Altcoin

Whales Benefit from Uniswap, AAVE – Is the Crypto Market Shifting?

Credit : ambcrypto.com

- UNI and AAVE whales earned $12.7 million in income.

- Whale exercise indicated worth swings, however the long-term prospects for each tokens remained robust.

Previously two days, 4 main crypto whales have collectively raked in $12.7 million in income from Aave [AAVE] and Uniswap [UNI]which sends ripples to the altcoins market.

This degree of whale exercise usually indicators worth shifts, leaving many market individuals questioning if these actions might point out future worth adjustments for these tokens?

Whales make essential actions

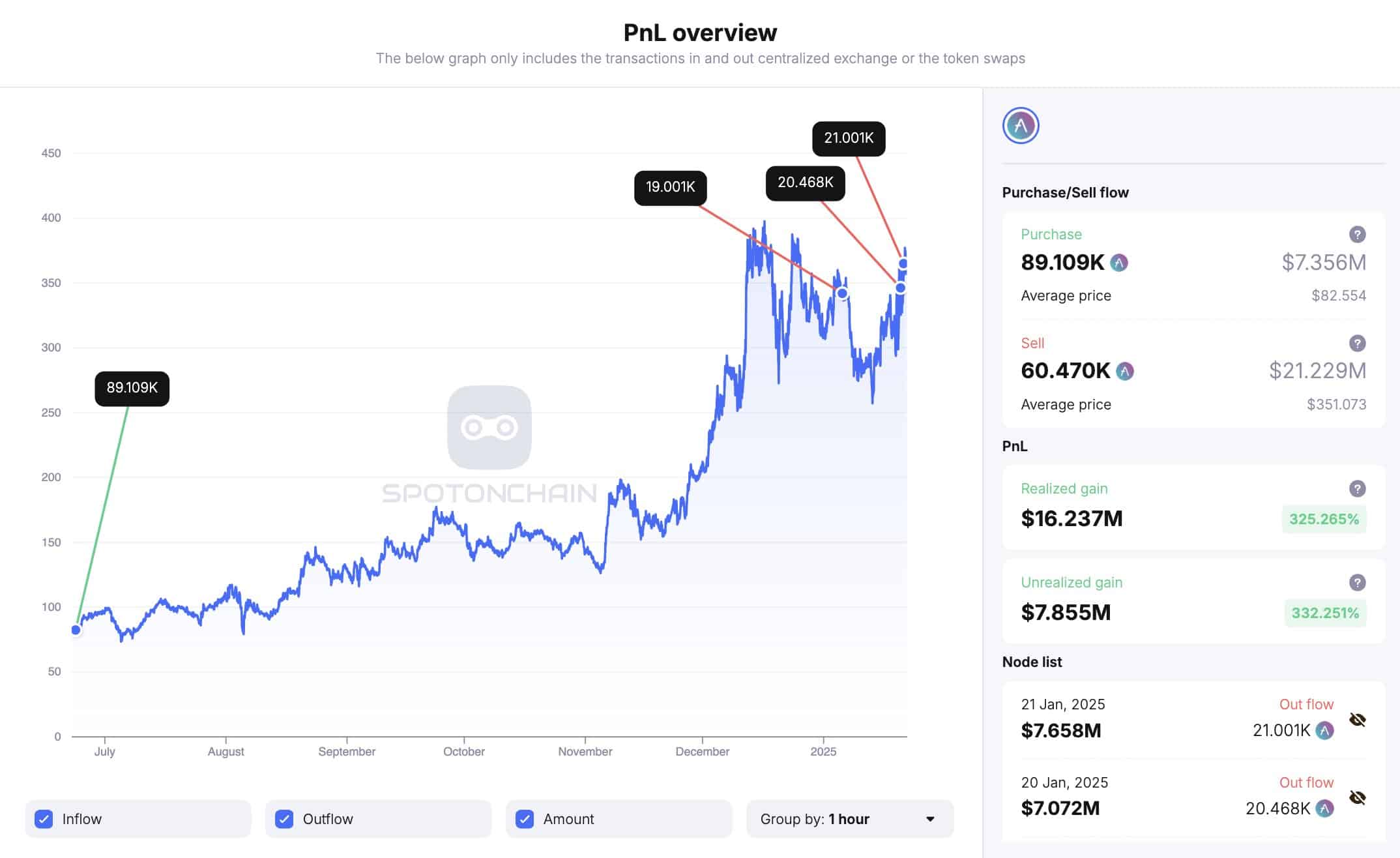

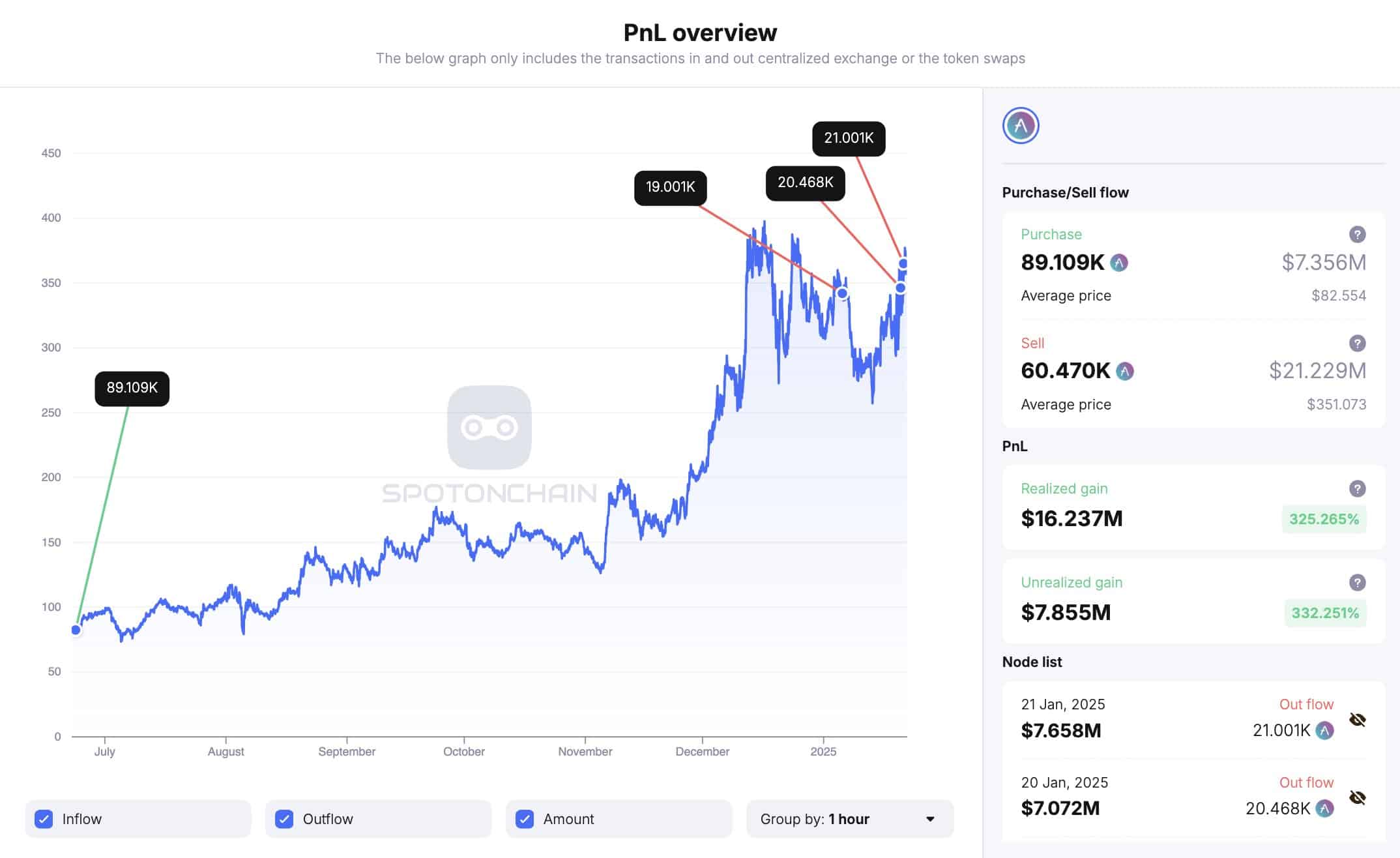

The biggest transaction got here from two whales, “0x991” and “0x97d” (most likely one entity), which moved 41,469 AAVE (price $14.7 million) within the final 40 hours.

