Ethereum

Why Ethereum’s long-terms trends look bullish despite short-term sell-offs

Credit : ambcrypto.com

- ETH noticed extra inflows into the exchanges over the last buying and selling session.

- The ETH stability on the alternate has continued to say no.

A current evaluation of Ethereum [ETH] Market exercise in current days revealed a sample of accumulation and sell-off throughout a number of addresses.

Regardless of these blended tendencies, ETH’s total quantity on exchanges has decreased, which is usually a bullish sign.

Ethereum sees blended indicators

Current Ethereum market exercise has produced blended indicators from key indicators. On the one hand, there was notable accumulation by some massive holders, or “whales,” which is usually a bullish signal.

Evaluation of the holders’ knowledge exhibits that these whale addresses elevated their holdings by roughly 200,000 ETH, equal to roughly $540 million.

However, some institutional gamers have bought their shares, which might point out a extra cautious or bearish outlook from sure market members.

Knowledge from Look at chain revealed that establishments like Amber Group and Cumberland bought greater than 13,000 ETH, value greater than $35 million, up to now 24 hours.

This promoting strain from establishments contrasted with the buildup by whales, creating blended market sentiment.

Whereas the buildup of whales signifies robust perception in Ethereum’s future, the institutional sell-offs might mirror issues about near-term value actions or broader market uncertainties.

