Analysis

Weak euro fuels Bitcoin’s standout performance in Eurozone

Credit : cryptoslate.com

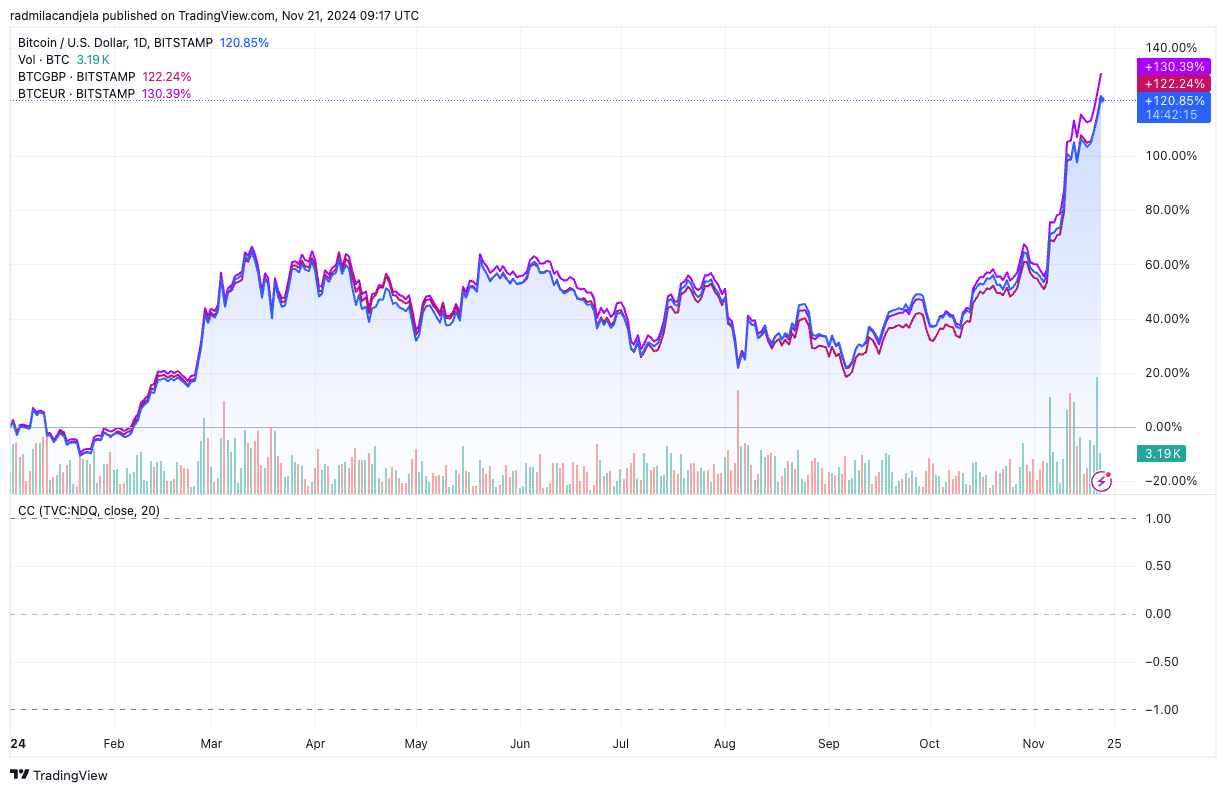

BTCUSD, BTCGBP and BTCEUR are probably the most traded Bitcoin pairs, every reflecting the interplay between Bitcoin and the precise financial atmosphere of their underlying forex. By analyzing their respective efficiency, we will acquire perception into the worldwide Bitcoin market and the way native financial situations affect worth motion. Whereas this knowledge is proscribed to a single trade, on this case Bitstamp, it offers a consultant view of broader developments and permits for significant conclusions.

To date, BTCEUR has achieved the very best returns, with a acquire of 130.39%, in comparison with 122.24% for BTCGBP and 120.85% for BTCUSD. This outperformance can largely be attributed to the weak point of the euro towards the greenback and the pound. With the eurozone scuffling with low development and restricted financial coverage flexibility, the forex has suffered towards the backdrop of a robust greenback.

