Bitcoin

Why Bitcoin’s short-term holders may drag price down to $61K

Credit : ambcrypto.com

- Metric revealed that Bitcoin was overvalued.

- A worth correction may deliver BTC again to $61,000.

After reaching nearly $65,000, Bitcoin [BTC] turned bearish once more when the each day chart of the king of cryptos turned crimson. As that occurred, short-term holders continued to promote their holdings. Does this imply a pattern reversal or a continued worth decline? Let’s discover out.

Is Bitcoin Promoting Stress Rising?

The value of the king coin rose by greater than 8% final week. The rebound allowed the bulls to push the coin in direction of $65,000 on August 24.

Nevertheless, issues took a flip for the more severe prior to now 24 hours as the worth of BTC dropped marginally. In accordance with CoinMarketCapOn the time of writing, Bitcoin was buying and selling at $63,816.53 with a market cap of over $1.28 trillion.

Within the meantime, intoTheBlock has posted tweet reveals an attention-grabbing sample. In accordance with the tweet, necessary info will be obtained by monitoring the balances of short-term merchants.

Traditionally, peaks within the metric have usually coincided with market tops and bottoms, offering helpful clues for timing the market.

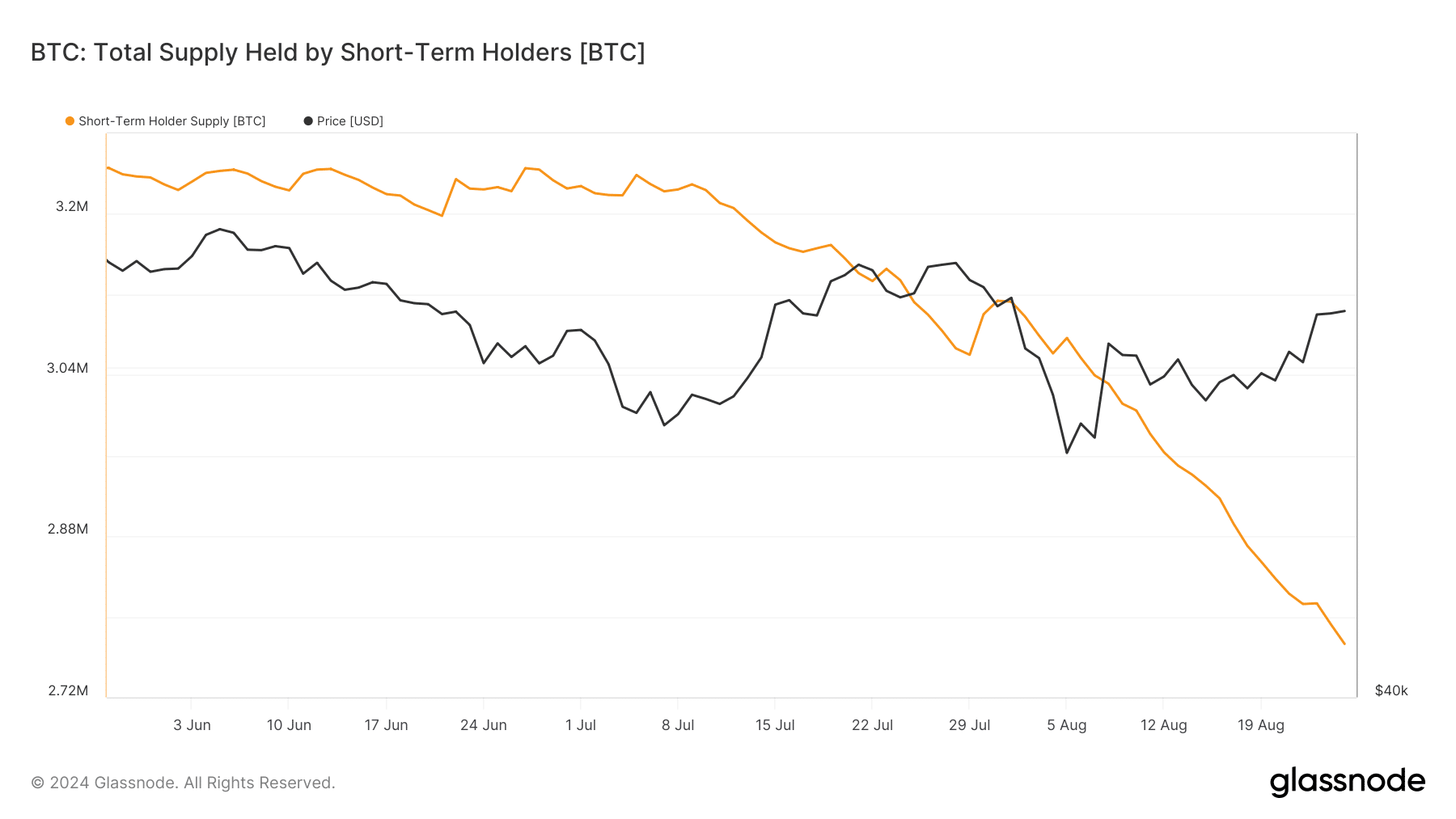

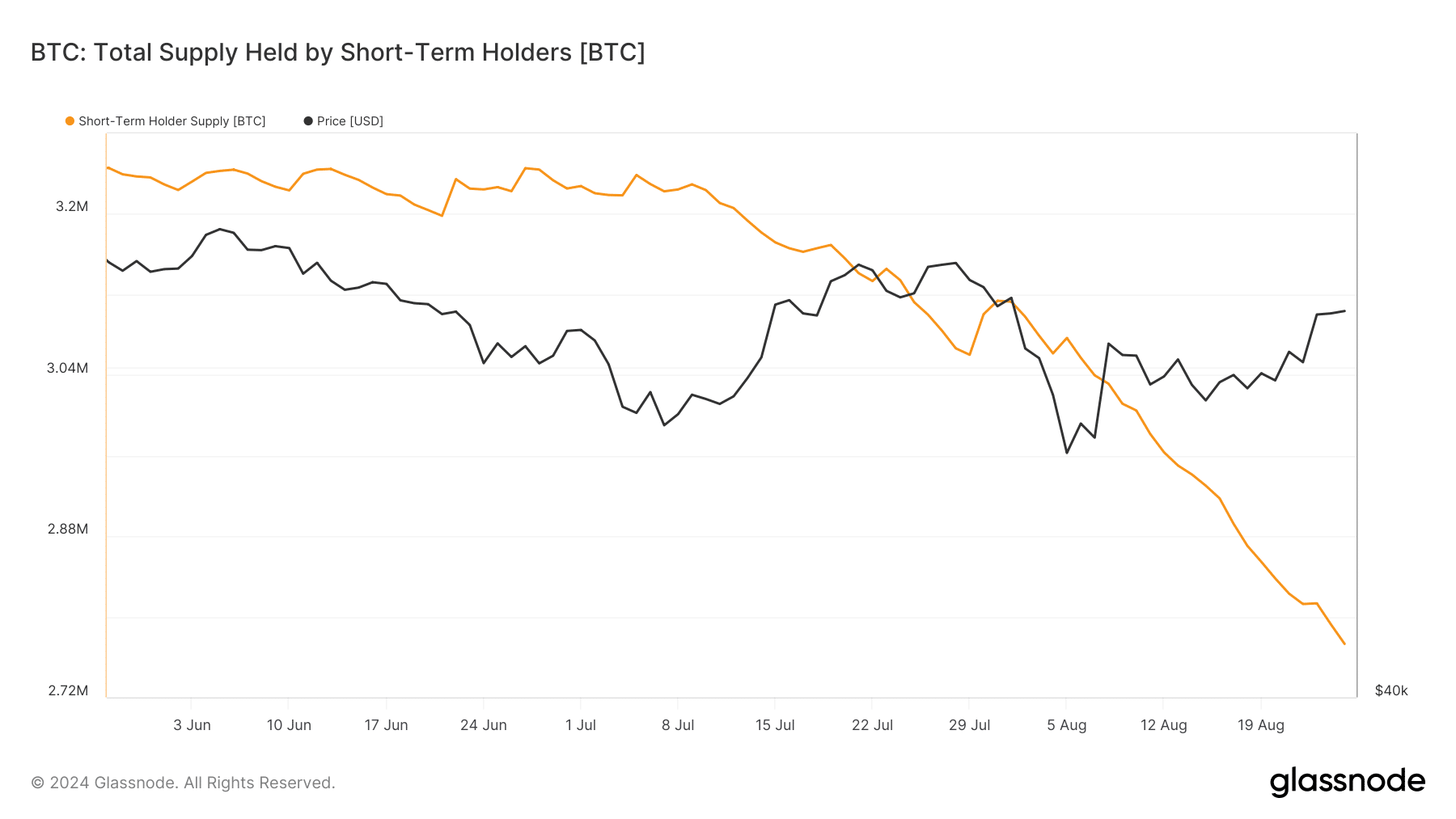

AMBCrypto then checked Glassnode’s knowledge to learn how STHs behaved. In accordance with our evaluation, STHs had been promoting. This was evident within the huge drop within the complete provide of short-term holders over the previous three months.

