Ethereum

Vitalik Buterin on why Ethereum centralization is a problem: ‘Higher risk of…’

Credit : ambcrypto.com

- Vitalik Buterin recognized block creation and staking as key centralization dangers.

- The crew explored some options to deal with these danger components.

Vitalik Buterin, co-founder of Ethereum [ETH]examined the community’s centralization dangers and the potential options the crew was exploring.

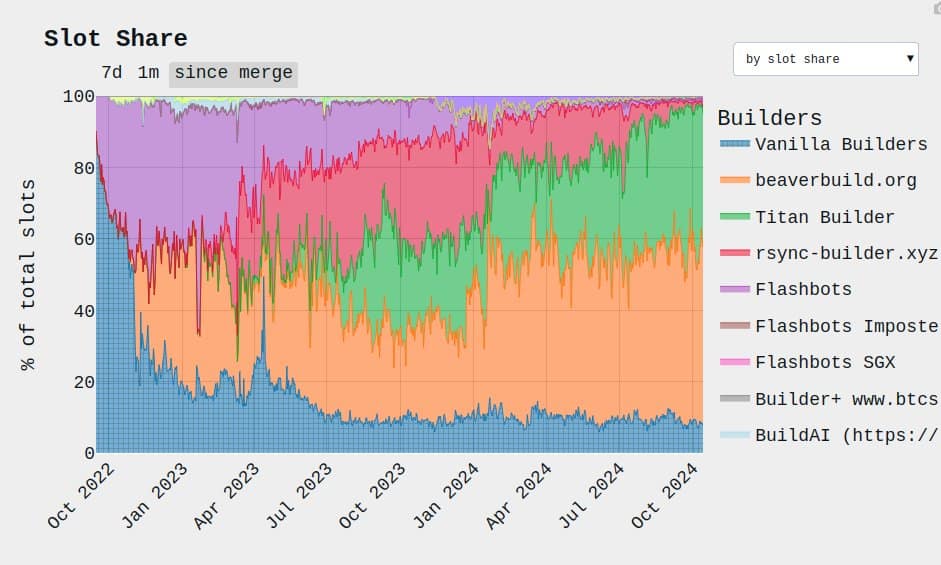

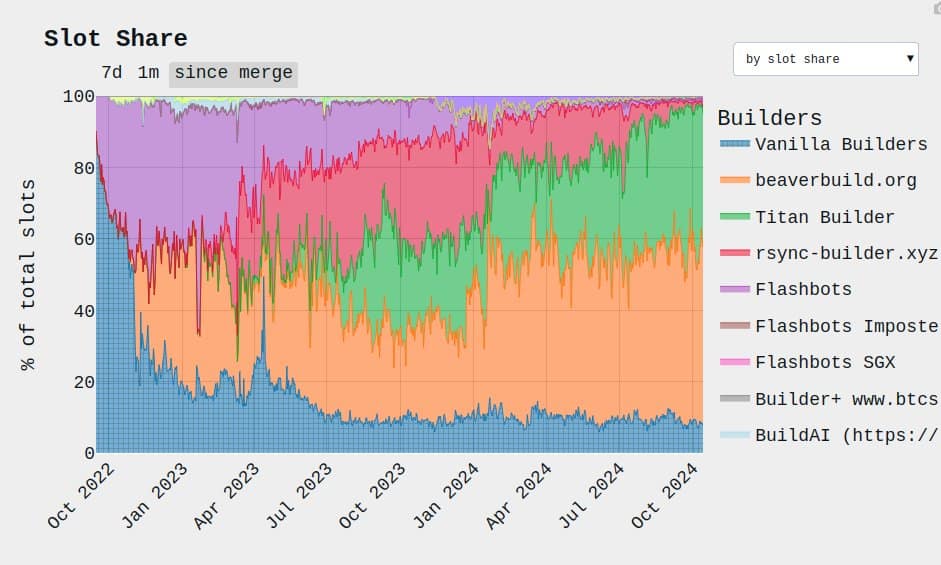

Buterin cited block creation and staking as vital danger components for centralization. To place the horrible state of affairs into perspective, two entities (Beaver and Titan) virtually created 90% of ETH blocks in October.

What may go unsuitable with such a degree of centralization?

Supply: Buterine

Buterin additionally emphasised that the dominance of main strikers may enhance community assaults and censorship dangers. He declared,

“This (massive staker dominance) results in a better danger of 51% assaults, transaction censorship and different crises. Along with the centralization danger, there are additionally dangers of worth extraction: a small group capturing worth that may in any other case go to Ethereum customers.”

Potential options

Since final 12 months, the dangers talked about above have elevated on account of a rise in the usage of specialised algorithms (MEV, most extraction worth) by block proposals to maximise income.

“Bigger actors can afford to run extra subtle algorithms (“MEV extraction”) to generate blocks, giving them larger income per block.”

