Altcoin

What Polkadot’s ‘falling wedge’ breakout means for traders

Credit : ambcrypto.com

- The falling wedge breakout signifies bullish potential and targets $24 with $10.88 as key resistance.

- Constructive metrics, together with oversold RSI and robust social sentiment, reinforce Polkadot’s rally potential.

Polka dot [DOT] has damaged out of the falling wedge sample on the weekly time-frame, an important sign that usually precedes vital bullish rallies.

Buying and selling at $6.83 on the time of writing, down 1.98% on the time of writing, the cryptocurrency’s breakout and retest part presents a promising alternative for merchants. The following key query is whether or not DOT can preserve this momentum and get better in the direction of its medium-term goal of $24.

DOT’s Breakout and Value Prediction

The break of the falling wedge on Polkadot’s chart highlights sturdy potential for a bullish reversal. The worth is now dealing with its first main resistance at $10.88, with a medium-term goal of $24.

Moreover, the current retest of the breakout stage strengthens the technical outlook, suggesting consumers are getting into at vital ranges. Due to this fact, DOT’s trajectory seems poised for a considerable upside, supplied the momentum continues.

Supply: TradingView

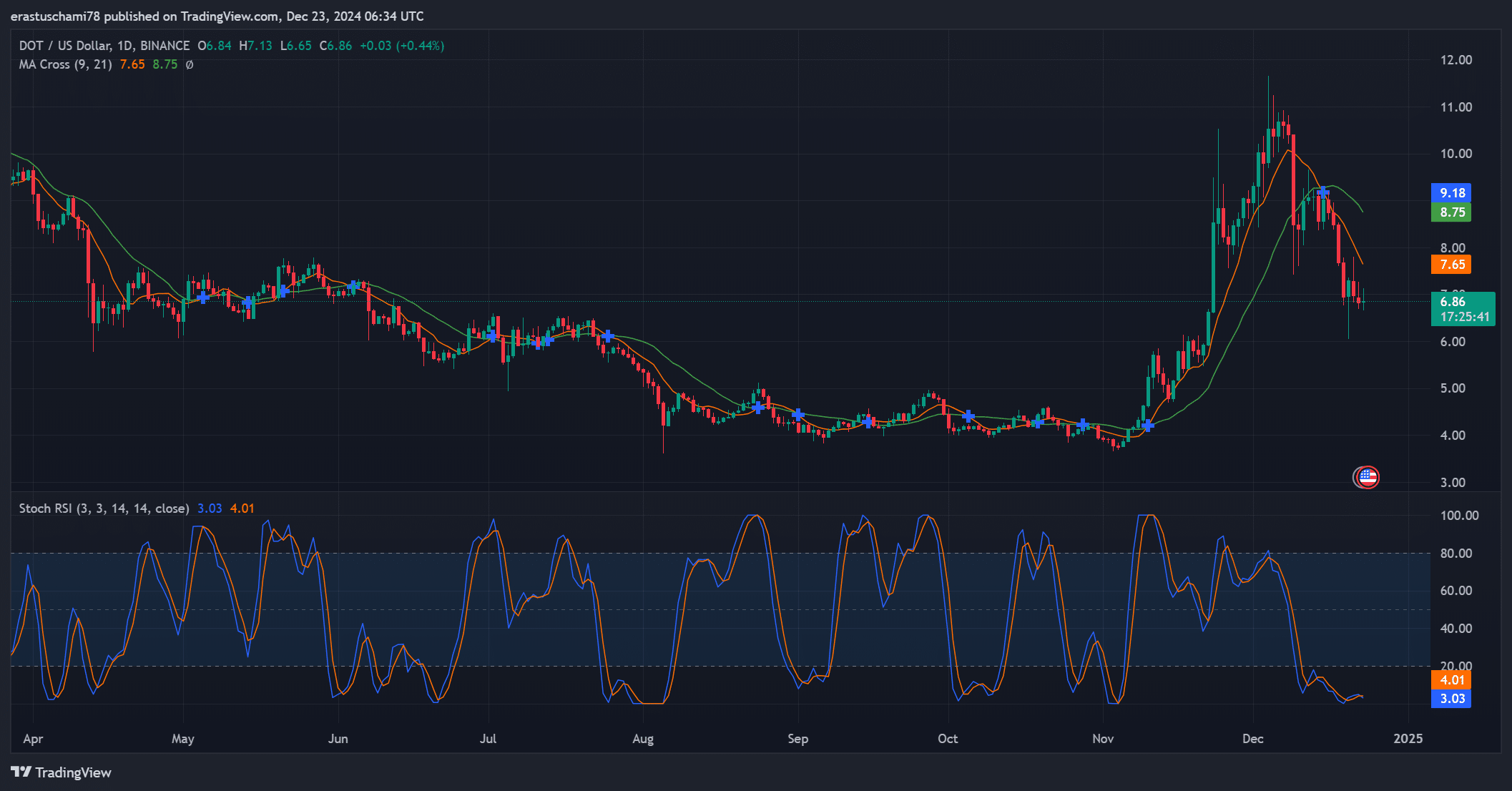

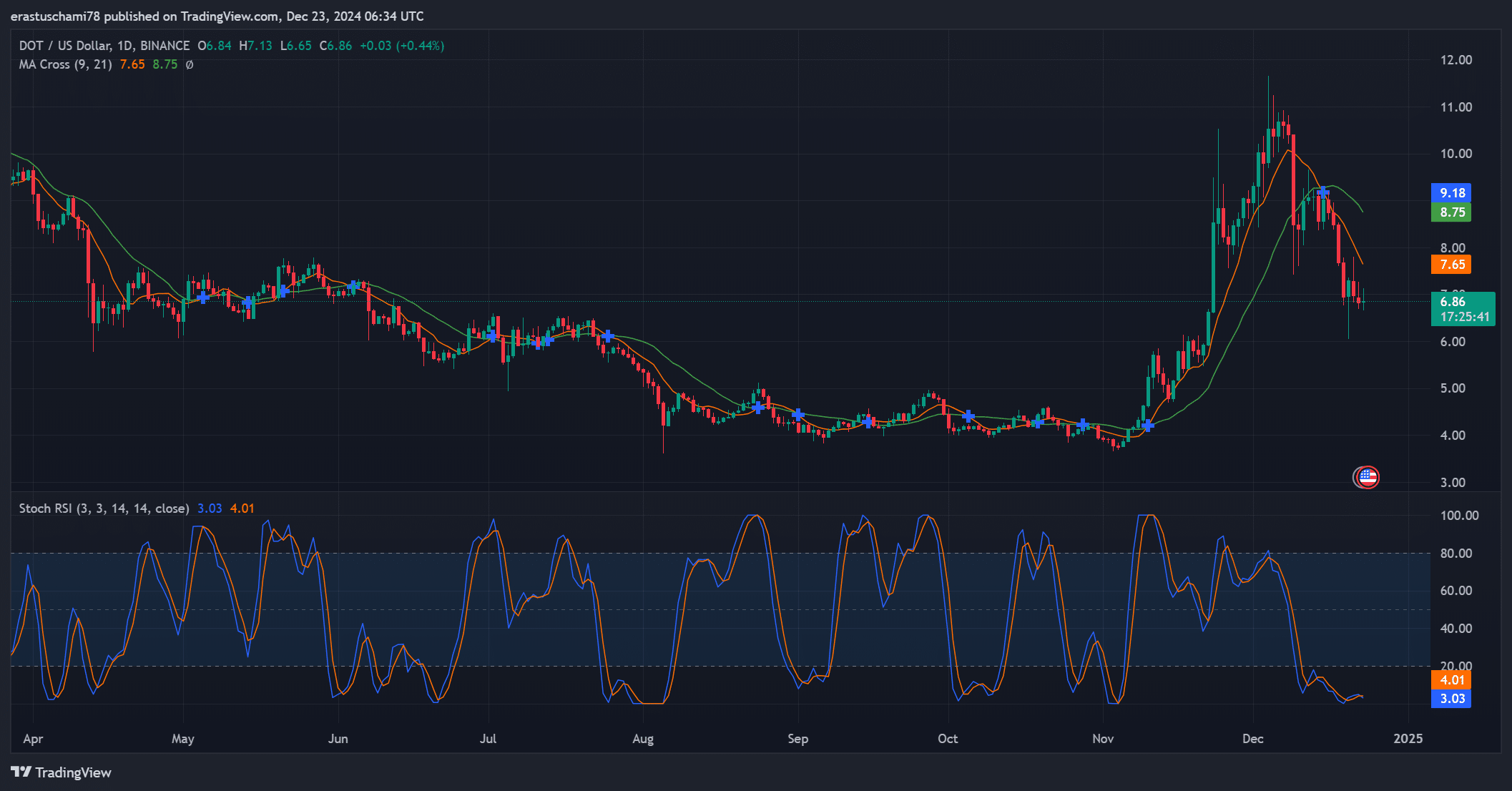

Evaluation of the stochastic RSI and transferring averages

Technical indicators additional help Polkadot’s bullish potential. The stochastic RSI reveals oversold circumstances, with values close to 3.03 and 4.01, indicating a possible near-term worth restoration.

Whereas the transferring common (MA) crossover on the day by day chart signifies near-term consolidation, it additionally means that the DOT may quickly reverse its downtrend.

Collectively, these indicators level to a promising outlook for the cryptocurrency within the coming weeks.

