Analysis

US elections boosted Bitcoin’s liquidity to new highs

Credit : cryptoslate.com

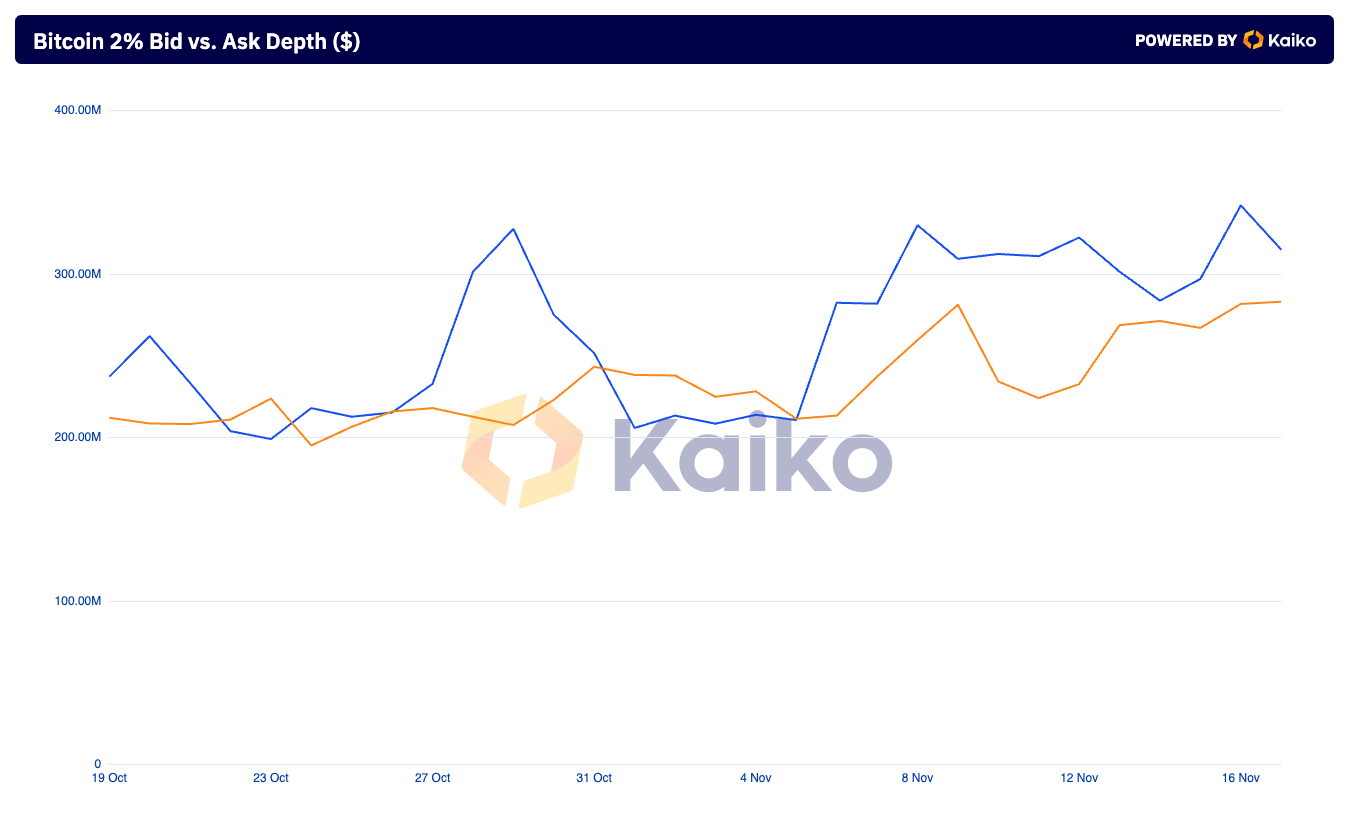

Bitcoin’s whole market depth of two%, a measure of liquidity that mixes purchase and promote orders inside a slim value vary of two% across the market value, rose to a one-year excessive of $623.40 million on November 16. This represents a big quantity. enhance from $422 million on November 5 – a big enhance in liquidity over a brief time frame.

It alerts rising market confidence, as deeper liquidity sometimes signifies merchants and establishments are extra keen to take part available in the market, offering a buffer towards value volatility.

This enhance in market depth within the run-up to and after the US presidential election just isn’t an remoted occasion, however a part of a broader shift in macroeconomic and political circumstances. The election of Donald Trump and his administration’s introduced intention to help Bitcoin and the crypto trade by concrete insurance policies have led to a rise in market exercise.

