Bitcoin

What Bitcoin Price History Predicts for February 2025

Credit : bitcoinmagazine.com

Because the Bitcoin market strikes into 2025, traders are keenly analyzing seasonal tendencies and historic knowledge to foretell what February may deliver. As a result of Bitcoin’s cyclical nature is commonly tied to halving occasions, historic insights present a beneficial roadmap for navigating future efficiency. By analyzing historic knowledge – together with Bitcoin’s common month-to-month return and post-halving efficiency in February – we purpose to supply a transparent image of what February 2025 may seem like.

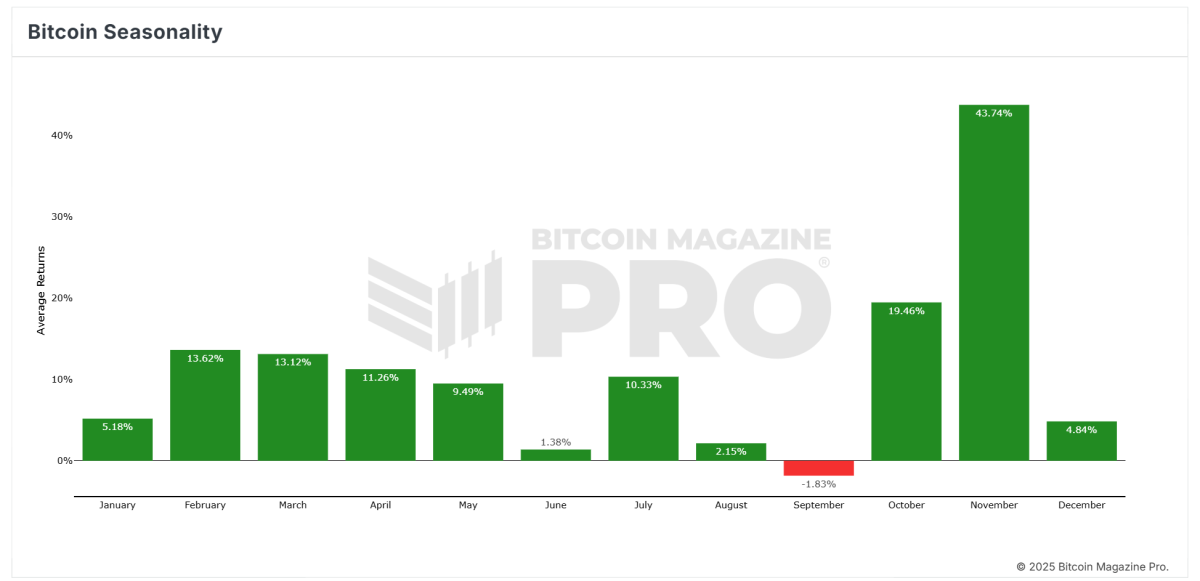

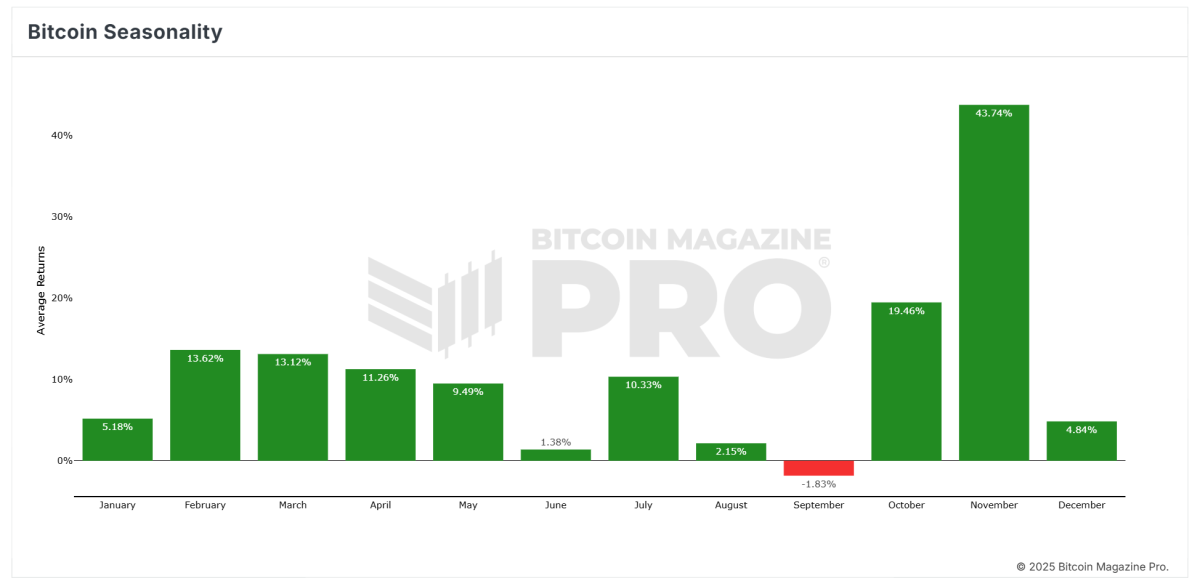

Understanding Bitcoin Seasonality

The primary diagram, “Bitcoin seasonality,” highlights the common month-to-month return from 2010 to the most recent month-end. The information highlights Bitcoin’s best-performing months and its cyclical tendencies. February has traditionally seen a mean return of 13.62%and ranks it as one of many strongest months for Bitcoin efficiency.

