Bitcoin

What Do Bitcoin Miners Expect Next?

Credit : bitcoinmagazine.com

Bitcoin miners have all the time been a dependable indicator of the final sentiment inside the market. By monitoring their earnings and actions, we are able to get an concept of the place the value of BTC might be heading. On this article, we discover the newest tendencies in Bitcoin mining, how miners are responding to present market situations, and what we are able to be taught from key indicators to gauge how Bitcoin miners are positioning themselves within the coming weeks and months.

State of Miners’ Earnings

Top-of-the-line methods to evaluate the sentiment of Bitcoin miners is to look at their earnings in relation to historic knowledge. This may be finished utilizing The Puell multiplewhich measures the present earnings of miners in comparison with the annual common of the earlier yr.

In response to the newest knowledge, the Puell A number of is hovering round 0.8, which suggests miners are incomes 80% of what they earned on common final yr. This can be a marked enchancment from a couple of weeks in the past when the a number of was simply 0.53, indicating miners had been incomes simply over half of final yr’s common.

This vital drop earlier this yr possible put monetary strain on many miners. Regardless of these challenges, the truth that the Puell A number of is recovering means that the outlook for miners could also be bettering.

Hashrate and community development

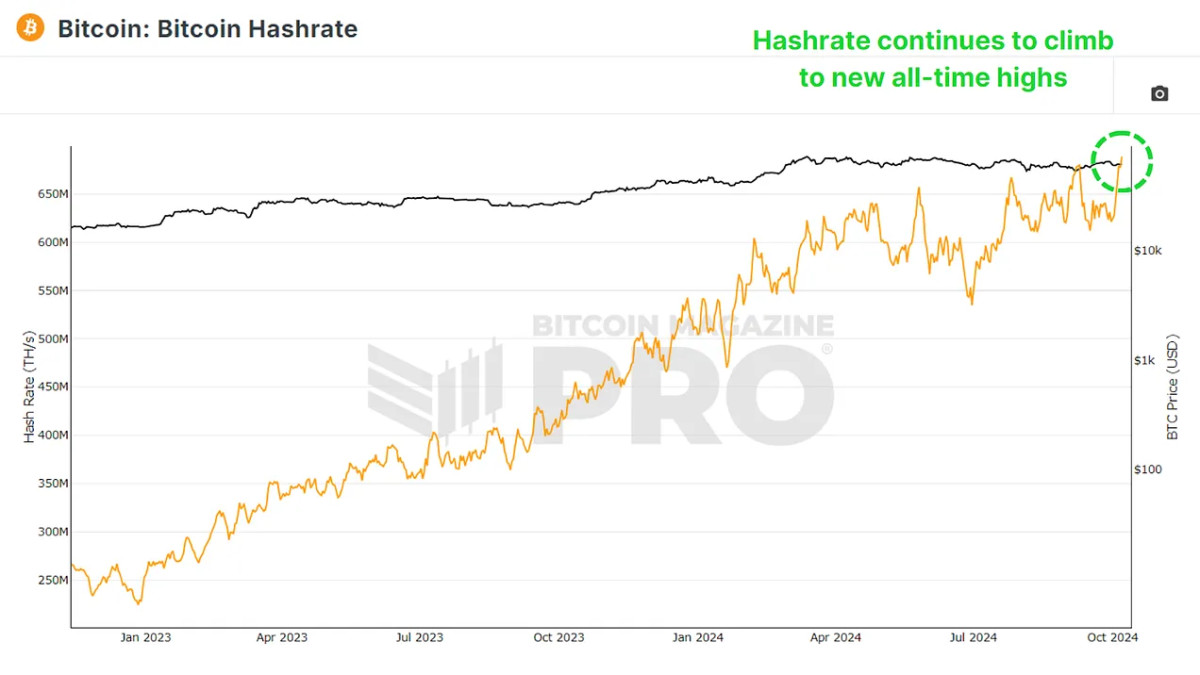

Though revenues have fallen, there aren’t any indicators of miners leaving the community. In actuality, The hashrate of Bitcointhe whole computing energy used to safe the community has steadily elevated. This improve in hashrate signifies that extra miners are coming into the community or current miners are upgrading their tools to compete for block rewards.

