Altcoin

Weekly winners and losers of Crypto Market – Cake, Hype, Pi, Jasmy

Credit : ambcrypto.com

- Largest revenue: 4 [FORM]Pancake wap [CAKE]Hyperliquid [HYPE].

- Largest losers: Pi -Community [PI]Jasmycoin [JASMY]Motion [MOVE].

This week the cryptocurrency market confirmed a big divergence, during which chosen tokens made exceptional income, whereas others expertise vital falls.

These tendencies emphasize the significance of selective positioning within the present commerce surroundings, as a result of the sector -specific momentum continues to stimulate the worth motion as an alternative of broad market tendencies.

High market artists

4 [FORM]: Layer-2 protocol leads the bundle

Four [FORM] The cryptom markets dominated this week and shot 54% from $ 1.20 to $ 1.85.

The Layer-2 Sensible Contract Platform organized a exceptional outbreak after gathering vital assist ranges firstly of March.

The rally began with explosive momentum on March 17, when the shape rose from $ 1.20 to $ 1.80 in a single session, in order that the market consideration was drawn instantly.

After a brief withdrawal to check $ 1.65 as assist, consumers returned in drive and pushed token on March 18 to a weekly excessive level of $ 2.05.

Whereas taking a revenue above the psychological degree of $ 2.00 arose, the shape confirmed resilience by sustaining nearly all of his revenue.

The consolidation of the center of the week round $ 1.75 established a wholesome foundation earlier than renewed buy curiosity appeared on 20-21 March of March.

Commerce quantity impressively peaked in the course of the first rise, which suggests a robust conviction behind the transfer.

The technical construction of the token reveals a transparent outbreak of its multi-month vary, with the extent of $ 1.75 now represents essential assist.

Pancake wap [CAKE]: Dex -Toks reveals spectacular energy

Pancake wap [CAKE] delivered a formidable efficiency this week and rose 40% from $ 1.85 to $ 2.59.

The main dex toppings of the Binance Sensible Chain defied wider market tendencies, which demonstrated distinctive energy when it broke via a number of vital resistance ranges.

The rally began decisively on March 17, when the cake exploded from $ 1.85 to $ 2.15 and for the primary time since January above his 50-day advancing common broke at $ 1.96.

This technical breakout led to appreciable buy curiosity, virtually doubled with commerce quantity in comparison with current averages.

Supply: TradingView

After a brief consolidation about $ 2.50 midway via the week, consumers returned to March 22, pushing cake to check the resistance degree of $ 2.75.

Whereas this zone has induced considerably worthwhile, Token has maintained nearly all of its income, in order that stable assist round $ 2.60.

Technical indicators favor a secondary bullish momentum. The 50-day advancing common has begun to bend to the 200-day ma [$2.25]Probably arrange a gold cross formation within the coming weeks.

As well as, accumulation distribution patterns exhibit constant consumption in the course of the rally, which means that institutional rates of interest relatively than hypothesis pushed by the retail commerce.

The spectacular value promotion comes within the midst of assorted elementary developments for the pancake wap system, together with improved stretching rewards, new token reliefs and administration proposals geared toward rising the token utility.

These components have in all probability contributed to the continued buying stress.

For merchants wanting forward, cake is confronted with fast resistance at $ 2.80, with a breakthrough which will open the trail to the psychological degree of $ 3.00 that’s final seen in December.

Then again, the newly established assist for $ 2.50- $ 2.60 should be seen carefully for indicators of weak spot.

The outperformance of token in a difficult market surroundings emphasizes its potential position because the market chief within the DEX sector whereas Defi exercise continues to recuperate.

Hyperliquid [HYPE]: Perpetual Alternate -Token breaks out

Hyperliquid [HYPE] delivered spectacular revenue this week and climbing 16% from $ 13.80 to $ 15.80.

The decentralized perpetual exchanging strips confirmed exceptional energy in a number of commerce periods, which confirmed the outbreak of the earlier consolidation vary.

The rally unfolded in two completely different waves, with hype that first rose from $ 13.80 to $ 15.60 between 19 and 20 March earlier than he skilled a withdrawal to $ 14.20 when the win got here ahead.