November specifically stands out with the best common return 43.74%adopted by October at 19.46%. Conversely, September was traditionally the weakest month with a mean return of -1.83%. February’s stable common places Bitcoin within the higher tier of Bitcoin seasonality, providing traders hope for optimistic returns in early 2025.

February’s historic efficiency within the years following the halving

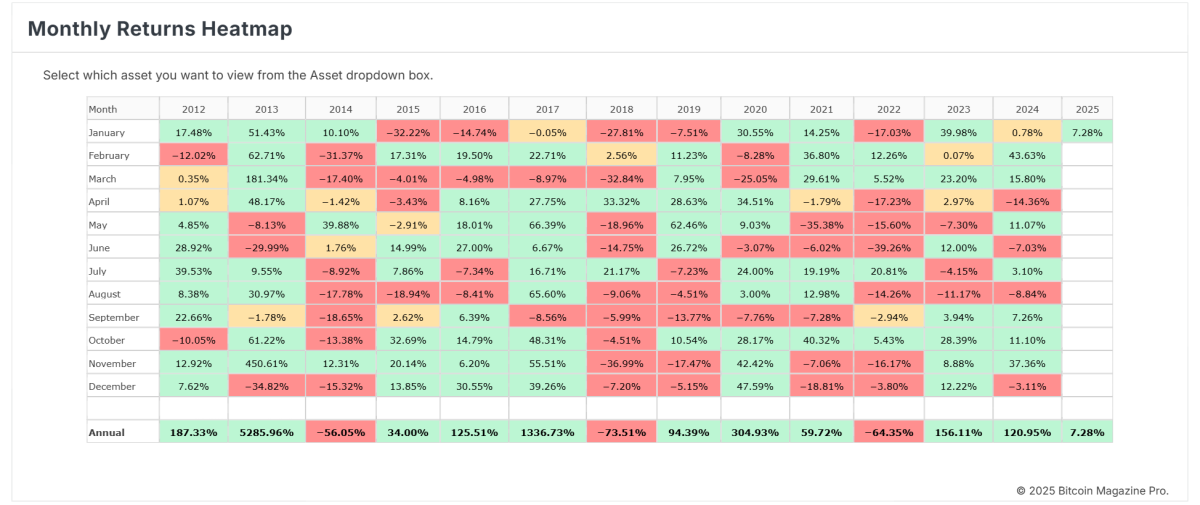

A deeper dive into Bitcoin’s historic February returns reveals fascinating insights for the years following a halving. Bitcoin’s halving mechanism – which happens roughly each 4 years – reduces block rewards by half, making a provide shock that has traditionally triggered worth will increase. February’s efficiency within the years following the halving has been persistently optimistic:

- 2013 (halving after 2012): 62.71%

- 2017 (halving after 2016): 22.71%

- 2021 (halving after 2020): 36.80%

The typical return over these three years is spectacular 40.74%. Every of those Februarys displays the bullish momentum that always follows halving occasions, pushed by lowered Bitcoin provide issuance and elevated market demand.

Associated: We’re Replaying the 2017 Bitcoin Bull Cycle

The efficiency of January 2025 units the stage

Though February 2025 has but to unfold, the yr began modestly 7.28% return up to now in Januaryas proven within the “Heatmap for monthly returnsJanuary’s optimistic efficiency indicators a continuation of bullish sentiment within the early months of 2025, according to historic patterns post-halving. If February 2025 follows the trajectory of latest years post-halving, it may ship returns on the order of 22% to 63%with a mean expectation round 40%.

What’s driving February’s sturdy efficiency after the halving?

A number of elements contribute to February’s historic power within the years following the halving:

- Provide shock: The halving reduces the brand new Bitcoin provide coming into circulation, rising shortage and rising worth appreciation.

- Market Momentum: Traders typically reply to the halving occasion with extra enthusiasm, inflicting costs to rise within the months following the occasion.

- Institutional significance: In latest cycles, institutional adoption has accelerated post-halving, creating important capital inflows into the market.

Key factors for February 2025

Traders ought to strategy February 2025 with cautious optimism. Historic and seasonal knowledge recommend that the month has excessive potential for optimistic returns, particularly within the context of Bitcoin’s post-halving cycles. With a mean return of 40.74% in latest post-halving February months, traders may count on related efficiency this yr barring important macroeconomic or regulatory headwinds.

Conclusion

Bitcoin’s historical past gives a beneficial lens via which to view its future efficiency. February 2025 can be one other optimistic month, pushed by the identical post-halving dynamics which have traditionally pushed spectacular positive factors. Combining historic knowledge efficiency with a optimistic regulatory setting, the brand new pro-Bitcoin administration and information that the Monetary Accounting Requirements Board (FASB) has issued new steering (ASU 2023-08) that basically modifications the best way Bitcoin is accounted for (Why A whole bunch of Firms Will Purchase Bitcoin in 2025), 2025 can be a transformative yr for Bitcoin. As at all times, traders ought to mix these insights with broader market evaluation and keep ready for Bitcoin’s inherent volatility.

Associated: Why A whole bunch of Firms Will Purchase Bitcoin by 2025

Through the use of the teachings of historical past and seasonal patterns, Bitcoin traders could make knowledgeable choices because the market navigates via this pivotal yr.

To discover dwell knowledge and keep updated with the most recent evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024