Ethereum

Wall Street Is Turning to Ethereum for Tokenization and Staking

Credit : coinpedia.org

The curiosity of Wall Avenue in Ethereum is warmed up. In keeping with a prime strategist, institutional acceptance might in the end push the value of ETH to $ 60,000.

In a detailed thread on X, Thomas (Tom) LeeManaging accomplice at Fsinsight and a well known Wall Avenue strategist, defined why institutional traders have been shortly drawn to Ethereum ($ ETH). His feedback come if ETH continues to change round $ 3,600, far beneath the implicit worth based mostly on historic ETH/BTC ratios.

Why does Wall Purchase Avenue Ethereum?

In keeping with Lee, varied necessary components from Ethereum make the Go-TO blockchain for conventional funds:

- Authorized readability within the US: ETH is usually thought of probably the most conforming good contract platform within the US.

- Impeccable uptime: Ethereum has skilled zero downtime In his 10-year historical past.

- Community impact: Massive settings corresponding to JPMorgan and Robinhood Construct or Tokenizing Activa on Ethereum.

“Wall Avenue runs to ETH,” Lee stated and famous that the story of Ethereum is stronger than a 12 months in the past at present.

Wall Avenue will use ETH

Lee emphasised that Wall Avenue not solely makes use of Ethereum; It would arrange ETH to take part within the worth layer of the community.

This development is a component of a bigger shift the place Actual-World belongings (RWAS) are signed on Ethereum.

Lee seen: “Whereas Wall Avenue funds the world on the blockchain, they are going to use ETH to be concerned within the development of Ethereum.”

- Additionally learn:

- Visa and Mastercard say that stablecoins are usually not a risk

- “

Is Ethereum worth undervalued?

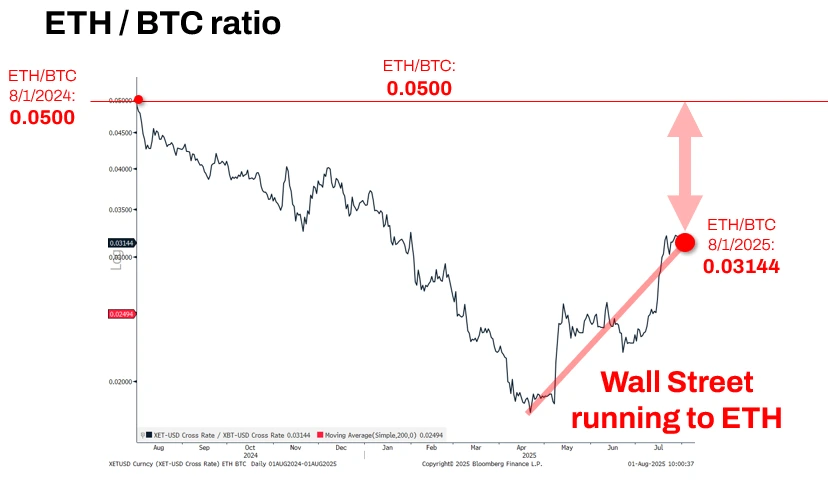

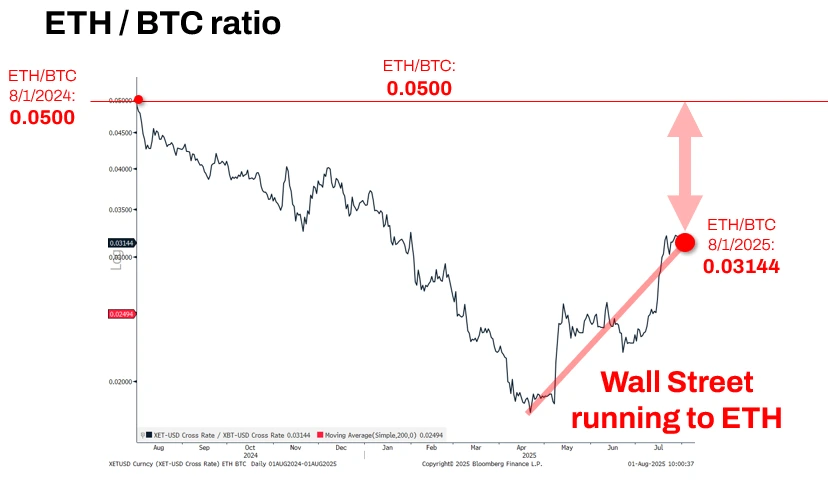

Lee pointed to the ETH/BTC ratio as an necessary indicator. A 12 months in the past the ratio was 0.0500. With Bitcoin at the moment round $ 114,000, this means an ETH valuation of roughly $ 5,707 An necessary premium for the present market worth.

“This argues that the ETH/BTC ratio ought to get well,” Lee defined, the emphasis on the disconnection between present costs and the rising dominance of Ethereum.

“The ETH story is stronger than August 2024 at present,” Said Lee.

ETH worth as much as $ 60,000?

Lee predicted that if Ethereum turns into the idea for monetary markets, the ETH worth sooner or later may very well be $ 60,000 or extra.

He’s clear that this isn’t a prediction, solely a chance. However given the way in which during which establishments are in accordance with Ethereum, it’s a situation that’s out of the blue not thus far -fetched.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, professional evaluation and actual -time updates on the newest tendencies in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

Sure. The ETH/BTC -Ratio implies $ 5,707 ETH worth (versus present $ 3,600). Analysts word that disconnection between costs and the rising institutional dominance of Ethereum.

Along with transactions, settings will set ETH to take part in community development whereas they token Actual-World belongings (RWAS) on the blockchain of Ethereum.

Fundamental benefits: 10-year good uptime, authorized readability within the US and enormous firms are already constructing monetary infrastructure on its community.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now