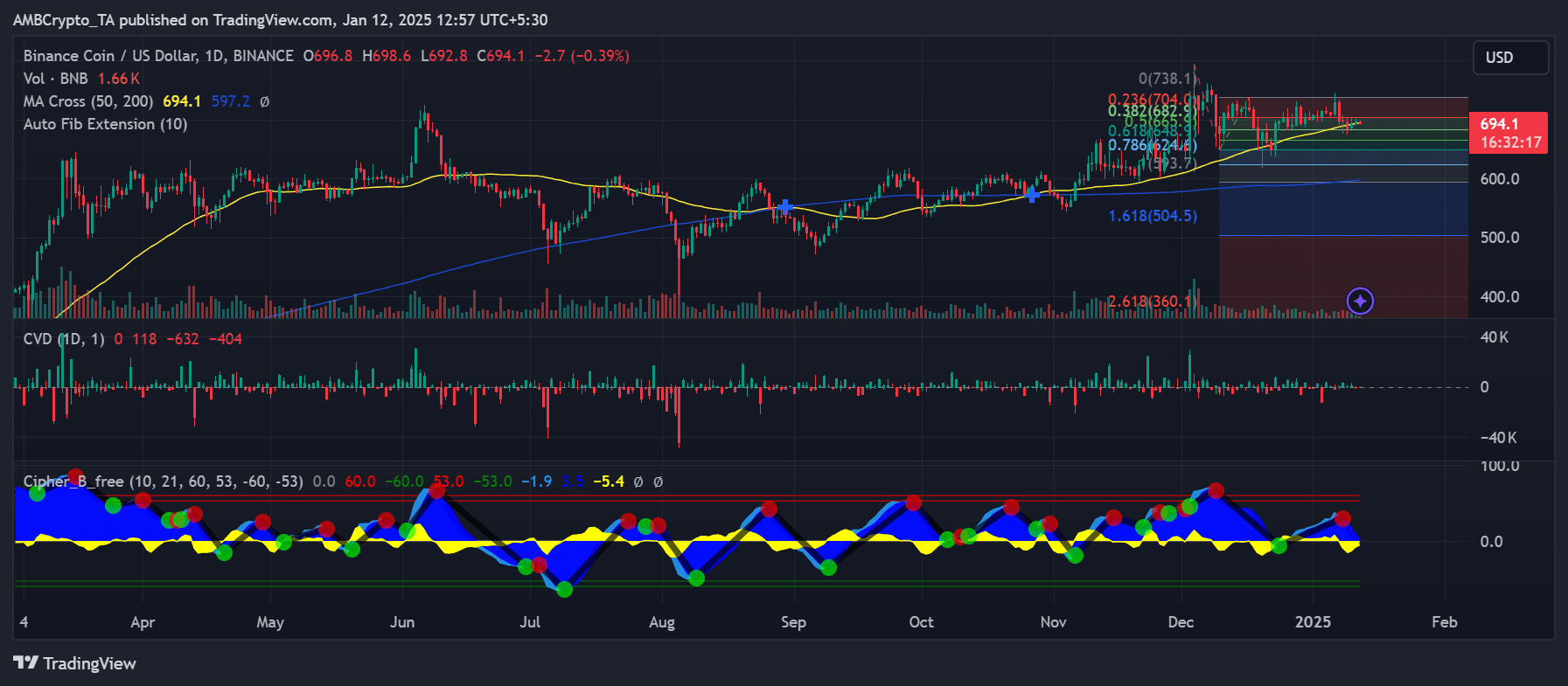

The token was buying and selling at $694.1 on the time of writing and gave the impression to be sustaining its place above vital transferring averages, with the 50-day MA at 694.1 transferring above the 200-day MA at 597.2. In doing so, it fashioned a golden cross sample on the playing cards.

Supply: TradingView

The Cumulative Quantity Delta (CVD) indicator additionally confirmed regular institutional accumulation, though this was extra measured than the aggressive shopping for in December. This may be interpreted as an indication that sensible cash continues to indicate curiosity, albeit with extra cautious positioning.

BNB’s market construction reveals energy

The Fibonacci extension ranges highlighted key areas of curiosity, with the 0.786 retracements round $624.8 serving as robust assist. The altcoin’s newest value motion fashioned a sequence of upper lows, pointing to its underlying energy regardless of the drop in OI.

Additionally, BNB’s market construction has remained constructive above the $680 assist zone. The decline in open curiosity, mixed with secure value motion, indicated a attainable shift from leveraged hypothesis to spot-driven value discovery – usually more healthy market dynamics.

– Learn Binance Coin (BNB) value prediction for 2025-2026

Whereas the billion-dollar OI milestone made headlines in December, the present market positioning may present a extra sustainable basis for BNB’s subsequent transfer. Merchants ought to keep watch over the convergence of spot and derivatives metrics to verify a directional bias.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024