For the block creation downside, Buterin talked about the inclusion checklist method as a probable answer, the place initiators and builders share the duty.

“The principle answer is to additional cut up the block manufacturing job: we give the duty of selecting transactions again to the initiator (i.e. a staker), and the builder can solely select the order and insert some transactions of his personal. That is what inclusion lists are attempting to do.”

The crew explored completely different nuances of inclusion lists with completely different trade-offs and needed to provide you with a single method.

When it comes to deployment danger, 34 million of the 120 million circulating provide is deployed, which is shut 30% of ETH in supply.

In response to Buterin, continued stake development may probably make one liquid staking token (LST) extra dominant and scale back liquidity.

To resolve this, the crew appeared into decreasing wagering rewards and limiting the quantity of ETH that could possibly be staked.

Total, Buterin reiterated the intention to forestall worth extraction from customers on the expense of centralized management and to dissuade the community from taking place the centralization route.

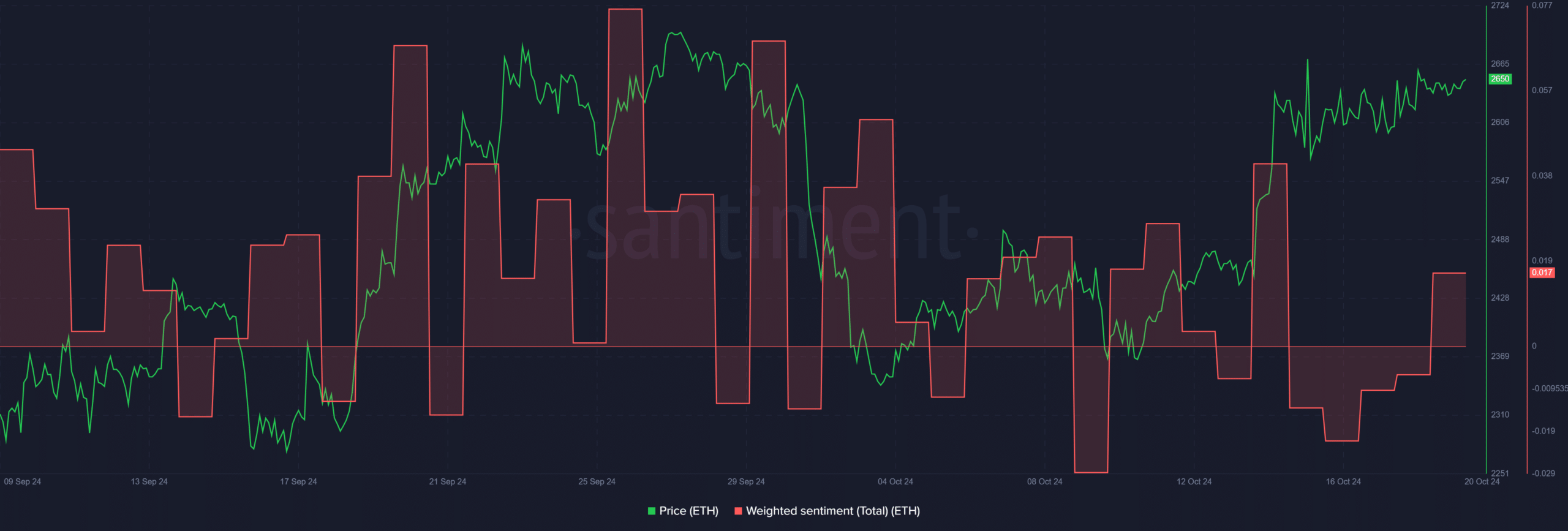

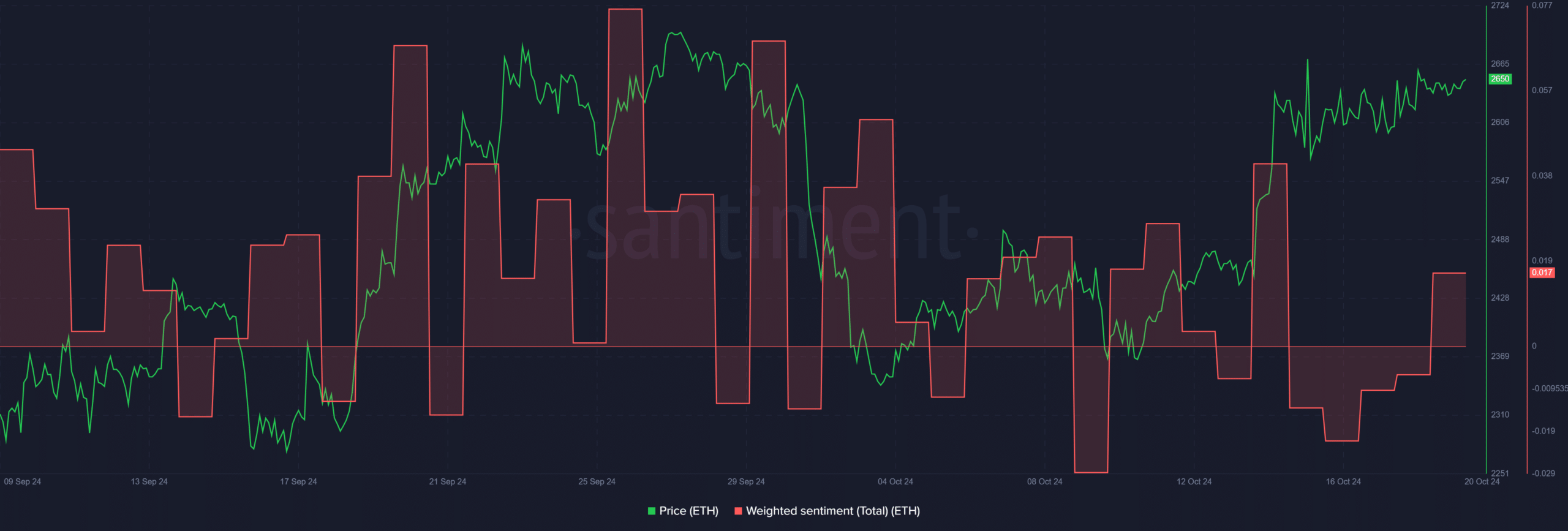

Just a few hours after the replace, ETH sentiment rose positively, indicating that market contributors have been hopeful in regards to the altcoin’s value prospects.

Supply: Santiment

Whereas it stays to be seen what options the crew will select to deal with the problems raised, this transfer may strengthen ETH’s worth in the long term.

