Layer 2

Uniswap DEX comprises 37% of Ethereum L2 volume

Credit : crypto.news

Ethereum’s main decentralized change, Uniswap, is contributing considerably extra quantity to layer 2 blockchains in comparison with exercise two years in the past.

The decentralized change (DEX) accounts for about 37% of whole layer 2 buying and selling quantity and runs on prime of crypto’s second largest blockchain, Ethereum (ETH).

21.co-researcher Tom Wan famous that the platform’s L2 volumes grew greater than 650% in 24 months, from about $4 billion in 2022 to greater than $30 billion this 12 months. The analysts added that this pattern might strengthen additional if extra high quality protocols had been launched on layer 2 networks reminiscent of Arbitrum, Coinbase’s Base and Optimism.

“L2s have seen elevated financial exercise, particularly Base and Arbitrum, which signify 82% of whole L2 quantity on Uniswap. I count on L2 quantity dominance on Uniswap to proceed to develop to 50% by the top of this 12 months.”

Tom Wan21.co-researcher

Knowledge confirmed that the change solely contributed 2.9% of the full quantity on altcoin L1s, however Wan believed that this narrative might see a shift sooner or later. Wan defined that high-performance EVM-enabled L1s mixed with a multichain enlargement technique might permit the DEX to seize extra quantity on networks like Sei and Monad.

Crackdown on Uniswap

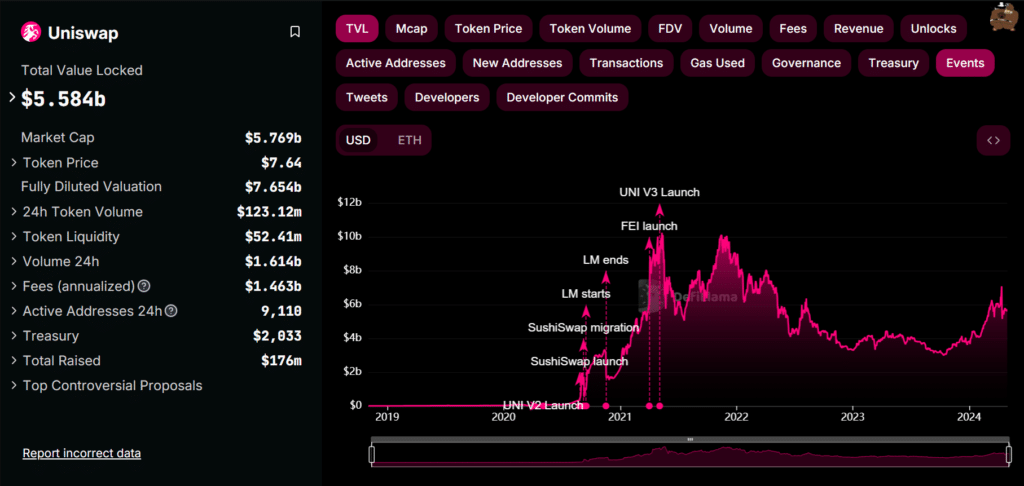

Uniswap (UNI) was the primary DEX on Ethereum and stays the biggest on-chain buying and selling platform on the crypto L1 blockchain. The protocol boasts a cumulative buying and selling quantity of greater than $2 trillion throughout 17 chains. DefiLlama states that customers have additionally deposited greater than $5.5 billion in worth deposits.

The Brooklyn-based crypto companies firm, based in 2017 by Hayden Adams, is now dealing with potential enforcement motion from the US SEC, which is at the moment embroiled in a broad crackdown on the crypto trade.

As crypto.information reported, the SEC has issued Adams’ firm a Wells Discover, and the DEX plans to defend itself in opposition to a “disappointing however not shocking” resolution.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now