Ethereum

Why Ethereum ETF faced outflows despite ETH’s gains

Credit : ambcrypto.com

- Ethereum ETF noticed outflows of over $20 million.

- ETH has misplaced most of its beneficial properties from the earlier buying and selling session.

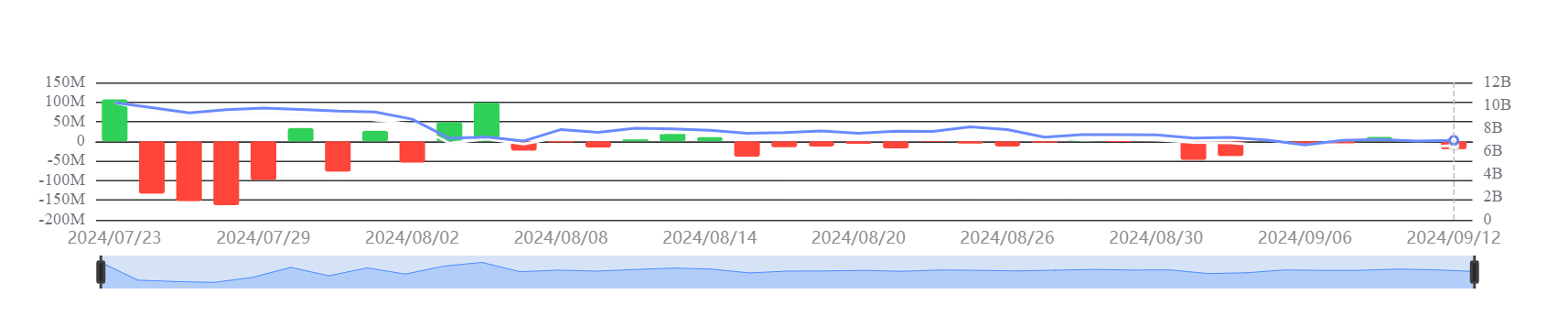

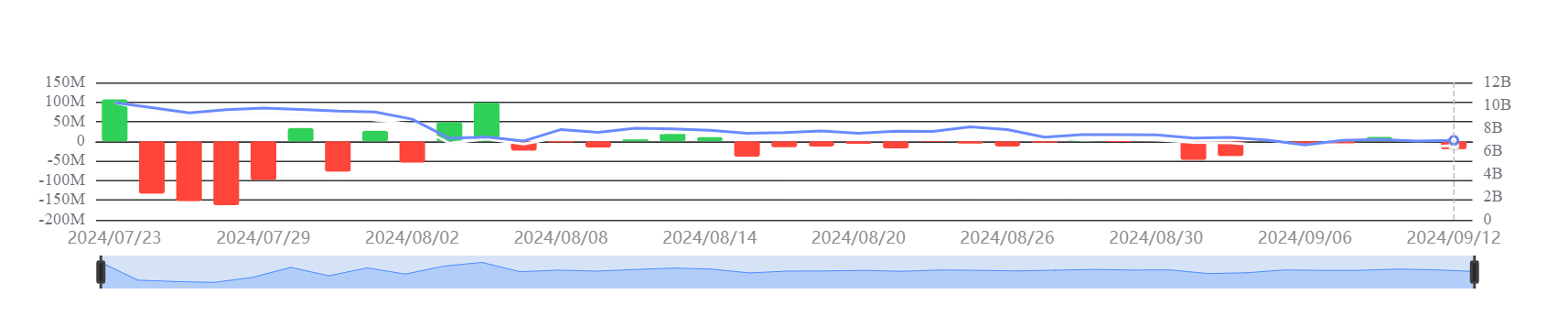

Current information exhibits that the Ethereum ETF skilled detrimental flows over the last buying and selling session, marking the second consecutive day of outflows.

This occurred regardless of Ethereum’s [ETH] worth exhibits a constructive shut and ends the buying and selling session with a revenue.

Ethereum ETF has seen consecutive outflows

Based on information from Soso valueEthereum ETF had one other day of outflows on September 12. This marked a continued pattern, regardless of ETH closing on a constructive notice through the earlier buying and selling session.

Moreover, the evaluation discovered that different US-based ETFs recorded zero internet flows, apart from Grayscale, which noticed outflows of $20.14 million. On the time of writing, the full internet asset worth is roughly $6.45 billion.

Supply: SosoValue

ETF outflows might point out that traders are taking earnings or reallocating cash, at the same time as Ethereum’s worth moved positively.