These whales most likely made a formidable revenue of $11.3 million, a rise of 330%.

That is not all, the 2 whales nonetheless personal a major quantity of AAVE, valued at $10.2 million, with $7.86 million in unrealized features in accordance with the tweet.

This reveals that even after payout they’ve a major function within the recreation.

Supply:

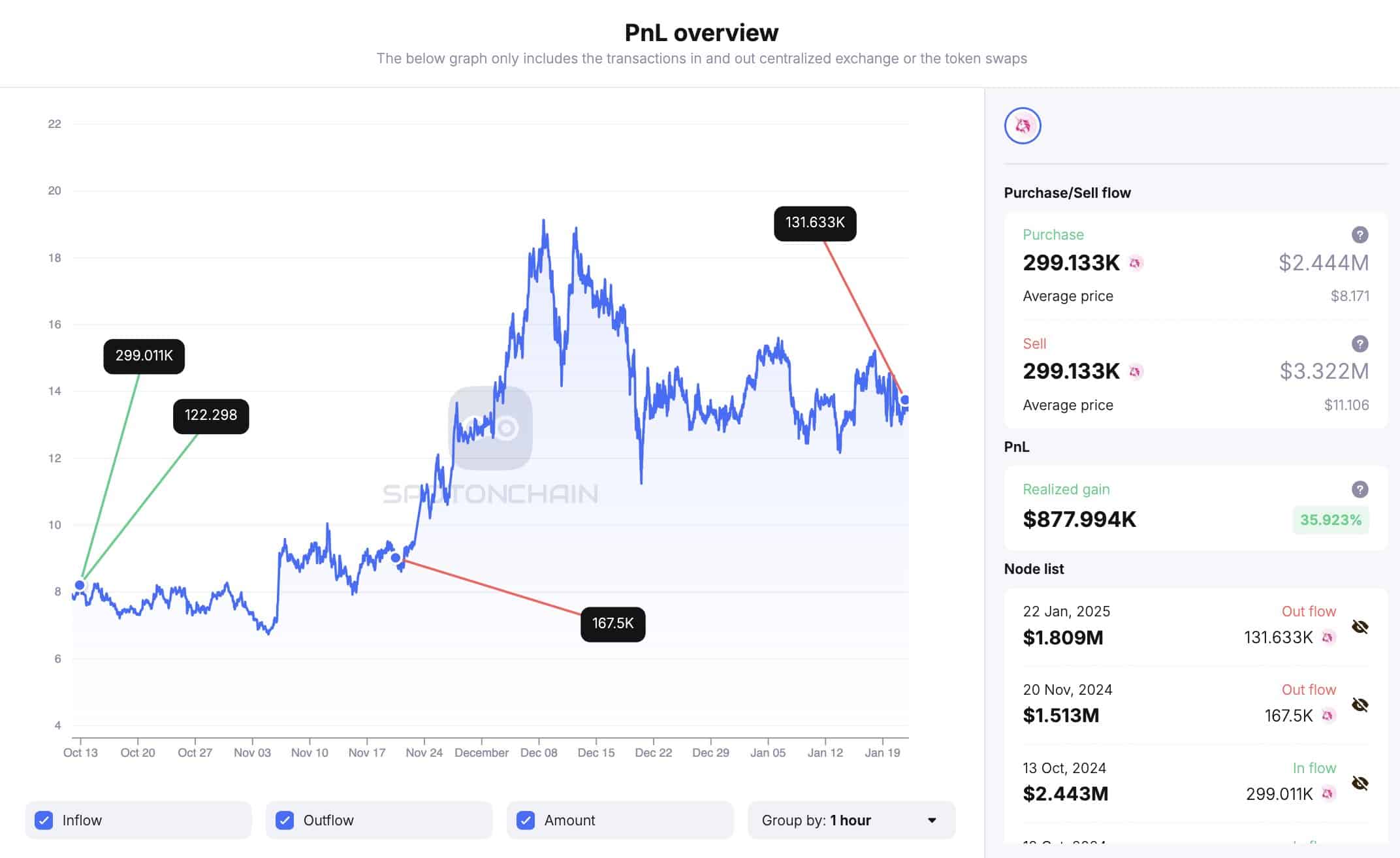

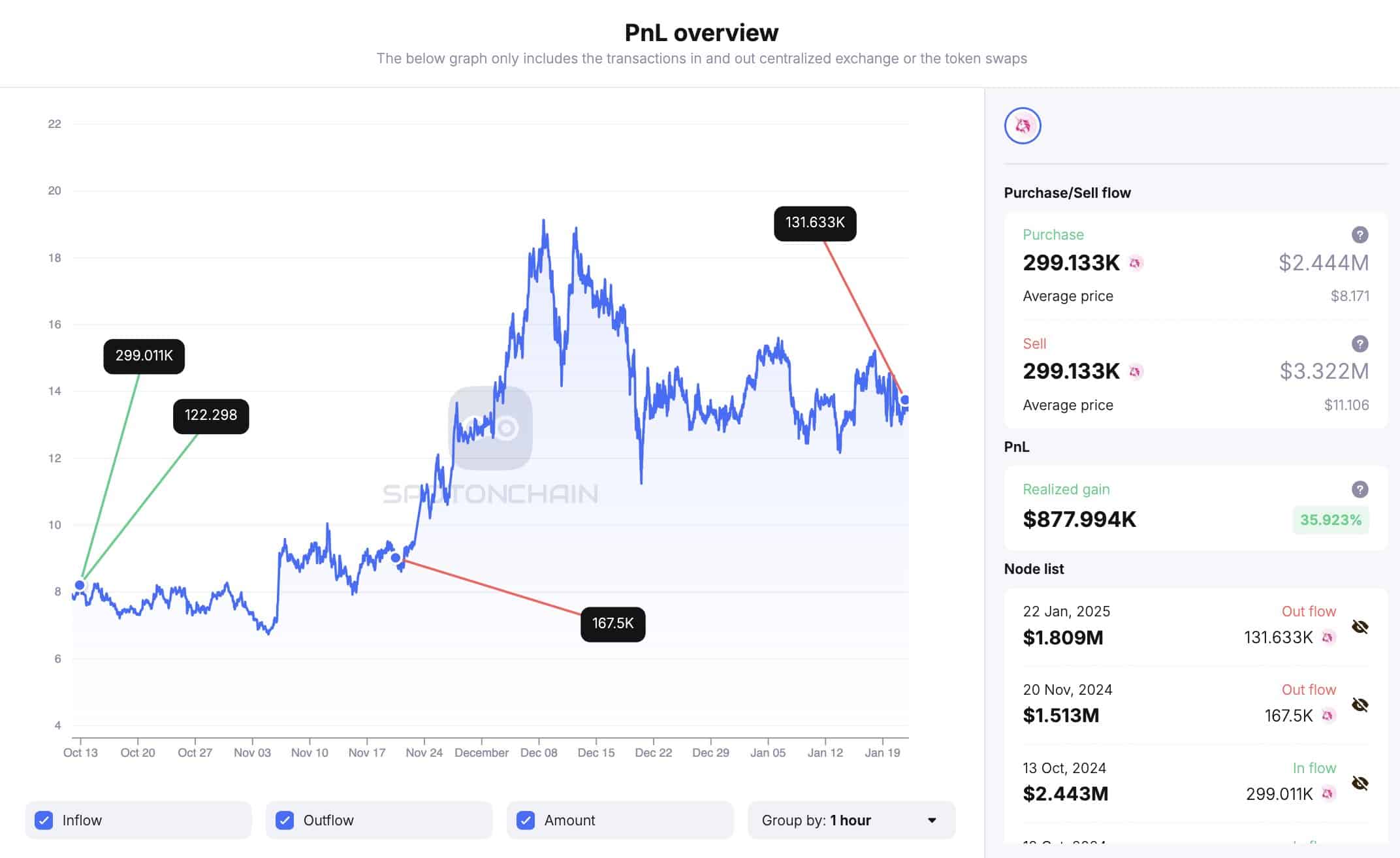

In one other case, whale “0x1d1” deposited 131,633 UNI (price $1.81 million) to Binance, raking in round $733K in income – a 68% improve in simply three months of possession.

