Bitcoin

USDT Slides by Most Since FTX Crash on MiCA, Raises Concern of Wider Crypto Slump

Credit : www.coindesk.com

Tether’s USDT, the world’s largest dollar-pegged stablecoin, has skilled the sharpest weekly market worth decline in two years, elevating considerations about market volatility.

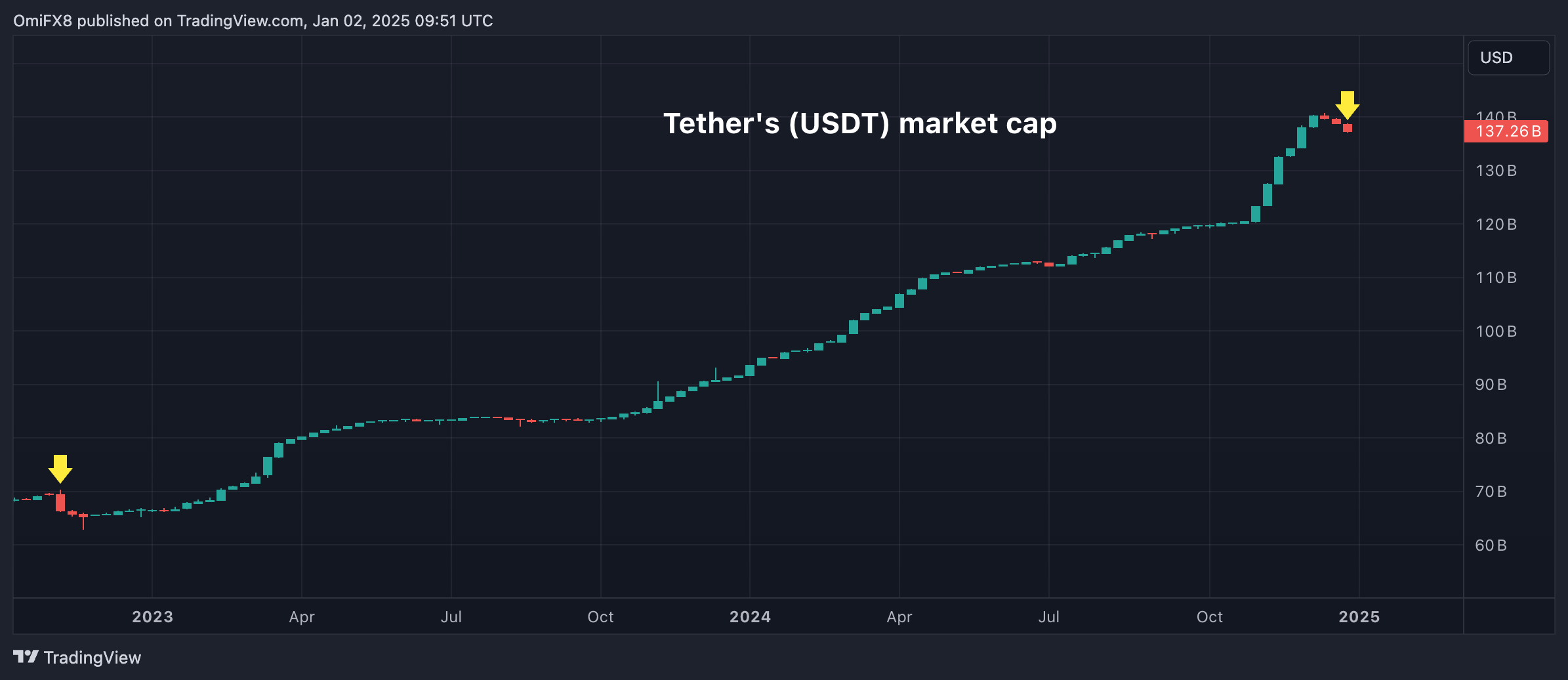

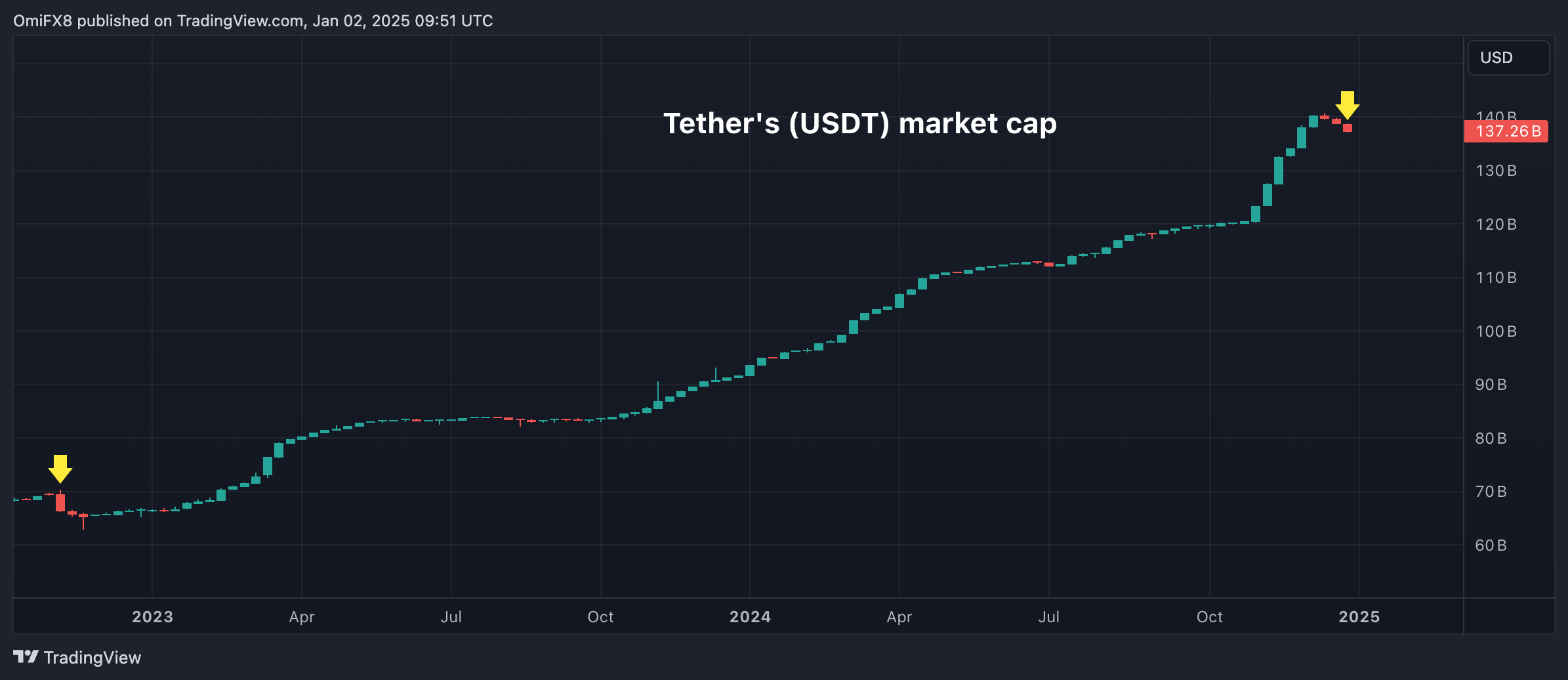

USDT’s market capitalization fell greater than 1% this week to $137.24 billion, the most important drop for the reason that FTX trade crashed within the second week of November 2022, TradingView information reveals. In mid-December it reached a report $140.72 billion.

The lower follows a choice by a number of European Union (EU) based exchanges And Coinbase (COIN) to delete USDT because of compliance points with EU Rules for Markets in Crypto Belongings (MiCA). fully effective December 30though the foundations for stablecoins – cryptocurrencies whose worth is pegged to a real-world asset such because the greenback – got here into impact six months in the past.

The regulation requires issuers to have a MiCA license to publicly provide or commerce asset-referenced tokens (ARTs) or e-money tokens (EMTs) inside the block. An ART is a crypto asset that seems to keep up a secure worth by referencing one other asset resembling gold, crypto tokens, or a mixture of each, together with a number of official currencies. ERTs check with a single nationwide forex, simply as USDT does.

EU-based merchants can nonetheless maintain USDT in non-custodial wallets, however can not commerce it on MiCA-compliant centralized exchanges.

