Ethereum

Why Ethereum Is Going Down Today? Justin Sun’s $143M Sell-Off Triggers Panic

Credit : coinpedia.org

Ethereum is having a troublesome week and the crypto market is feeling the strain. Including to the drama is Tron founder Justin Solar, who has made waves with some huge Ethereum transactions. This previous week, Solar offered $143 million value of ETH – about half of its holdings – inflicting a pointy value drop.

The group is buzzing with questions: why is he issuing a lot ETH? Is there a hidden agenda behind these steps?

Let’s unravel the components driving Ethereum’s decline and see what lies forward.

Justin Solar’s huge ETH trades

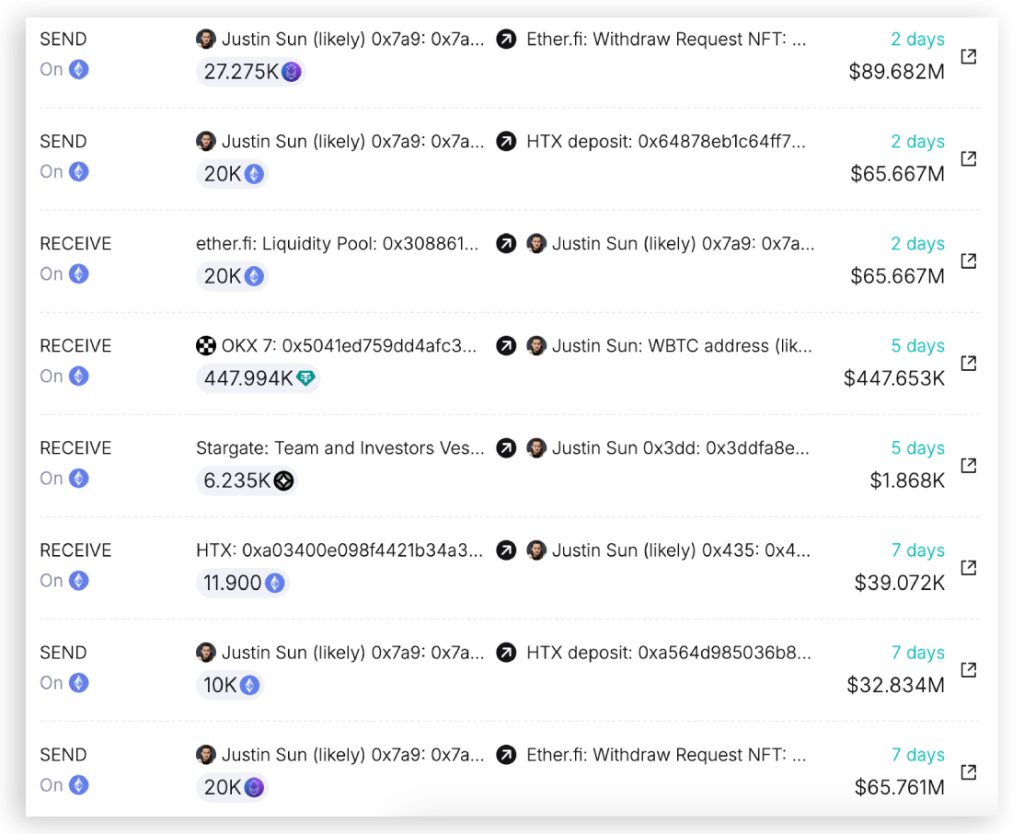

Since November 10, Justin Solar has deposited 108,919 ETH – value roughly $400 million – into HTX (previously Huobi), in line with blockchain knowledge from Spot on chain. Most of those deposits occurred when Ethereum’s value was close to its current highs, averaging $3,674 per ETH.

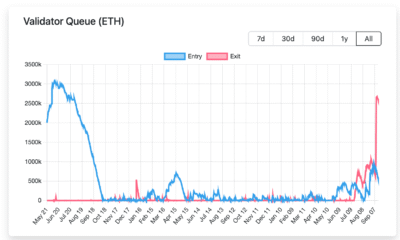

Moreover, Solar just lately reversed 42,904 ETH from Lido Finance, value $139 million. There may be hypothesis that he might also transfer these funds to HTX. Such giant transactions put strain on Ethereum’s value, and the market is feeling the warmth.

Ethereum’s value is taking a success

Ethereum is now buying and selling at $3,304, down 17% from its current rejection of $4,000. Within the final 24 hours, it’s down one other 2.19% and buying and selling quantity is down 8.57%.

Market sentiment is not nice both. Information exhibits that 54% of futures trades are quick positions, with the long-short ratio standing at 0.8495. Nonetheless, there’s a small brilliant spot: 78% of Ethereum holders are nonetheless making a revenue on the present value.

Key technical ranges to control

Ethereum is approaching an important help stage at USD 3,260. If the worth falls under this stage, the worth might fall additional in direction of $3,000, with the 200-day shifting common offering some help.

The Relative Energy Index (RSI) is at 39.28, close to oversold territory, whereas the Common Directional Index (ADX) signifies sturdy bearish momentum. These alerts counsel that Ethereum’s value might stay below strain within the close to time period.

What’s subsequent for Ethereum?

The massive query is whether or not Ethereum can maintain greater than $3,260. If not, analysts warn the worth might fall to $2,800, particularly if large holders like Justin Solar proceed to promote. Whereas some specialists imagine Ethereum remains to be in a ‘protected zone’, others warn that low weekend buying and selling volumes and uncertainty within the inventory market might result in extra volatility.

Justin Solar’s giant Ethereum trades have put strain on the already weak market, resulting in hypothesis about his motives. For now, traders ought to stay cautious and control key help ranges and whale actions because the market stays risky.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024