Ethereum

Why crypto market is down today: U.S. jobs data and forced liquidations cause…

Credit : ambcrypto.com

- Crypto markets face elevated volatility as $443 million in lengthy positions are liquidated following strong US jobs knowledge.

- A robust labor market alerts fewer rate of interest cuts, placing stress on Bitcoin, Ethereum and danger property.

The crypto market is in a hunch on January 9 as a mixture of stronger-than-expected US financial knowledge and vital liquidation occasions weigh closely on investor sentiment.

The recession has hit main cryptocurrencies like Bitcoin[BTC] and Ethereum[ETH]This raised considerations in regards to the market’s skill to keep up current momentum.

Stronger than anticipated US job figures are sending shock waves

On January 8, the US Bureau of Labor Statistics has printed the newest Job Openings and Labor Turnover Survey (JOLTS), which revealed 8.096 million vacancies for November 2024. This determine simply exceeded the consensus estimate of seven.605 million, indicating strong demand within the labor market.

Stronger job postings point out the U.S. financial system stays resilient regardless of considerations about slowing progress. Whereas that is excellent news for the broader financial system, it has vital implications for financial coverage.

A robust labor market reduces the chance of aggressive rate of interest cuts by the Federal Reserve, a state of affairs that usually favors dangerous property like cryptocurrencies.

The anticipation of upper rates of interest for an prolonged time period has prompted many traders to maneuver away from speculative property, which has contributed to the present downturn within the crypto market.