This depreciation amplifies Bitcoin’s positive factors in EUR phrases, because it takes extra Euros to purchase the identical quantity of BTC. In distinction, the energy of the greenback – buoyed by sturdy US financial knowledge, strong Treasury yields and expectations of longer and longer Federal Reserve coverage – has tempered BTCUSD’s obvious positive factors, as a stronger greenback continues to place upward stress on the value of Bitcoin compensates.

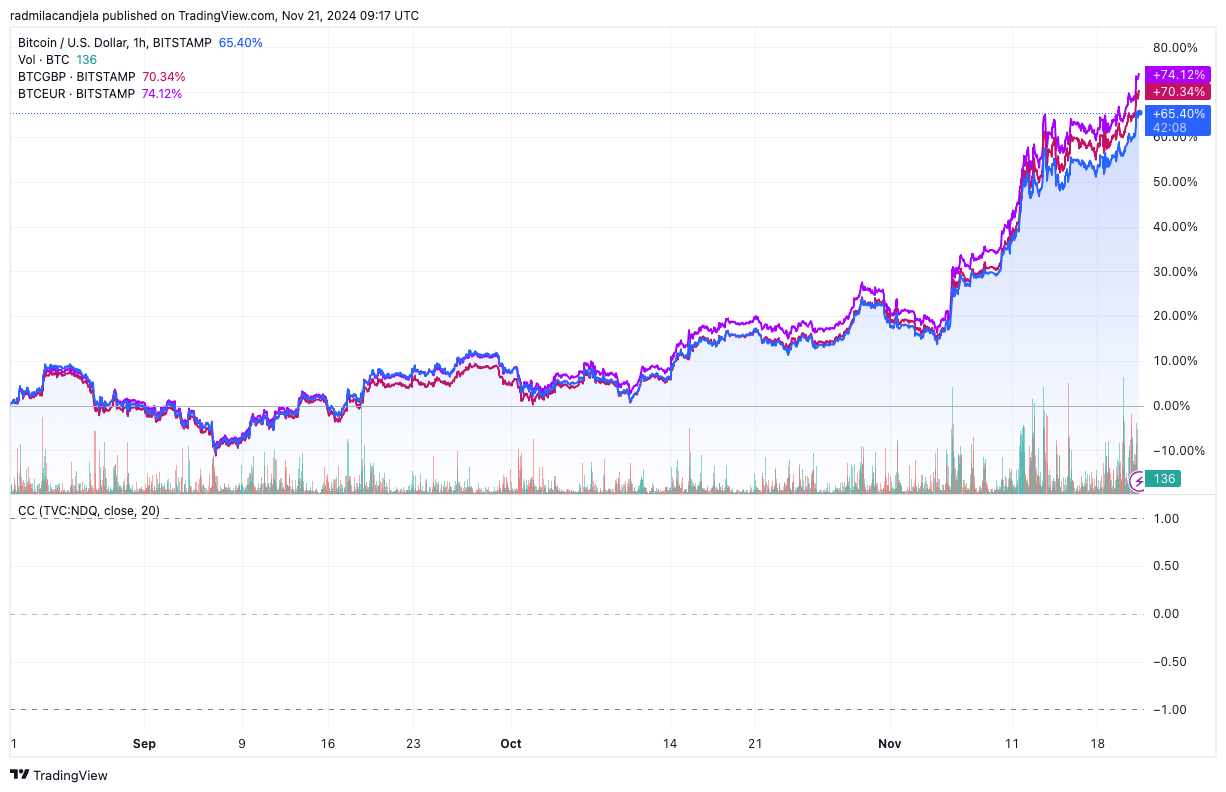

Over the three-month interval, the developments stay constant, with BTCEUR persevering with to outperform BTCGBP and BTCUSD. Throughout this era, the euro’s weak point grew to become much more obvious, falling to a one-year low towards the greenback. This decline displays a mixture of disappointing development figures within the eurozone, delicate indicators from the European Central Financial institution and geopolitical uncertainties.

In the meantime, BTCGBP has carried out barely extra robustly than BTCUSD, underscoring the pound’s relative weak point. Continued financial stagnation in Britain and the Financial institution of England’s much less aggressive stance have put stress on the GBP, even because the nation stays barely extra resilient than the euro.

