Web 3

Wealthtech Solutions Market Report 2024 – Wealthtech Solutions Market Trends And Share

Credit : web3wire.org

Wealthtech options market

“The Enterprise Analysis Firm lately launched a complete report on international Wealthtech Options market dimension and development evaluation with forecast for 2024-2033. This newest market analysis report supplies a wealth of priceless insights and information, together with international market dimension, regional shares and competitor market share. Moreover, it covers present traits, future alternatives, and important information for achievement within the trade.

Able to dive into one thing thrilling? Obtain your free unique pattern of our analysis report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=16824&type=smp

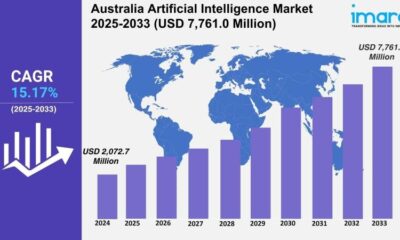

In response to The Enterprise Analysis Firm, the market dimension of WealthTech options has grown quickly lately. The financial system will develop from $4.72 billion in 2023 to $5.42 billion in 2024 at a compound annual progress fee (CAGR) of 14.7%. The expansion over the historic interval might be attributed to the rise of on-line buying and selling platforms, the rise of robo-advisors, the early adoption of cell banking apps, the expansion of mutual funds and ETFs, and the introduction of low-cost buying and selling choices.

The market dimension for energy expertise options is predicted to develop quickly within the coming years. This may develop to $9.43 billion by 2028 at a compound annual progress fee (CAGR) of 14.9%. The expansion over the forecast interval might be attributed to rising curiosity in digital monetary providers, improved customer support, enhancements in cybersecurity, the emergence of digital asset administration platforms and sustainable investing is gaining traction. Key traits over the forecast interval embody elevated adoption of AI and machine studying, integration of blockchain expertise, modern energy tech options, rising adoption of cloud computing, and adoption of massive information analytics.

Get the total scope of the report @

https://www.thebusinessresearchcompany.com/report/wealthtech-solutions-global-market-report

Market components and traits:

Rising curiosity in digital monetary providers is predicted to drive the expansion of the wealth expertise options market sooner or later. Digital monetary providers (DFS) discuss with a variety of economic providers supplied by way of digital channels reminiscent of cellphones, the Web or different digital units. Growing shopper expectations for customized, environment friendly and accessible wealth administration providers, enabled by technological developments, are driving the necessity for digital monetary providers. Digital monetary providers use wealth expertise options to supply modern and customized wealth administration and funding providers by way of digital channels, bettering accessibility and effectivity for customers. For instance, in response to FedPayments Enchancment, a US-based product of the Federal Reserve Banks, digital wallets and cell apps have been adopted by 62% of companies in Might 2024, a notable enhance from 47% in 2022. Curiosity in digital monetary providers is driving the expansion of the wealth expertise options market.

Main firms working within the wealth expertise options market are specializing in innovating portfolio administration software program to realize a aggressive benefit. Portfolio administration software program permits monetary establishments and asset managers to effectively handle and observe their purchasers’ investments. For instance, in July 2022, Bricknode, a Sweden-based asset expertise firm, launched a brand new portfolio administration software program software referred to as Funding Supervisor. The brand new device permits traders to trace all their property and liabilities in a single place, analyze their funding efficiency and handle their portfolios. The device is geared toward small household places of work and company traders. With an funding supervisor, traders can observe all their property and liabilities in a single place, analyze efficiency and automate accounting.

Key advantages for stakeholders:

• Complete Market Insights: Stakeholders achieve entry to detailed market statistics, traits and evaluation that assist them perceive the present and future panorama of their trade.

• Knowledgeable determination making: The studies present essential information that helps strategic selections, reduces dangers and improves enterprise planning.

• Aggressive Benefit: With in-depth competitor evaluation and market share info, stakeholders can determine alternatives to outperform their competitors.

• Customized Options: The Enterprise Analysis Firm supplies customized studies that meet particular wants, offering stakeholders with related and actionable insights.

• International perspective: The studies cowl totally different areas and markets and supply a broad view that helps stakeholders increase and function efficiently on a world scale.

Key gamers available in the market:

JPMorgan Chase & Co., Financial institution of America, Citigroup Inc., Wells Fargo & Firm, BNP Paribas, Goldman Sachs, Barclays PLC, FMR LLC, BlackRock Inc., State Avenue International Advisors, The Vanguard Group Inc., Lightspeed POS, Paymentus Holdings Inc., Angel One Restricted, Verafin, Wealthfront Company, DriveWealth LLC, Aixigo AG, Valuefy, Moxtra, Trackinsight SAS, WealthTechs Inc., Advisor Software program (ASI), Bridge Monetary Know-how

Wealthtech Options Market 2024 Key Insights:

• The market dimension for energy expertise options is predicted to develop quickly within the coming years. This may develop to $9.43 billion by 2028 at a compound annual progress fee (CAGR) of 14.9%.

• Remodeling wealth options by way of digital monetary providers

• Progressive WealthTech portfolio administration software program options

• North America was the most important area within the energy expertise options market in 2023

We offer customized report, click on @

https://www.thebusinessresearchcompany.com/Customise?id=16824&type=smp

Study extra in regards to the enterprise analysis firm

The enterprise analysis firm (http://www.thebusinessresearchcompany.com) is a number one market intelligence company recognized for its experience in enterprise, market and shopper analysis. With a world presence, TBRC’s consultants specialise in numerous sectors reminiscent of manufacturing, healthcare, monetary providers, chemical substances and expertise, offering unparalleled insights and strategic steering to purchasers worldwide.

Contact us:

The enterprise analysis agency

Europe: +44 207 1930 708

Asia: +91 88972 63534

America: +1 315 623 0293

Electronic mail: information@tbrc.information

Comply with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ“

This launch was printed on openPR.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024