Altcoin

VIRTUAL’s Latest Price Test – How Can Altcoin Network Activity Go?

Credit : ambcrypto.com

- The Golden Cross confirmed the long-term energy on the altcoin chart

- Alternate outflows elevated, whereas every day lively addresses soared

The Virtuals Protocol (VIRTUAL) is at present in a vital market section. Particularly as the value assessments vital Fibonacci help ranges, whereas on-chain metrics highlighted rising community engagement regardless of latest value volatility.

For sure, the token’s trajectory has captured the market’s consideration as community fundamentals strengthened amid value consolidation.

VIRTUAL Fibonacci ranges sign a vital help take a look at

VIRTUAL’s value motion reached a decisive level at $2,846, which coincided with the 0.5 Fibonacci retracement degree at $2,638. Moreover, the token recorded a decline of 14.17%, with buying and selling quantity reaching 483.7K VIRTUAL at press time, indicating vital market curiosity at these ranges.

Notably, on the time of writing, the 50-day shifting common at $2.836 remained comfortably above the 200-day MA at $0.82711. This allowed the altcoin to keep up a bullish market construction regardless of latest bouts of corrections.

Supply: TradingView

Community exercise reveals resilience

In the meantime VIRTUAL daily active addresses confirmed exceptional progress, with latest knowledge exhibiting that consumer engagement continued all through the consolidation section. The metric additionally noticed a spike earlier this month, with the crypto sustaining constantly excessive ranges all through.

This development indicated rising adoption, no matter value fluctuations. Such a divergence between VIRTUAL value motion and community exercise has traditionally preceded vital market actions.

The dynamics of the change circulation indicators accumulation

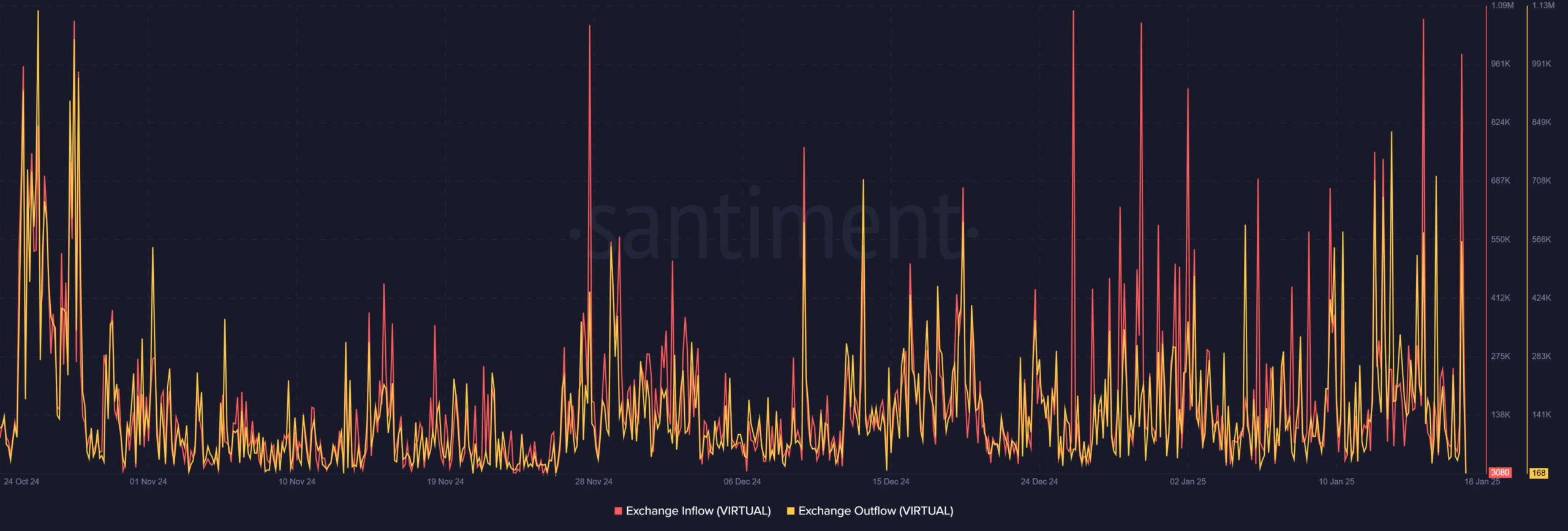

Moreover, VIRTUAL’s change circulation statistics revealed superior market habits. Outflow spikes have change into more and more widespread since December, indicating strategic accumulation by bigger gamers throughout value declines.

Consequently, influx patterns confirmed managed distribution quite than panic promoting – an indication of mature market participation and rising confidence in VIRTUAL’s ecosystem.

Supply: Santiment

VIRTUAL’s technical construction emphasizes the maturity of the market

The golden cross shaped by VIRTUAL’s shifting averages, with the 50-day at $2.836 sustaining its place above the 200-day at $0.827, underlined the underlying energy of the longer-term development. Moreover, the Fibonacci retracement ranges from the latest excessive additionally supplied some essential insights, with speedy resistance at $4,017 and powerful help at $2,022.

Latest change price patterns additional confirmed VIRTUAL’s maturing market construction. The synchronization of strategic outflows and measured inflows indicated positioning at an institutional degree, quite than retail-driven volatility.

This habits and constantly rising every day lively addresses collectively level to strengthening community fundamentals regardless of value fluctuations.

– Is your portfolio inexperienced? Take a look at the Virtuals Protocol Revenue Calculator

VIRTUAL’s speedy problem lies in sustaining help above the 0.5 Fibonacci degree at $2,638. A profitable protection of this zone, supported by rising community metrics, may spell the tip of the continued correction section.

The convergence of technical help with rising community exercise makes a compelling case for market stability on the press degree. What this implies is that VIRTUAL’s market construction is maturing and able to supporting sustainable progress.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024