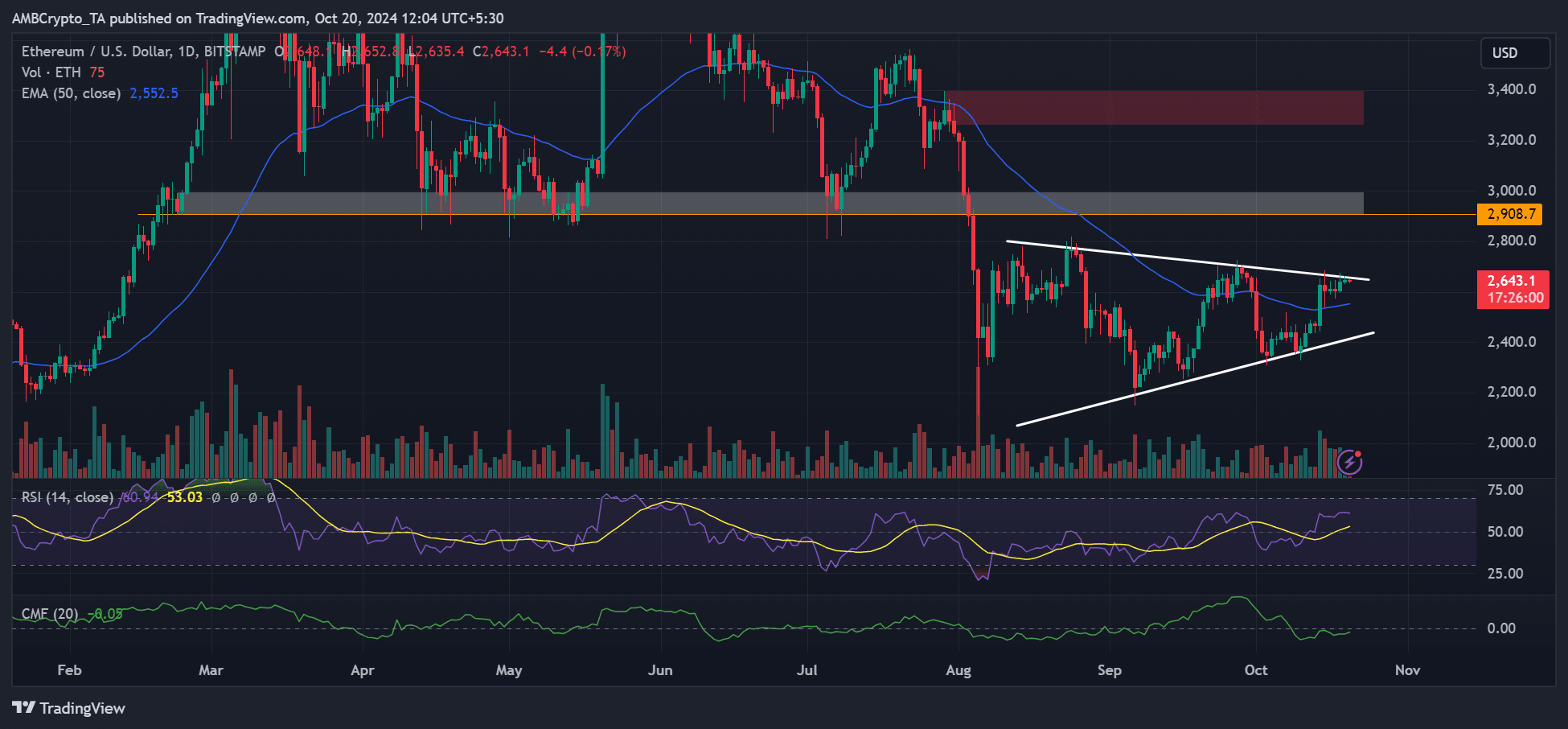

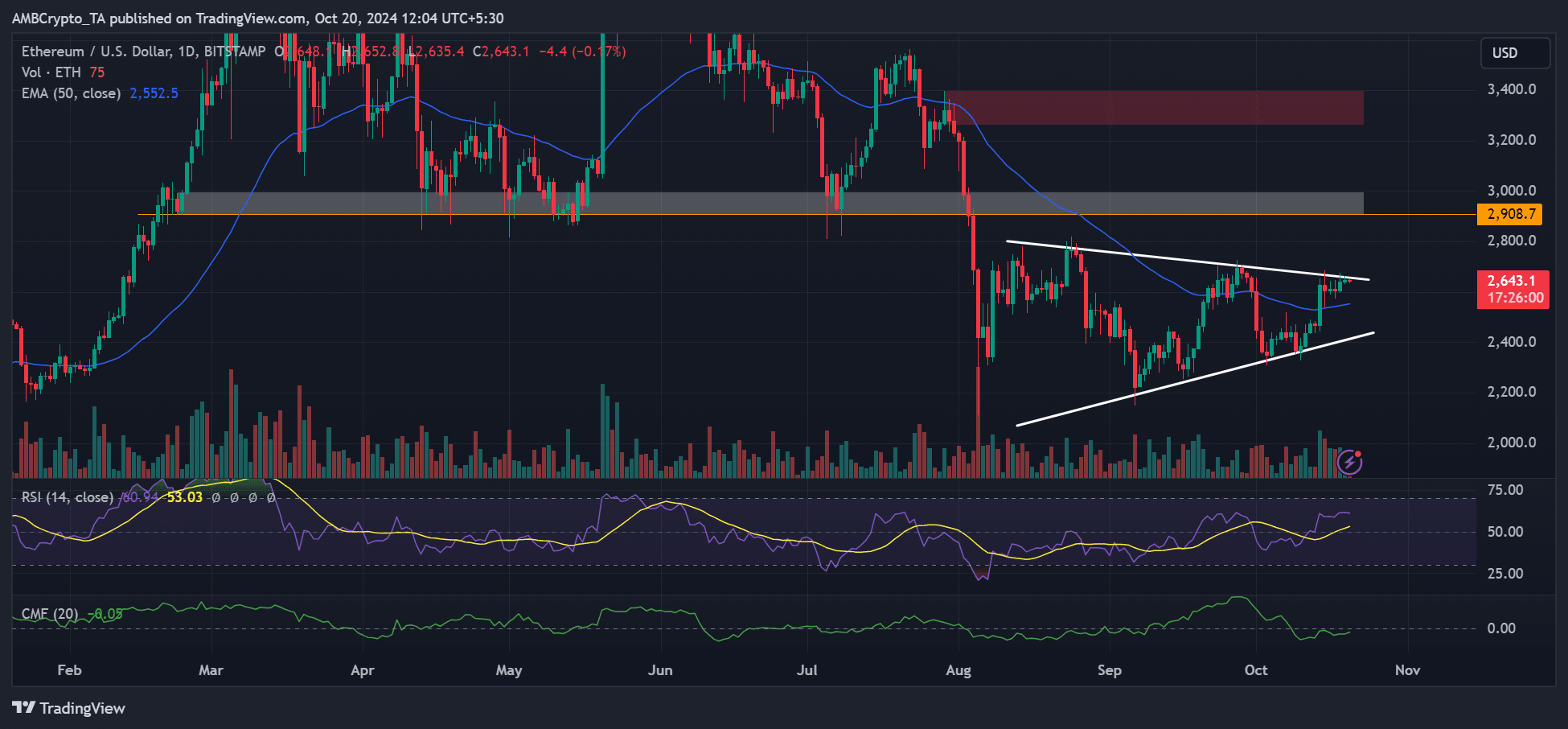

On the time of writing, ETH’s value was $2.6K, under a significant roadblock away from the bullish goal of $2.9K.

Supply: ETH/USD, TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now