Bitcoin

Why Bitcoin might see a correction despite the recent surge

Credit : ambcrypto.com

- Bitcoin is up 7.96% previously week.

- Market fundamentals prompt that Bitcoin might expertise a market correction quickly.

As anticipated, Bitcoin [BTC] has had a robust October. Though the month began on a low word, the crypto has made important positive factors that exceed its earlier losses.

Because the low of $58867, BTC has surged to achieve the July degree of $69,000.

On the time of writing, Bitcoin was even buying and selling at $69028. This marked a 7.96% improve over the previous week, with the crypto gaining 9.52% on the month-to-month charts.

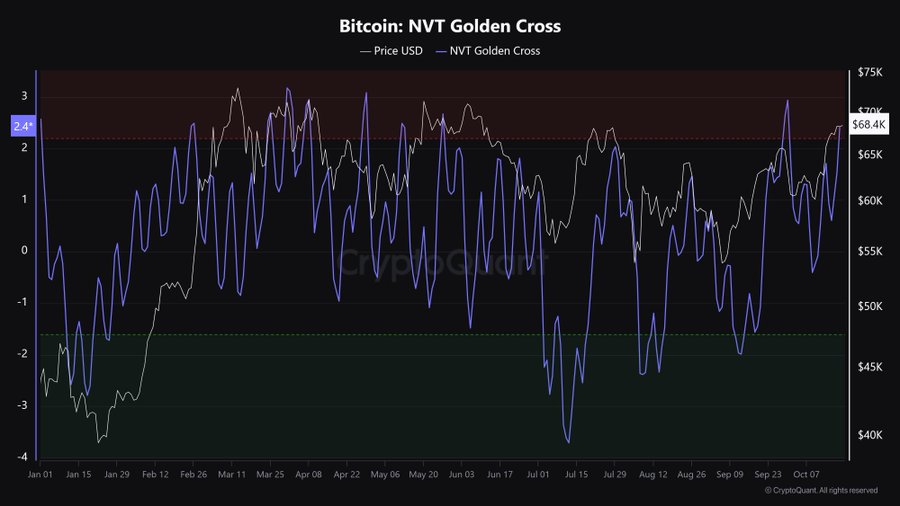

The current upturn has made analysts optimistic and pessimistic in equal measure. For instance, CryptoQuant analyst Burak Kesmeci prompt that Bitcoin might see a market correction, citing the NVT gold cross.

Market sentiment

In his evaluation, Kesmeci said that Bitcoin’s NVT Golden Cross has entered a “sizzling zone” within the brief time period.

Supply:

In keeping with him, the market will finally bear a correction earlier than an uptrend resumes.

For the uninitiated, the NVT Golden Cross hitting the ‘sizzling zone’ means that BTC is at present buying and selling greater than what the community exercise warrants.

So it has turn out to be overvalued relative to the quantity of worth transferred on the blockchain.

This means a possible overbought scenario the place value development isn’t supported by the elemental utilization of the community.

These situations usually precede a value correction, the place the market adjusts and brings the worth again in step with community fundamentals.

Primarily based on this analogy, Bitcoin will expertise a pullback within the brief time period.

What the BTC charts say

As Kesmeci has famous, present fundamentals don’t assist a sustained rally and will fall to satisfy demand.

The query subsequently is: how sustainable is the present rally, and what do market indicators recommend?

