Policy & Regulation

What Does David Sacks’ New White House Role Mean for the Market?

Credit : cryptonews.net

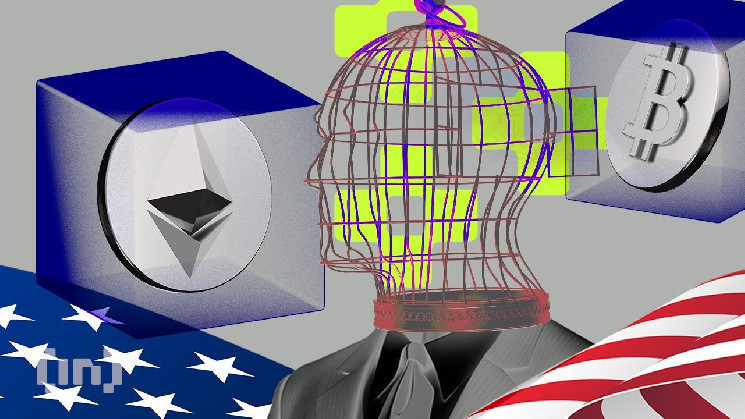

As newly elected President Donald Trump prepares to take over the White Home subsequent yr, expectations are rising round David Sacks’ position as america’ crypto czar within the cryptocurrency sector.

Chatting with BeInCrypto, {industry} leaders Ryan Chow of Solv Protocol and Kadan Stadelmann of Komodo expressed optimism over Sacks’ appointment, anticipating favorable modifications in direction of a extra industry-friendly regulatory setting.

Crypto {industry} embraces Sacks’ appointment

Earlier this month, Trump appointed Sacks, a veteran entrepreneur and investor with greater than twenty years of expertise in Silicon Valley, because the White Home cryptocurrency and AI czar.

Sacks brings intensive expertise to this position, having served because the founding father of PayPal and a fellow member of the PayPal Mafia. He later based Yammer, an enterprise software program platform that Microsoft subsequently acquired for $1.2 billion.

The crypto group has excessive hopes for Sacks and expects him to information the event of a unified nationwide strategy to policymaking and place america as a frontrunner in rising applied sciences.

“It’s anticipated that Sacks will advocate for clearer tips that might profit blockchain firms, which might scale back compliance burdens and encourage funding in digital belongings,” Brian Chow, CEO of Solv Protocol, advised BeInCrypto.

As an early and outspoken proponent of cryptocurrency, Sacks endorsed Trump’s efforts to have interaction with {industry} leaders. Following his appointment, he expressed enthusiasm in an X-post in regards to the alternative to advance American competitiveness in rising applied sciences.

“Certainly one of Sacks’ key duties can be to ascertain a authorized framework for cryptocurrency that gives much-needed readability to an {industry} typically suffering from regulatory uncertainty. His appointment might sign that the Trump administration is seeking to implement business-friendly rules that would promote innovation within the blockchain sector. That is consistent with Trump’s marketing campaign guarantees to place the US as a frontrunner in expertise and cryptocurrency,” Chow added.

Given his long-standing enthusiasm for cryptocurrency, Sacks now has the chance to affect the event of industry-friendly rules.

Dismantling Gary Gensler’s “overly aggressive” rules

The brand new “crypto czar” can also be recognized partly for his outspoken disdain for present Securities and Change Fee (SEC) Chairman Gary Gensler’s regulatory strategy to digital belongings.

Underneath Gensler’s management, the SEC took an aggressive regulatory strategy, concentrating on main crypto firms and exchanges. Though supposed to guard buyers, these actions prompted friction throughout the {industry}, with stakeholders arguing that they hindered innovation and created regulatory uncertainty.

The USA at present lags behind international locations just like the UAE and Singapore in offering clear regulatory frameworks for the cryptocurrency {industry}.

In accordance with Chow, as Trump’s crypto czar, Sacks can successfully affect the event of clear regulatory tips for digital belongings.

“Sacks is anticipated to advocate for clearer tips that might profit blockchain firms, which might scale back compliance burdens and encourage funding in digital belongings,” Chow mentioned.

Sacks is now tasked with deciding whether or not america can be a frontrunner in blockchain innovation or threat creating additional regulatory uncertainty throughout the crypto {industry}.

