Bitcoin

Why Bitcoin miners might drag down BTC’s price to $54K again

Credit : ambcrypto.com

- Miners could have bought BTC resulting from their lowered revenue.

- Nonetheless, long-term traders had confidence in BTC.

Bitcoin [BTC] has managed to extend its value within the final 24 hours however continues to be struggling beneath the $60,000 mark. The latest value surge failed to alter the sentiment of Bitcoin miners as they continued to unload their holdings.

Will the most recent miner sell-off push BTC to $54,000 once more?

Bitcoin miners promote BTC

The bulls took management over the previous 24 hours as they pushed the value of BTC up by over 3%. On the time of writing, BTC was buying and selling at $56,675.42 with a market cap of over $1.11 trillion.

Nonetheless, miners nonetheless selected to promote BTC as the value gained bullish momentum.

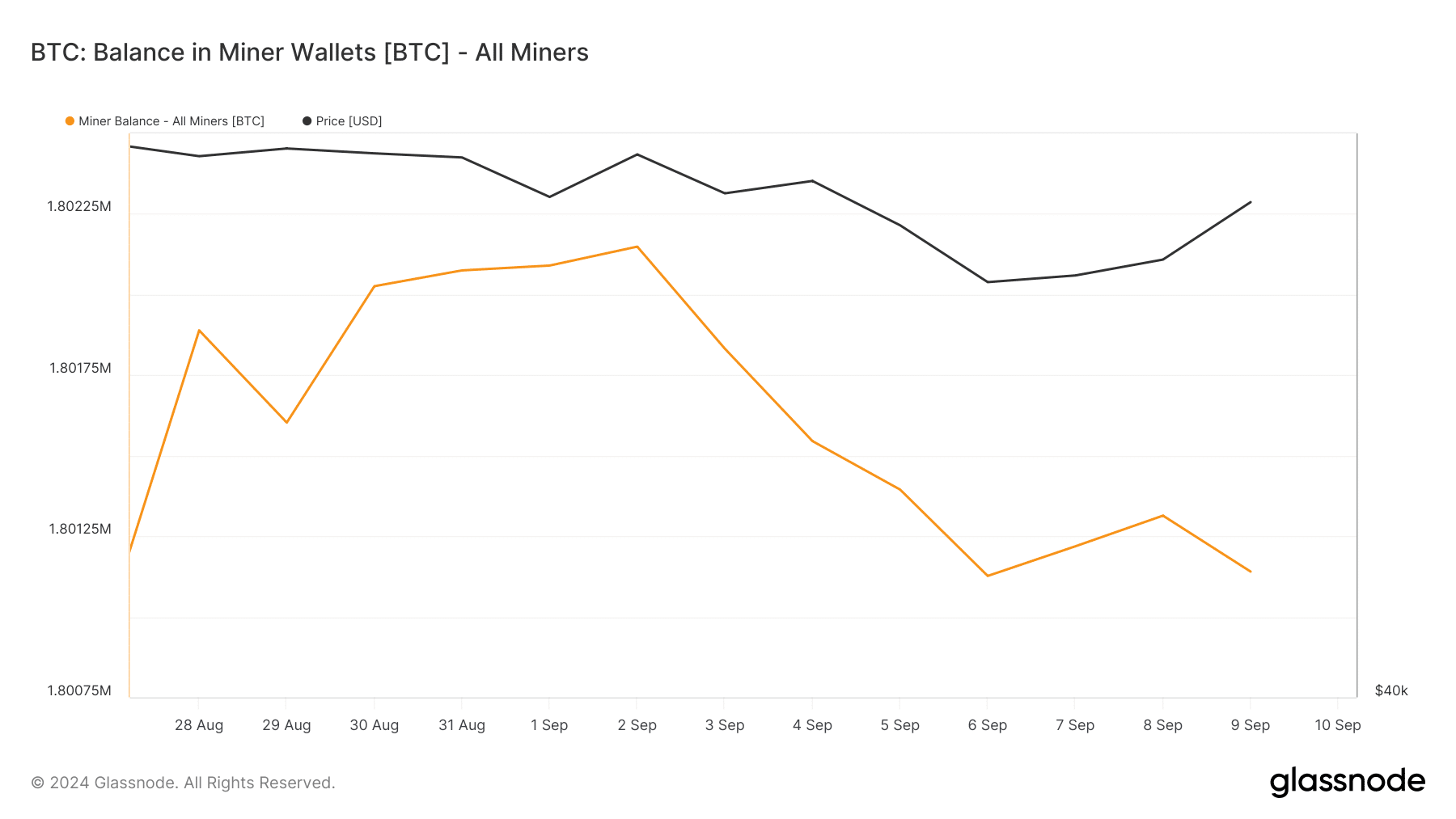

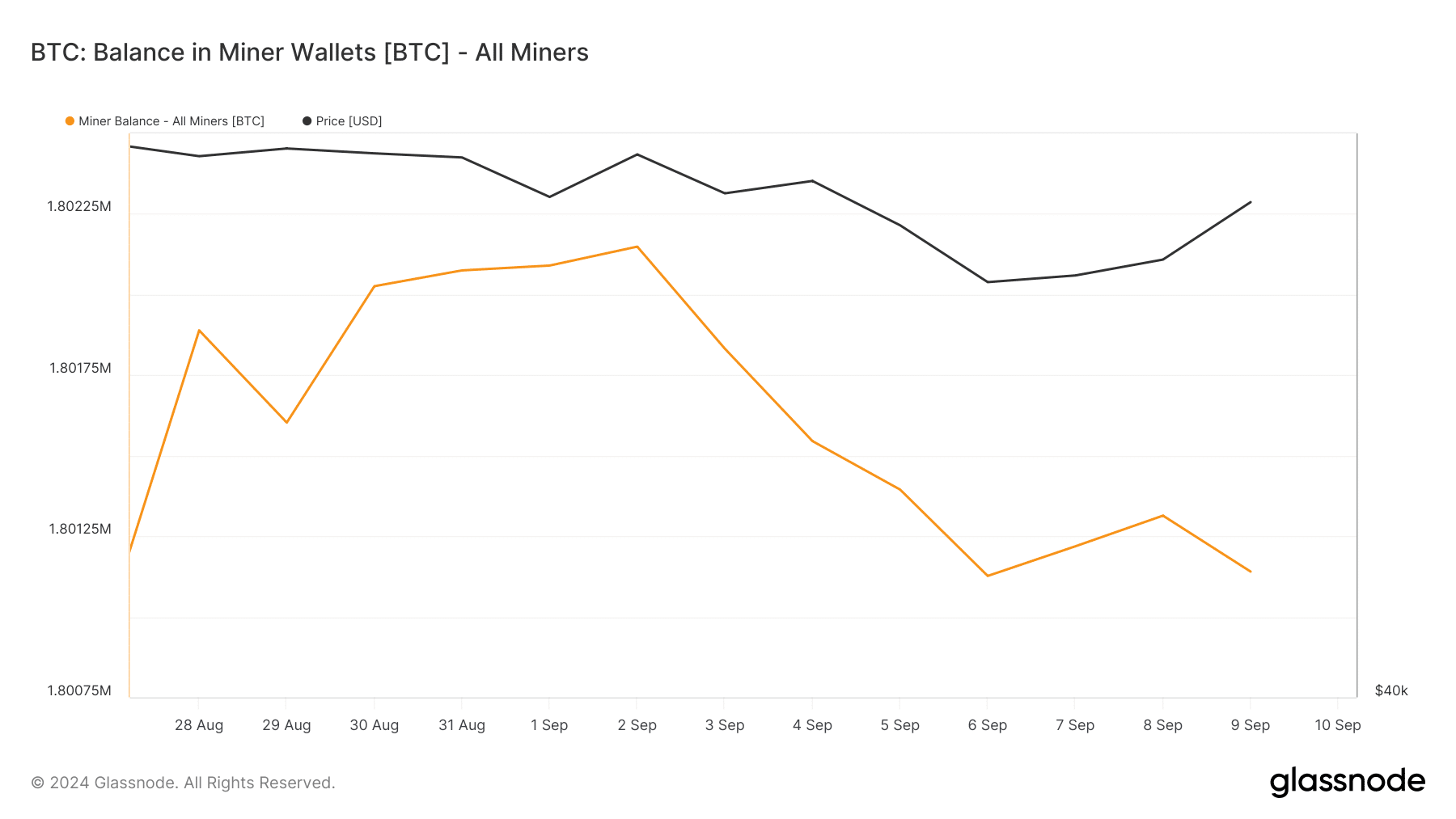

In accordance with AMBCrypto’s take a look at Glassnode’s knowledge, the stability in miner wallets dropped to 1.8 million BTC. This urged that miners didn’t count on the value of the king coin to rise additional.