Ethereum movement exhibits vendor dominance

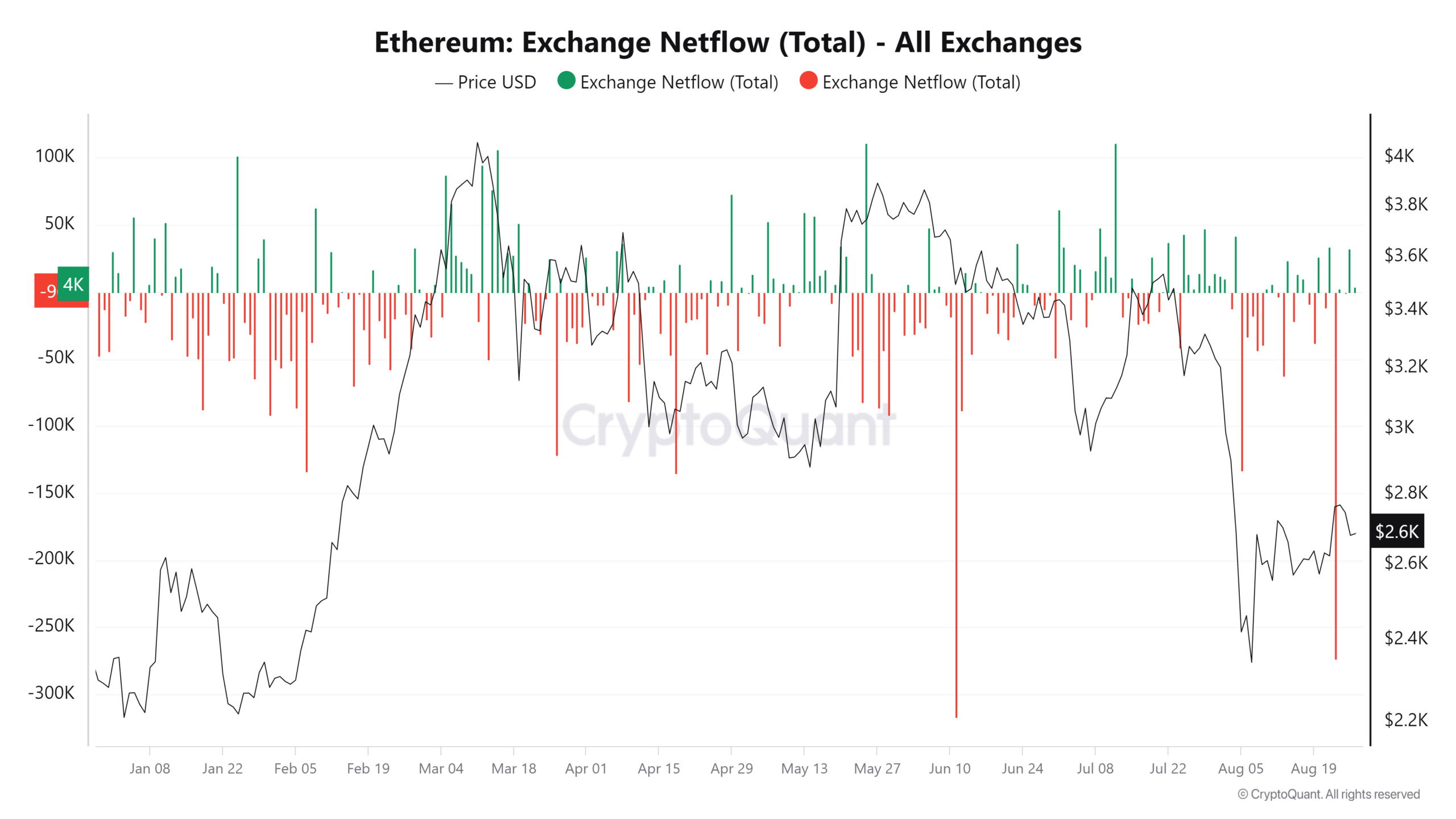

AMBCrypto’s evaluation of Ethereum’s alternate netflow knowledge from CryptoQuant on August 26 revealed constructive netflow.

This indicated that extra ETH was deposited on exchanges than was withdrawn on that day. Particularly, the online movement exceeded 32,000 ETH, indicating that the amount of the sell-off exceeded the buildup throughout this era.

Supply: CryptoQuant

A constructive internet movement usually signifies that buyers are shifting ETH to exchanges, presumably to promote or commerce, which might trigger short-term promoting strain.

This aligned with current knowledge displaying that some establishments, corresponding to Amber Group and Cumberland, have bought important quantities of ETH.

Nonetheless, regardless of this short-term enhance in forex inflows, the broader development in current weeks has led to better outflows of ETH total.

Because of this in the long term, extra ETH has been withdrawn from the exchanges than deposited, which is usually interpreted as a bullish indicator.

