Ethereum

What PayPal USD’s decline says about the state of tokenized assets in TradFi

Credit : ambcrypto.com

- PayPal’s USD market capitalization has fallen considerably from its historic peak

- Regardless of the current restoration, this is probably not sufficient in the long run

PayPal USD made an enormous impression in the marketplace within the second half of 2024 for a number of causes. It was the primary time a conventional cost supplier engaged with Web3 in a mainstream method. It additionally marked a brand new daybreak for tokenized belongings.

Expectations for PayPal USD had been excessive, however quick ahead to the current and it seems that the story on tokenized belongings is operating out. The preliminary pleasure after launching on Solana was mirrored in its efficiency, which remained the identical because it cooled down.

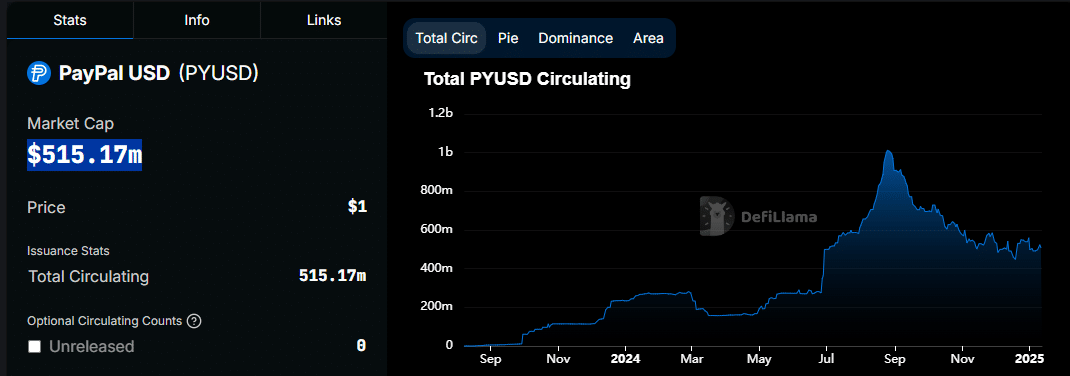

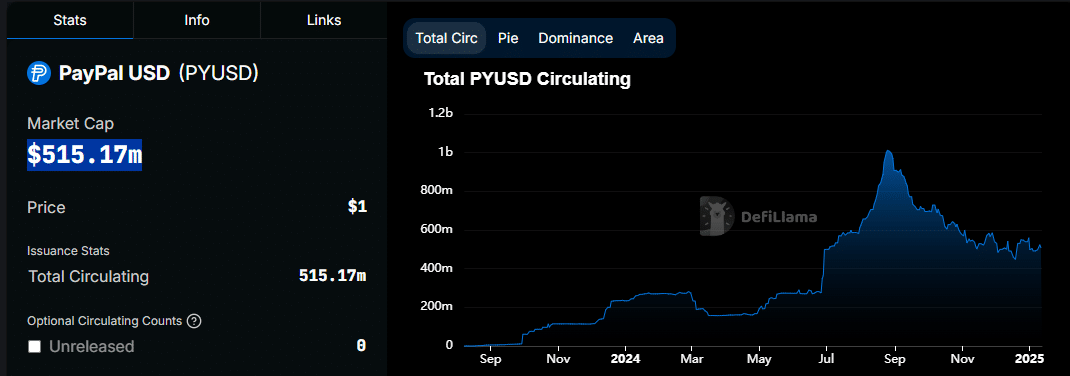

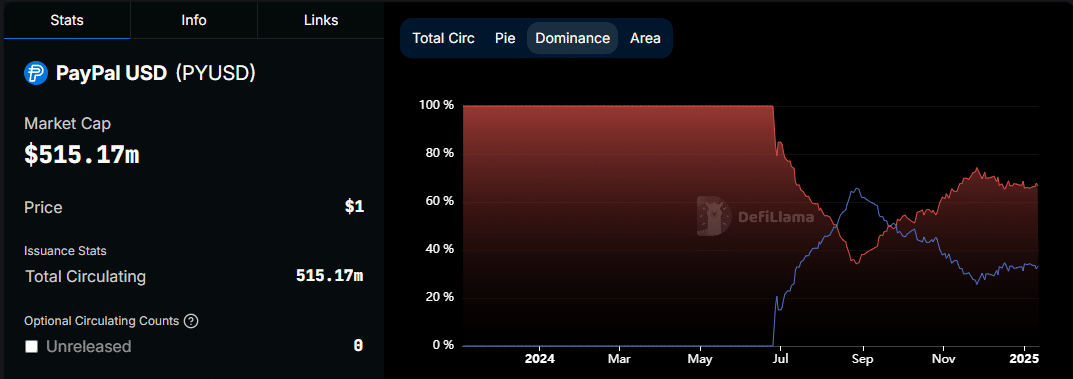

PayPal’s USD market capitalization peaked at $1.01 billion on August 25. Since then, rates of interest have progressively fallen, even falling under $500 million in December. PYUSD had a market cap of $515.17 million on the time of writing.

Supply: DeFiLlama

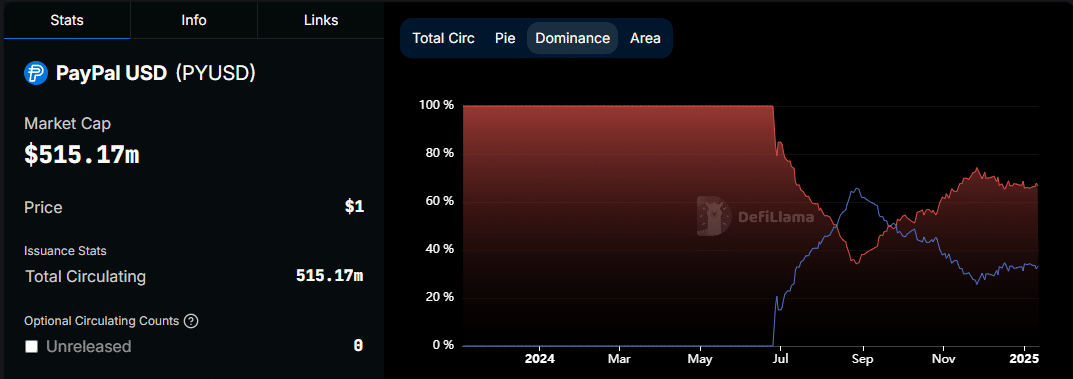

The decline in PayPal’s USD market capitalization occurred across the similar time that PayPal’s dominance over Solana started to say no.

The preliminary pleasure allowed PayPal USD market cap to outperform Ethereum earlier on on Solana. At its peak, the market cap on Solana was 65.79% on August 29. Solana blockchain dominance reached a low of 25.42% on November 27.