Supply: Glassnode

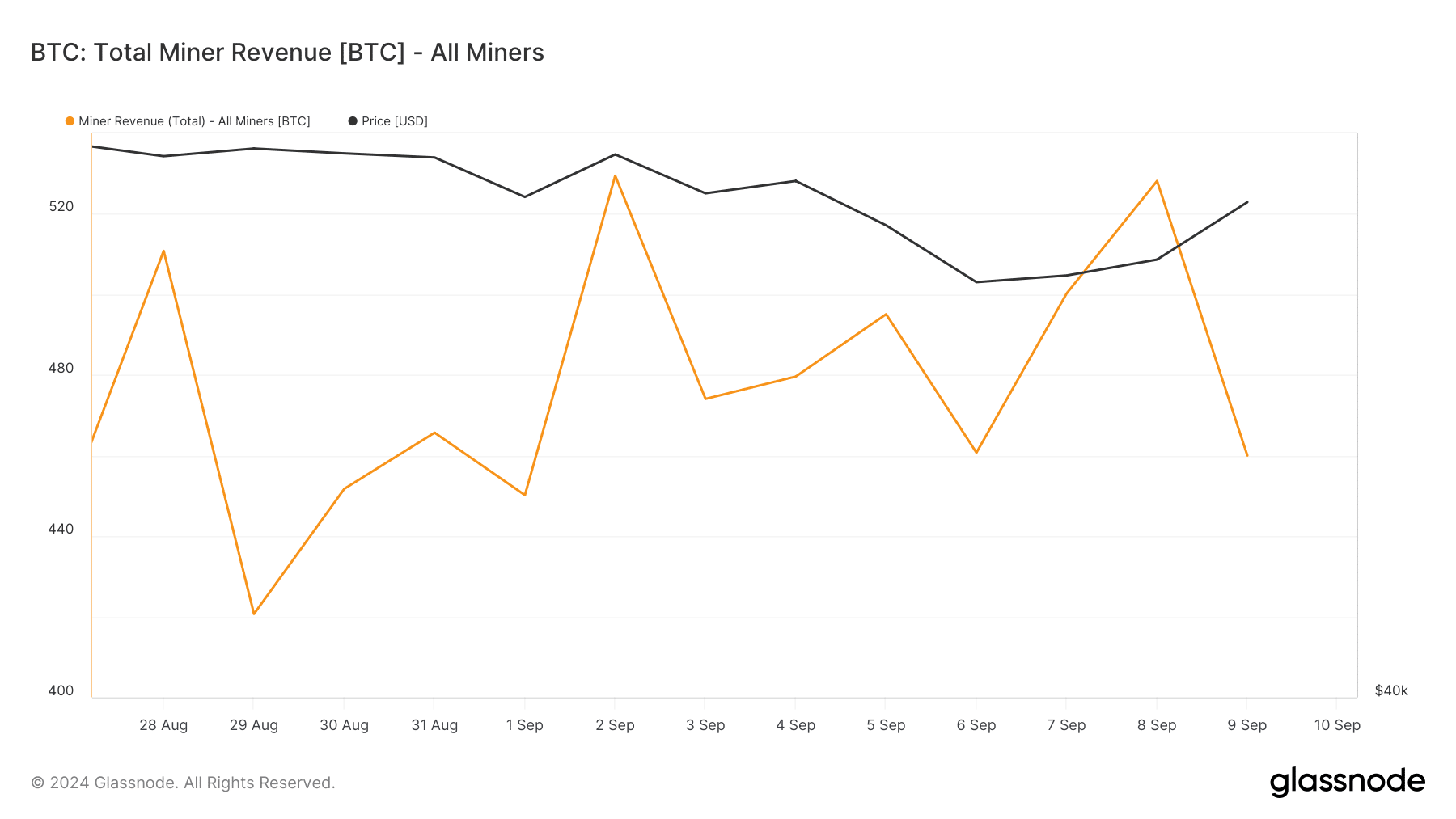

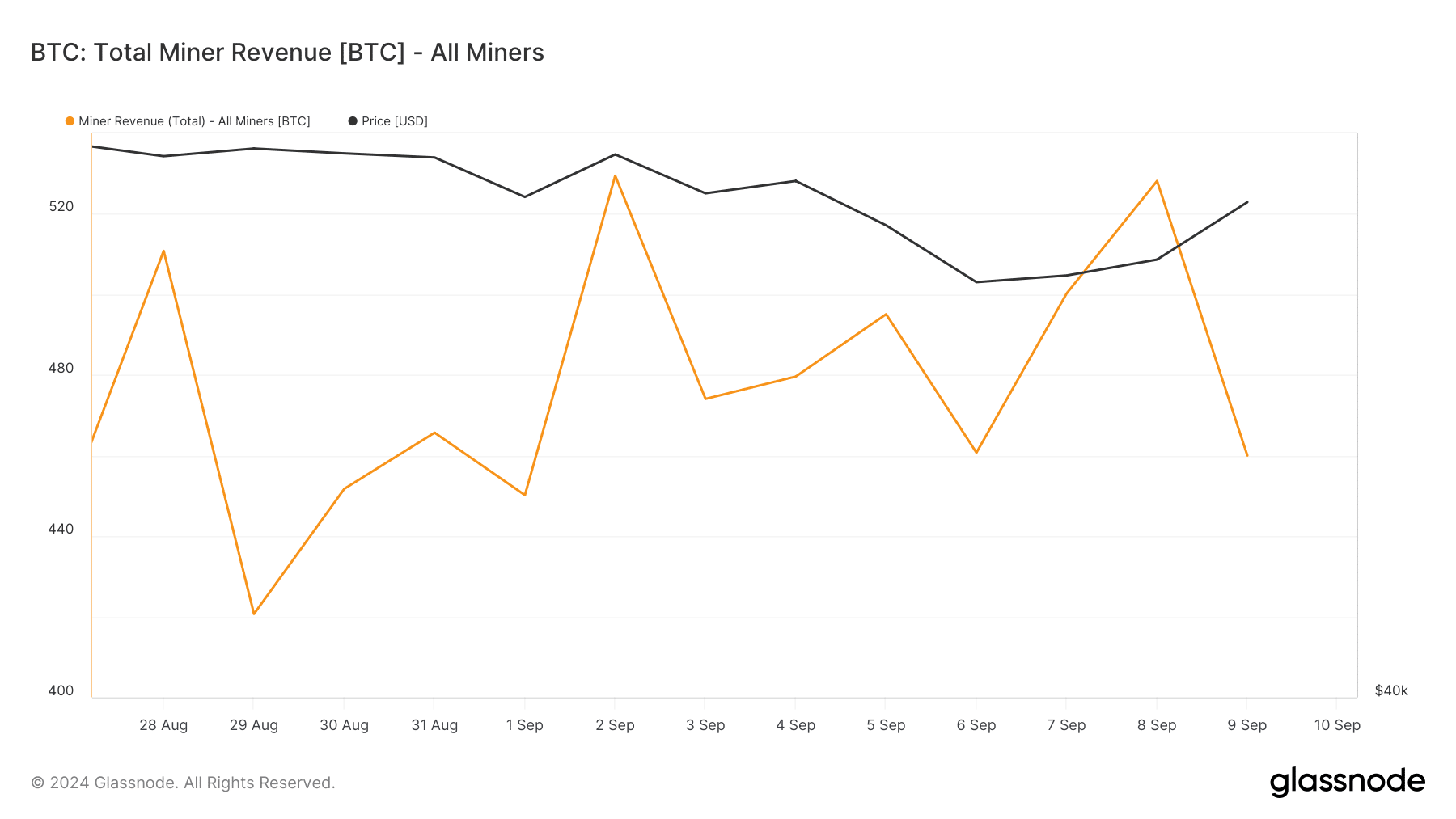

We then checked miners’ earnings to seek out out what motivated them to promote. Curiously, their revenues additionally declined within the latest previous.

Supply: Glassnode

The decline in miners’ balances and revenue additionally affected the blockchain hashrate. In accordance with Coinwarz factsBTC’s hashrate has dropped in latest days. On the time of writing, the quantity stood at 712.57 EH/s.

Will the value of BTC be affected?

There’s a likelihood that this miner habits will impression the value of BTC as promoting stress typically ends in value corrections.

Ali, a preferred crypto analyst, not too long ago posted tweet exhibiting that if BTC falls to $54.2k, it’ll endure a liquidation value $24 million.

Tsubsequently, AMBCrypto checked extra datasets to seek out different purple flags.

