Altcoin

Uniswap Price Prediction – How Could UNI’s Price Action Fuel the Next DeFi Rally?

Credit : ambcrypto.com

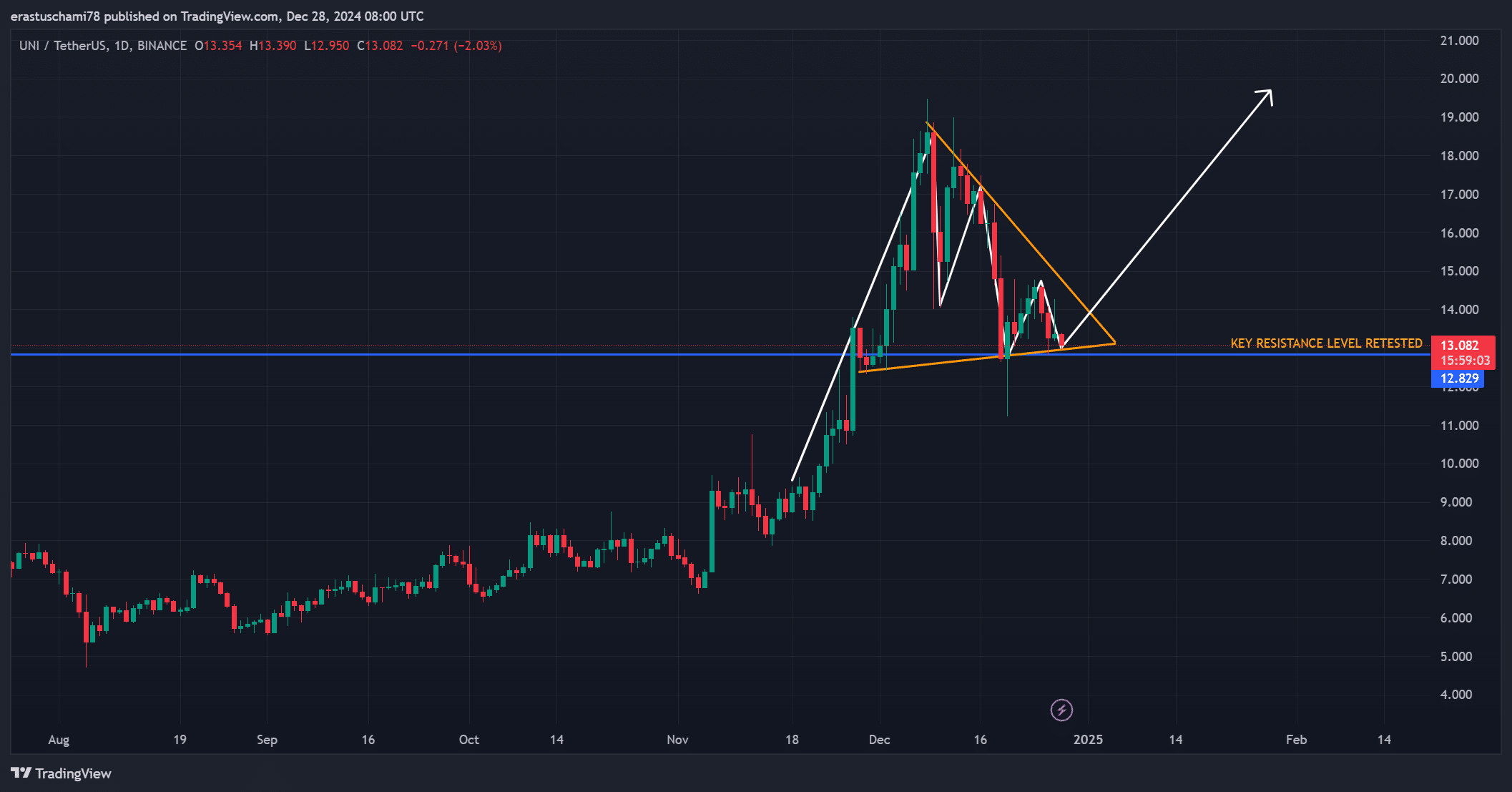

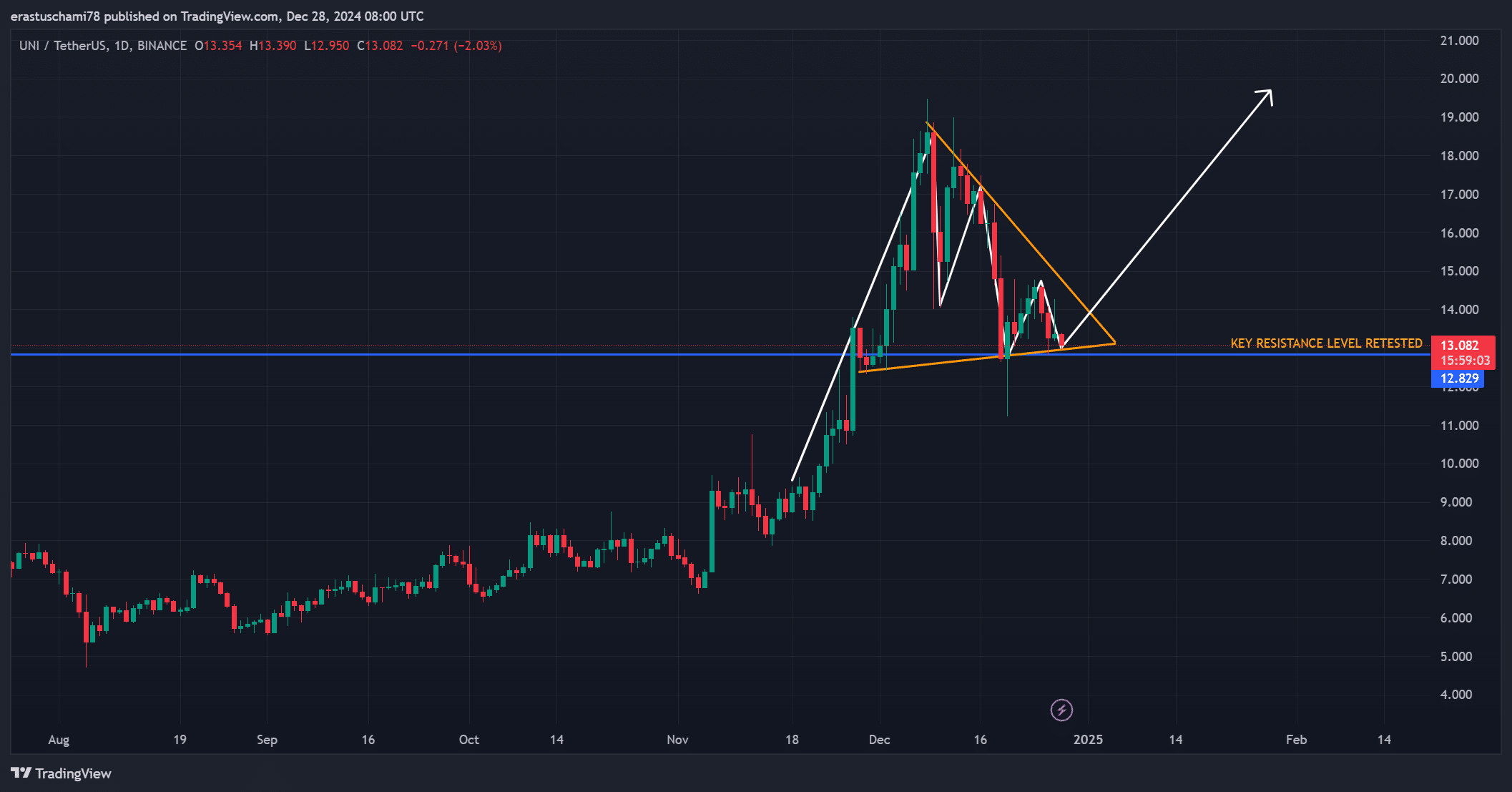

- UNI’s worth fashioned a bullish triangle, indicating the potential for a major breakout

- Bullish on-chain metrics and rising lengthy sentiment indicated sturdy upside

Uniswaps [UNI] Its dominance within the decentralized trade market (DEX) continues to develop, with community exercise rising from 36.8% to a formidable 91.3% by 2024. This outstanding progress has attracted over 45.3 million customers, cementing its place because the main DEX for consumer acquisition is strengthened.

In the meantime, a whale’s current buy of 100,000 UNI value $1.42 million USDC for $14.24 underscored sturdy investor confidence. On the time of writing, UNI was buying and selling at $13.07, with the altcoin down 4.07% and key worth ranges prone to dictate the subsequent route.

Key ranges to observe for a breakout

UNI’s worth chart highlighted the potential for a serious breakout as a symmetrical triangle sample fashioned. Such construction typically alerts a serious transfer, and the retest of the $12 resistance degree supplied extra bullish potentialities.

A breakout above this degree might push UNI in the direction of $20 or increased, offering vital upside potential for merchants. Nevertheless, the current promoting strain on the chart underscored the significance of continued shopping for momentum.