USDT is a gateway to the crypto market, with buyers utilizing it extensively to finance spot cryptocurrency purchases and derivatives buying and selling. As such, the delistings and decline in market worth have occurred led to speculation of a broader crypto market decline on social media.

Nevertheless, these considerations could also be unfounded and so might the destructive penalties, at finest limited to the eurozoneKaren Tang, head of APAC partnerships at Orderly Community, a permissionless Web3 liquidity layer, mentioned in a put up on

“Entry to @Tether_to might be restricted within the EU because of MiCa rules and won’t hurt USDT’s dominance,” Tang wrote. “The EU is just not the most important crypto market. Most cryptocurrency buying and selling quantity takes place in Asia and the US. All this may do is hinder the EU’s innovation in digital property, which is already gradual because of advanced over-regulation. If I might do the EU a disservice, I’d… ”

Crypto analyst Bitblaze mentioned Asia accounts for the huge share of tether quantity, downplaying the impression of MiCA-led delistings in Europe.

“USDT is the most important stablecoin, with a market capitalization of $138.5 billion and a day by day buying and selling quantity of $44 billion. As of right now, 80% of USDT’s buying and selling quantity comes from Asia, so the EU delisting is not going to have any critical penalties .” Bitblaze listed on X.

Tether has invested in MiCA-compliant corporations StablR and Quantoz Funds in an effort to align rules.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now