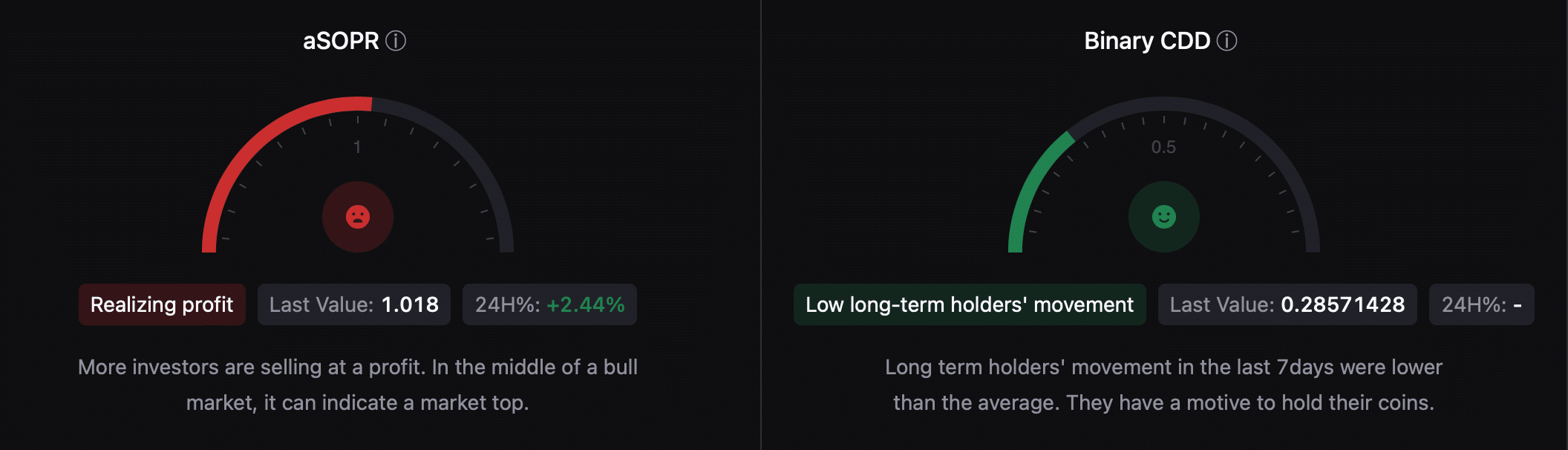

In accordance with our evaluation of CryptoQuant’s factsBTS’s aSORP was purple, which means extra traders bought at a revenue. In the course of a bull market, this might point out a market high.

Learn Bitcoins [BTC] Worth prediction 2024–2025

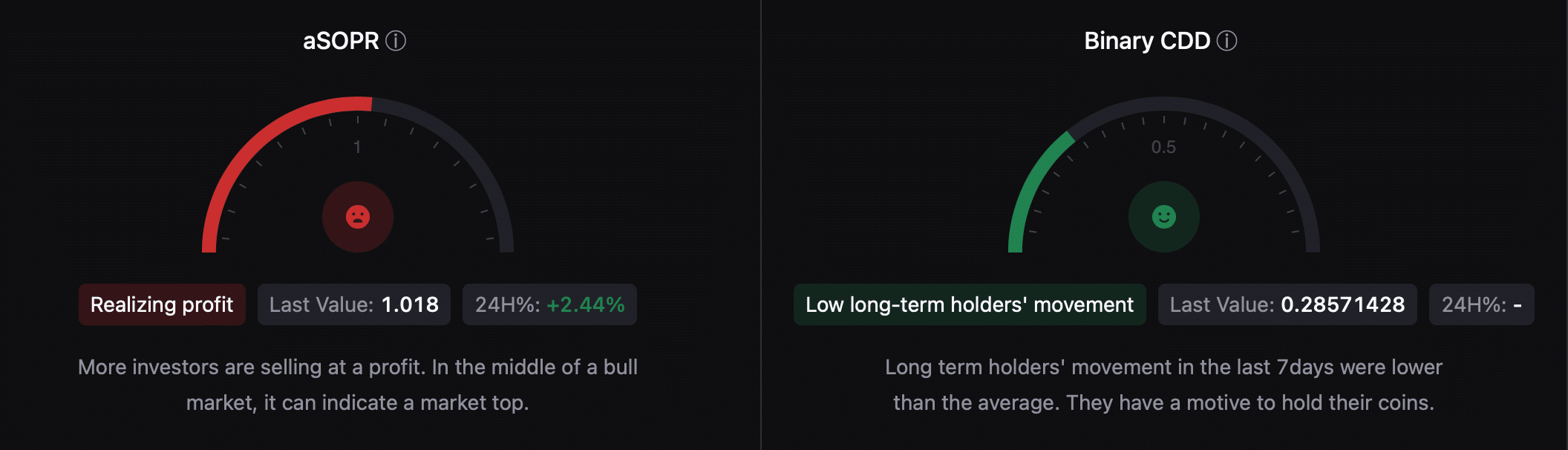

Nonetheless, the remainder of the metrics seemed bullish. For instance, Bitcoin’s Binary CDD confirmed that the motion of long-term holders over the previous seven days was decrease than the common. They’ve a motive to carry on to their cash.

Supply: CryptoQuant

Aside from that, issues within the derivatives market additionally seemed fairly optimistic because the coin taker’s purchase/promote ratio was within the inexperienced. This indicated that purchasing sentiment was dominant amongst futures traders.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now