Supply: TradingView

What do community exercise statistics reveal?

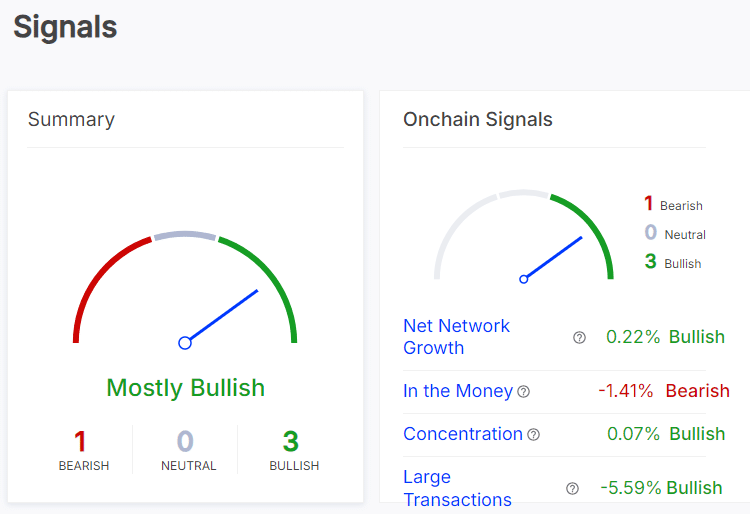

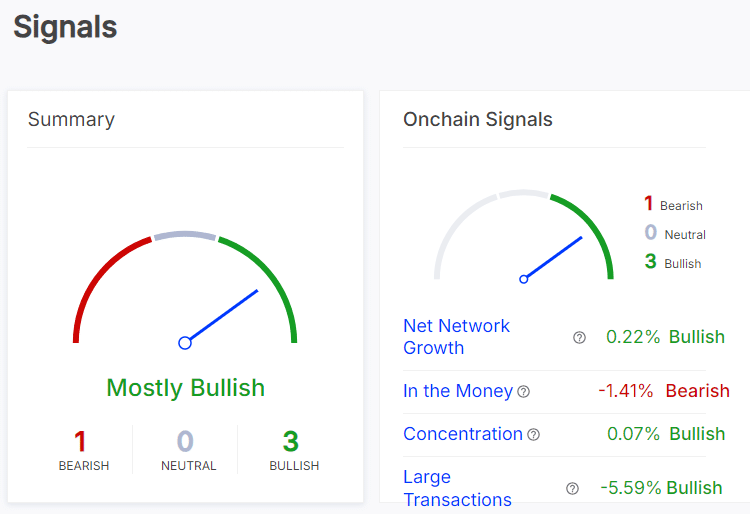

On-chain metrics pointed to a largely bullish outlook for UNI. Internet community progress elevated by 0.22%, indicating an inflow of latest customers. Moreover, whale exercise has remained constant, with concentrations rising by 0.07%.

Nevertheless, the ‘Within the Cash’ metric dropped -1.41%, indicating profit-taking habits amongst some holders. Massive trades fell -5.59%, indicating warning within the quick time period. These blended alerts highlighted the significance of monitoring whale actions and broader market sentiment to gauge UNI’s trajectory.

Supply: IntoTheBlock

Evaluation of UNI’s international trade reserves

International trade reserves noticed a modest improve of 0.21%, bringing the overall to 70.22 million tokens. Whereas this might point out gentle promoting strain, the low upside indicated that the majority holders have maintained their positions.

This appeared to be consistent with the general market retracement, though a major spike in reserves might point out bearish intent.

Supply: CryptoQuant

Construct momentum or lose steam?

Technical indicators supplied additional perception into Uniswap’s press-time standing. The Common Directional Index (ADX) of 26.77 underlined the reasonable development energy. In the meantime, the 9-day shifting common was under the 21-day MA, indicating near-term bearishness.

Nevertheless, the symmetrical triangle highlighted {that a} bullish crossover might quickly spark renewed shopping for curiosity.

