Bitcoin

What Bitcoin Indicators Predict For Q3 2025?

Credit : bitcoinmagazine.com

The journey of Bitcoin 2025 didn’t produce the explosive stier market rise that many expects. After a peak above $ 100,000, the Bitcoin worth 2025 rang again to as little as $ 75,000, some debate amongst buyers and analysts aroused the place we’re within the Bitcoin cycle. On this evaluation we have now the noise intersected, the usage of indicators on the chain and macrose information to find out whether or not the Bitcoin-Bull market stays intact or or a deeper bitcoin correction looms up in Q3 2025. Major statistics corresponding to MVRV Z-score, Demply Days-capital), and Bitcoin within the Tight within the Tight), and BitCiDINDININ-CASTINININININININ-ADDDDDDDDDDDIN-CASTINININ-CASTINININ-CASTINININ-CASTINININ), and Bitcoini-capital), and Bitcoin’s capital-capital-capital-capital-capitino-capitino-capital), Subsequent motion of the market.

Is Bitcoin’s 2025 pullback wholesome or bull cycle -end?

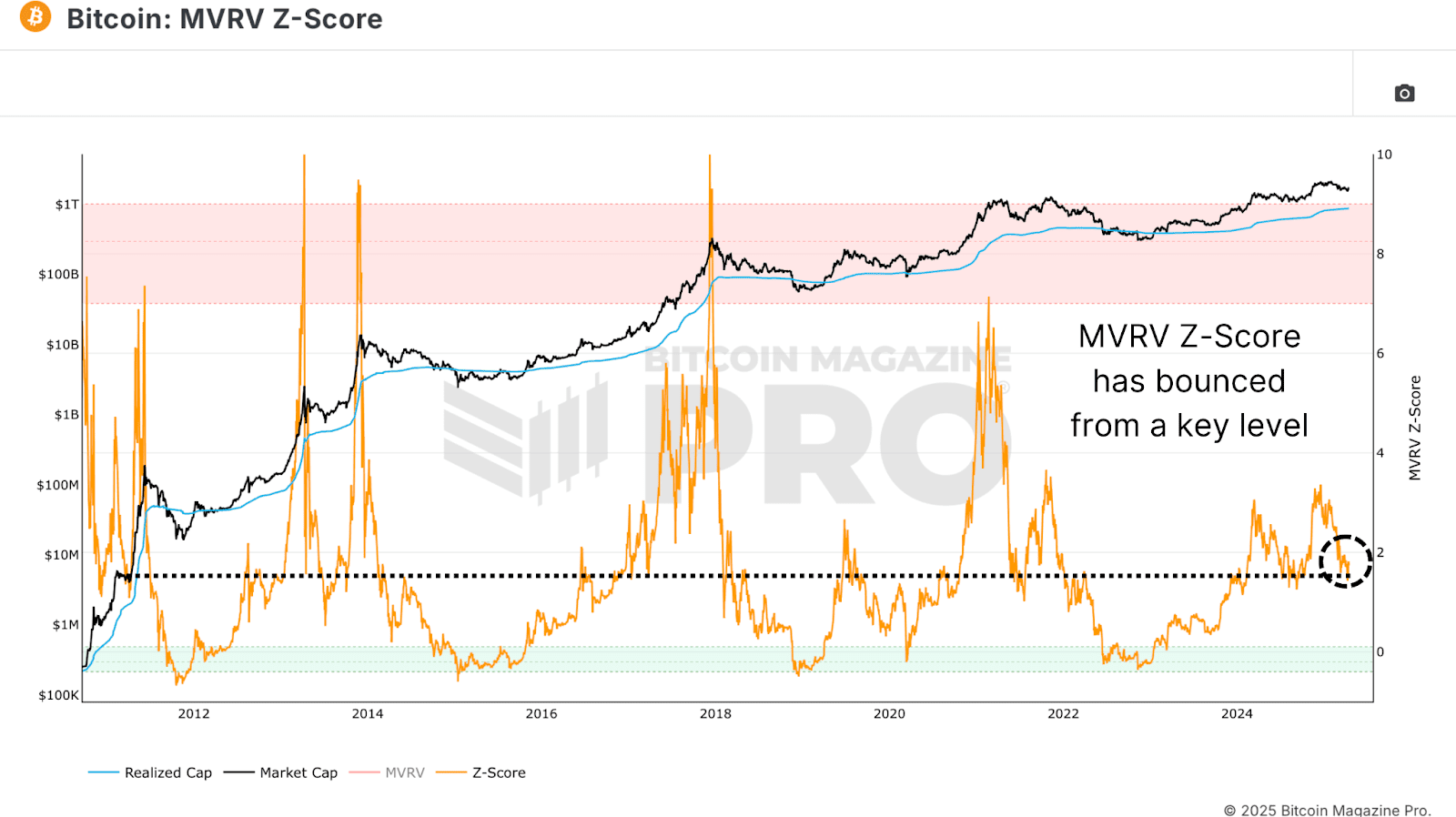

A robust start line for assessing the Bitcoin cycle of 2025 is the MVRV Z-scoreA trusted indicator on the chain that compares the market worth with realized worth. After having overwhelmed 3.36 on Bitcoin’s $ 100,000 peak, the MVRV Z rating dropped to 1.43, expiring with the 2025 Bitcoin worth drop from $ 100,000 to $ 75,000. This 30% Bitcoin correction could appear alarming, however latest information exhibits that the MVRV Z rating returns from its 2025 low level of 1.43.

