Bitcoin

‘Undervalued’ Bitcoin can still hit a new ATH in Q1 2025 – Explained

Credit : ambcrypto.com

- Knowledge indicated that BTC is now in an oversold area, which might point out an impending worth restoration

- The overall revenue providing confirmed that BTC shouldn’t be but on the cycle low, leaving room for vital upside

Market sentiment has steadily turned bullish. Actually, Bitcoin is up 2.57% over the previous 24 hours, pushing its worth to round $97,500 on the time of writing. Nonetheless, this worth enhance shouldn’t be totally supported by the market momentum, which fell by 23.23% throughout the identical interval.

A broader market evaluation based mostly on historic tendencies underlined the potential for additional development. What this implies is that BTC should have the chance to hit a brand new all-time excessive within the coming weeks.

An ‘undervalued’ place

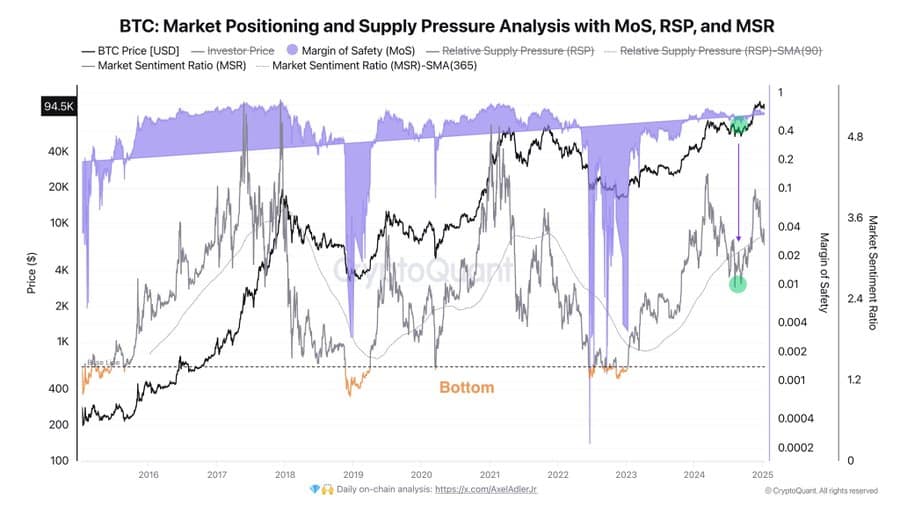

Knowledge from CryptoQuant’s Market Place and Provide Strain metrics advised that Bitcoin (BTC) could also be undervalued. This evaluation is predicated on the Margin of Security (MoS) and Market Sentiment Ratio (MSR) indicators.

The margin of security (MoS) evaluates whether or not BTC is overvalued or oversold relative to a crucial baseline. When the MoS strikes above this line it signifies overvaluation, whereas a place beneath it suggests the asset is undervalued.

On the time of writing, the MoS (represented by the purple cloud) was beneath the baseline, valued close to the $90,000 zone (baseline). This implied that BTC is now in an oversold place – an indication {that a} rally could also be coming.

Supply: CryptoQuant

Equally, the Market Sentiment Ratio (MSR) measures the extent of optimism or pessimism available in the market by evaluating its worth to the annual Easy Transferring Common (SMA). On the time of penning this stood at 1.4.

A price above the SMA signifies prevailing optimism, whereas a price beneath displays market pessimism. At press time, the MSR was beneath the annual SMA – an indication of pessimistic sentiment.

Traditionally, as indicated by the inexperienced dots on CryptoQuant’s chart, these situations, when the MoS falls beneath the baseline and the MSR tendencies beneath the annual SMA, current a robust shopping for alternative. In such circumstances, BTC has typically seen vital rallies on the charts.

The identical sample appears to be forming available in the market now – an indication that BTC could possibly be poised for a brand new uptrend.

Removed from the market high?