Supply: TradingView

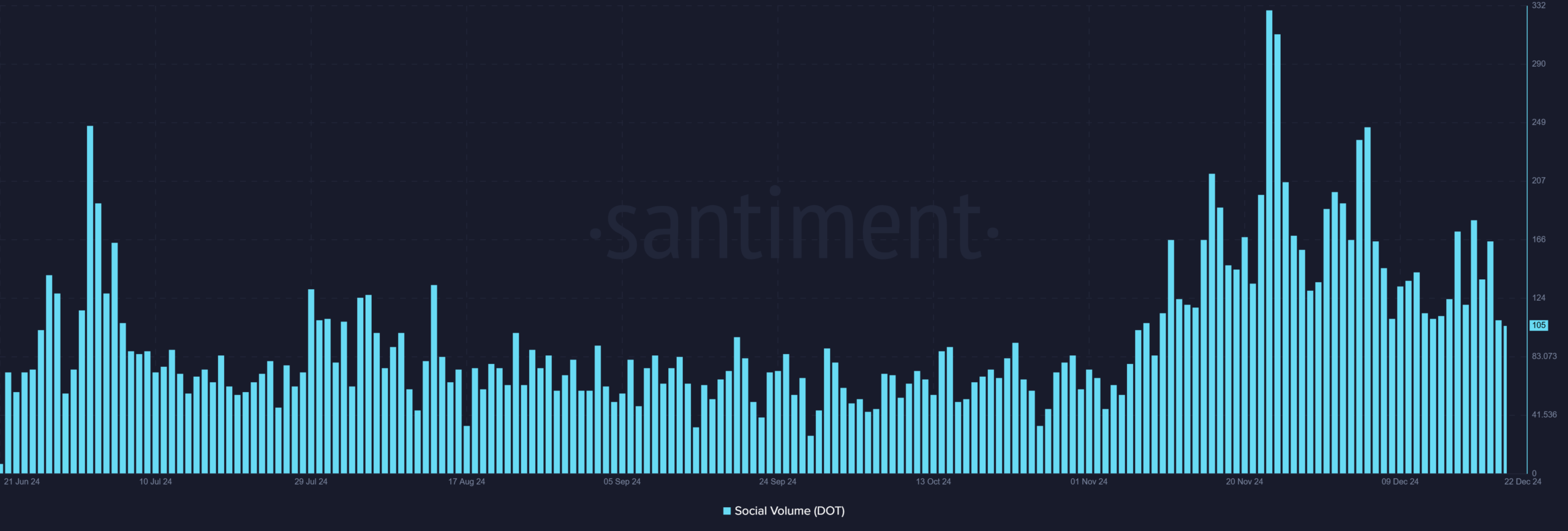

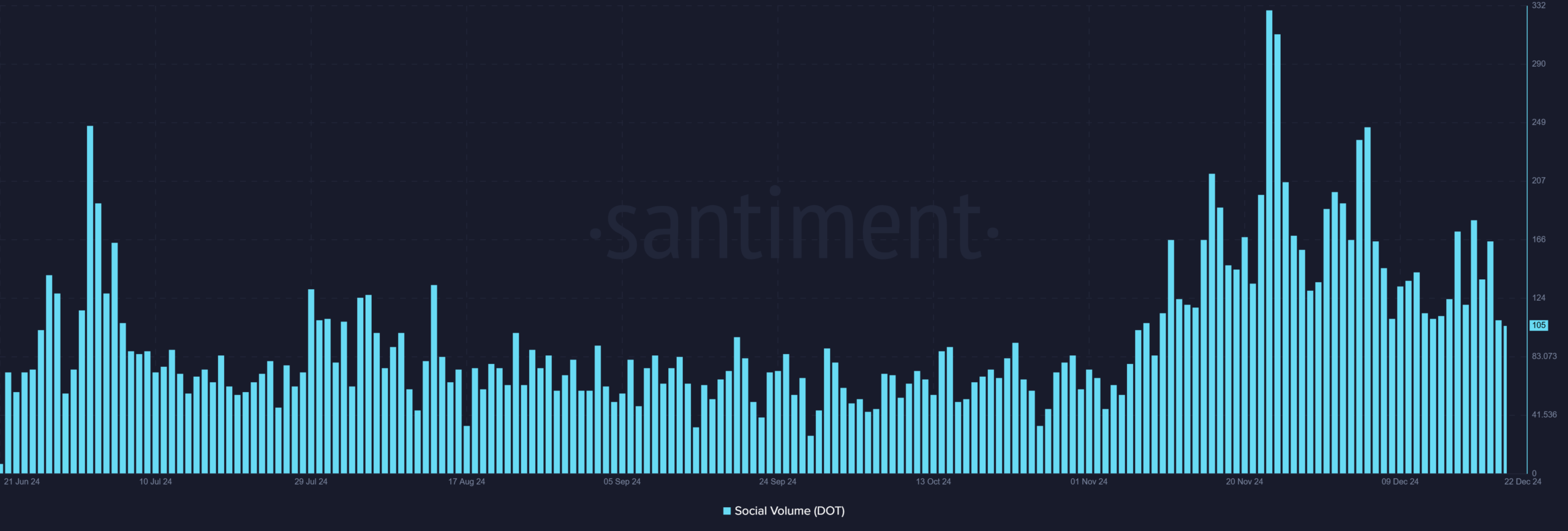

Social quantity information, 105, signifies growing curiosity in Polkadot as neighborhood engagement continues to extend throughout platforms. This elevated exercise, seen by way of constant spikes, is usually related to a renewed curiosity within the asset.

Due to this fact, the narrative round Polkadot’s bullish potential continues to develop, making a optimistic suggestions loop for each sentiment and worth motion.

