Ethereum

Vitalik Buterin-linked wallet dumps $1.72 mln ETH, What’s Next?

Credit : ambcrypto.com

- ETH might attain the $2,900 stage if it closes a every day candle above the $2,700 stage.

- ETH’s Lengthy/Brief ratio stood at 0.927, indicating bearish sentiment amongst merchants.

Within the persistently struggling cryptocurrency market, a pockets is linked to Vitalik Buterin, the co-founder of Ethereum [ETH] dumped a big quantity of ETH.

Based on the on-chain analytics firm SpotonchainOn September 29, pockets tackle “0x556” linked to Buterin deposited 649 ETH price $1.72 million to Paxos.

Pockets linked to Buterin dumps $1.72 million price of ETH

The corporate additionally famous that the pockets had deposited a big 1,300 ETH price $3.35 million over the previous 11 days at a median value of $2,581.

Moreover, the corporate added that on September 19, this pockets obtained 1,300 ETH from one other pockets funded by Vitalik Buterin in 2022.

This large deposit of ETH has the potential to shift market sentiment to a bearish aspect.

Ethereum technical evaluation and key ranges

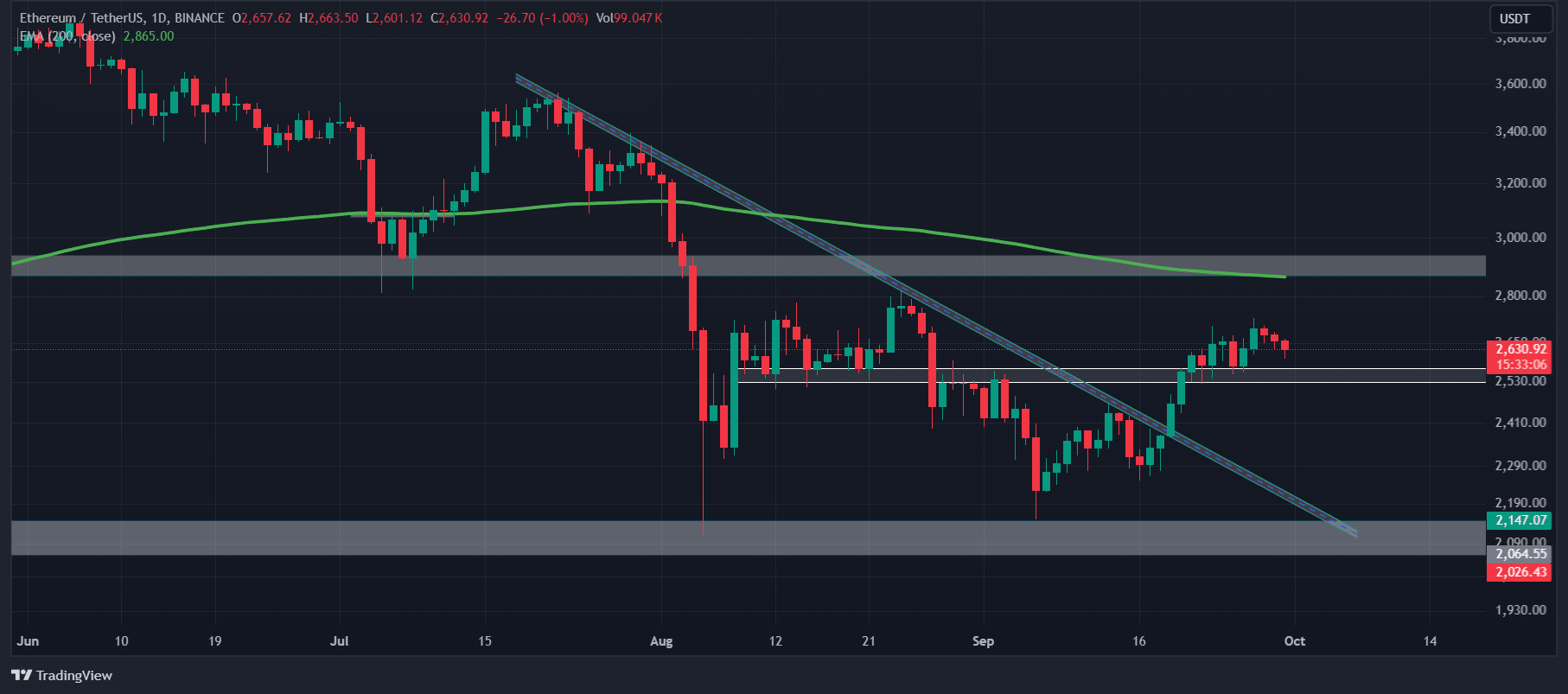

Based on AMBCrypto’s technical evaluation, ETH is consolidating inside a decent vary after breaking a vital resistance stage at $2,590.

If the value of the asset rises and closes its every day candle above the $2,700 stage, there’s a excessive chance that ETH might attain the $2,900 stage within the coming days.