This retracement turned out to be non permanent, with consumers returning strongly on March 22 and pushed the token to a weekly excessive level of $ 16.40.

The buying and selling quantity significantly explored throughout each claims, specifically on March 22, when the amount virtually doubled in comparison with the weekly common.

This elevated participation actually suggests institutional curiosity relatively than hypothesis pushed by the retail.

Technical indicators stay sturdy bullish, whereby the hype determines a sequence of upper lows and better highlights. The extent of $ 15.50 now represents vital assist, with consumers constantly defending this zone throughout current pullbacks.

Different exceptional revenue

Past the highest performers, the broader market noticed numerous beautiful actions.

Bugcoin [BGSC] Led the highest 1,000 tokens with a revenue of 339%, whereas Keta [KTA] and Mubarak [MUBARAK] adopted with spectacular revenue of 290% and 258% respectively.

The largest losers of this week

Pi -Community [PI]: Cellular -MIJNDoking collapses

Pi -Community [PI] This week a devastating collapse suffered and 33% fell from $ 1.50 to $ 1.00. Toking the Cellular Mining Challenge stood for non -repellent gross sales stress, with bears who dominate each commerce session since Monday.

The decline began instantly on March 17, with Pi 7% falling within the opening session.

This primary breakdown accelerated dramatically on March 18, when the token collapsed because of the vital degree of $ 1.30, which had been held earlier since February.

By March 21, panic gross sales turned extra intense when PI dropped to a low -point of three months of $ 0.87 earlier than a modest aid arose.

Whereas this technical over-sold state induced some dip-buying, the restoration of brief period and weak, with the token struggling to even reclaim $ 1.10.

Current periods present PI that consolidate across the psychologically vital degree of $ 1.00, though Bears stay in management.

For a significant restoration, token should first reclaim the resistance degree of $ 1.15, though the intense technical injury means that additional drawback stays.

