Policy & Regulation

US Treasury weighs digital ID verification in DeFi to tackle illicit finance

Credit : cryptonews.net

The US Division of Treasury is on the lookout for public suggestions on how digital identification instruments and different rising applied sciences can be utilized to fight unlawful financing in cryptom markets, whereby one choice embedded identification controls into decentralized funds (Defi) good contracts.

The session, revealed this week, stems from the newly established steering and institution of Nationwide Innovation for US Stablecoins Act (Genius Act), signed in July.

The regulation, which explains a regulatory framework for cost stabini -expenditures, instructs the treasury to discover new compliance applied sciences, together with software programming interfaces (APIs), synthetic intelligence, digital identification verification and blockchain monitoring.

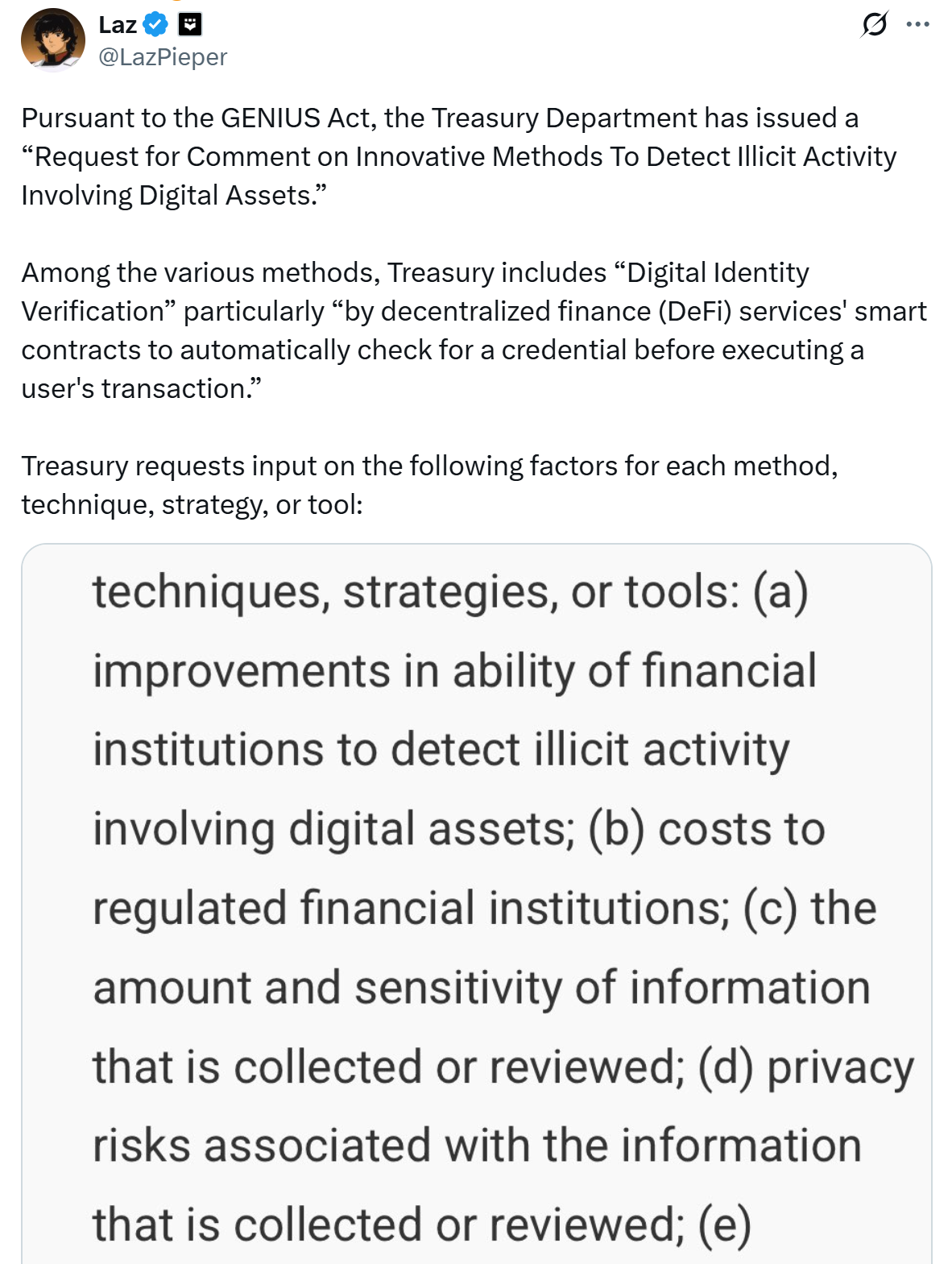

One of many concepts within the request for remark is the potential for Defi protocols to combine digital identification references straight into their code. In line with this mannequin, a Sensible contract can robotically confirm the login information of a person earlier than a transaction is carried out, efficient constructing Know Your Buyer (KYC) and Anti-Cash Launking (AML) assure in blockchain infrastructure.

Treasury is contemplating digital ID verification in Defi. Supply: Laz

Associated: Genius Act to Spark Wave of ‘Killer Apps’ and New Cost Companies: Sygnum

Treasury: Digital IDs can decrease the compliance prices

In line with Treasury, digital identification options that embody authorities IDs, biometrics or transportable references can decrease the compliance prices and strengthen privateness safety.

They will additionally make it simpler for monetary establishments and Defi companies to detect cash laundering, terrorist financing or sanctions earlier than transactions happen.

Treasury additionally acknowledged potential challenges, together with concern about information privateness and the necessity to steadiness innovation with authorized supervision. “Treasury welcomes enter about any problem that’s related to commentators for Treasury’s efforts,” the company wrote.

Public feedback are open till 17 October 2025. After the session, Treasury will submit a report back to the congress and may problem tips or suggest new guidelines primarily based on the findings.

Associated: Genius ACT PROPERTY PROCT PROFESSION could be pushed into Tokenized Activa Exec in Tokenized Activa

American banks warn towards Stablecoin income Maas within the regulation

Final week, a number of giant American financial institution teams, led by the Financial institution Coverage Institute (BPI), insisted on the congress to sharpen the foundations underneath the Genius Act, warning {that a} Maas within the regulation might have the expenditure of Stablecoin handled restrictions on curiosity paid curiosity.

In a letter that was despatched on Tuesday, BPI mentioned that the hole might permit emissents to collaborate with gala’s or affiliated firms to supply proceeds that undermine the intention of the regulation. The group warned that uncontrolled development of effectivity stablecoins may cause to trigger conventional banks as much as $ 6.6 trillion, threatening credit score entry for firms.

Journal: Bitcoin vs Stablecoins Showdown seems when the good act is approaching

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024