ETH’s buying and selling flight

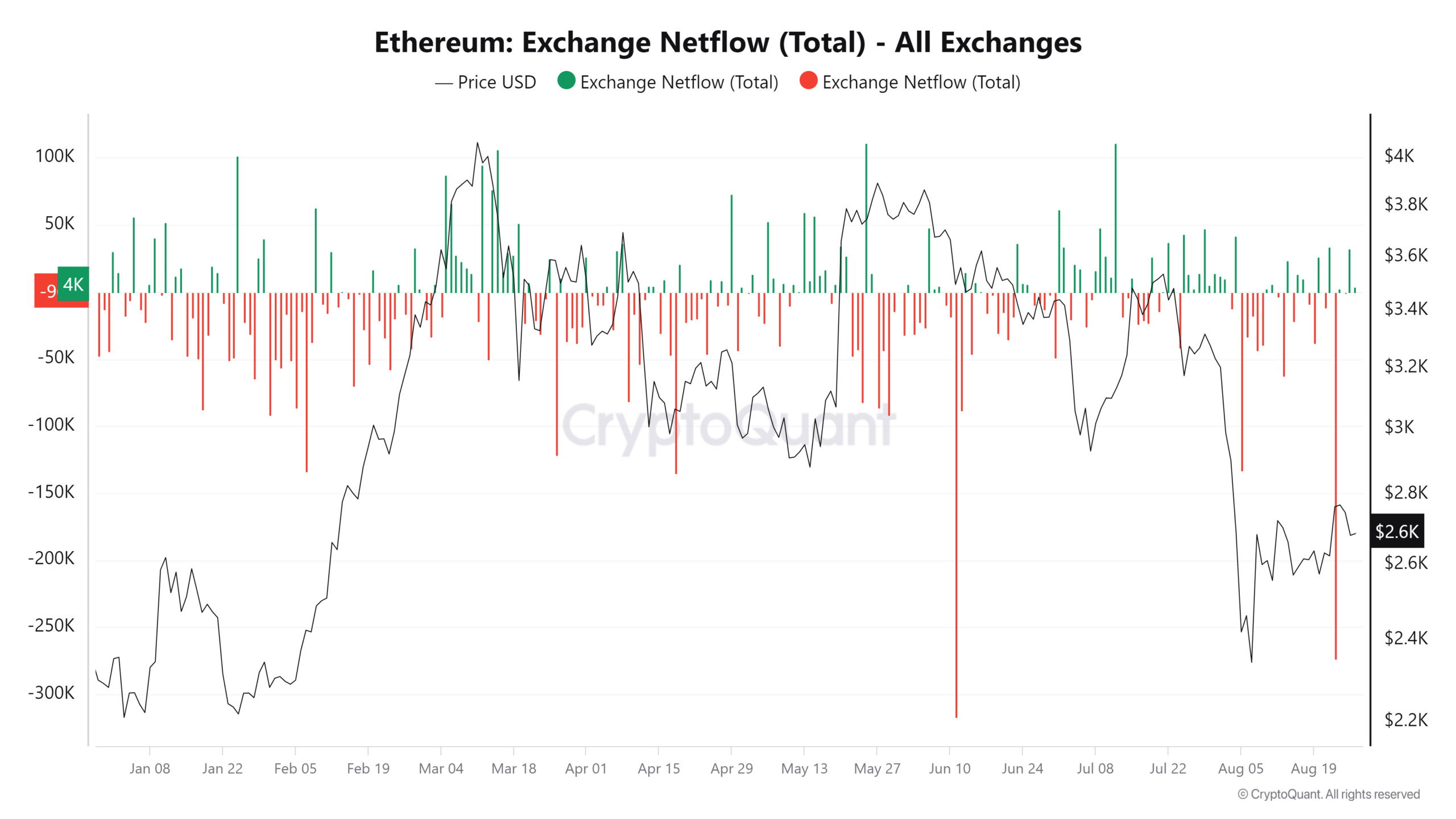

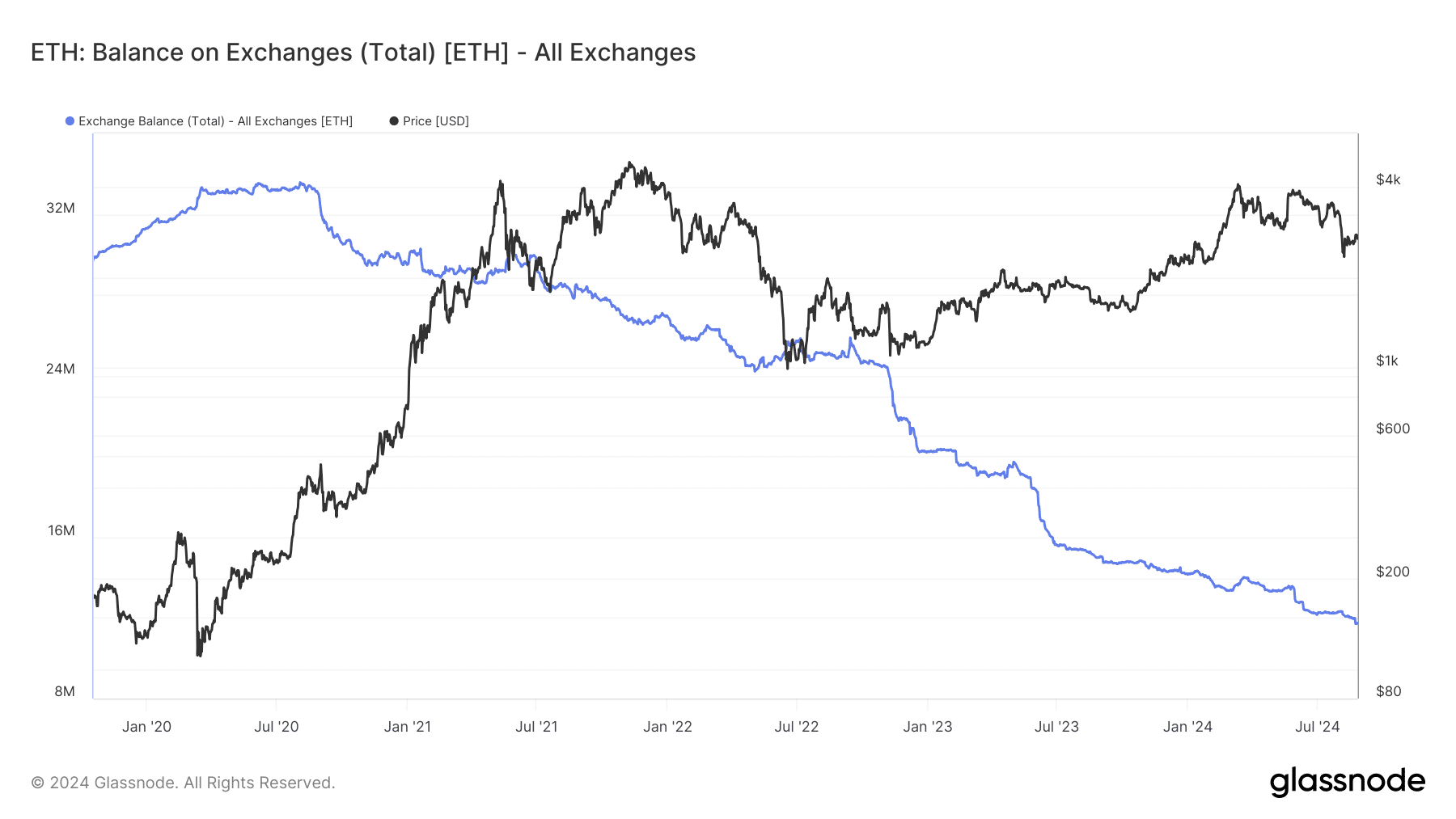

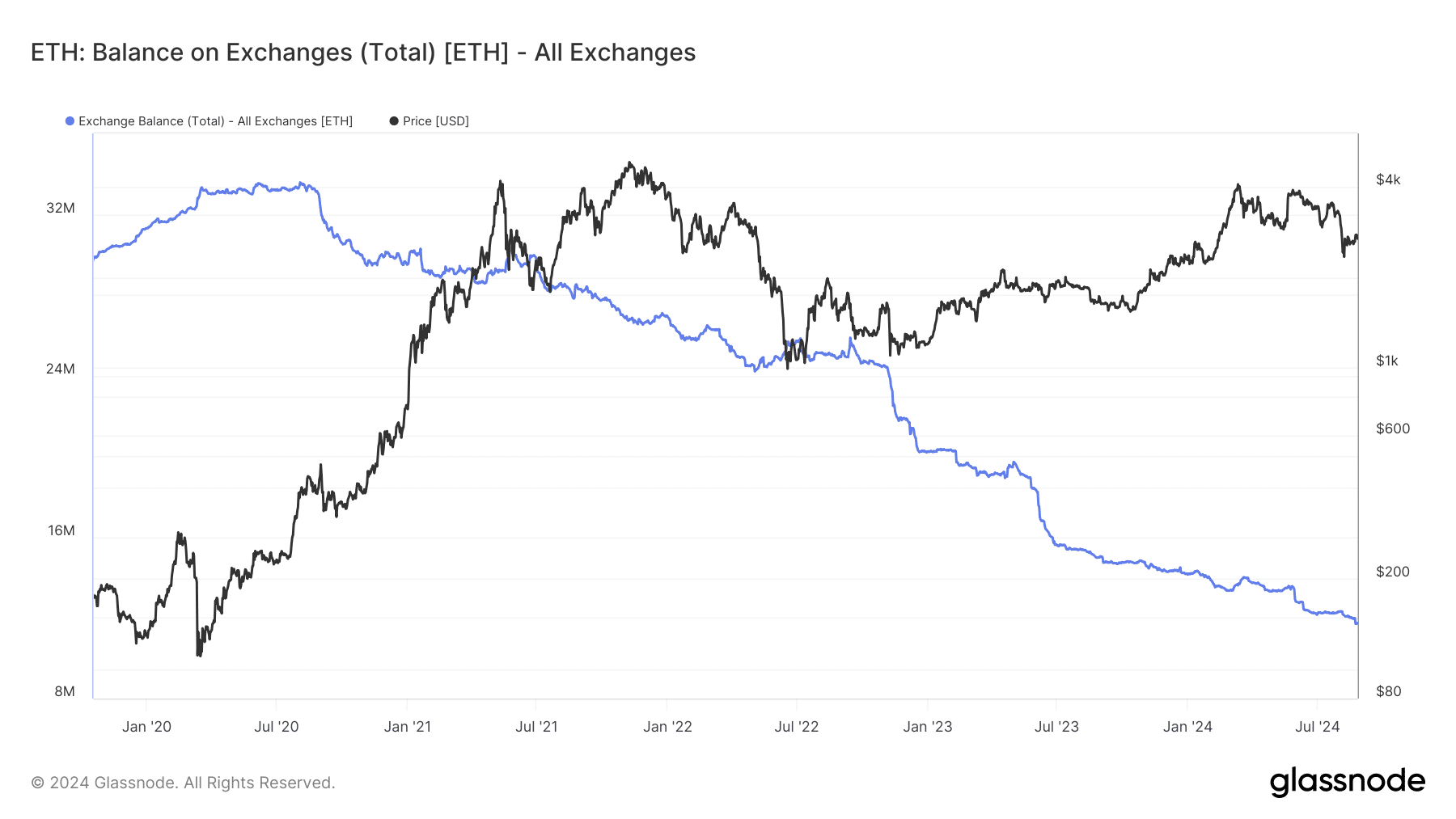

The continued decline in Ethereum balances on the exchanges is a serious development, indicating that increasingly buyers are withdrawing their holdings from the exchanges.

This drop in alternate charges steered that buyers could also be shifting their ETH to chilly storage, staking, or different types of long-term investing, moderately than preserving it available for buying and selling.

Supply: Glassnode

A falling alternate price stability can result in shortage within the obtainable provide of ETH on exchanges, which usually has a bullish implication for the asset’s worth.

If there are fewer cash obtainable to commerce, and if demand stays robust or will increase, shortage can drive up costs because of the fundamental financial precept of provide and demand.

These falling alternate charges add to the record of bullish indicators for Ethereum, regardless of the blended indicators seen in current weeks.