This newfound political alignment within the crypto area probably signaled to institutional and retail buyers that the regulatory atmosphere might develop into considerably extra favorable, decreasing perceived dangers and inspiring higher participation.

The market reacted enthusiastically to the prospect of a pro-crypto administration, with merchants probably decoding the information as a inexperienced gentle for wider adoption and institutional inflows. This value enhance, mixed with the rise in general market depth, means that market contributors had been buying and selling in response to the election outcomes and positioning themselves for a continued bullish pattern. The higher market depth displays this elevated engagement, as deeper liquidity permits bigger orders to be full of minimal slippage – essential in a market with fast upward value actions.

The affect of the election will also be noticed within the bid versus ask depth. Whereas the imbalance favoring promote orders of $341.81 million over $281.59 million in purchase orders suggests some revenue taking, it is very important observe that this exercise has not led to a big value correction. As a substitute, the market absorbed sell-side stress effectively, indicating strong purchaser demand whilst Bitcoin breached $93,000.

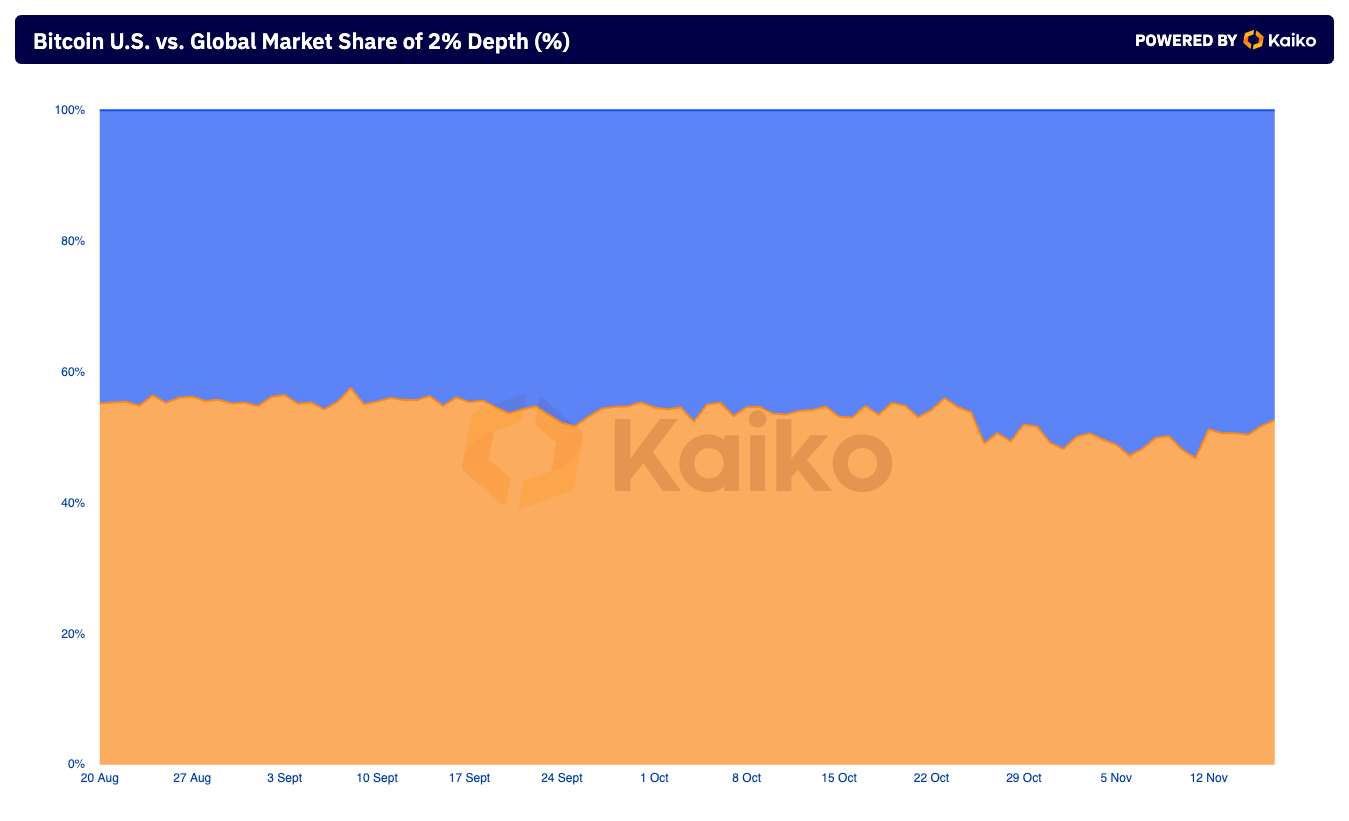

The US market’s traditionally dominant share of the worldwide market depth seems to have performed a significant position in driving this liquidity wave. Though US market share fell barely after the election, the broader pattern by 2024 – with the US accounting for over 50% of worldwide market share – means that US establishments and merchants have performed a vital position in shaping market exercise .