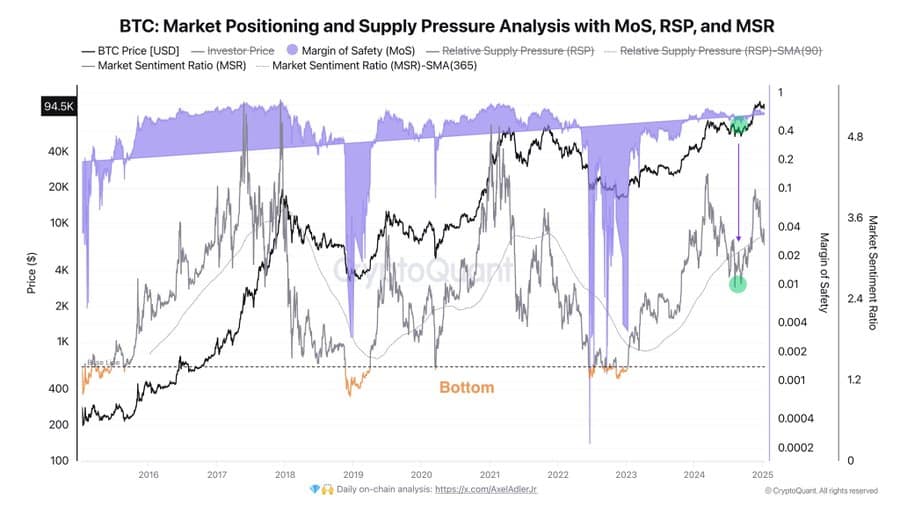

Knowledge from Glassnode’s Whole Provide of Bitcoin in Revenue, a key metric for figuring out BTC’s cyclical tops and bottoms, advised that Bitcoin continues to be removed from reaching its market high.

In response to the identical, BTC has not but reached the crimson trendline, which traditionally marks these crucial ranges.

Supply: Glassnode

If BTC hits this crimson trendline, it could imply a majority of holders are making earnings. Traditionally, such eventualities have led to main market sell-offs. Particularly as merchants begin to understand earnings, placing downward strain on the value.

At the moment, BTC stays effectively above this trendline, indicating a good place for additional upside as addresses holding this provide are incentivized to proceed holding in anticipation of upper features.