Supply: Glassnode

The trail that BTC has forward of it

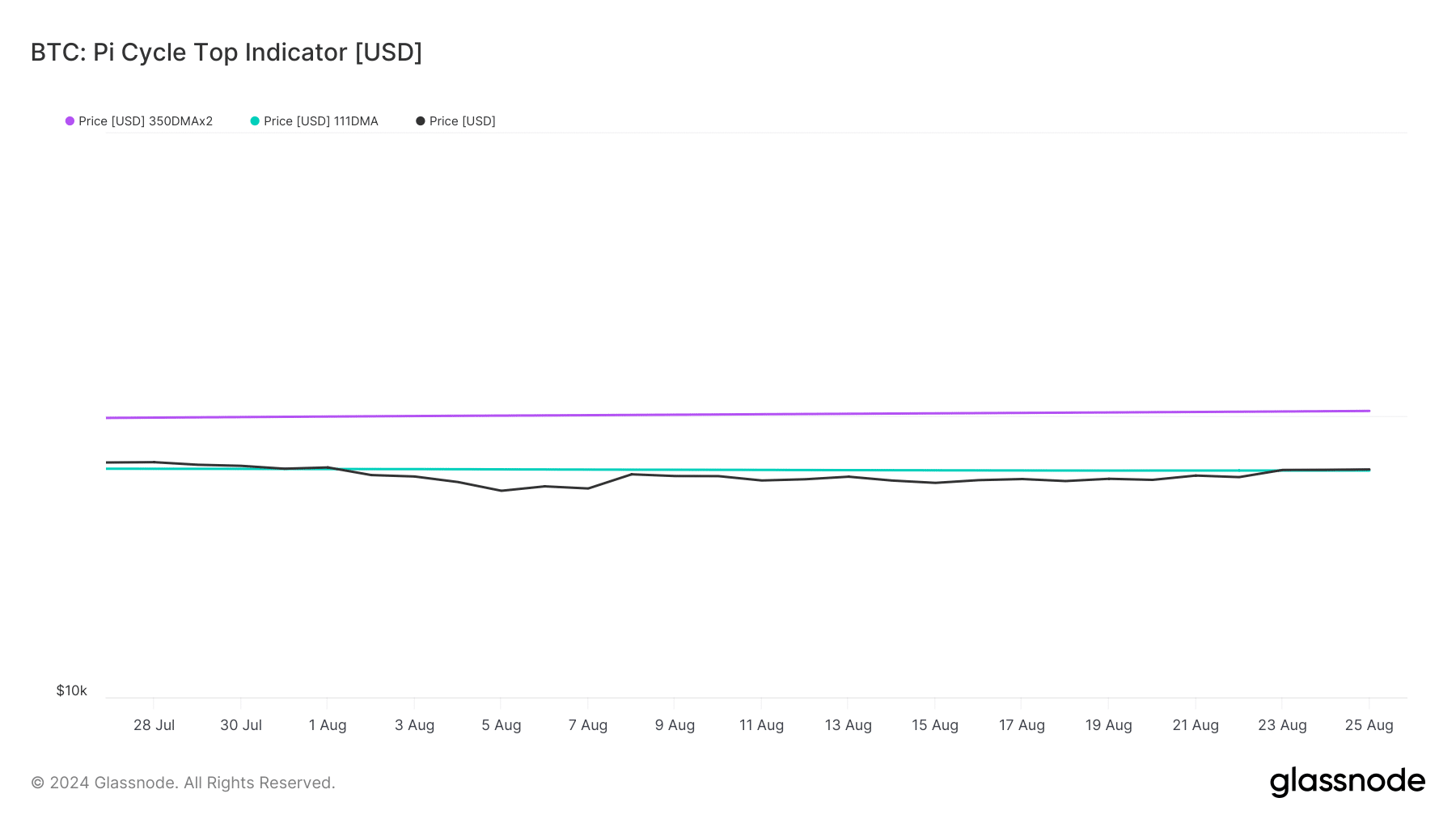

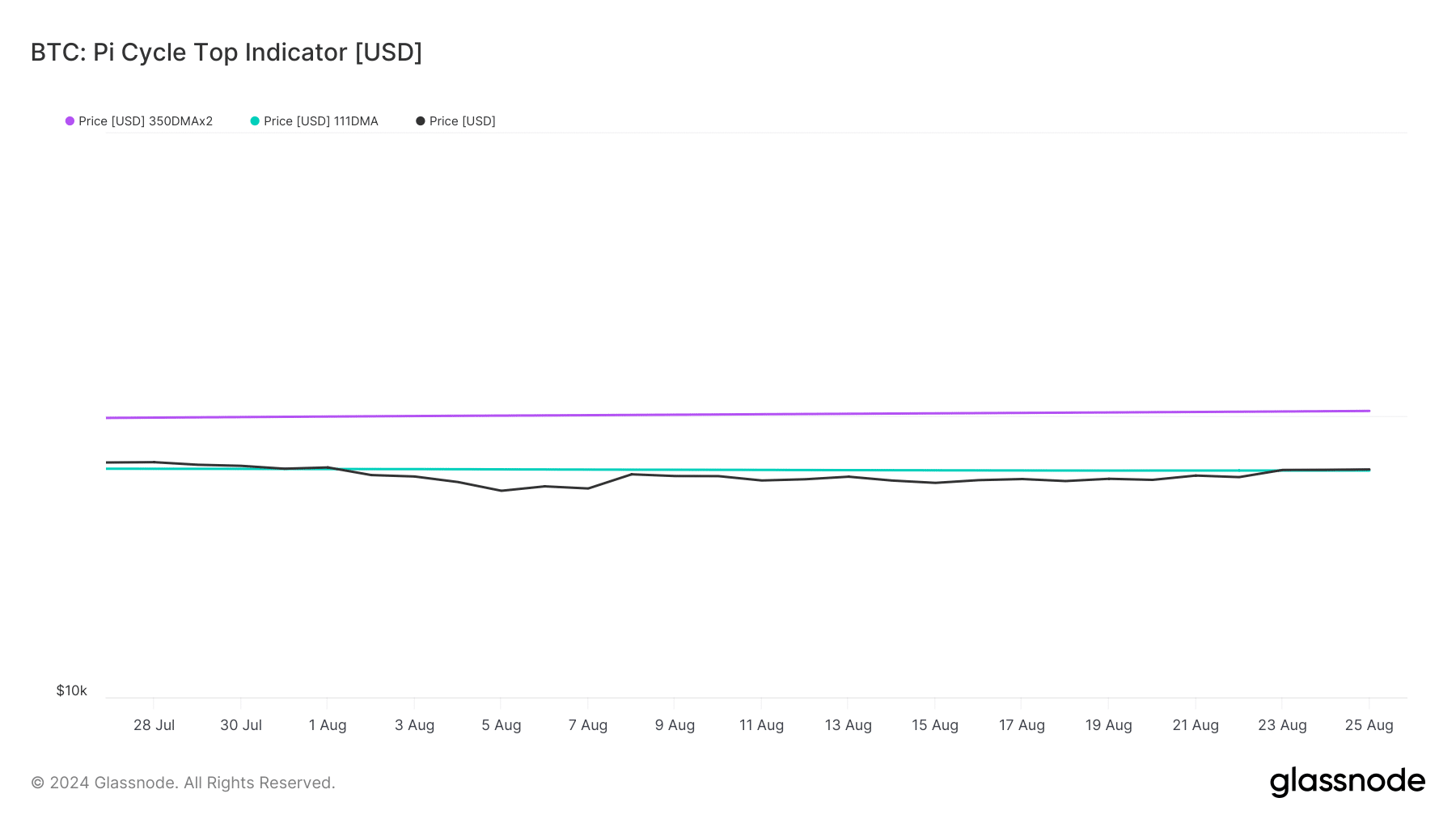

To seek out out if BTC was on the backside of the market, AMBCrypto checked out BTC’s Pi Cycle Prime indicator. In accordance with our evaluation, BTC was proper on the market backside of $63.7k.