Supply: Santiment

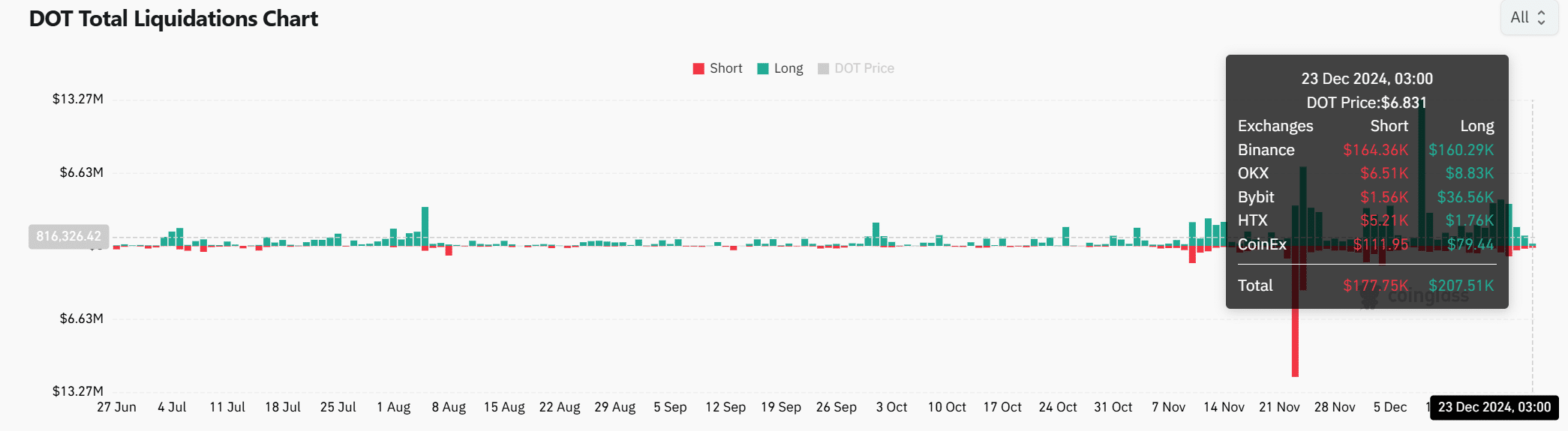

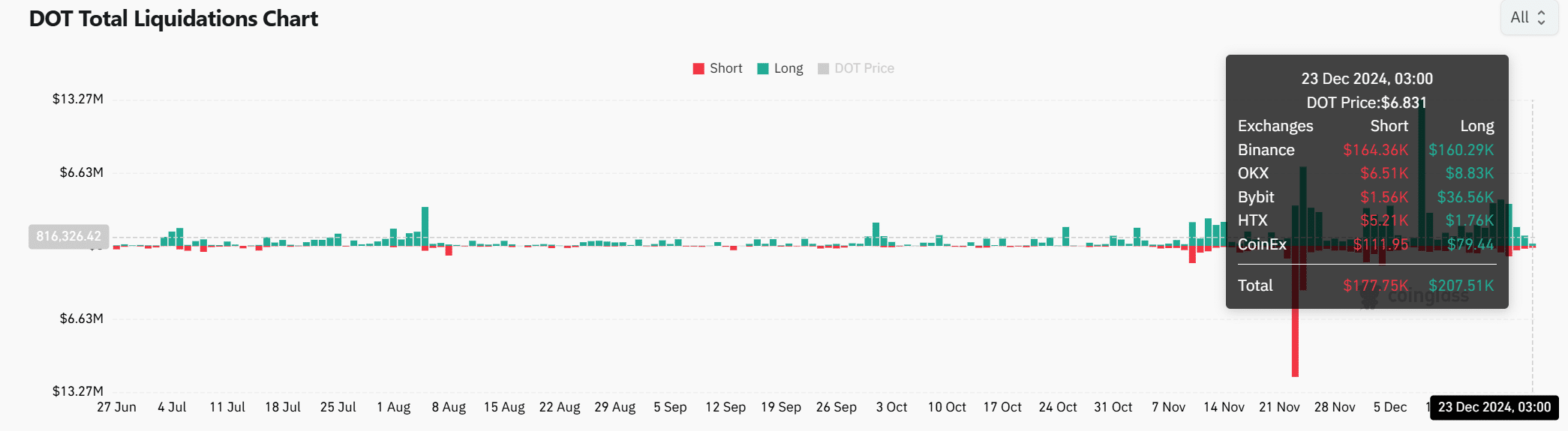

The DOT derivatives market helps the bullish outlook

Polkadot’s whole liquidations present $207.51K in lengthy liquidations, in comparison with $177.75K in shorts, indicating rising confidence amongst lengthy merchants. Furthermore, the OI-weighted financing charge stays optimistic at 0.01%, reinforcing bullish sentiment.

These numbers point out that Polkadot is gaining momentum within the derivatives market, additional strengthening its upside potential.

Supply: Coinglass

Learn Polkadot [DOT] Value forecast 2024-2025

With the falling wedge breakout, bullish technical indicators, and rising momentum in social and derivatives, Polkadot seems properly positioned for a rally.

Whereas overcoming the resistance at USD 10.88 is crucial, the medium-term goal of USD 24 is achievable if the present momentum continues. Polkadot is undoubtedly on its technique to an enormous breakthrough.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now