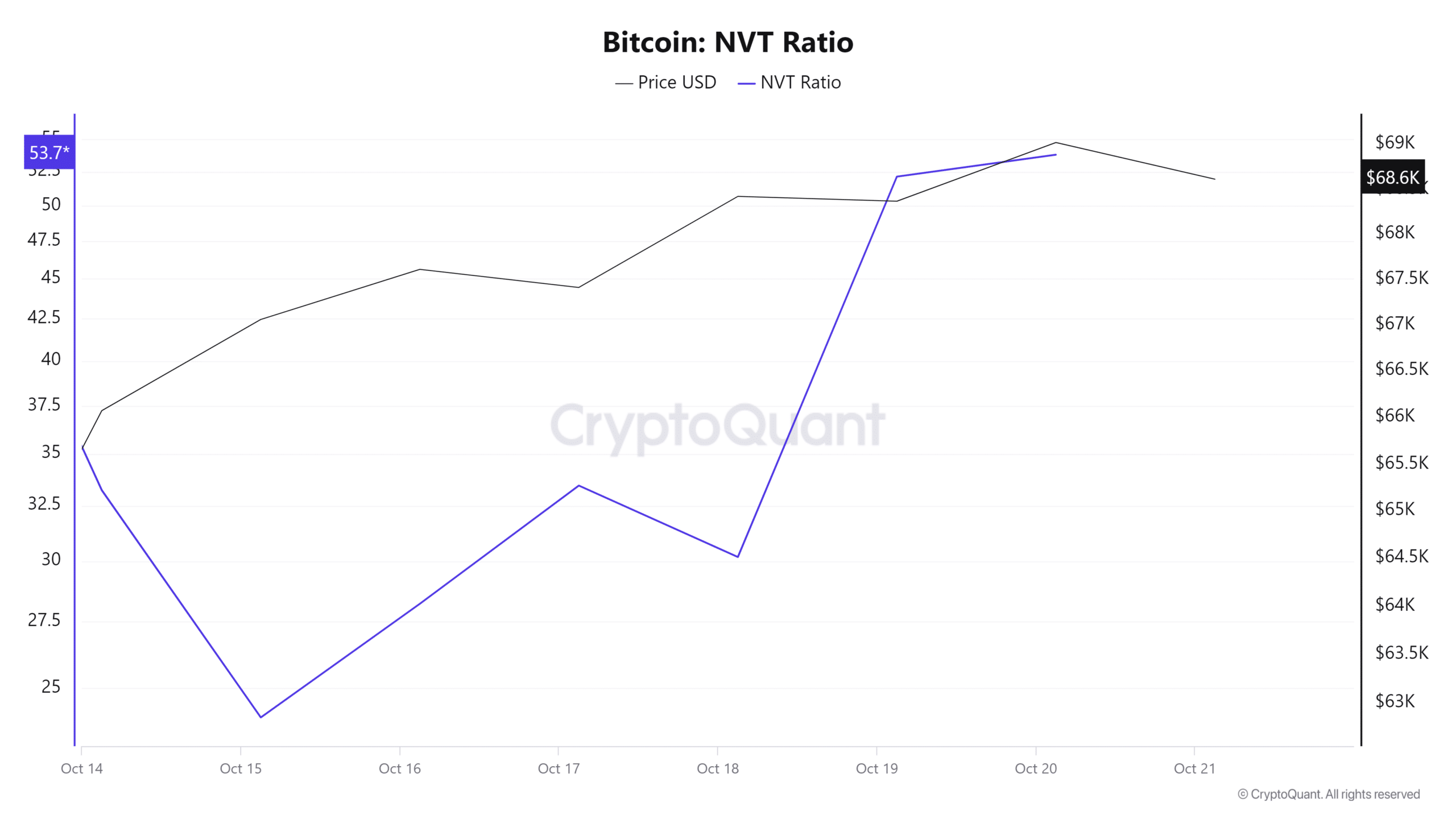

Supply: CryptoQuant

The primary indicator to consider is Bitcoin’s NVT ratio, which measures the community worth in opposition to the transaction.

In keeping with CryptoQuant, the NVT ratio has elevated over the previous week. This improve implies that BTC is overvalued in comparison with precise utility and community exercise, making costs unsustainably excessive.