If the indicator is to be believed, BTC may quickly begin its bull rally and attain its potential market prime of $102,000 within the coming weeks or months.

Supply: Glassnode

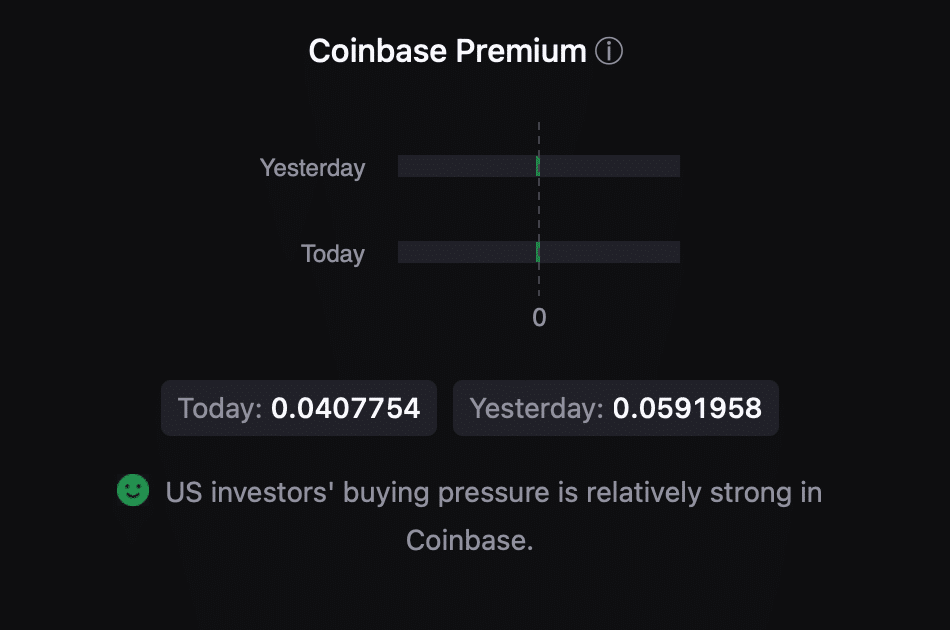

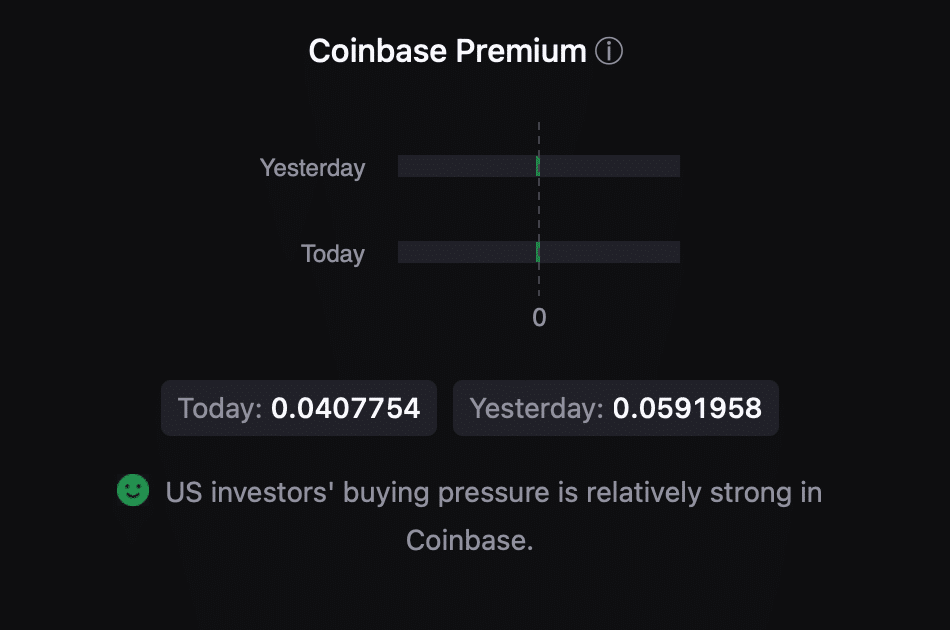

We then checked different metrics to learn how probably Bitcoin is to begin a brand new bull rally. Our evaluation of CryptoQuant’s facts revealed that BTC’s Coinbase bounty was inexperienced.

