Ethereum

Why ETH Is Underperforming Amid Market Turmoil

Credit : coinpedia.org

Worldwide markets are in chaos after the brand new ‘Liberation Day’ charges of President Trump and a sudden liquidity crunch. This has activated top-of-the-line crypto market corrections since 2020. Though Bitcoin holds comparatively nicely, Ethereum is confronted with a lot heavier losses – which asks an necessary query: Why does ETH fall greater than BTC? Let us take a look at it nearer.

Markets worldwide are underneath strain

Giant markets all over the world have come underneath severe strain up to now week. The US inventory market has fallen by 0.68%, Europe has fallen by 4.65%, China is falling by 3.28%, India 3.53percentand Australia 1.21%.

The sale has additionally affected different necessary belongings, particularly these intently linked to the American economic system. Since 1 April, costs for crude oil with crude oil have fallen by nearly 13.79%. Even gold – often seen as a secure haven – has fallen greater than 4.74% between 3 and seven April.

The scenario within the cryptocurrency market isn’t any completely different. Within the final seven days, the highest two cryptos, Bitcoin and Ethereum, by no less than 1.1% and 11%, have been slipped.

It appears that evidently the financial chaos has induced extra accidents to Ethereum in comparison with Bitcoin.

Ethereum sees bigger capital outflows

A brand new analysis report offers us some solutions. On the peak, Ethereum noticed capital influx of +$ 15.5 billion monthly. Now it’s confronted with outskirts of $ 6 billion a month.

The inflow of Bitcoin can be delayed – however they’re nonetheless constructive at +$ 6 billion a month. This reveals that investor confidence in Bitcoin stays stronger than in Ethereum.