ETH continues to development weakly

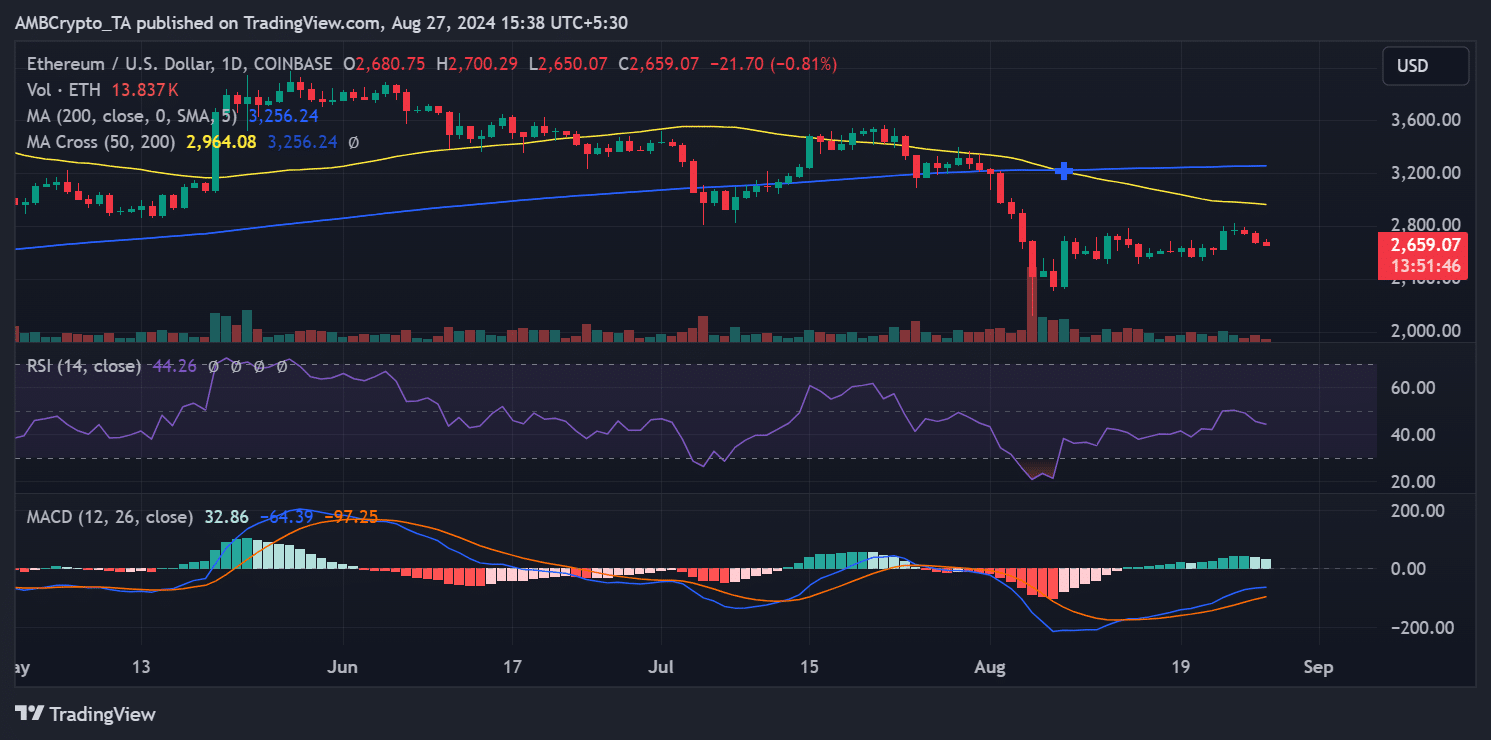

In response to AMBCrypto’s evaluation, Ethereum has struggled to take care of constructive momentum these days.

The day by day value development evaluation exhibits that Ethereum has skilled consecutive declines over the previous three days. On the time of writing, Ethereum was buying and selling at round $2,656, reflecting a further decline of virtually 1%.

Supply: TradingView

The quick shifting common (yellow line) continued to behave as a major resistance stage round $2,900.

Learn Ethereum’s [ETH] Worth forecast 2024-25

This resistance has repeatedly prevented Ethereum from rising increased, contributing to the current downward strain on the worth.

The continued value decline underlines the blended indicators which have characterised Ethereum market exercise in current weeks, with short-term bearish tendencies contrasting with some longer-term bullish indicators, corresponding to falling alternate charges.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024