This meant that purchasing sentiment amongst US buyers was sturdy.

Supply: CryptoQuant

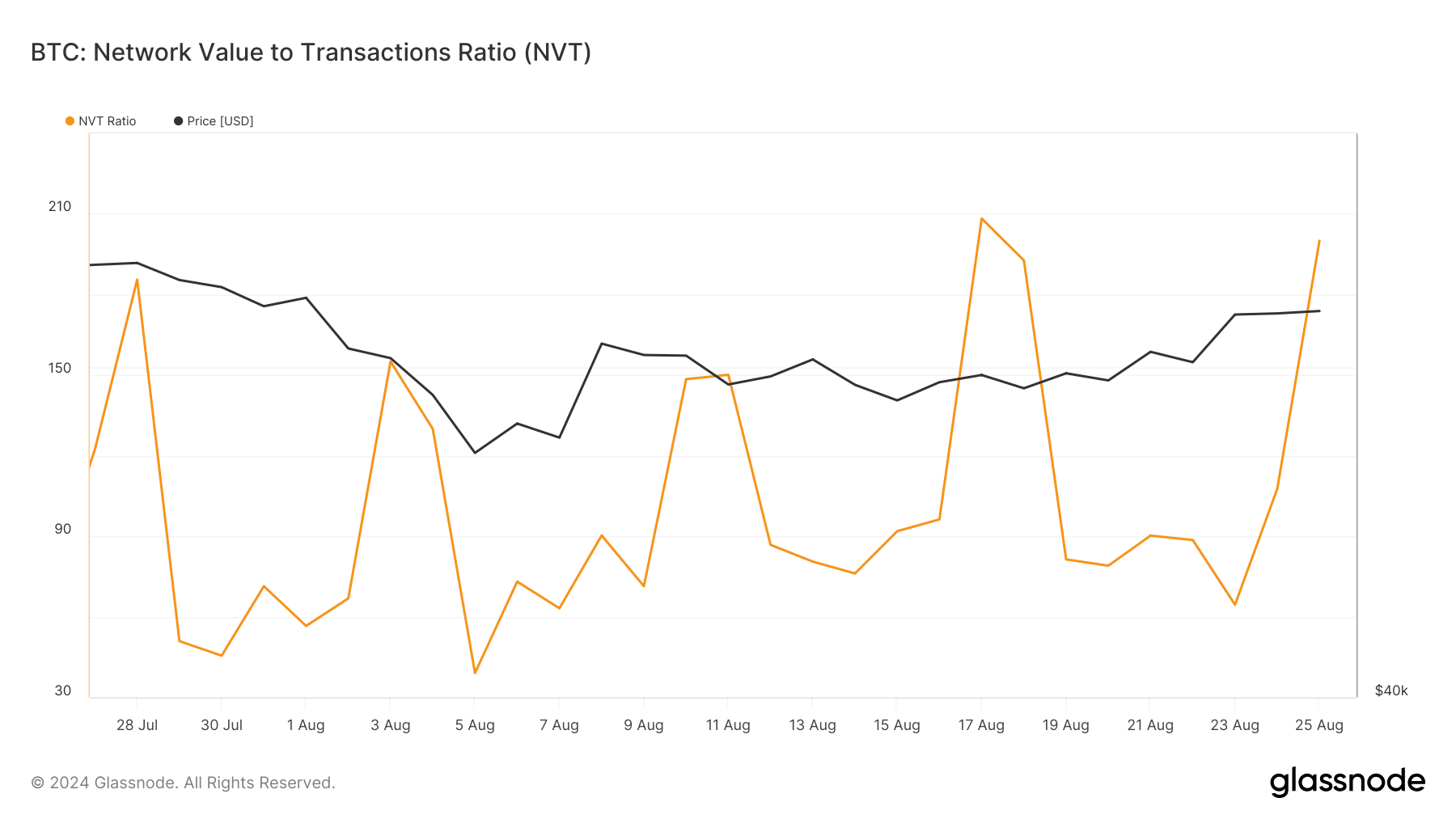

Web deposits of BTC on the exchanges had been additionally low in comparison with the common of the previous seven days, indicating a rise in shopping for strain. Nevertheless, the king of cryptos’ NVT ratio recorded a pointy enhance.

Usually, an increase within the benchmark means an asset is overvalued, indicating a worth correction.