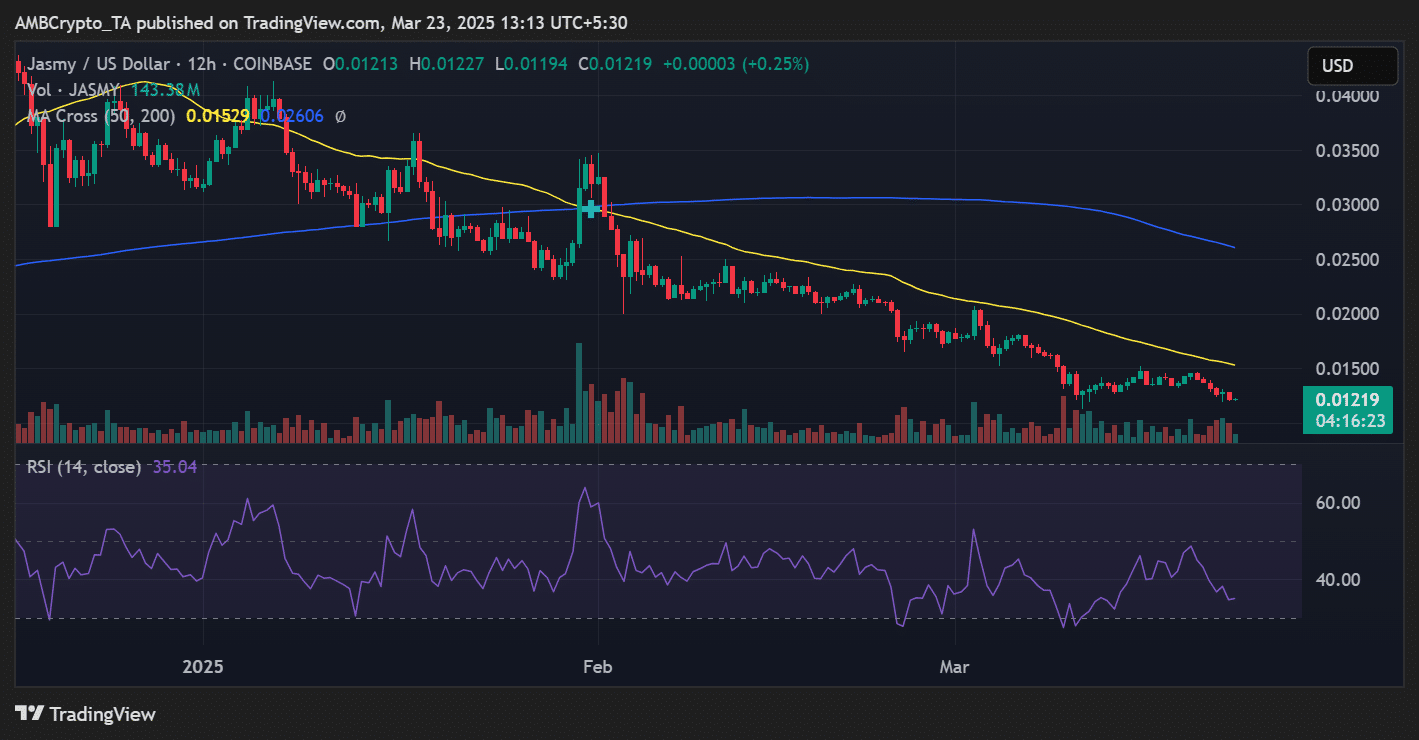

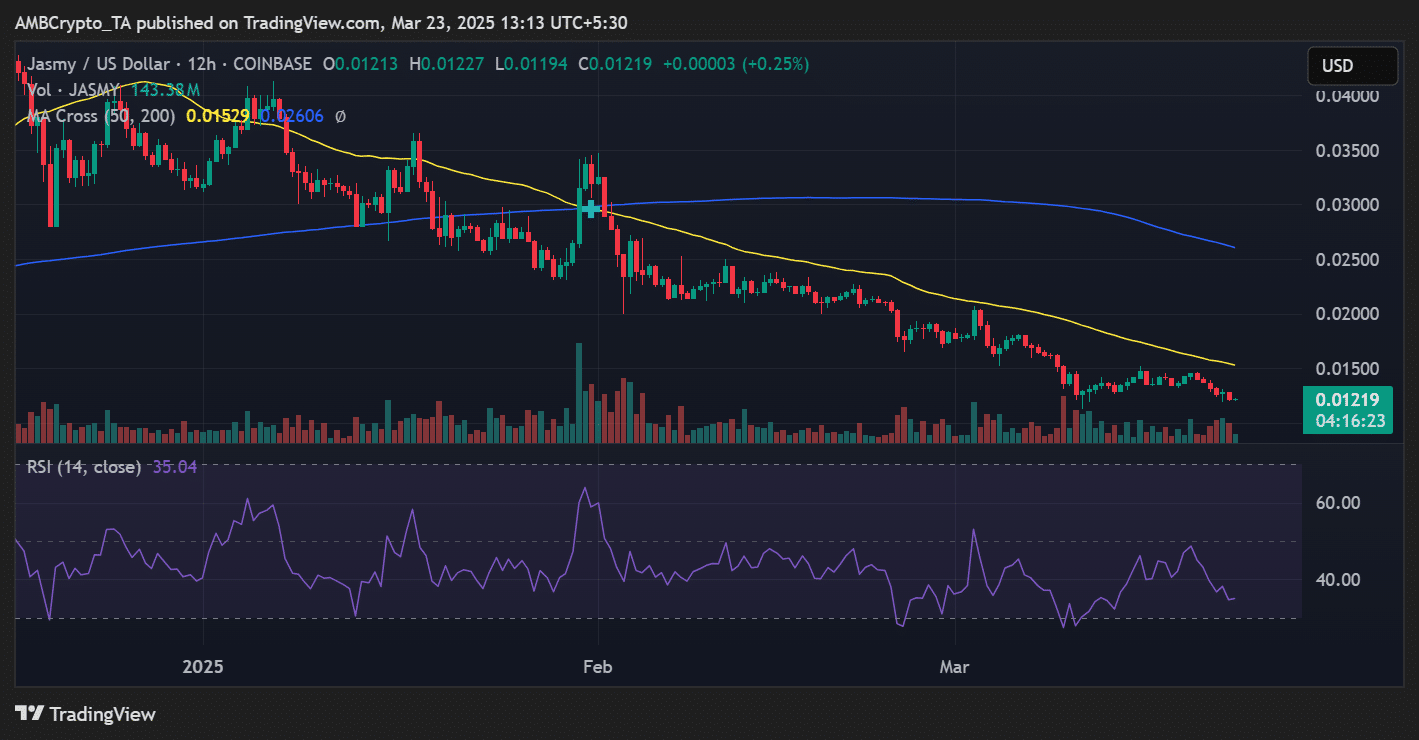

Jasmycoin [JASMY]: Japanese token extends downwards

Jasmycoin [JASMY] Leed one other penalty week and dropped 14% from $ 0.0144 to $ 0.0122.

The Japanese knowledge dedcentrisite smoke expanded its Downtrend from a number of months, regardless of brief restoration makes an attempt, which confirms that bears stay firmly underneath management.

The week began with Jasmy, who consolidated round $ 0.0144, after a small bouncing of the lows of the final week.

This stability turned out to be brief -lived, as a result of sellers arose on March 18 and the token pushed beneath the extent of assist of $ 0.014 that had held earlier firstly of March.

A brief auxiliary has ended up on March 19 and 20, with Jasmy recovering to check the $ 0.0145 resistance zone.

This technical leap confirmed promising as a result of the commerce quantity virtually doubled in comparison with the weekly common.

Nevertheless, the rejection at this degree proved decisive, which induced a brand new wave of gross sales that might dominate the remainder of the week.

Supply: TradingView

A very powerful breakdown came about on March 21, when Jasmy collapsed via a number of assist ranges, which accelerated its decline when cease losses have been activated.

By March 22 it had reached $ 0.0125 earlier than it had skilled a brand new failed restoration try.

Technical indicators define a related picture for Jasmy holders. The RSI has fallen underneath 35 and is approaching over -sold territory, however doesn’t present clear divergence alerts that may recommend an imminent reversal.

Each the 50-day ($ 0.0152) and 200-day ($ 0.0160) progressive averages stay decrease development, which determines the demise crossing in January.

Commerce quantity knowledge present constant distribution as an alternative of accumulation, with practically 143 million models that change possession in the course of the decline of the week.

The sale has been methodically as an alternative of panic -driven, suggesting that institutional repositioning as an alternative of retail capitulation.