This sample instructed that whereas there could also be some near-term repositioning amongst institutional traders, personal and direct market demand for Ethereum may nonetheless be robust, permitting for worth stability or development regardless of ETF outflows.

ETH is caught between revenue and loss

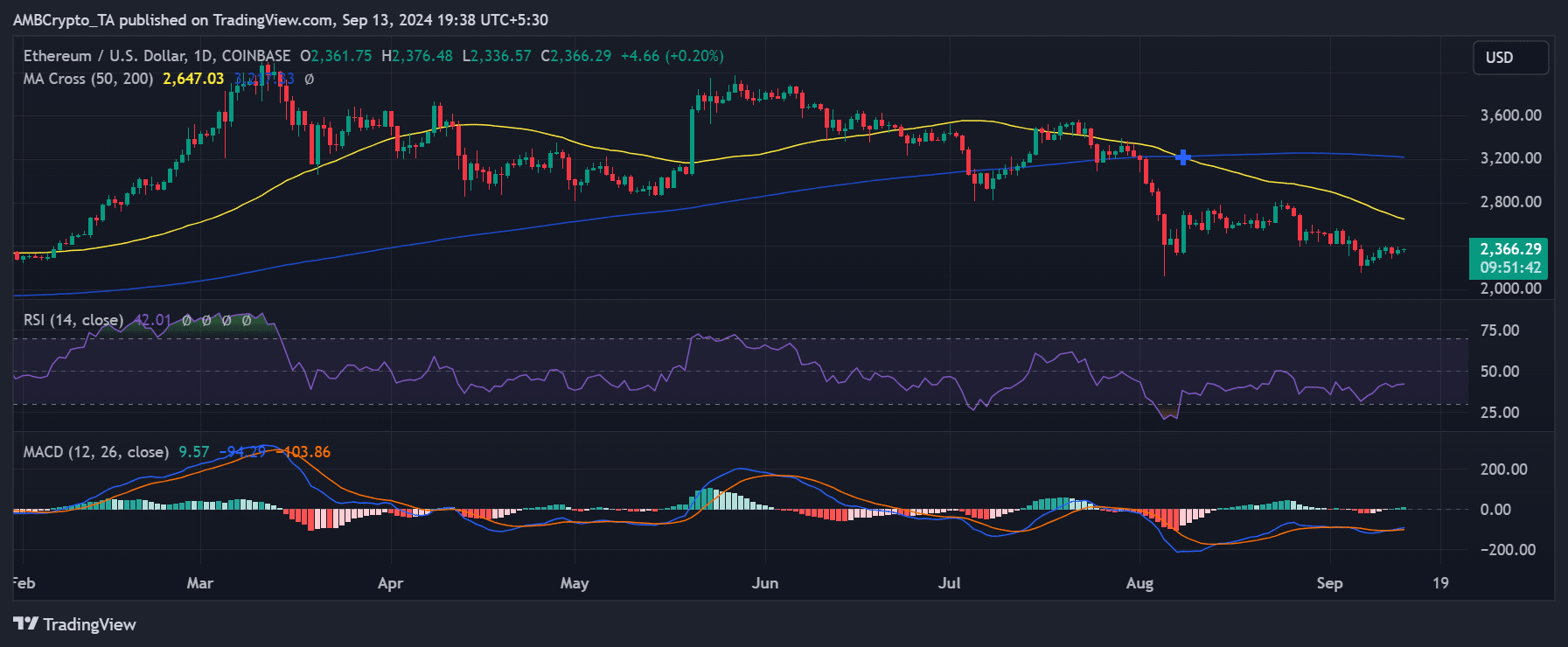

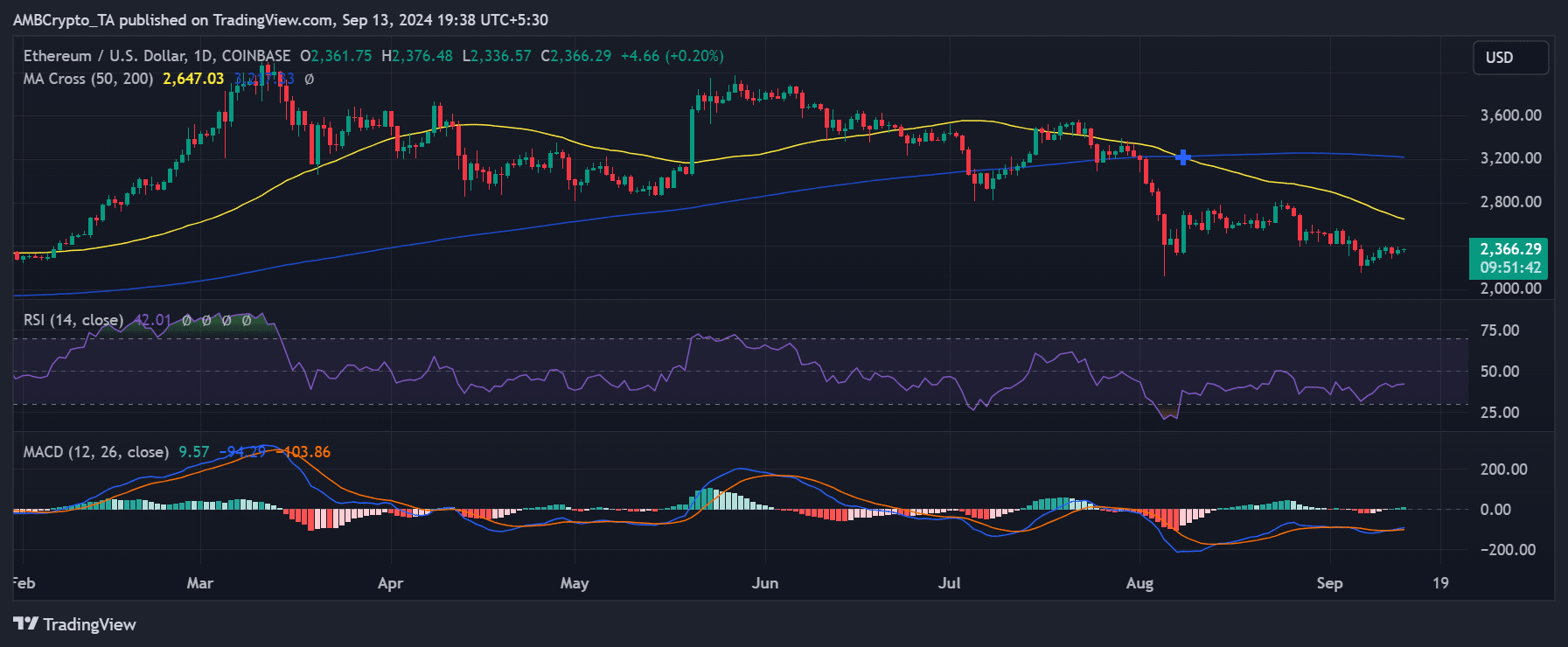

AMBCrypto’s evaluation of Ethereum’s every day worth chart confirmed that ETH closed the final buying and selling session up nearly 1%, bringing its worth to round $2,361.

Nevertheless, on the time of writing, the king of altcoins misplaced most of these beneficial properties and was buying and selling at round $2,350 on the time of writing, reflecting a decline of 0.45%.

Supply: TradingView

Additional evaluation indicated that ETH’s worth is subdued, very similar to Ethereum ETF’s circulation developments, because it struggled to climb to the $2,500 worth degree.

The quick transferring common (yellow line) has turn out to be a key resistance close to this worth space, with ETH persistently failing to interrupt above it.

This resistance round $2,500 has held, making it a serious hurdle to Ethereum’s worth momentum.