Supply: Glassnode

Learn Bitcoins [BTC] Value prediction 2024-25

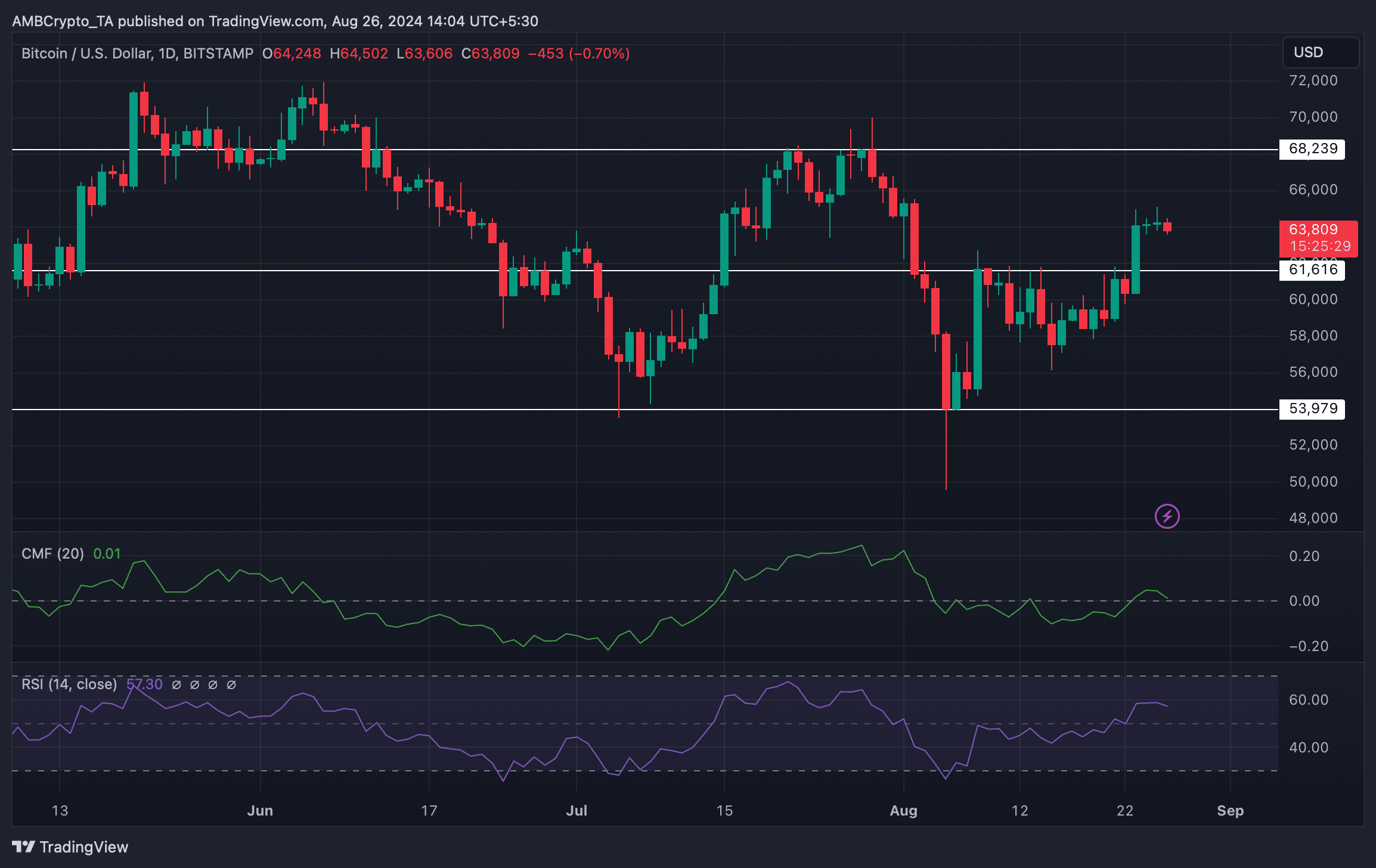

Identical to the above stats, the market indicators additionally appeared fairly bearish for BTC. For instance, the Chaikin Cash Move (CMF) recorded a decline. The Relative Energy Index (RSI) additionally adopted an identical path.

These indicated that buyers would possibly witness a short-term decline within the worth of BTC earlier than it regains bullish momentum.

Supply: TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now