Supply: TradingView

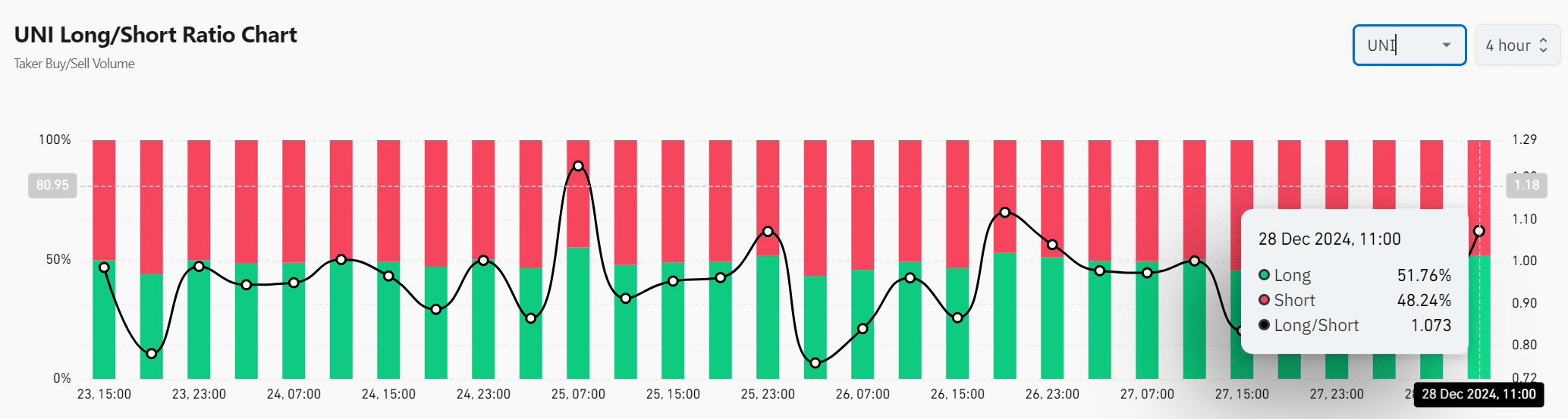

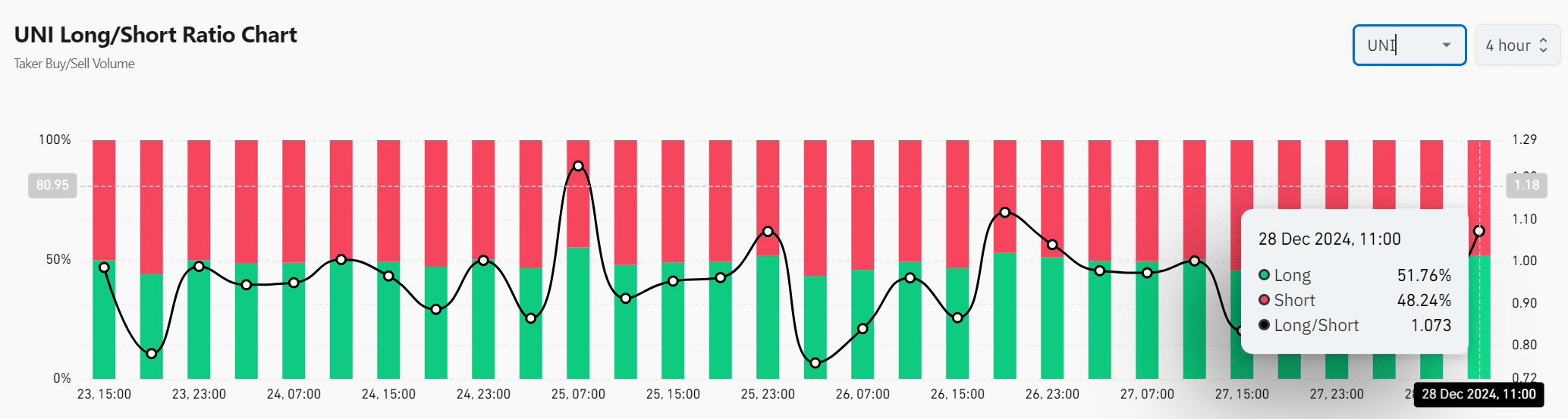

Lengthy/quick ratio – Is the market bullish?

The lengthy/quick ratio for UNI on the time of writing was 1.073, with 51.76% of taker quantity favoring longs. This rising bullish sentiment advised merchants had been positioning themselves for a potential breakout. Moreover, the shift to lengthy positions aligned with broader expectations of upward worth motion.

Nevertheless, sustaining this sentiment will rely on UNI’s potential to surpass the crucial resistance ranges and preserve momentum within the coming periods.

Supply: Coinglass

Learn the one from Uniswap [UNI] Worth forecast 2025–2026

Is Uniswap prepared for a breakout?

UNI’s charts confirmed indicators of sturdy breakout potential, supported by bullish on-chain alerts and technical patterns.

If UNI can decisively break above $14, it would probably surge in the direction of $20, cementing its energy within the DeFi market. Subsequently, UNI may very well be poised for vital upside, particularly if key metrics and market sentiment align favorably.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now