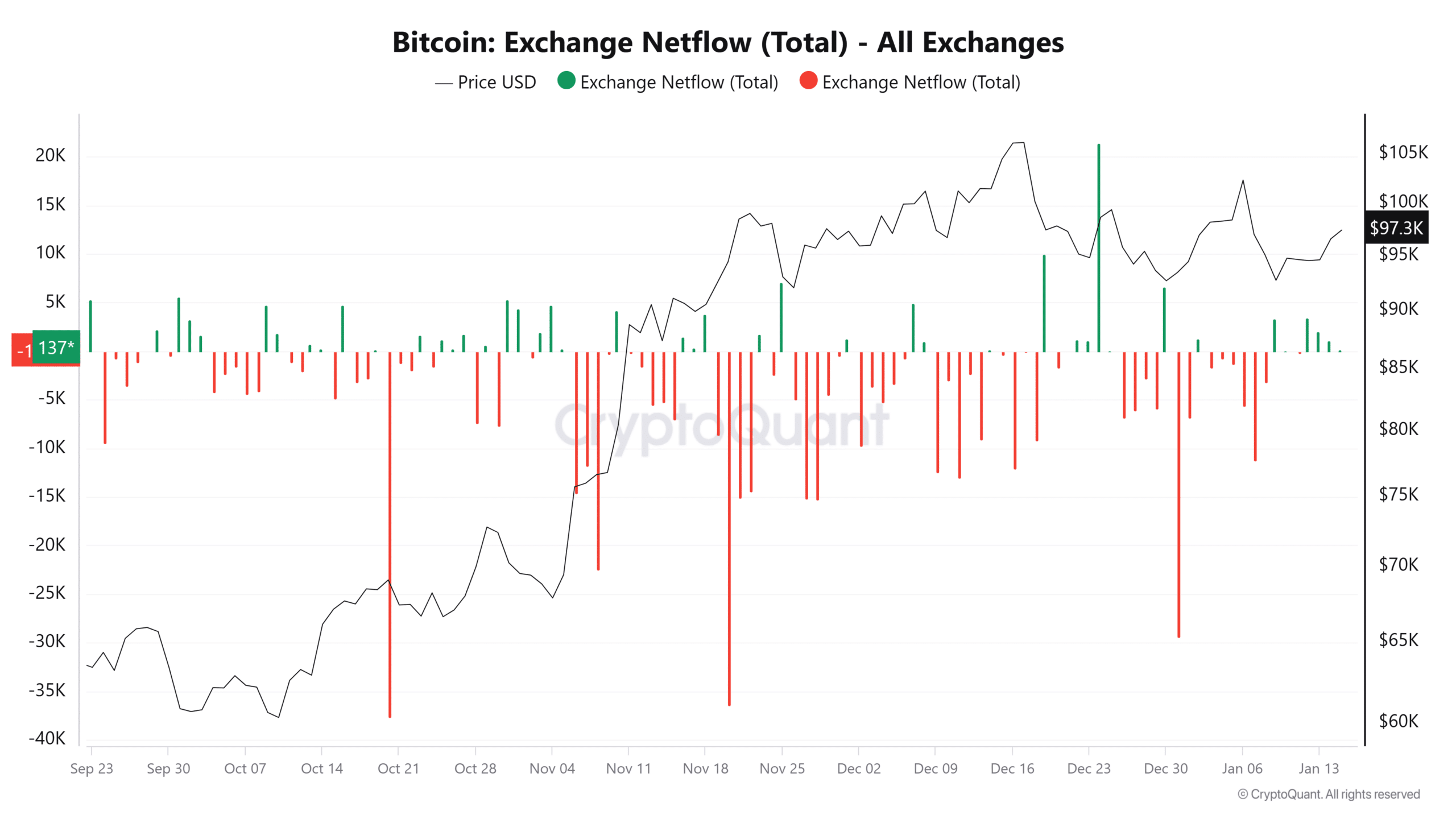

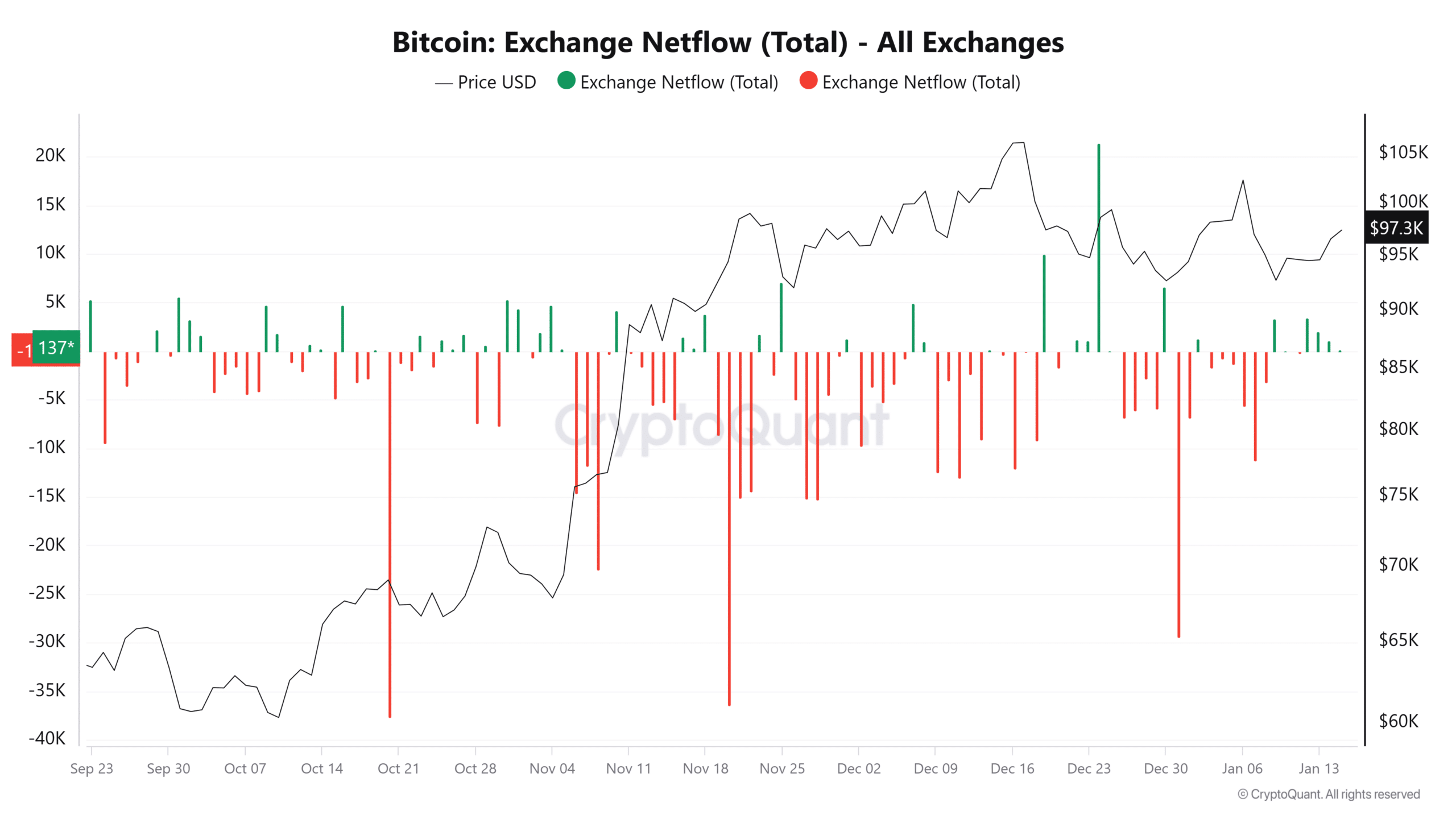

Alternate netflows findings

Lastly, the change community flows confirmed that As of January 12, there was a constant decline in web foreign money stream – down considerably from round 3,431.69 BTC to simply 137 BTC.

A continued decline in web flows means lowered promoting strain as extra traders transfer their BTC from exchanges to personal portfolios. This habits may be interpreted as a rising perception among the many holders.

Supply: Cryptoquant

If the web stream on the change turns damaging, it could imply that spot merchants have gotten more and more assured – a sentiment that has traditionally correlated with the next BTC worth.

Merely put, BTC stays in a robust place to proceed its upward restoration, supported by easing promoting strain and growing market confidence.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now