Jasmy first has to reclaim the extent of $ 0.013 for a significant restoration, adopted by the extra vital resistance of $ 0.014.

Nevertheless, the present market construction promotes strongly, with the psychological assist of $ 0.012 that represents the next vital take a look at.

Motion [MOVE]: Health token faces steady stress

Motion [MOVE] Struggled in the course of the week and fell by 9% from $ 0.48 to $ 0.43. The fitness-to-earn protocol couldn’t preserve assist ranges, as a result of sellers dominated virtually each commerce session.

The decline began instantly on March 17, with motion that fell from $ 0.48 to $ 0.45 within the first day.

After a brief consolidation interval, token made numerous makes an attempt to recuperate, particularly on March 1920 when it climbed to check the resistance round $ 0.46.

This rally turned out to be brief -lived, as a result of sellers shortly return the examine and pushed to a weekly low of $ 0.42 on 22 March.

Whereas a modest bounce got here from this offered -over state, restoration makes an attempt remained weak and never sturdy.

Handels patterns present decrease highlights and decrease lows which might be fashioned in the course of the week, which confirms the Bearish Pattern stays intact. Each brief restoration acquired a brand new gross sales stress, particularly clearly within the newest periods.

For a significant reversal, Transfer should first reclaim the extent of $ 0.45, though the present market construction means that the trail of the least resistance stays down.

Different vital decliners

Numerous tokens skilled dramatic losses within the wider market.

Entry [NTGL] led the decreases with a lower of 45%, adopted by Ancient8 [A8] and Whiterock [WHITE]who fell 43% and 39% respectively within the week.

Conclusion

Right here is the weekly abstract of the most important revenue and losers. It’s essential to take note of the unstable nature of the market, the place costs can swap shortly.

So do your individual analysis [DYOR] Earlier than taking funding selections, is the most effective.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now