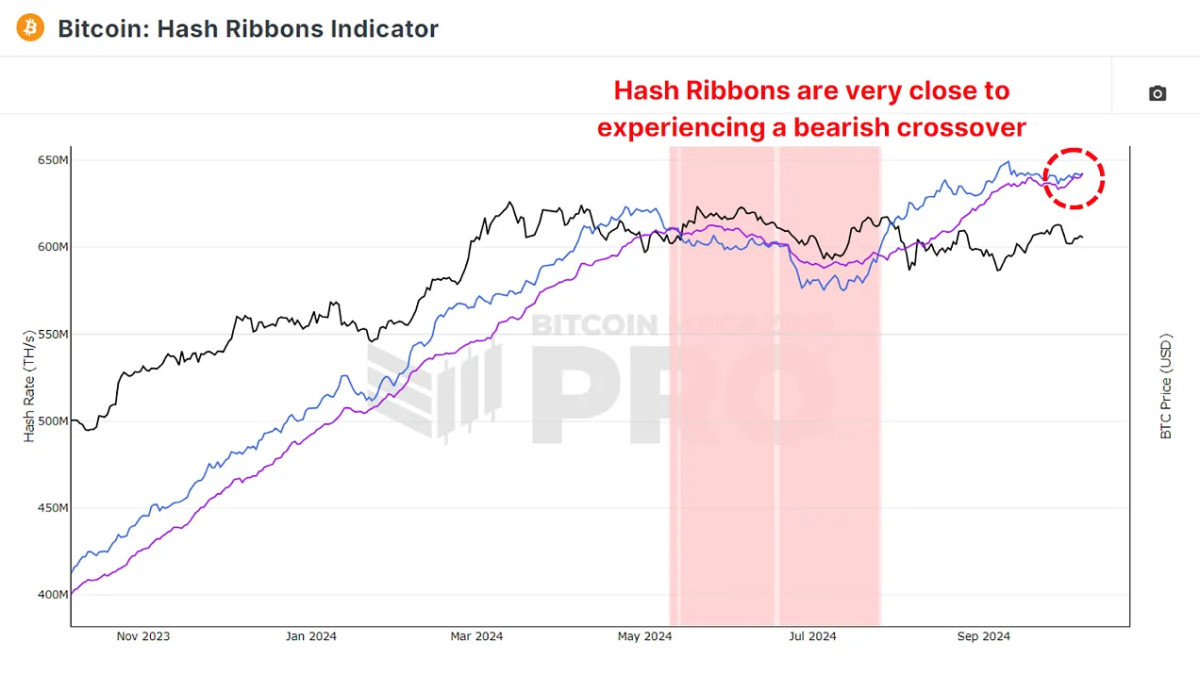

Nonetheless, trying on the Hash Ribbons indicatorwhich tracks the 30-day (blue line) and 60-day (purple line) transferring averages of Bitcoin’s hashrate, these two averages have moved nearer collectively, doubtlessly indicating a bearish near-term outlook. Traditionally, when the 60-day common rises above the 30-day common, it indicators miner capitulation, a time when miners, beneath monetary stress, shut down their tools.

Till we see a bearish crossover, there isn’t any quick signal of bearishness. One optimistic is that every time this occurs, it’s adopted by a interval of accumulation, which usually precedes an increase in Bitcoin costs. Traders usually view these capitulation intervals as nice alternatives to purchase BTC at decrease costs.

How a lot do miners earn?

Though we have now mentioned miners’ revenue in relation to the value of Bitcoin, one other necessary issue is the Hash pricethe variety of BTC or USD miners who can earn for each terahash (TH/s) of computing energy they contribute to the community.

