Altcoin

Uniswap (UNI) Price Prediction – This is the case for a 30% rally

Credit : ambcrypto.com

- An RSI discovering of 56 instructed that UNI was buying and selling beneath the overbought zone

- On the time of writing, 67.63% of the highest UNI merchants on Binance had lengthy positions, whereas 32.37% had quick positions

Because the higher cryptocurrency market recovered throughout the board, Uniswap’s native token – UNI – broke out of a bullish value sample. This marked a possible upside, with this breakout following a long-term battle that the asset has confronted since December 2024.

Technical evaluation of Uniswap (UNI).

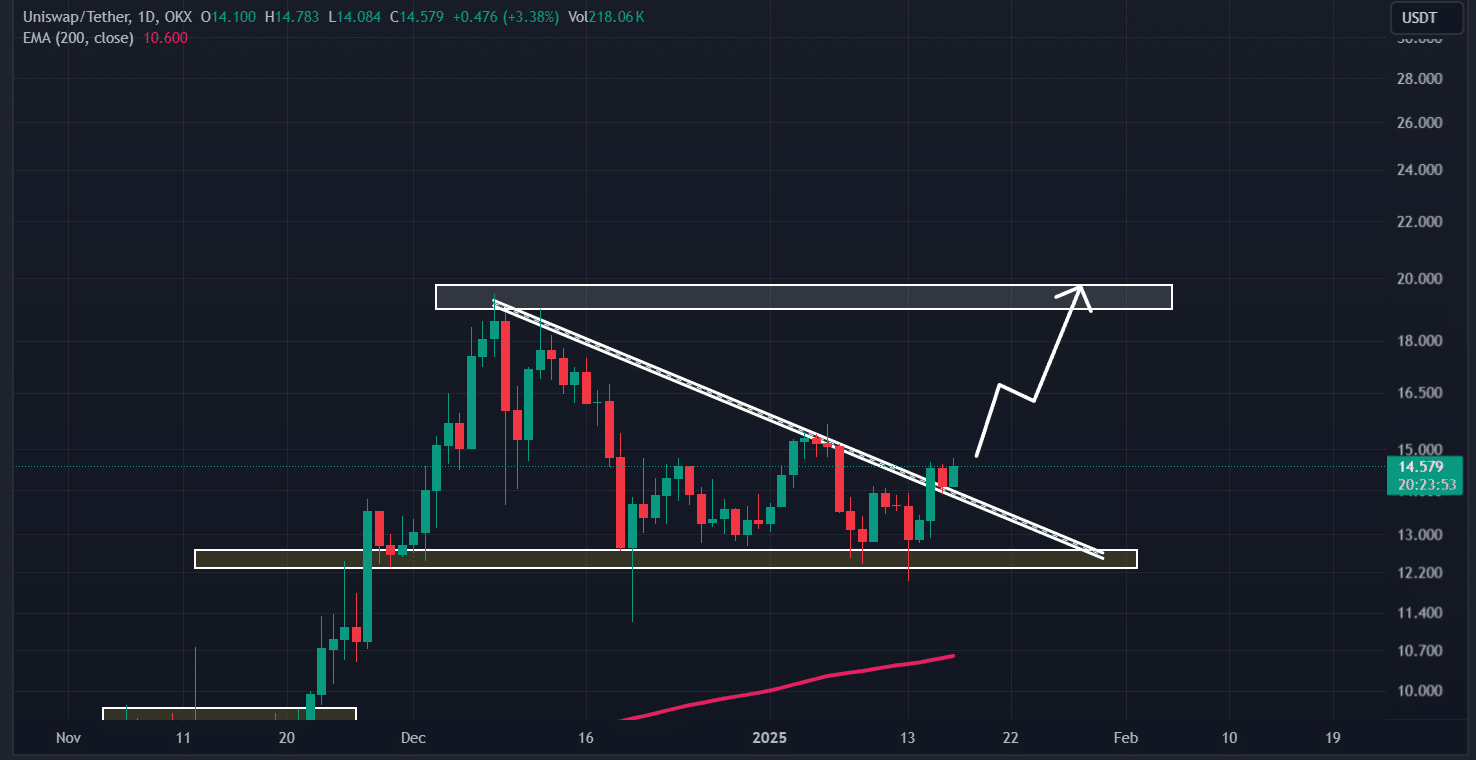

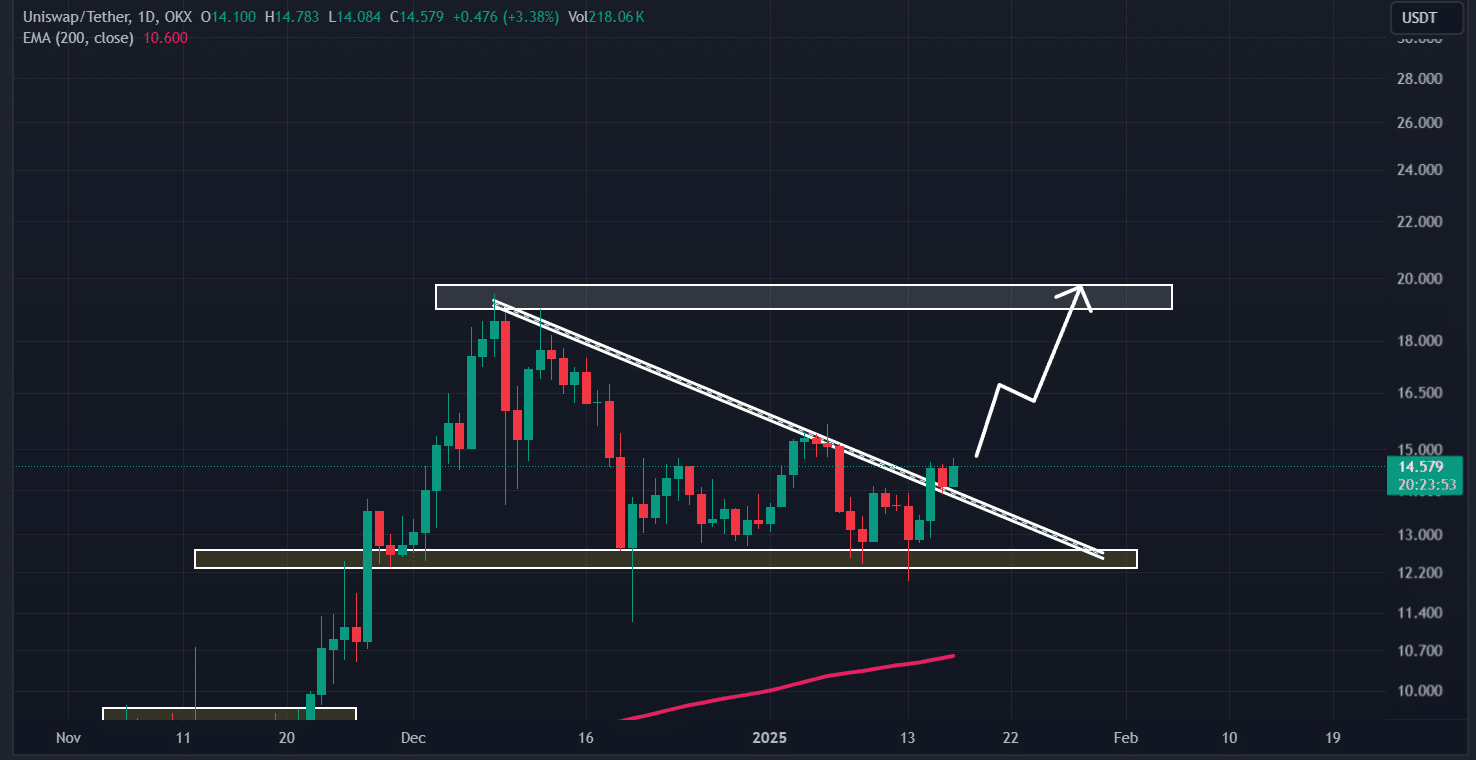

In accordance with AMBCrypto technical evaluation, UNI broke out of the descending triangle sample on the each day timeframe and reached the $15.20 resistance stage for the third time since December 2024.

Nonetheless, crypto historical past has not been in favor of the bulls on the subject of this resistance stage.

Supply: TradingView

UNI value forecast

Based mostly on the altcoin’s current value motion, if UNI breaks the horizontal stage and closes a each day candle above $15.50, there’s a sturdy risk that the altcoin might rise 30% to hit the following resistance stage of $20 within the close to future reaches.

Nonetheless, UNI’s efficiency has been fairly spectacular in current days. Actually, knowledge confirmed that property rose greater than 16% within the final three days alone.

Moreover, high property akin to Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have additionally seen important value will increase. These property and their efficiency influence broader market sentiment and, by extension, UNI.

On the upside, UNI seemed to be nicely beneath the overbought zone with an RSI of 56 – an indication that there could also be loads of room for additional positive factors.