Supply:

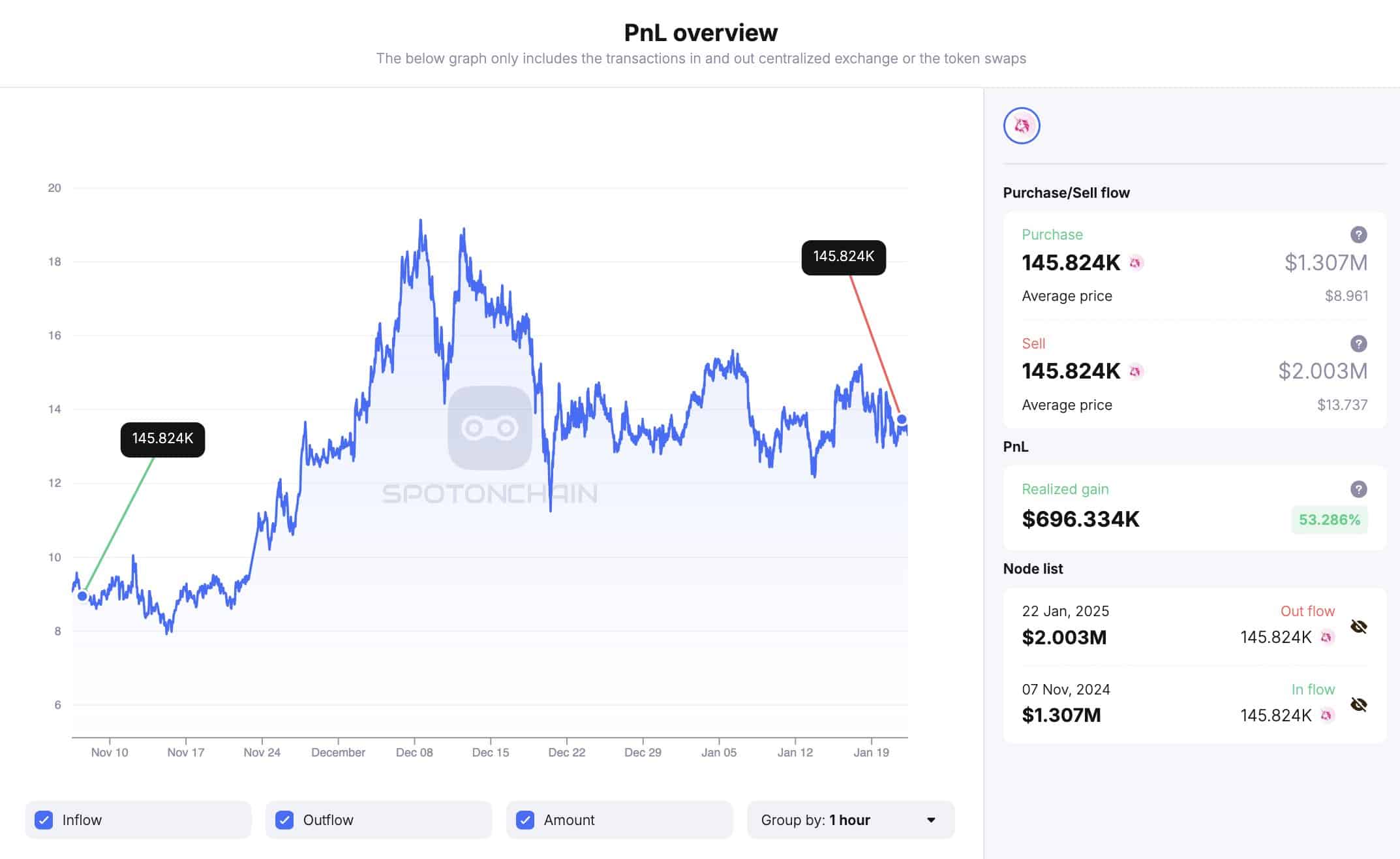

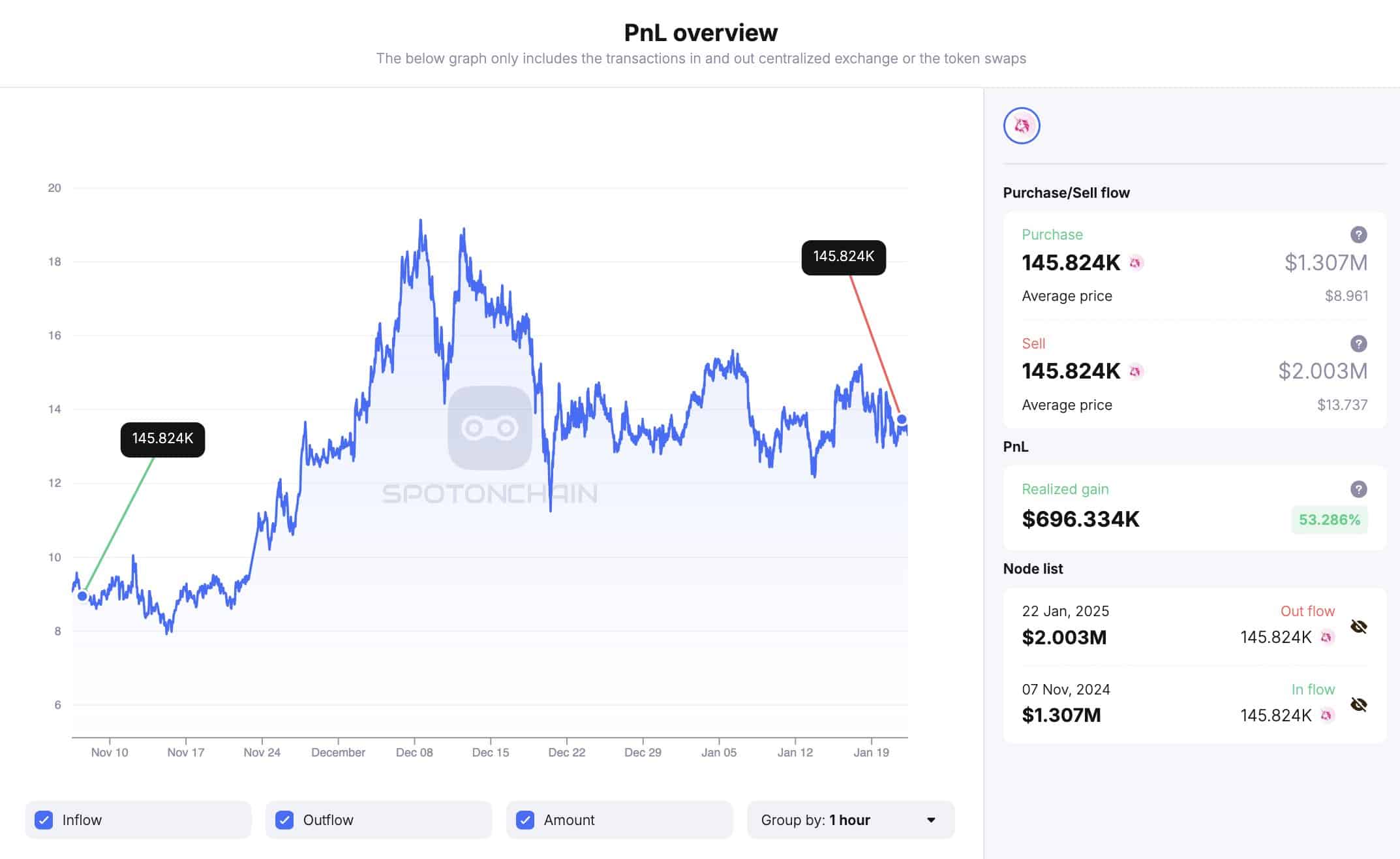

In the meantime, pockets “0xcc0” moved 145,824 UNI, price $2 million, to Binance, leading to a revenue of roughly $696K, which is a 53% improve in 2.5 months.