Supply: TradingView

As of now, ETH is buying and selling beneath the 200 Exponential Transferring Common (EMA) on a every day time-frame, indicating a downtrend.

The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an up or down development.

Blended sentiment resulting from on-chain metrics

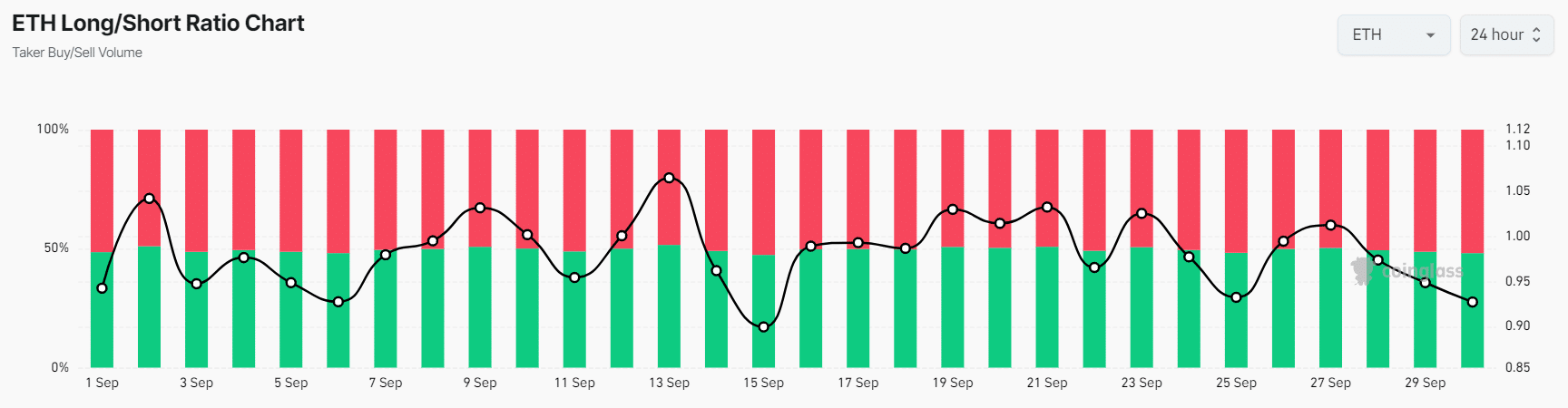

Along with the technical evaluation, the on-chain metrics point out blended sentiment.

Based on on-chain analytics agency Coinglass, ETH’s Lengthy/Brief ratio stood at 0.927, indicating bearish sentiment amongst merchants.

Supply: Coinglass

Moreover, the Futures Open Curiosity has remained unchanged over the previous 24 hours, indicating that merchants are nonetheless holding their positions whereas new merchants are hesitant to construct new positions.

Learn Ethereum’s [ETH] Worth forecast 2024-25

51.89% of prime merchants maintain brief positions, whereas 48.11% maintain lengthy positions. On the time of writing, ETH was buying and selling round $2,635 and has remained unchanged over the previous 24 hours.

Throughout the identical interval, buying and selling quantity elevated by 22%, indicating higher participation from merchants and traders amid ongoing consolidation, probably a constructive sign for ETH.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now