Liquidations reinforce the decline

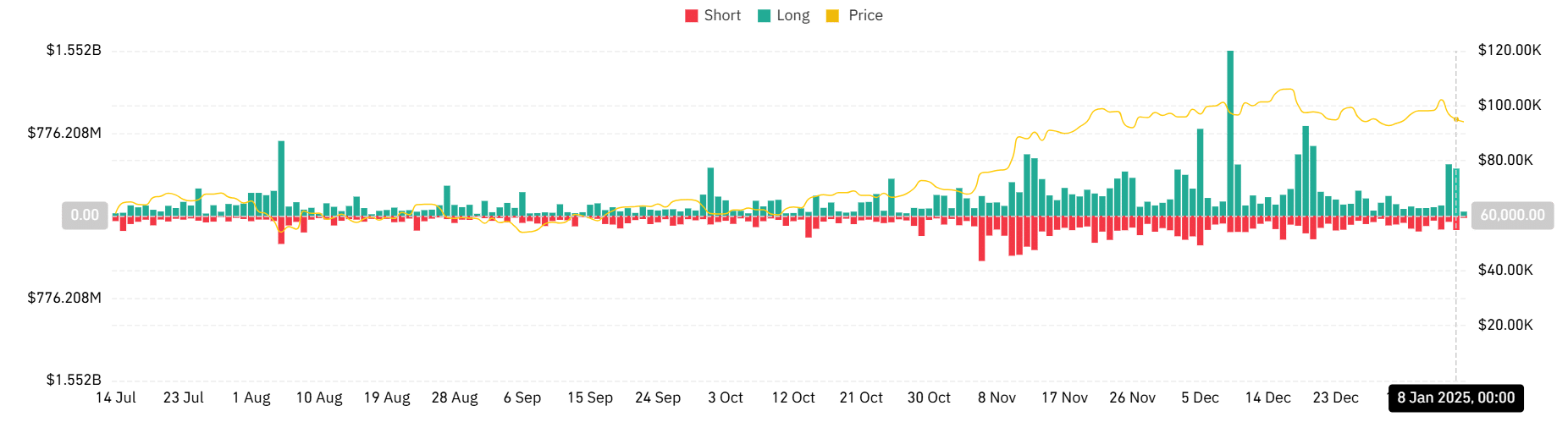

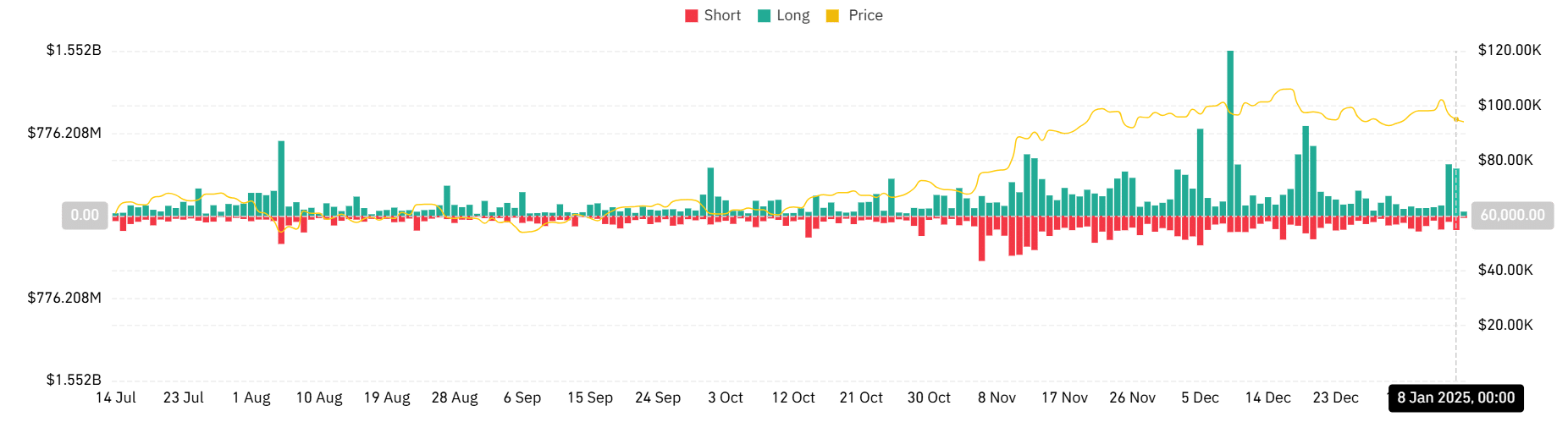

Including to the stress, the crypto market skilled its largest liquidation occasion of the yr.

In accordance with the info, lengthy liquidations within the final 24 hours totaled $443.023 million, whereas quick liquidations totaled $135.539 million.

AMBCrypto’s evaluation of the liquidation chart highlights the spikes, the place lengthy positions dominated losses as costs fell sharply. Liquidations of this magnitude point out extreme leverage amongst merchants, exacerbating market volatility throughout worth declines.

These pressured liquidations have additional fueled downward stress on Bitcoin, Ethereum, and different main cryptos.

Supply: Coinglass

The evaluation discovered that Bitcoin had the biggest liquidation, with a recorded worth of over $143 million. Ethereum had the second largest liquidation, with a recorded worth of over $97 million.

Why the crypto market is dangerous in the present day: the broader context

The sell-off comes amid broader financial and geopolitical considerations. A current decline in know-how shares and continued uncertainties in world markets have created a difficult surroundings for cryptos.

Whereas central banks keep an aggressive stance and traders wrestle with lowered liquidity, the crypto market stays notably susceptible to macroeconomic shocks.

Stablecoins have proven relative resilience throughout this era, as evidenced by a slight improve in market share, reflecting a cautious investor pivot in the direction of safer crypto property.

Nonetheless, the riskier altcoins have borne the brunt of the recession, with vital losses throughout the board.

What’s the future for crypto markets?

The present decline within the crypto market underlines the sector’s sensitivity to macroeconomic developments.

As traders digest the newest jobs knowledge and its implications for Federal Reserve coverage, consideration will now shift to imminent financial occasions, together with December’s ADP employment report and Friday’s official jobs numbers.

Market contributors ought to put together for continued volatility because the interaction between macroeconomic knowledge and cryptocurrency dynamics stays dominant.

For now, cautious buying and selling and shut monitoring of worldwide financial circumstances will doubtless decide the market’s subsequent strikes.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International