At the moment, miners earn about 0.73 BTC per terahash, or about $45,000 in USD. This quantity has steadily declined within the months following Bitcoin’s final halving, which noticed miners’ block rewards halved, decreasing their profitability. Regardless of these challenges, miners are nonetheless rising their hashrate, indicating that they’re betting on a future BTC value improve to compensate for his or her decrease income.

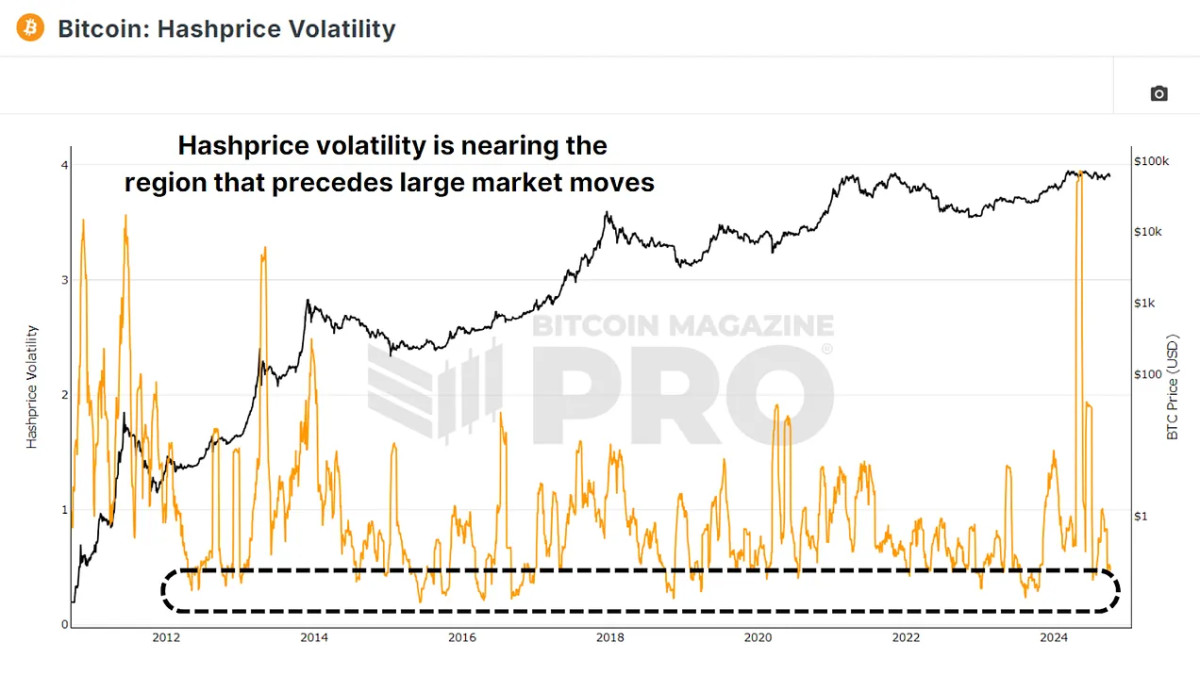

One of the fascinating statistics to have a look at is the Hashish price volatilitywhich tracks how secure or risky miners’ earnings are over time. Traditionally, intervals of low hash value volatility have preceded vital value actions for Bitcoin. In response to the newest knowledge, hash value volatility is beginning to decline once more, suggesting that we might be approaching a interval of considerable value motion for Bitcoin.

Conclusion

Bitcoin miner revenues have fallen in comparison with the historic common after the halving, however are recovering from a latest vital low. Bitcoin’s hashrate remains to be rising; Which means miners are placing extra computing energy into the community regardless of decrease profitability. The hash value continues to say no, however miners stay optimistic, possible because of the anticipated future value improve. Hash value volatility is falling, which traditionally signifies {that a} massive transfer within the value of BTC might be imminent.

Bitcoin miners look like optimistic about BTC’s long-term potential regardless of present challenges. If present metric tendencies maintain, we might be on the cusp of serious value motion, with most indications pointing to a optimistic outlook.

For a extra in-depth take a look at this matter, watch a latest YouTube video right here:

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024