Supply:

These whale actions are essential to regulate as they usually affect token costs. However how does this relate to future worth predictions?

What these whale actions imply for AAVE and UNI

Wanting deeper into these latest whale trades, we will count on some near-term worth swings for each AAVE and UNI.

The large outflow of overseas change might point out a possible for worth declines as whales might make income earlier than a doable market correction.

Nevertheless, the truth that they nonetheless personal vital quantities of those tokens means that they see long-term potential in AAVE and UNI.

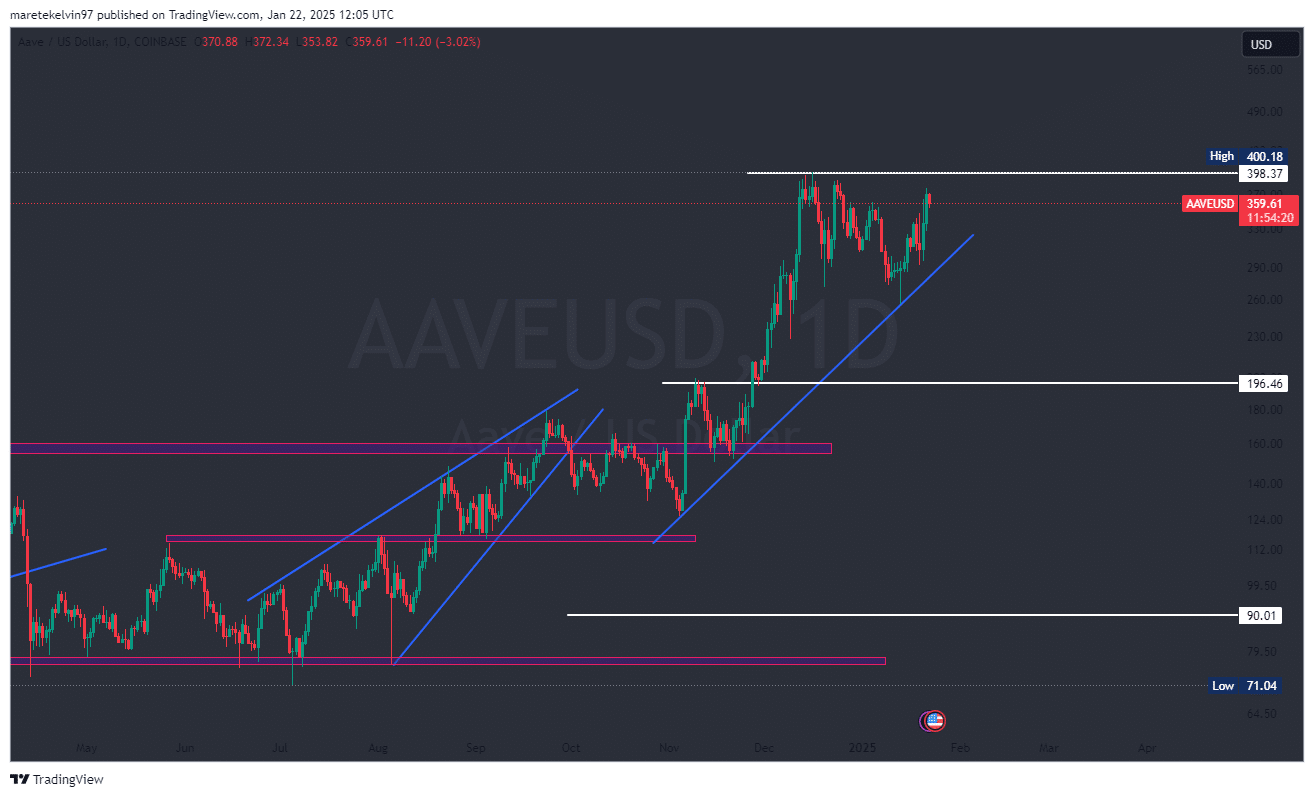

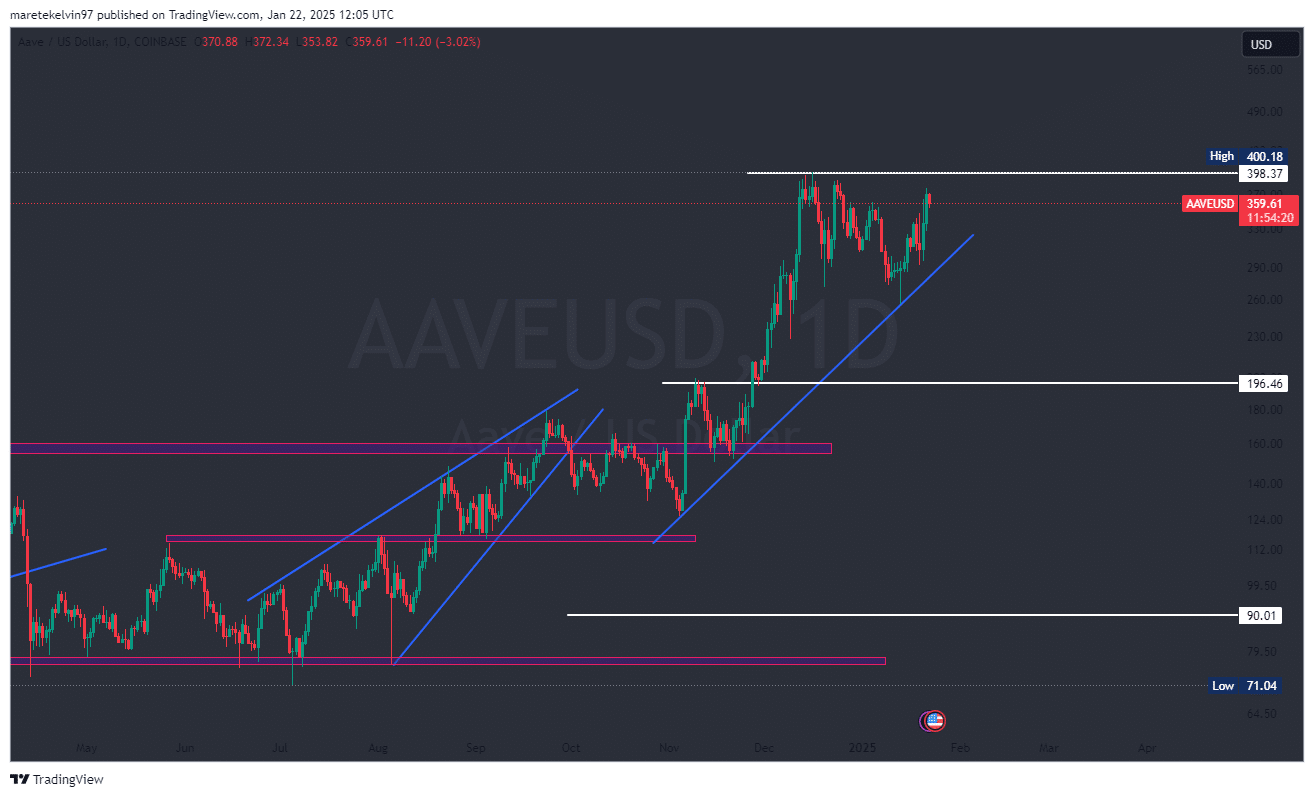

With the latest unrealized features, it’s cheap to count on AAVE to consolidate within the quick time period earlier than recovering for an additional upward transfer to check the $400 resistance zone.

Supply: TradingView

Lifelike or not, right here is AAVE’s market cap by way of UNI

Whale’s conduct usually causes shopping for strain once they maintain their positions for prolonged durations of time, and that may trigger a worth improve for the altcoin.

For UNI, the 68% improve in income signifies that the altcoin is in a powerful progress cycle, and whereas some whales have made cash, the token might proceed its upward trajectory if extra institutional curiosity emerges.

Supply: TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now