Altcoin

What the Fourth Quarter Holds for Bitcoin: Assessment of Key Levels

Credit : ambcrypto.com

- Bitcoin bulls emerged in response to fee hikes because the market will get a confidence enhance.

- Evaluating the chance of extended liquidations as volatility makes a comeback.

Bitcoin [BTC] responded positively to the Federal Reserve’s newest rate of interest lower announcement. The long-awaited choice confirmed that rates of interest will fall by 50 foundation factors.

Traders responded to the speed cuts by collaborating in a Bitcoin shopping for wave that pushed the worth above $62,000 for the primary time this month.

This was according to earlier hypothesis as decrease rates of interest are anticipated to have a optimistic impression on liquidity flows in dangerous property. However the actual query is: the place does the market go from right here?

A bumpy experience forward for Bitcoin?

There are excessive expectations round Bitcoin, particularly now that rates of interest are falling. Whereas this might help extra upside potential within the coming months, it additionally paves the way in which for extra volatility.

Translation, extra sudden pullbacks and extremely risky value actions.

A basic instance of why Bitcoin will expertise extra volatility is that prime expectations result in extra optimism and a better want for leverage. It’s possible that extra lengthy positions will now be executed.

In the meantime, whales and institutional gamers see this as open season for liquidations.

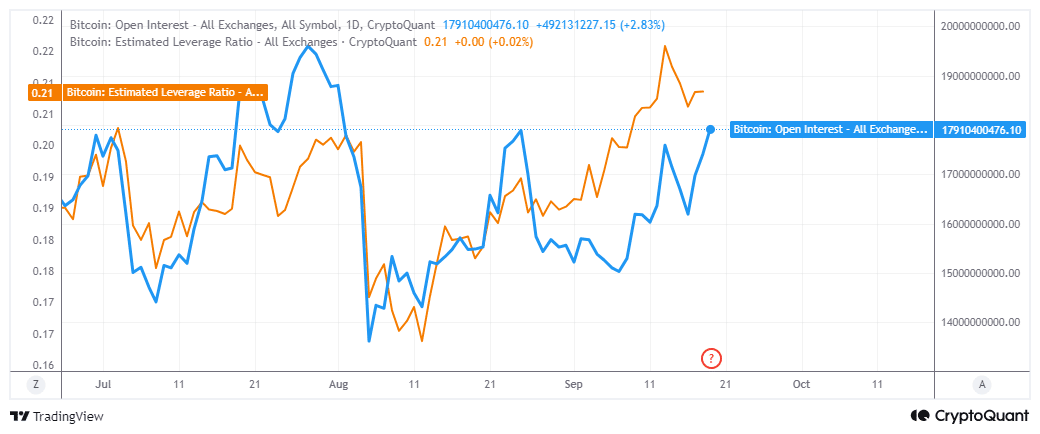

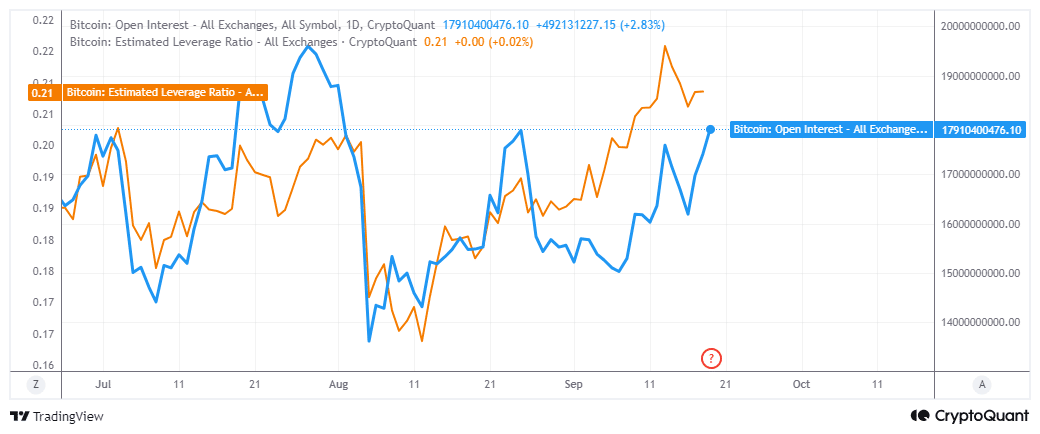

Market knowledge coincides with the above expectations. For instance, open curiosity simply rose to its highest stage previously seven weeks.