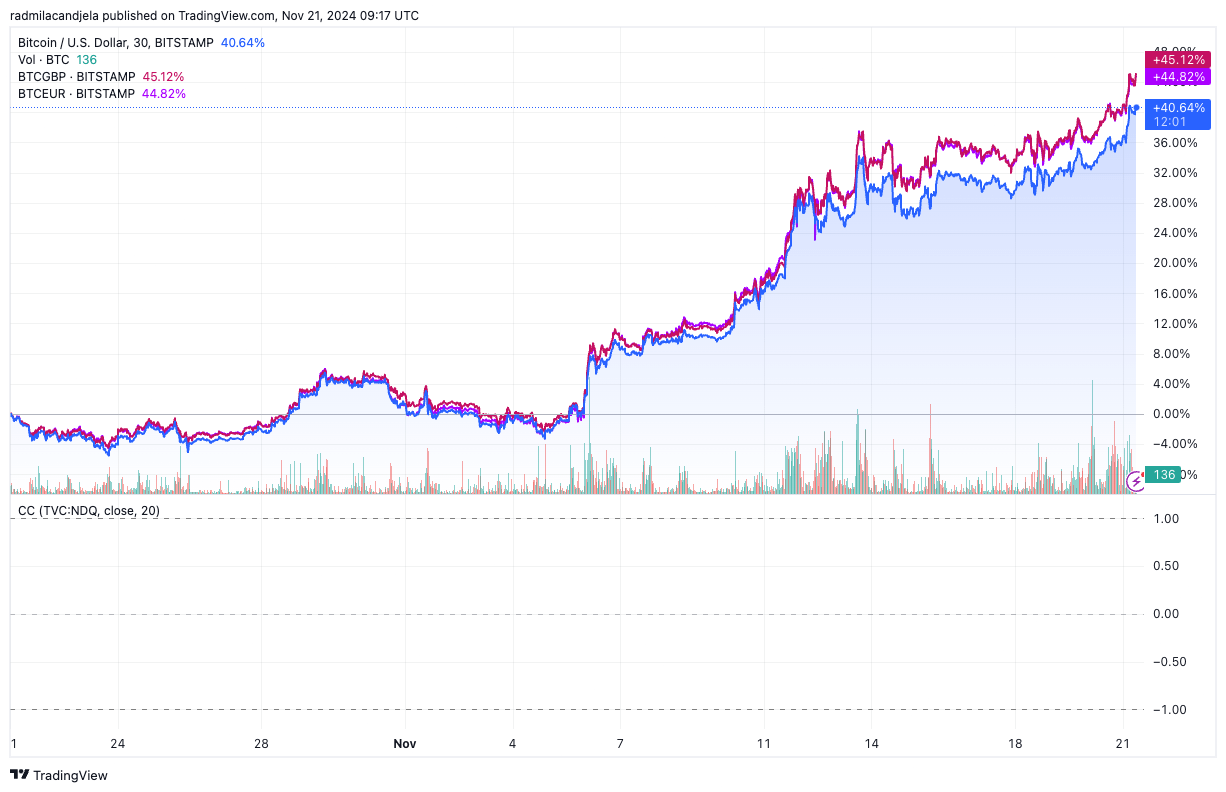

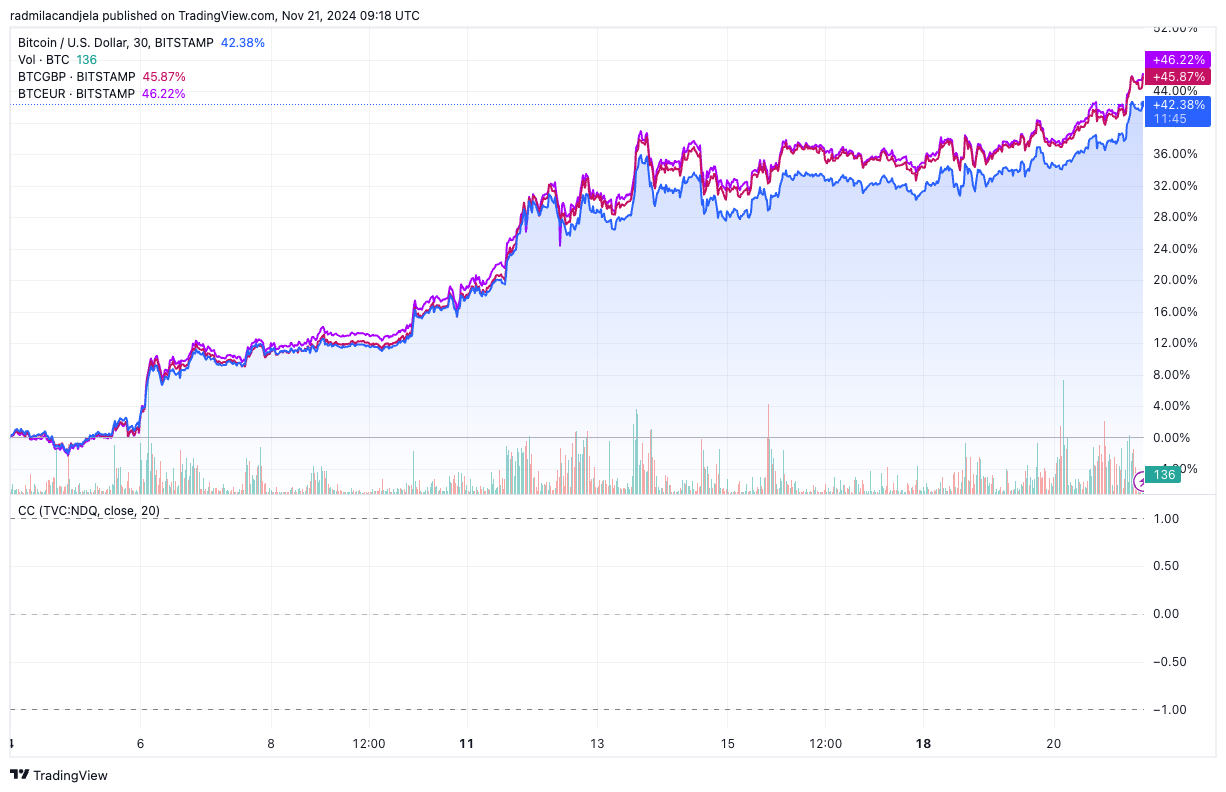

The value motion because the US election exhibits that Bitcoin’s efficiency towards these three currencies displays the newest macroeconomic and geopolitical developments. BTCUSD rose 42.38%, behind BTCEUR and BTCGBP, which grew 46.22% and 45.87%, respectively. The continued energy of the greenback has been key in dampening BTCUSD’s positive factors. The market response to the US elections was aggressive.

Because the insurance policies of the incoming Trump administration are anticipated to spice up US development, the election strengthened the greenback and boosted demand for US property, which weighed on BTCUSD. In distinction, BTCEUR and BTCGBP have been comparatively unaffected by this political occasion, and their efficiency remained largely a operate of their respective fiat weaknesses.

The distinction in Bitcoin’s efficiency between these pairs additionally exhibits how fiat volatility impacts perceived returns. The euro and the pound have been far more risky than the greenback this yr, particularly given the contrasting financial insurance policies and financial prospects of every space.

This volatility exaggerates Bitcoin’s worth actions by way of EUR and GBP, creating the phantasm of higher returns in comparison with BTCUSD. Because the Eurozone continues to face structural development challenges, Bitcoin’s outperformance towards the Euro is prone to proceed. Whereas the pound has been below comparable stress, it has proven barely extra resilience because of much less extreme structural points, in step with BTCGBP’s mid-range efficiency towards BTCUSD and BTCEUR.

The short-term developments noticed because the November 5 US elections present a quite attention-grabbing market scenario. Regardless of the energy of the USD, BTCUSD rose steadily throughout this era. This means that whereas the energy of the greenback dampened Bitcoin’s positive factors in comparison with BTCEUR and BTCGBP, it didn’t fully suppress worth momentum.

For BTCEUR and BTCGBP, the continued weak point of the EUR and GBP after the elections allowed Bitcoin to take care of its relative outperformance. That is particularly related provided that Eurozone and UK markets are more and more viewing Bitcoin as a hedge towards depreciating fiat currencies.

The put up Weak Euro Fuels Bitcoin’s Standout Efficiency within the Eurozone appeared first on CryptoSlate.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now