Traditionally, MVRV Z-score ranges have round 1.43 marked native soils, not tops, in earlier Bitcoin Bull markets (eg 2017 and 2021). These Bitcoin -Pullbacks had been typically preceded on uptrends, which means that the present correction is tailor-made to a wholesome dynamic of the bull cycle. Whereas the belief of buyers is shaken, this motion matches with historic patterns of Bitcoin market cycles.

How good cash the Bitcoin Bull -Markt 2025 is

The Value days destroyed (vdd) severalOne other crucial indicator of the chain follows the pace of BTC transactions weighed by durations. Spikes in VDD sign revenue by skilled holders, whereas low ranges point out bitcoin accumulation. VDD is presently within the “inexperienced zone”, ranges which can be seen in late bear markets or early bull market restoration.

After the reversal of Bitcoin from $ 100,000, the low VDD suggests the top of a revenue set up part, whereby holders accumulate in the long run pending increased 2025 bitcoin costs. The Bitcoin Cycle Capital Flows Graphs additional illuminates this development and breaks down the realized capital by way of coin age. Close to the height of $ 106,000 new market and members (<1 month) a peak in exercise, which buyed FOMO-driven to purchase. Because the Bitcoin pullback, the exercise has cooled from this group to ranges which can be typical of early to center bull markets.

The 1-2-year-old Cohort-Vaak Macro-Savvy Bitcoin-investors is, alternatively, growing actions that accumulates at decrease costs. This shift displays Bitcoin accumulation patterns from 2020 and 2021, the place long-term holders purchased throughout dips, inflicting the stage for bull cycle rallies.

The place are we within the Bitcoin market cycle of 2025?