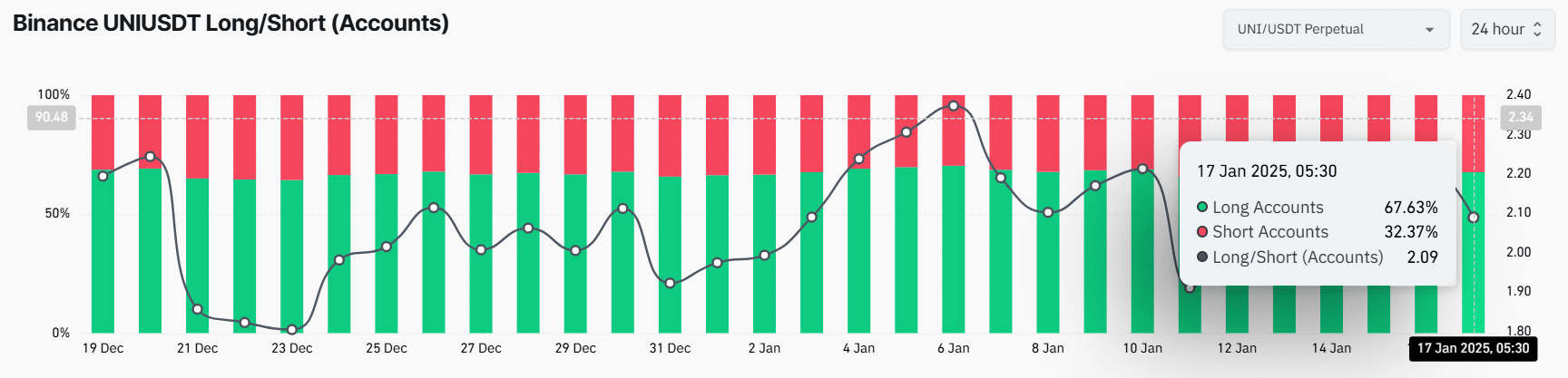

67.63% of the highest UNI merchants are lengthy bets

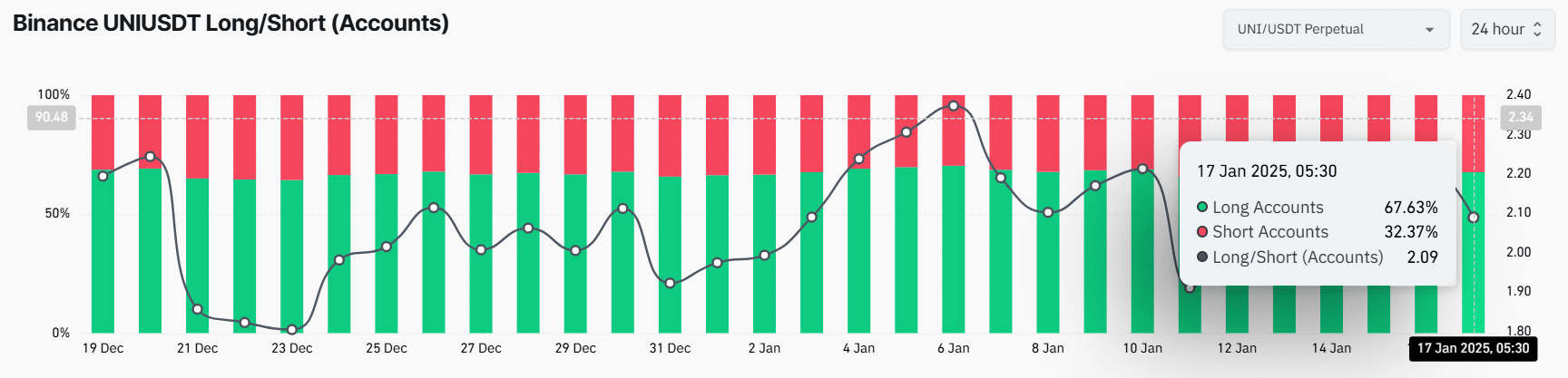

On the time of writing, it appeared that dealer curiosity and confidence had skyrocketed over the previous 24 hours, as evidenced by on-chain analytics agency Coinglass.

Actually, Binance’s UNI/USDT lengthy/quick ratio stood at 2.09, underscoring sturdy bullish market sentiment amongst merchants.

Supply: Coinglass

Furthermore, 67.63% of high UNI merchants on Binance had lengthy positions, whereas 32.37% had quick positions, additional supporting the bullish sentiment out there.

When these on-chain metrics are mixed with technical evaluation, it seems that bulls are at present dominating the property. Due to this fact, they’ll be sure that UNI exceeds the $15 threshold to attain the anticipated aim.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024