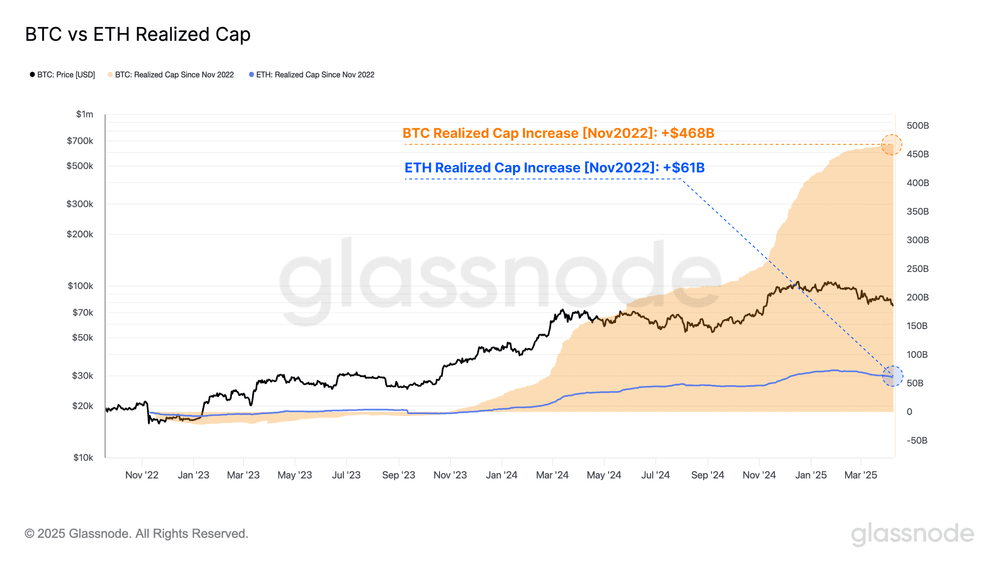

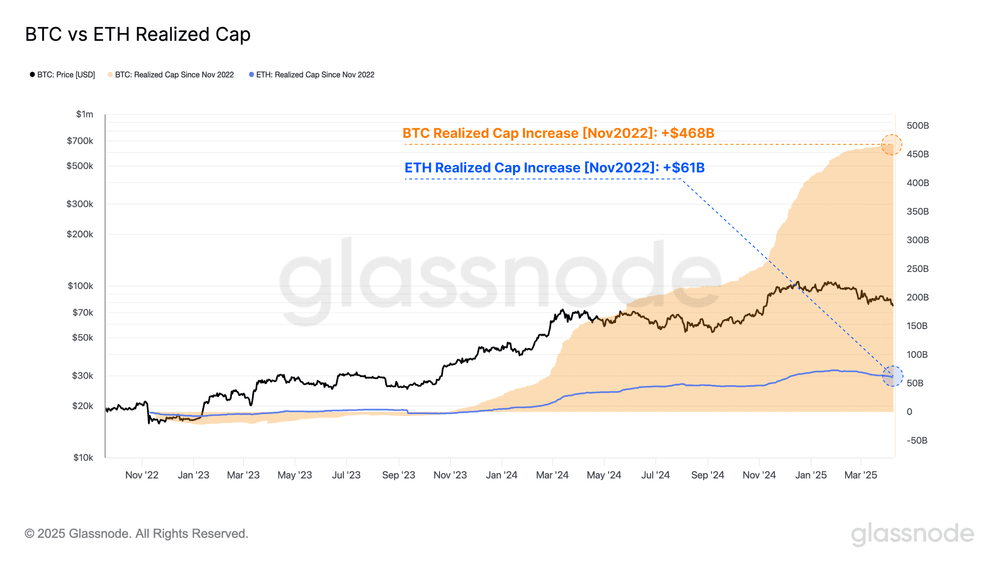

The realized cap -graph that compares BTC and ETH additionally tells an necessary story. Because the finish of 2022, Ethereum’s CAP has solely grown by solely 32% – from $ 183 billion to $ 244 billion. For comparability: Bitcoin’s realized cap has risen 117%, from $ 402 billion to $ 870 billion.

Which means that Bitcoin has attracted rather more investor demand on this cycle than Ethereum.