supply: DeFiLlama

The overall PYUSD market cap matched Solana’s dominance. This discovering confirmed that its usefulness on the Solana community was not sustainable. The truth is, on the time of writing, Ethereum held 67.21% of the circulating PayPal USD provide.

What fueled PayPal’s preliminary USD market cap progress and what’s totally different now?

The PYUSD market cap started to say no because the crypto market started to see sturdy demand. Earlier than that, the worth rallied from June 26 to August 30, 2024. This was simply earlier than the market frenzy. There have been extra stablecoin holders on the time and the PayPal stablecoin provided engaging returns on Solana.

Nonetheless, because the market has turned extraordinarily bullish, yield miners could have withdrawn their liquidity and pumped it into crypto. The truth that PayPal USD was nonetheless comparatively new meant that it had additionally failed to attain sustainable transaction volumes.

Whereas the above might clarify why the PayPal-related stablecoin has misplaced liquidity, this might border on hypothesis. The truth is, the stablecoin nonetheless enjoys vital on-chain exercise. For instance, circulating provide on each networks has elevated considerably over the previous 30 days.

For instance, it rose 5.31% in opposition to Ethereum and 4.12% in opposition to Solana up to now 4 weeks. This appeared to substantiate that there’s nonetheless some demand for the stablecoin. Nonetheless, it’s only restricted to the 2 networks and this has been a barrier to adoption.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September