Policy & Regulation

What a shortcut for ETF approvals could mean for crypto

Credit : cryptonews.net

The US Securities and Trade Fee permitted new itemizing requirements final week for commodity-based Belief shares, a coverage shift that would shorten the highway to the launch of spot Crypto Trade-Traded Funds (ETFs), however there’ll proceed to ask for some buyers.

Bloomberg ETF analyst James Seyffart stated that the coverage change, introduced by the SEC on September 17, could be a constructive step in the direction of a “Gulf of Spot Crypto ETP launches.”

Eric Balchunas, one other senior ETF analyst at Bloomberg, instructed that the SEC had simply cleaned up the regulatory tape for crypto ETFs “so long as they’ve futures on coinbase”, hinting on the varied laws that might be confronted with candidates, relying on the investable automobile that they must do.

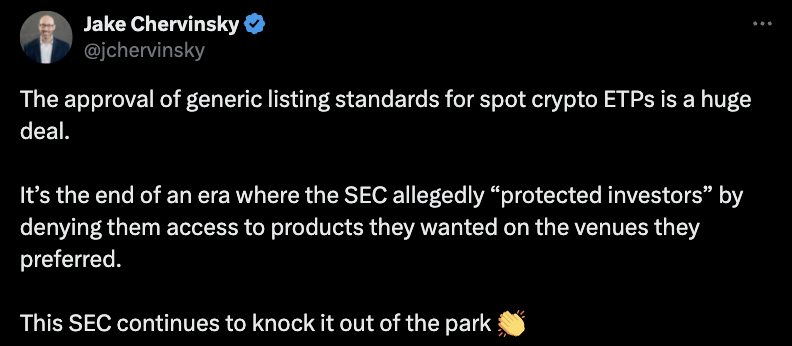

Supply: Jake Chervinsky

“For a brand new futures of spot ETF in a ‘legitimized’ class (BTC, ETH), these latest rule modifications have little or no time on approval,” Seoyoung Kim, a college trainer Finance instructed the Leavey College of Enterprise on Santa Clara College, to Cointelegraph.

“For futures or spot ETF for digital property that haven’t but been investigated individually, these rule modifications can cut back the time to approve years to months. After all, the potential ETF should nonetheless meet current requirements for ETF formation, point out and commerce.”

Federico Brokate, head of American actions at ETF-Emittent 21Shares, stated that “property within the scope” within the listing requirements “would have rather more predictability for points and buyers”, leading to significantly shorter approval instances.

“Each the S-1 and 19B-4 are not [applications] Required for in-scope or eligible property, “stated Brokate.” Now, if a product meets the generic requirements akin to qualification through current futures or related constructions, an change can state it instantly. is ”

Are there any dangers for ETF mittens or retail buyers?

The SEC has been lower on enforcement actions towards cryptocurrency corporations and has typically assumed the coverage that promotes business, a few of which declare to be on the expense of the safety of buyers.

Caroline Crenshaw, the one democratic commissioner within the SEC, stated after the introduced listing requirements that the coverage change has bypassed the necessities for revising the safety of buyers. She added that the crypto -eetfs that may in all probability come up from the coverage have been ‘new and demonstrably unproven merchandise’.

“In spite of everything, our mission is to not shield buyers to speed up non-tested funding merchandise for point out and commerce on the inventory change,” stated Crenshaw.

Kim van Santa Clara College argued that “all current IJverse necessities are nonetheless current”, including that the rule modifications “higher as clarifications might be seen.” He stated:

The lengthy -term intensive necessities of the ’33 and ’40 actions are nonetheless current and are usually not diminished by the latest selections of the SEC. “

Greg Benhaim, govt vice -president of product at Digital Asset Supervisor 3IQ, stated in a press release shared with Cointelegraph that the generic listing requirements might help common buyers to tell apart from which cash to purchase.

“An Avax ETF and an Ada ETF, for instance, are very completely different, however the investor could not totally admire this,” stated Benhaim. “In the long run, it will launch the way in which for the business to find out which property have a substantial occupation within the retail commerce in ETF format and which don’t.”

https://www.youtube.com/watch?v=2Sonoog6WC8

Within the week for the reason that change within the listing requirements, Asset Supervisor Hashdex has expanded its crypto ETF with XRP (XRP), Solana (SOL) and Stellar (XLM). Nonetheless, Balchunas and others have speculated that there might quickly be rather more, which factors to 22 cash with futures on Coinbase that “have been eligible for spot ETF-Aization.”

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now