Altcoin

What’s Behind the Exchange Exodus of Bitcoin and Ethereum?

Credit : www.newsbtc.com

This text is accessible in Spanish.

Crypto buyers aren’t eager on coping with cryptocurrency buying and selling platforms, which has resulted in Bitcoin and Ethereum’s dwindling international change reserves. Centralized exchanges on Bitcoin and Ethereum hit all-time lows after buyers and crypto lovers opted for self-management options for his or her digital belongings.

Associated studying

Keep away from cryptocurrency buying and selling

A current development has proven that merchants and different lovers are selecting to carry on to their crypto belongings slightly than resell them Bitcoin and ether change platforms.

They most well-liked direct possession of their belongings utilizing self-custody wallets, creating an rising demand for self-custody options. Nonetheless, it led to a drop within the liquidity of BTC and ETH on centralized exchanges.

Strengthening Bitcoin and Ethereum Values

A optimistic consequence of merchants’ choice for self-management options is the rising worth of Bitcoin and Ethereum belongings over time. Merchants turning away from cryptocurrency buying and selling platforms create a way of shortage, which ends up in the expansion of its worth.

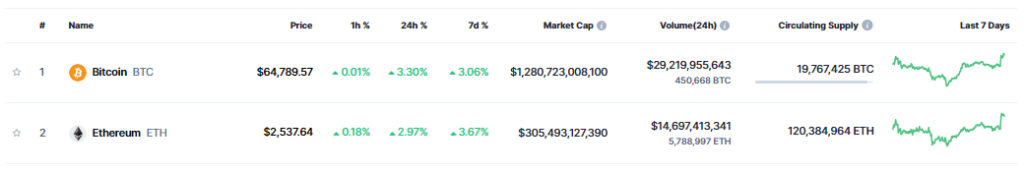

On the time of writing, the price of Bitcoin is pegged at $64,842. Since hitting an all-time excessive of $73,000 in March this yr, the value has remained someplace between $66,000 and $49,000. In the meantime, in accordance with Coinmarketcap, Ethereum is buying and selling at $2,464.

Bitcoin and Ethereum reserves are falling

Bitcoin and Ethereum on centralized reserves took a nosedive, reaching all-time lows early this month. As of October thirteenth The CryptoQuant graph confirmed that the centralized exchanges for BTC recorded an all-time low of two,666,717 bitcoins.

The best quantity of Bitcoin was set at 3,361,854, which was recorded on June 8, 2022. After that interval, Bitcoin declined sharply. The bottom stage was reached at the start of this month.

When it comes to quantity, spot exchanges have 1.1 million Bitcoin in reserves, whereas derivatives exchanges maintain 1.39 million reserves. Binance holds by far 563,000 Bitcoin reserves, the biggest crypto change by buying and selling quantity, adopted by Kraken with 112,3000 reserves.

Alternatively, Coinbase Superior has 830,530 Bitcoin reserves and Coinbase Prime has 3,000 reserves. Ethereum’s centralized exchanges are additionally dealing with an analogous dilemma as Bitcoin, with reserves persevering with to say no, hitting a report low of 18.7 million.

Associated studying

In line with CryptoQuant it’s derivatives exchanges personal a big portion of Ethereum with 10.3 million in reserves, whereas 8.4 million Ethereum reserves are held on spot exchanges.

Traditionally, Ethereum’s all-time excessive in reserves on September 6, 2022 was 2,310,823. Since that interval, Ethereum reserves on central exchanges have continued to say no.

When it comes to reserves, Coinbase has a big reserve of 4.5 million Ethereum, adopted by Binance with 3.6 million Ethereum. Kraken additionally has a big Ethereum reserve of 1.3 million.

Featured picture from Pexels, chart from TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now