The estimated leverage ratio, which displays the extent of leverage at a given cut-off date, has been rising since its August low.

Since September 13, the worth has retreated barely, however is poised to finish increased due to the latest enchancment in market sentiment.

Supply: CryptoQuant

Talking of sentiment, the announcement of rate of interest cuts seems to have had a optimistic impression on Bitcoin ETFs. There was approx $52.83 Million in Bitcoin ETF Inflows on September 18.

Optimistic ETF flows and anticipated liquidity injections ought to set the stage for a wholesome Bitcoin run-up. Nonetheless, it may additionally pave the way in which for heavy liquidations and withdrawals alongside the way in which.

Assessing latest demand

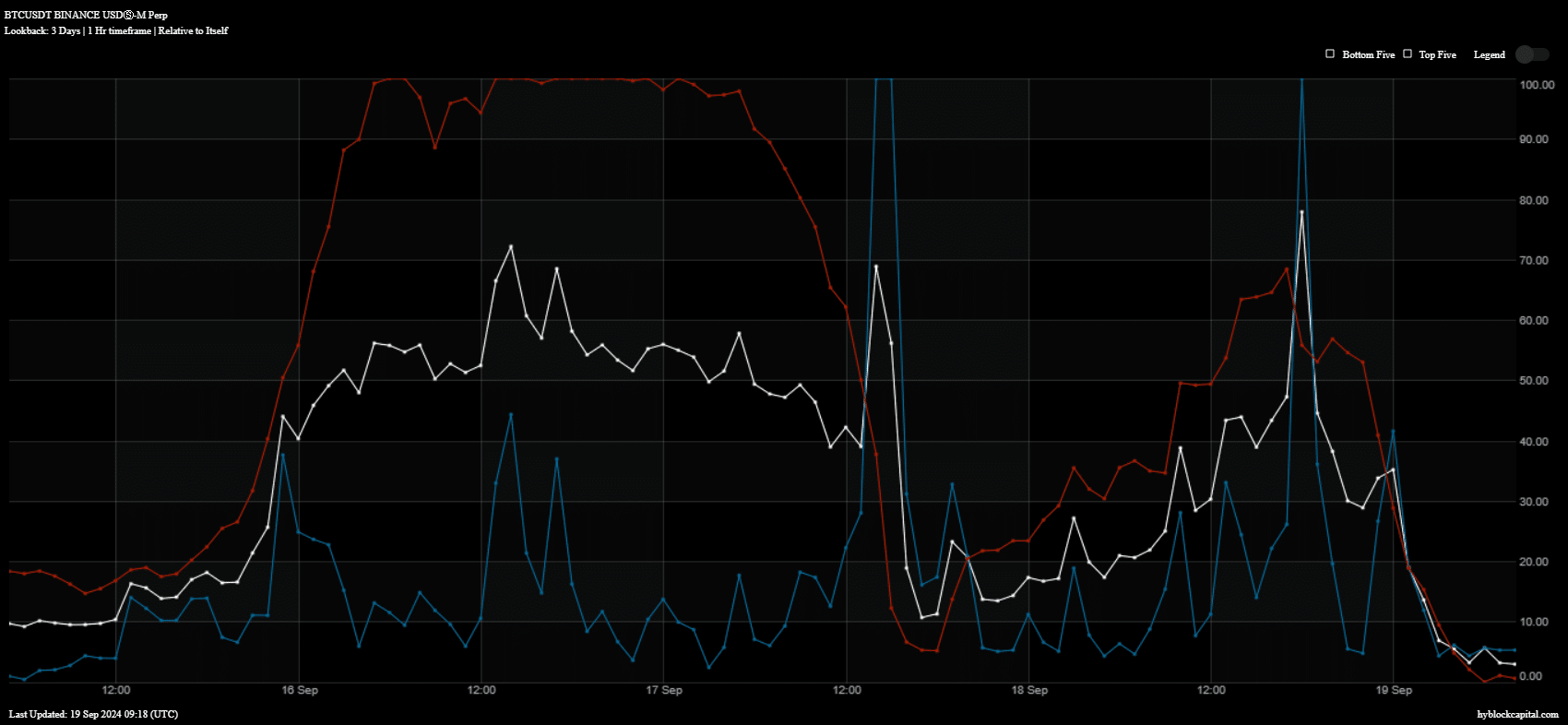

