Bitcoin

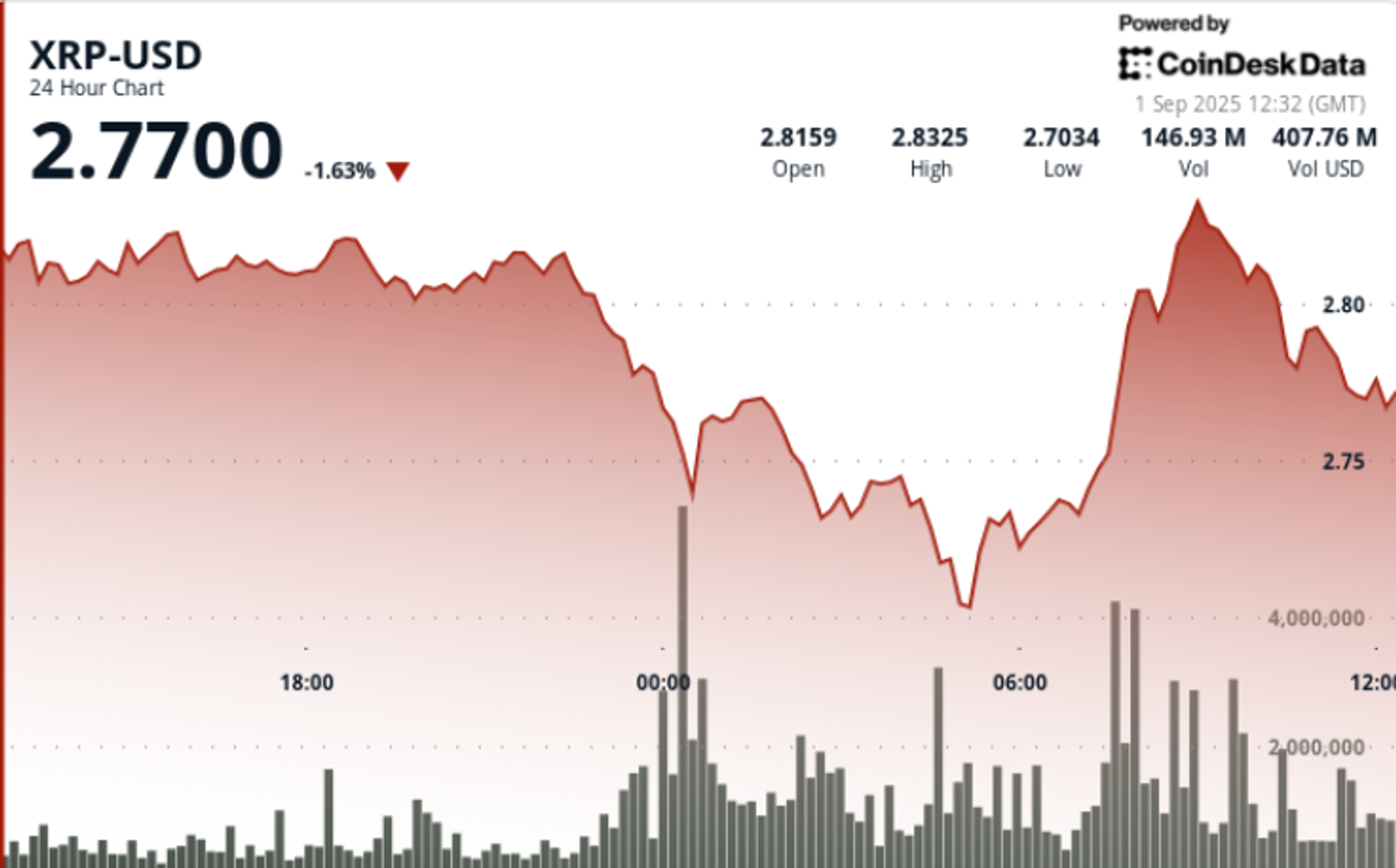

Volatility Widens as Price Holds $2.77 Support

Credit : www.coindesk.com

Token acts between $ 2.70 – $ 2.84 in August 31 August – Sept. 1 window, with whale accumulation that stops severe resistance to $ 2.82 – $ 2.84.

Information background

- XRP fell from $ 2.80 to $ 2.70 within the late 31 August – Early 1 September earlier than he returned to $ 2.82 on heavy volumes.

- Whales gathered 340m XRP for 2 weeksA sign from institutional conviction regardless of the bearish strain within the brief time period.

- To the chain actions enriched with 164m tokens that had been traded throughout the Rebound of September 1, morningGreater than double session averages.

- September stays a traditionally weak month for crypto, however the accumulation of whales is seen as a counterbalance for the liquidation of the retail commerce.

Abstract of the value promotion

- Business vary spanned $ 0.14 (≈4.9%) Between $ 2.70 low and $ 2.84 excessive.

- The steepest decline got here at 23:00 GMT on August 31, when the value of $ 2.80 to $ 2.77 decreased 76.87M QuantityVirtually 3x every day averages.

- At 07:00 GMT 1 September Bullish Flows drove a rebound from $ 2.73 to $ 2.82 164m quantityCementing $ 2.70- $ 2.73 as a short-term assist.

- Final hour of consolidation (10: 20–11: 19 GMT) Noticed worth waste 0.71% from $ 2.81 to $ 2.79, with a heavy sale between 10: 31-10: 39 on 3.3 m quantity per minuteattaching resistance to $ 2.80 – $ 2.81.

Technical evaluation

- Assist: $ 2.70– $ 2.73 ground repeatedly defended, bolstered by shopping for whales.

- Resistance: $ 2.80 – $ 2.84 stays the rejection zone, with $ 2.87 – $ 3.02 as the following upward threshold.

- Momentum: RSI virtually mid-40s after the rebound, with neutral-to-bearable bias.

- MacD: Compression part continues; doable crossover if the buildup persists.

- Patterns: Symmetrical triangle that varieties with volatility compression; Breakout -Pad stays open to $ 3.30 if the resistance knew.

Which merchants take a look at

- If $ 2.70- $ 2.73 is maintained, short-term merchants will deal with it as a springboard for retests of $ 2.84.

- A close-by $ 2.84 would place $ 3.00 – $ 3.30 again within the recreation.

- Drawback state of affairs: Incalence of $ 2.70 exposes $ 2.50 as the following structural assist.

- Whale accumulation versus Institutional Gross sales-the Push-Pull Dynamics that might dictate the path of September.

Continue Reading

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024