MVRV -Ratio reveals that ETH holders are in losses

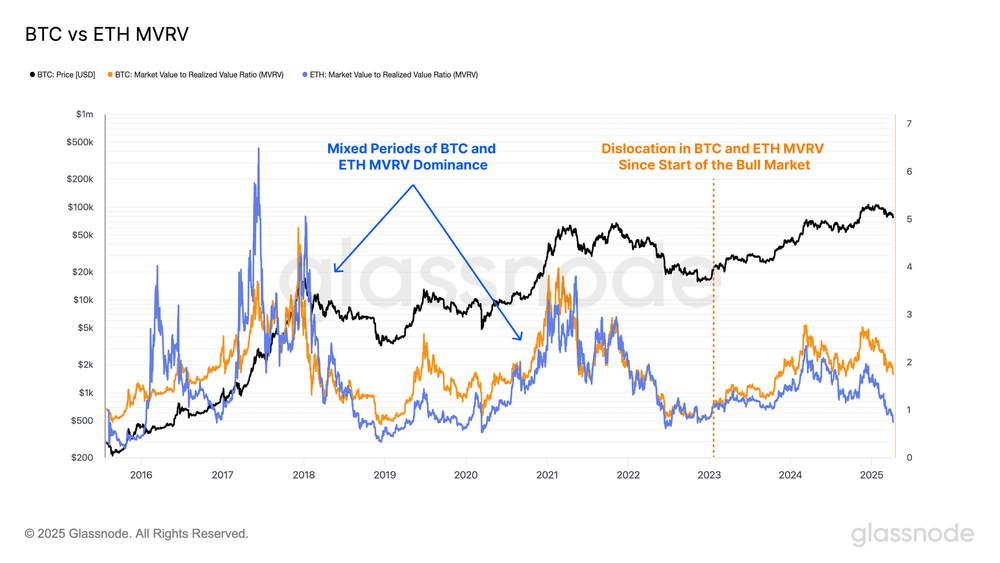

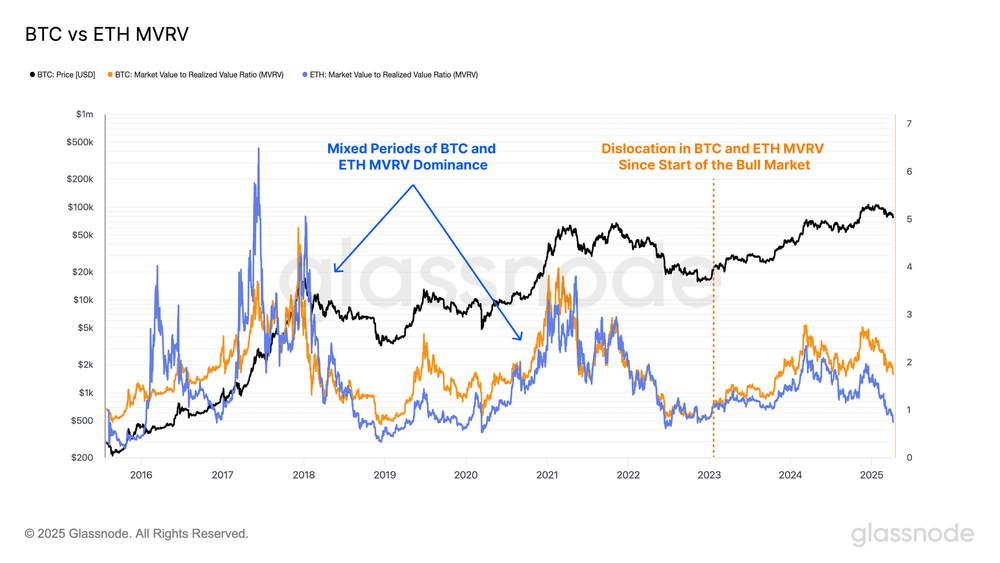

The MVRV ratio (market worth and realized worth) reveals another excuse for the UnderPerformance of ETH. The ETH ratio has fallen underneath 1.0, which implies that the common holder is now a loss. The MVRV ratio of Bitcoin, however, continues to be above 1.0 -so most BTC holders are nonetheless in profitable.

When buyers are in loss, they promote earlier – Add to the gross sales strain on ETH.

BTC has surpassed greater than 800 days than ETH

The report factors out that Bitcoin holders have already had larger revenue for 812 consecutive days than ETH holders. This lengthy interval of underperformance has additionally weakened the sentiment round Ethereum

- Additionally learn:

- Trump’s tariff break sparks crypto rally: XRP, ETH Lead Winins

- “

ETH/BTC pair reveals that Ethereum loses the bottom

Since September 2022, the ETH/BTC pair has fallen by no less than 75%. Originally of April it was 0.02207. Since then it has fallen one other 11.46%.

This reveals how a lot Ethereum on this cycle is again -controlled in comparison with Bitcoin.

What’s the subsequent step: can ETH restore his momentum?

Throughout the latest sale, Ethereum buyers have locked up $ 564 million in realized loss-more than double the $ 240 million in losses for Bitcoin holders. This emphasizes how rather more ache ETH buyers really feel.

In earlier bull markets, Ethereum would usually carry out higher than Bitcoin on sure factors. However that didn’t occur on this cycle – and it hurts the arrogance of buyers.

With the outflow of capital, weakening sentiment and necessary statistics that show deeper losses, the underperformance of Ethereum can proceed, except a robust bullish shift takes place. For now, the market appears to present choice to Bitcoin because the safer gamble.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, professional evaluation and actual -time updates on the newest developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

Whereas Ethereum is acquainted due to its robust primary ideas, Bitcoin continues to dominate together with his widespread adoptions.

In accordance with our Ethereum -price forecast 2025, the ETH value might attain a most of $ 5,925.

In accordance with our newest ETH value evaluation, Ethereum might attain a most value of $ 123,678.

By 2050, a single Ethereum value might go as excessive as $ 255.282.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024