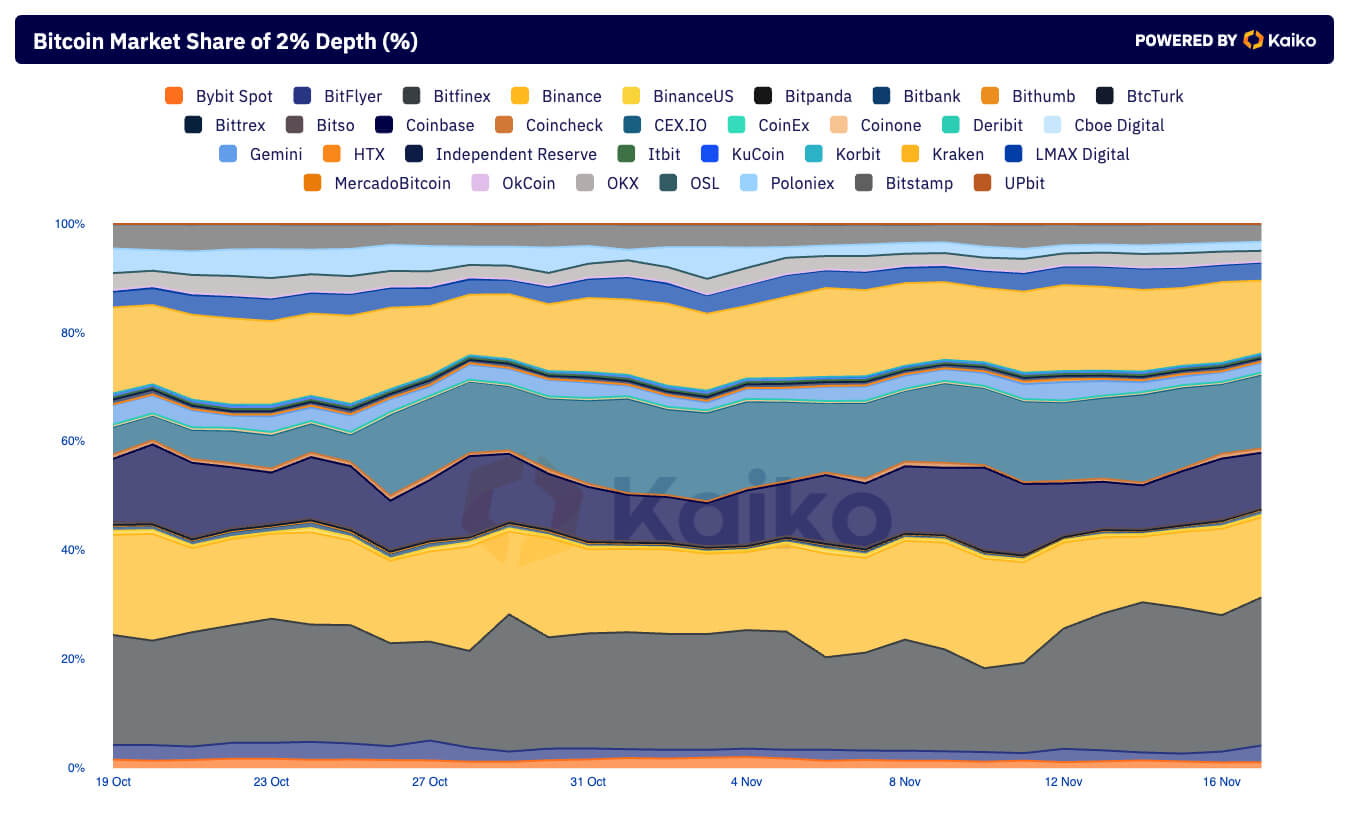

At an exchange-specific degree, Bitfinex’s emergence as a frontrunner in world market depth might replicate its capacity to draw liquidity amid these political and market shifts. The inventory’s 27% share on November 16 coincides with Bitcoin’s post-election rally, indicating that Bitfinex has efficiently captured a good portion of the elevated buying and selling exercise.

In distinction, Binance’s declining inventory, which hovered between 10% and 15% in November, may very well be attributed to continued regulatory scrutiny, which can have deterred institutional gamers from utilizing the platform regardless of broader market optimism.

The post-US election boosted Bitcoin liquidity to new highs, showing first on CryptoSlate.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now