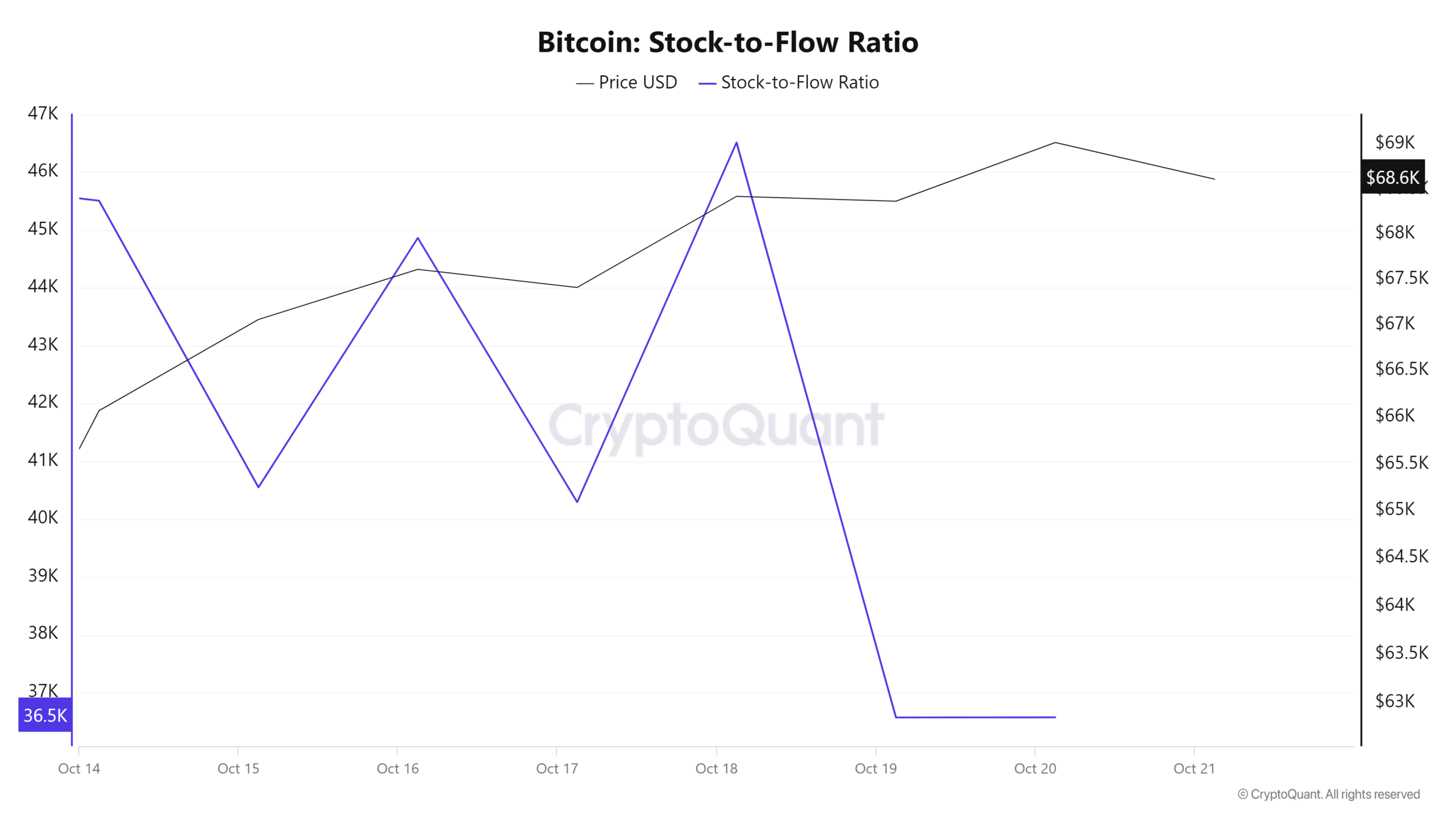

Supply: CryptoQuant

Moreover, Bitcoin’s Inventory-to-Circulate Ratio has fallen over the previous week, indicating a rise in provide. The elevated availability of BTC tends to show the market into bearish, particularly if demand doesn’t develop.

Supply: Santiment

Lastly, Bitcoin’s price-DAA divergence has remained damaging over the previous week. This means that there’s an unsustainable value improve.

When the Value DAA is damaging, it means that the present rally is pushed by hypothesis or short-term demand.

Learn Bitcoin’s [BTC] Value forecast 2024 – 2025

Merely put, although BTC has risen to a current excessive, market fundamentals recommend a correction is imminent. As such, the present rally is especially pushed by hypothesis and never supported by demand.

A correction will see Bitcoin fall in the direction of the assist degree of $65872.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September