An undefined position

Whereas Sacks guarantees a crypto agenda, the duties of a “crypto czar” stay unsure.

“The paradox surrounding Sacks’ position — being part-time and never requiring Senate affirmation — raises questions on his capability to make vital coverage modifications,” Chow mentioned.

Regardless of this ambiguity, Trump’s appointment of pro-crypto people to key seats of his incumbent administration will extra simply foster a regulatory setting conducive to digital innovation.

“The choice of Sacks, alongside Paul Atkins as SEC chairman, alerts a transfer away from the enforcement insurance policies we noticed throughout the Biden administration,” Chow famous.

Along with Atkins, Trump selected Stephen Miran, a former Treasury Division official throughout his first administration, to chair the Council of Financial Advisors (CEA). Because the title suggests, the Council serves as an advisory physique to the president on financial issues.

Miran is an outspoken advocate for cryptocurrency and has beforehand known as for regulatory reforms in america. As chairman of the CEA, he’ll analyze financial tendencies, develop methods for financial progress and consider the effectiveness of present insurance policies.

In the meantime, Trump appointed Bo Hines, a former congressional candidate, as govt director of the Presidential Council of Advisers for Digital Belongings. Hines will work with Sacks to develop a regulatory framework that balances innovation and shopper safety. However, the crypto {industry} expects Sacks to advance decision-making.

“Whereas Sacks’ position is advisory and part-time, his shut relationship with Trump positions him to affect key coverage choices affecting each AI and cryptocurrencies,” Chow added.

The extent of Sacks’ affect

Chatting with BeInCrypto, Komodo Platform CTO Kadan Stadelmann mentioned that Trump himself will finally be capable of train essentially the most energy over crypto coverage.

“By giving the crypto {industry} his blessing, Donald Trump himself can do sufficient to assist the US meet up with international locations the place regulatory readability is already the order of the day. Sacks can actually advise, and maybe assist push different branches of presidency to align with the president’s imaginative and prescient,” Stadelmann mentioned.

Though Sacks is an efficient asset, in keeping with Stadelmann his appointment is just not indispensable in shaping the rules.

“Donald Trump’s re-election might be a motive for firms to return to the US, particularly as he guarantees 15 % company tax charges. Sacks’ appointment is a aspect subject,” he added.

The crypto {industry} will bear a number of coverage modifications along with the appointment of a brand new SEC chairman. This consists of govt orders that might facilitate higher entry to banking providers for crypto firms, the appointment of crypto-friendly people to key authorities positions, and even the creation of a potential strategic Bitcoin reserve.

Uncertainty about CBDCs

The dialog round a friendlier strategy to digital belongings additionally results in the subject of Central Financial institution Digital Currencies (CBDCs). Central banks subject and regulate CBDCs, that are digital types of cash. In contrast to cryptocurrencies, CBDCs are supposed to co-exist with, fairly than exchange, bodily forex.

Recognizing the digitalization of cash and funds, central banks world wide have more and more explored the event of CBDCs to make sure their continued relevance in a altering digital monetary world.

“Whereas Sacks is just not explicitly tasked with creating a CBDC, his affect on crypto coverage might form discussions round it. A CBDC may be seen as a authorities response to the rise of personal digital currencies, probably resulting in elevated oversight and regulation of those belongings,” Chow advised BeInCrypto.

Contemplating that the Trump administration should adjust to an extended record of crypto-friendly insurance policies, CBDCs will not be on the high.

“Sacks’ choice for deregulation might delay or complicate any transfer towards the creation of a CBDC, as he might prioritize enhancing the prevailing crypto ecosystem over introducing authorities alternate options,” Chow added .

How a lot management Sacks has over the creation of US-backed digital currencies stays a query.

“Critics argue that its capability to affect main choices concerning CBDCs or personal cryptocurrencies might be restricted with out formal authority or oversight. It’s seemingly that CBDC can be challenged throughout his tenure, however finally, well-regulated digital belongings should still be preferable,” Chow mentioned.

Whether or not Trump desires to create a digital greenback is one other hurdle for hopeful CBDC fanatics. In January, Trump gave a speech in New Hampshire wherein he vowed that as president he would “by no means enable the creation of a central financial institution digital forex,” calling it “very harmful” and a type of “authorities tyranny.”

Solely time will inform if Trump’s place will stay the identical.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024