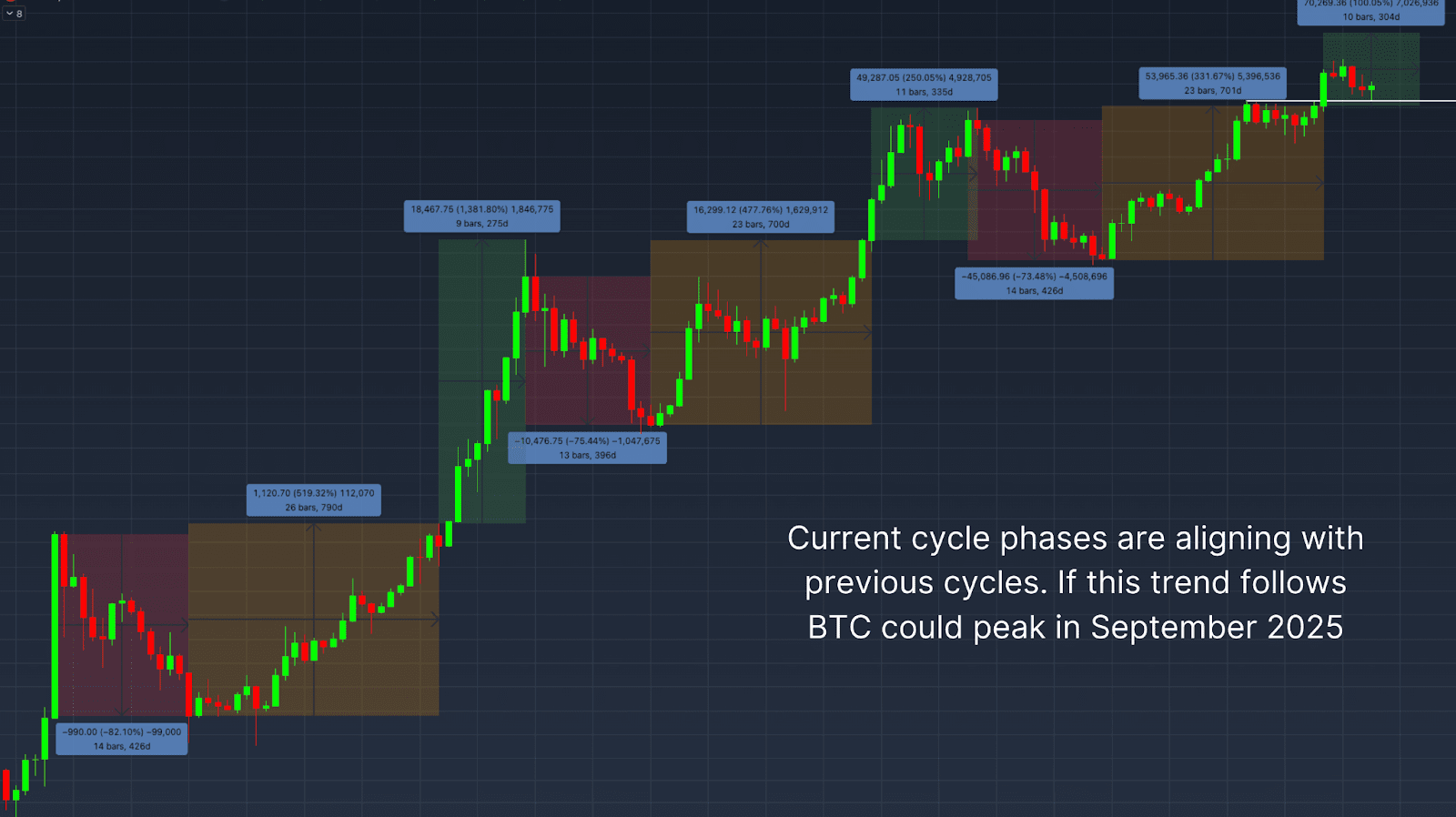

The Bitcoin market cycle can choose might be subdivided into three phases:

- BEERFASE: Deep Bitcoin corrections of 70-90%.

- Restoration part: reclaim earlier all-time highlights.

- Bull/Exponential part: Parabolic Bitcoin worth pre -trips.

Previous Bear Markets (2015, 2018) lasted 13-14 months and the newest Bitcoin -bear market adopted after 14 months. Restoration phases normally embody 23-26 months and the present 2025 Bitcoin cycle falls inside this attain. In distinction to bull markets prior to now, the Bitcoin outbreak above earlier highlights was adopted by a withdrawal as an alternative of an instantaneous improve.

This Bitcoin -Pullback can point out a better layer, in order that the exponential part of the Bullmarkt 2025 is ready up. Primarily based on the exponential phases of Sep 11 months of earlier cycles, the Bitcoin worth may peak round September 2025, assuming that the bull’s cycle will resume.

Macro dangers that affect Bitcoin -price in Q3 2025

Regardless of bullish indicators on the chain, macro-offs are the dangers for the Bitcoin worth of 2025. The S&P 500 vs. Bitcoin -correlation Graph exhibits that Bitcoin is tightly linked to US shares. With the worry of a worldwide recession development, the weak spot in conventional markets may shut the rally potential of Bitcoin within the brief time period.

Monitoring these macro dangers is essential, as a result of a deteriorating inventory market may trigger a deeper Bitcoin correction in Q3 2025, even when information on the chain helps.

Conclusion: Bitcoin’s Q3 2025 Outlook

Crucial indicators on the chain-MVRV Z-score, worth days destroyed and capital flows from Bitcoin cycle level to wholesome, cycle-consistent habits and accumulation within the Bitcoin cycle of 2025 in the long run. Though slower and uneven in comparison with earlier bullmarkets, the present cycle closes. As macro situations stabilize, Bitcoin appears prepared for an additional leg up, which can peak in Q3 or This autumn 2025.

Nevertheless, macro dangers, together with volatility of the inventory market and worry of recession, stay essential to view. View this YouTube video for a deeper dive: Where we are in this Bitcoin cycle.

Go to a go to to a bigger examine, technical indicators, actual -time market warnings and entry to a rising neighborhood of analysts Bitcoinmagazinepro.com.

Safeguard: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024