Bitcoin

Who Is Currently Dictating the Bitcoin Market? Van Straten

Credit : www.coindesk.com

Disclosure: The writer of this story owns inventory in MicroStrategy (MSTR).

Since Donald Trump received the US elections on November 5, bitcoin (BTC) has risen from $67,000 to round $100,000. This coincided with a large improve in bitcoin’s complete buying and selling quantity, which has now surpassed $100 billion.

In line with checkonchain In line with information, bitcoin futures buying and selling quantity reached an all-time excessive of round $120 billion on November 17, virtually doubling because the US election. Since then, nevertheless, futures buying and selling quantity has remained secure at round $100 billion.

The identical will be seen in spot market buying and selling quantity, which has additionally doubled from roughly $6 billion to $12 billion. Whereas US exchange-traded funds (ETFs) buying and selling quantity has additionally elevated to $4 billion per day.

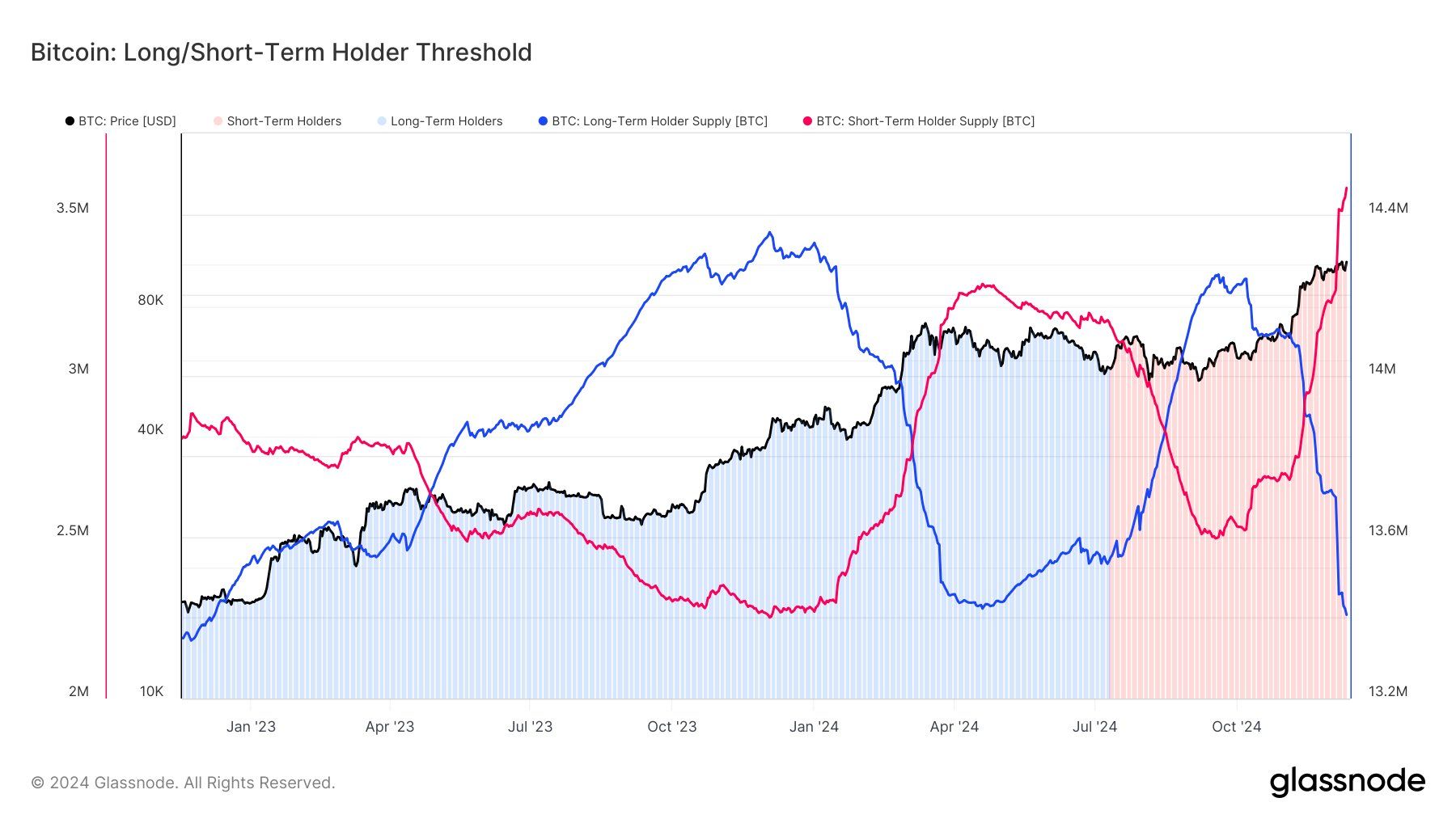

Bitcoin stays inside a key buying and selling vary of $100,000 and strikes above and beneath the important thing psychological space a number of instances. A lot of this has to do with the big promoting strain from long-term holders (LTH), or traders who’ve held bitcoin for greater than 155 days.

Since September, LTHs have bought 843,113 BTC. Over the identical interval, short-term holders (STHs), those that have held bitcoin for lower than 155 days, have accrued 1,081,633 BTC. This quantities to roughly 9,960 BTC bought by LTHs and STHs, which equates to 12,432 BTC per day.

To point out the distinction in buying and selling volumes between long-term and short-term holders, we evaluate them to different main gamers within the sector, akin to self-proclaimed bitcoin growth firm MicroStrategy (MSTR). MicroStrategy owns 423,650 bitcoin or simply over 2% of the full provide. Moreover, US ETFs now maintain greater than 1 million bitcoin.

Since September, MicroStrategy has collected 197,250 BTC, which equates to roughly 2,168 BTC per day. Whereas the US ETFs have accrued roughly 205,000 BTC, which equates to 2,253 BTC per day. The US ETF BTC stability has grown from 916,000 BTC to 1.12 million BTC.

To ensure that Bitcoin to lastly get above $100,000, we might want to see LTHs offload their tokens or bigger cohorts enter the house and choose up the purchases.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now