Policy & Regulation

US stablecoin rules split global liquidity with Europe, CertiK warns

Credit : cryptonews.net

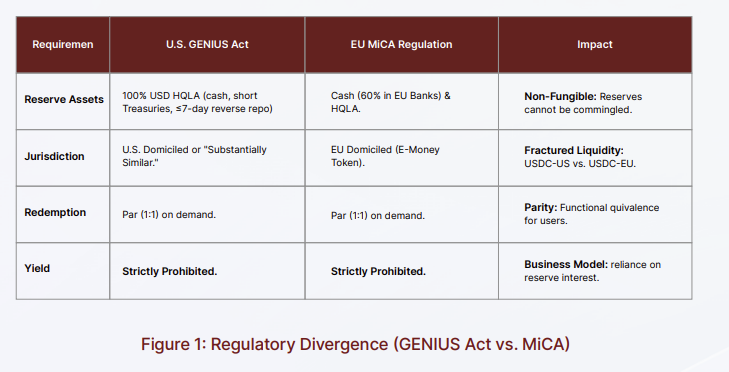

The USA’ new strategy to stablecoin regulation is reshaping world liquidity flows and creating a pointy structural break with the European Union’s Markets in Crypto-Belongings (MiCA) regime, successfully creating separate US and European stablecoin liquidity swimming pools, in response to a brand new report from blockchain safety auditor CertiK.

The report reveals that the U.S. digital asset market will enter a brand new part of regulatory readability in 2025, with federal legislation and administrative reforms now largely aligned round how digital property are issued, traded and held.

Central to this shift is the GENIUS Act, which was signed into legislation by US President Donald Trump in July and establishes the primary federal framework for funds stablecoins. The legislation imposes strict reserve necessities, bans interest-bearing stablecoins, and formally integrates stablecoin issuers into the U.S. monetary system.

Whereas the framework gives long-sought regulatory certainty to US issuers, the report warns that it additionally accelerates world divergence with the EU’s MiCA regime, leaving the US with a “clear liquidity pool” and successfully disrupting the worldwide stablecoin market.

Consequently, CertiK expects stablecoin liquidity to grow to be more and more segmented by jurisdiction, creating new cross-border settlement frictions and doubtlessly opening the door to regional stablecoin arbitrage.

The distinction in rules between the US and the European Union surrounding stablecoins. Supply: CertiK

Associated: Crypto Biz: Company stablecoin race heats up with Citi and Western Union on the helm

MiCA attracts hearth over banking danger as a result of the US sees stablecoins as statesmanship

Whereas the European Union’s MiCA regime mirrors the US GENIUS Act by requiring full redemption at par and banning returns on stablecoins, it has drawn criticism for introducing financial institution focus dangers as the foundations require a majority of issuers’ reserves to be held with EU-based banks.

Paolo Ardoino, CEO of Tether, advised Cointelegraph that this construction may introduce “systemic dangers” for issuers, noting that banks usually lend out a good portion of their deposits below the fractional reserve system.

Others, together with Fideum founder Anastasija Plotnikova, have warned that MiCA’s framework may additionally speed up trade consolidation, elevating limitations to entry for smaller issuers on account of larger compliance and capital prices.

Nonetheless, neither the GENIUS Act nor MiCA seem designed to protect the worldwide fungibility of stablecoins. As an alternative, each frameworks prioritize regulatory oversight and monetary stability whereas, within the case of the US, explicitly strengthening greenback liquidity and world greenback use.

That view was bolstered earlier this yr by Treasury Secretary Scott Bessent, who stated the federal government would take a deliberate strategy to stablecoin regulation and use it as a device to broaden the dominance of the US greenback.

“As President Trump has directed, we’re going to protect the US [dollar] the world’s dominant reserve forex, and we are going to use stablecoins for that,” Bessent stated.

Journal: China Formally Hates Stablecoins, DBS Trades Bitcoin Choices: Asia Specific

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now