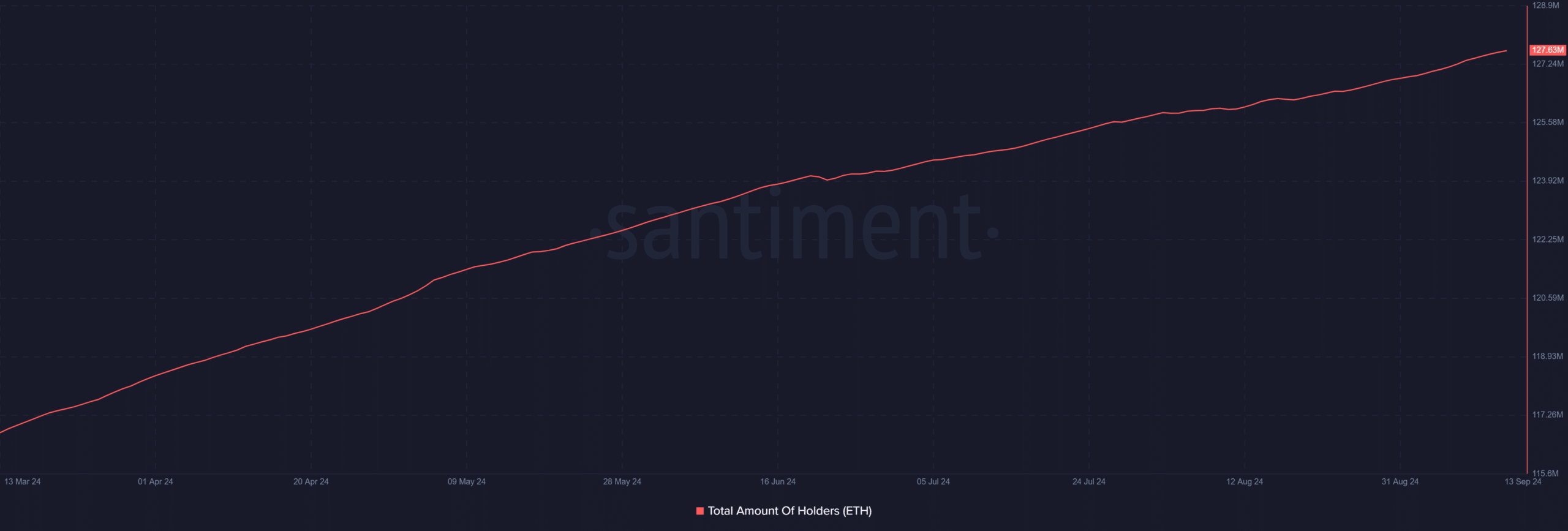

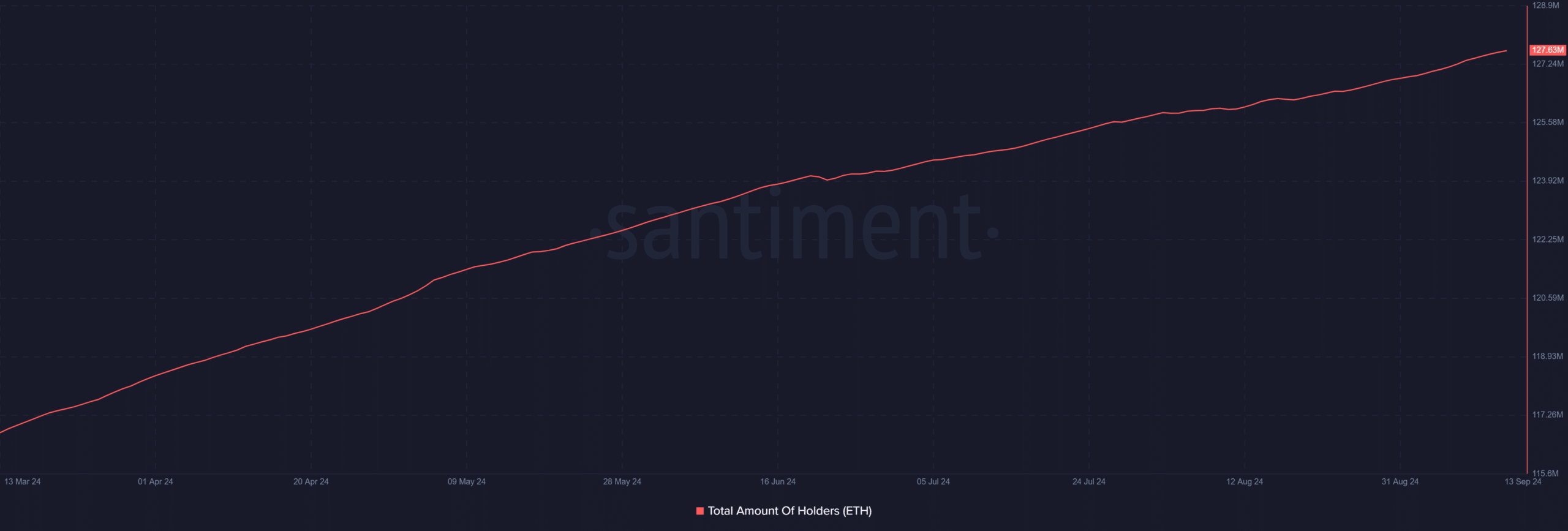

Holders proceed to build up

An evaluation of the Ethereum holder chart confirmed that the variety of ETH holders continued to develop regardless of the current Ethereum ETF outflow developments.

On the time of writing, the variety of holders exceeded 127 million, exhibiting a constant upward pattern.

Learn Ethereum’s [ETH] Worth forecast 2024-25

This indicated that the variety of addresses with non-zero balances was growing, indicating that extra addresses are actively buying ETH.

Supply: Santiment

This development within the variety of holders is seen as a constructive pattern, particularly contemplating Ethereum’s present average worth actions and resistance across the $2,500 degree.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now