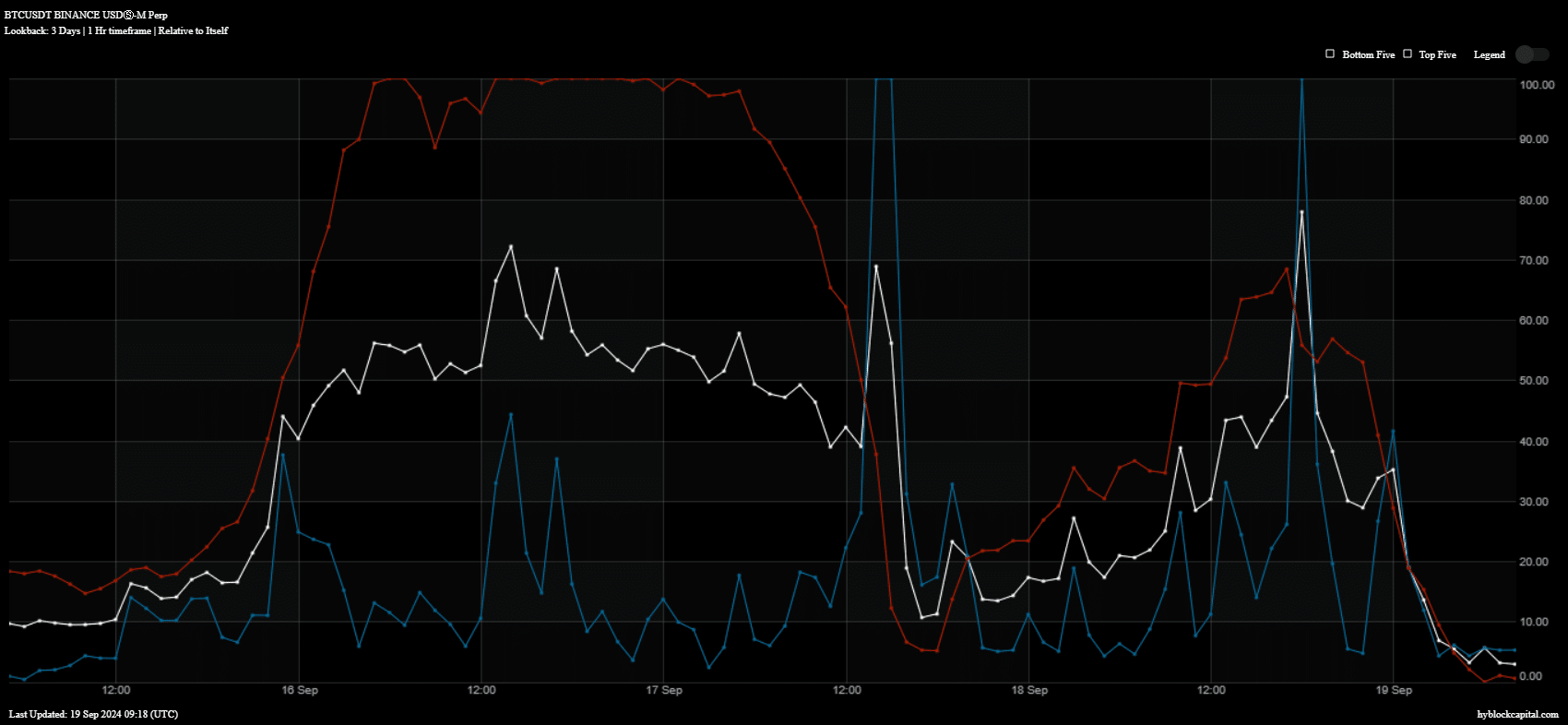

Bitcoin continues to be prone to liquidations that might occur quickly. On-chain knowledge confirmed that the latest wave of liquidity injections into Bitcoin has already dissipated, evidenced by shopping for quantity (blue).

We now have additionally seen a spike in lengthy positions (pink), that are prone to liquidation if the market pulls again unexpectedly.

Supply: Hyblock Capital

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

The presence of extremely leveraged lengthy positions can pave the way in which for whales and establishments to control costs.

Regardless of the chances of a retracement, increased liquidity flows are anticipated to push Bitcoin increased within the coming months.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024