Bitcoin

What Has Bitcoin Become 17 Years After Satoshi Nakamoto Published The Whitepaper?

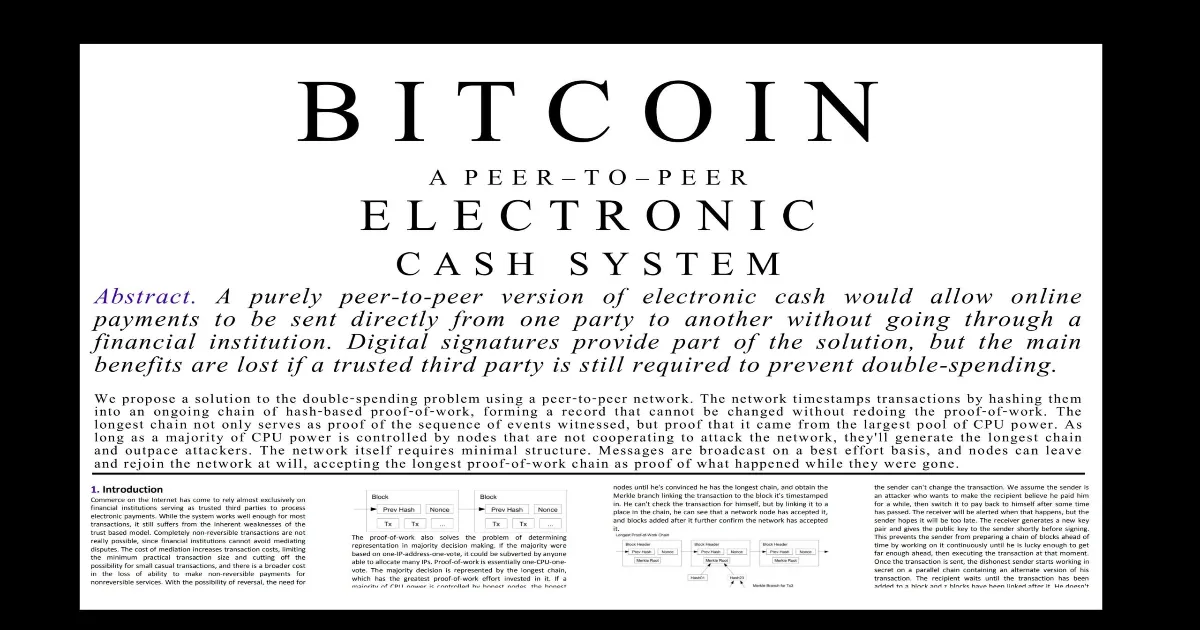

Credit : bitcoinmagazine.com

As we speak marks seventeen years since Satoshi Nakamoto revealed the Bitcoin Whitepaper on the cryptography mailing listing in 2008. On the time, Bitcoin was nothing greater than a proposal for a brand new area of interest know-how, the most recent in an extended line of area of interest applied sciences created by the cypherpunks of the Nineties.

Bitcoin has undergone many large transformations since that day 17 years in the past. It went from a distinct segment Web collectible, to a decentralized community powering unlawful darkish internet markets, to a mainstream speculative retail funding, to Wall Road and governments world wide’s favourite new asset class. All of us had a front-row seat to the Web’s first explosive world technological revolution, and it was a wild trip.

I feel you will need to contact on this anniversary an idea that could be very related: POSIWIDor the aim of a system is what it does. The essential thought is that when you have a fancy system, there isn’t a level in making an attempt to outline it primarily based on what you need wish to To do that, the primary factor is what the elements of that complicated system are really does. In the long run, that is all that issues.

We’re as soon as once more in a interval the place persons are turning to the white paper as a placeholder for some sort of founding doc, definition, or blueprint. The white paper is none of these issues. It’s merely a high-level summary rationalization of a Proof-of-Work blockchain used to implement a digital foreign money. It is the concept of a cart with wheels, versus the precise blueprint of the cart (the supply code).

Bitcoiners appear to periodically fixate on the whitepaper on this manner, inevitably utilizing it as justification for his or her hostility towards a use case or thought to enhance Bitcoin that they disagree with. Possibly we’ll recover from this finally, perhaps we cannot, nevertheless it’s an unhealthy perspective in direction of such a doubtlessly impactful know-how like Bitcoin.

Individuals weren’t reciting the writings and speeches of Alexander Graham Bell when digital modems have been invented to allow the primary tendrils of the early Web to achieve between units and facilitate the digital alerts between them. They embraced it as a beneficial technological innovation, and in right this moment’s world that dynamic has fully reversed itself. Most phone alerts are actually really conveyed by communications media particularly designed for digital communications.

Phone networks have been used to construct the digital medium of the fashionable Web in ways in which Alexander Graham Bell would possibly solely have imagined, reshaping the complete world in ways in which have been unattainable for individuals of his technology to think about.

Satoshi did not give us a fundamental doc to decide to when he launched the whitepaper; he gave us a high-level description of the software program that adopted.

That is the precise reward he gave us, the software program. And he gave it to us fully freely, open supply, to do with no matter we determine to do.

“BitDNS customers may be fully liberal about including huge information options as a result of comparatively few area registrars are wanted, whereas Bitcoin customers can turn into more and more tyrannical about limiting the dimensions of the chain in order that it’s handy for a lot of customers and small units.” -Satoshi Nakamoto, 2010

This quote is at all times introduced up within the context of block measurement limits, or Bitcoin enabling a number of functionalities, however what at all times struck me essentially the most is “customers may get.” Finally, earlier than his disappearance, Satoshi clearly has specific respect for customers’ needs, and within the context of a essential and elementary resolution just like the block measurement restrict.

Bitcoin does not belong to Satoshi anymore, it belongs to us, and together with the way in which we really use our bitcoin, we determine what the aim of the system is. It is vital to do not forget that.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now