Ethereum

Whales Scoop $1.73B In ETH As Exchange Balances Hit Nine-Year Low

Credit : www.newsbtc.com

Experiences have introduced that 16 portfolios have picked up 431.018 Ether Between 25 and 27 September, spend round $ 1.73 billion to do that. The purchases got here by means of names equivalent to Kraken, Galaxy Digital, Bitgo, Falconx and OKX.

Associated lecture

That scale of accumulation set again consideration to who the dip is shopping for and why bigger gamers appear prepared so as to add publicity whereas the costs are wigging.

Wisselsali lower as much as 9 years low

In line with Glass node Knowledge, the quantity of ETH held on exchanges, has fallen from roughly 31 million to round 14.8 million ETH – a lower of 52% in comparison with the 2016 degree.

A lot of these cash are in all probability in stopping contracts, chilly portfolios or institutional detention, and the latest launch of the primary Ethereum strike ETF has helped to tug extra inventory from inventory markets.

Decrease alternate calves imply fewer cash able to be bought immediately at festivals, in order that the worth actions can turn into sharper when massive orders come available on the market.

ETH floats nearly $ 4,000 as volatility rises

Primarily based on TradingView -measurements, ETH is traded round $ 4,011, about 0.33% fall within the final 24 hours and greater than 10% up to now week.

The token slid briefly below the session under $ 3,980 earlier than it climbed again, and it stays below a latest $ 4,034 closure.

This two -week pullback has returned ETH to an essential help space of $ 4,000, and brief -term fluctuations have turn into extra pronounced because the holders repositioned.

$ 3,700 turns into a line in sand

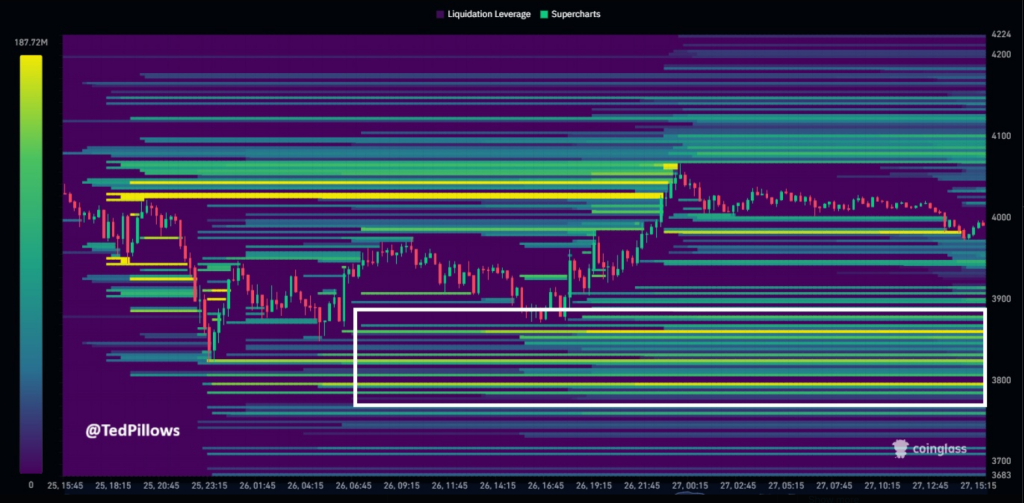

Crypto analyst Ted Pillows has warned that the zone may be confronted from $ 3,700 to $ 3,800. Experiences observe that if ETH drops under $ 3,700, many marpositions may be worn out and compelled gross sales could cause the costs decrease.

$ ETH Liquidity Heatmap exhibits appreciable lengthy liquidations across the degree of $ 3,700- $ 3,800.

This degree may be revised once more earlier than Ethereum exhibits any restoration. pic.twitter.com/sqtbfrujaaa

– Ted (@tedpillows) September 27, 2025

With fewer cash about inventory exchanges and concentrated margin-blot up, the short-term entrance views are extra susceptible, even when demand indicators look strong in the long term.

ETF outflows present that the institutional temper can flip round

US-raised ETH funds registered nearly $ 800 million this week, their best redemption to this point. But it accommodates round $ 26 billion Ethereum ETFsequal to five.37% of the whole supply.

Whales maintain accumulating $ ETH!

16 portfolios have acquired 431,018 $ ETH($ 1.73b) of #Draken” #Galaxydigital” #Bitgo” #Falconx And #Okx Prior to now 3 days.https://t.co/0DPXGZMGN7 https://t.co/xtplbko9lz pic.twitter.com/oexzkiermr

– Lookonchain (@lookonchain) September 27, 2025

Associated lecture

These figures underline how rapidly institutional sentiment can change: massive influx can disappear simply as rapidly and ETF flows now add a brand new, appreciable layer to cost dynamics.

Lookonchain Knowledge additionally emphasised an earlier accumulation of roughly $ 204 million in ETH, with related patterns of huge gamers who carried out throughout dips.

Retail merchants now appear extra cautious. However the order of huge purchasers of institutional high quality means that some consumers see dips as alternatives, whereas others select to attend on the sidelines.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024