Altcoin

Why Ethereum’s path to $3.7K depends on THIS accumulation metric

Credit : ambcrypto.com

- Ethereum deal with possession has elevated by 60% since August 2024

- Volatility has taken cost of Ethereum’s worth motion over the previous 48 to 72 hours

Since its latest excessive of $4,109, Ethereum’s [ETH] worth chart has seen a powerful market correction. Previous to the restoration at press time, which noticed the altcoin rise greater than 7% in 24 hours, the altcoin even fell to a low of $3,095.

This market correction bought many key stakeholders speaking. Based on CryptoQuant’s analyst Mac D, this correction might have been brought on by macroeconomic components.

And but, on the time of writing, some restoration was so as as altcoin traders had been nonetheless accumulating the altcoin.

ETH accumulation will increase possession

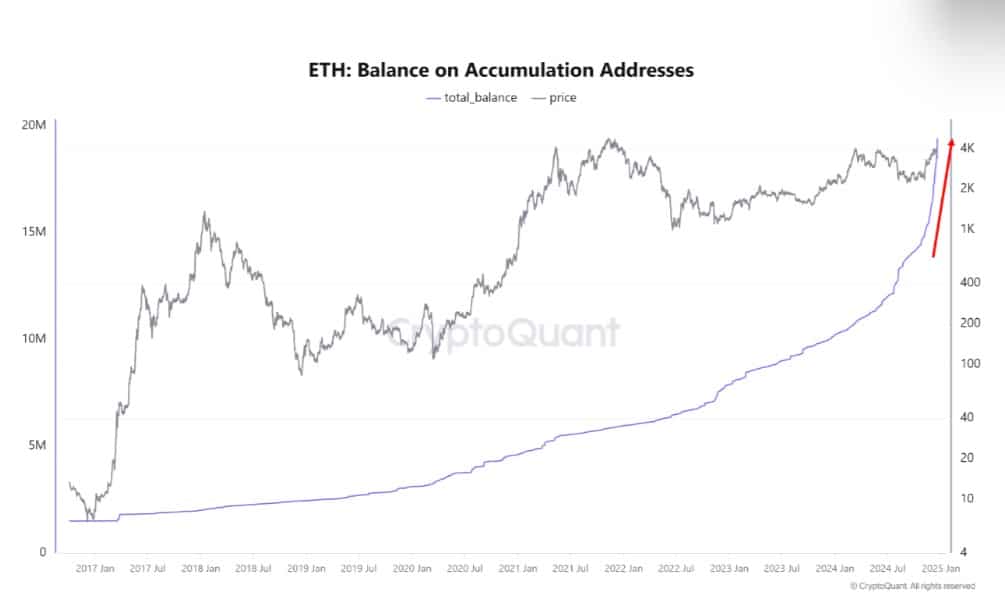

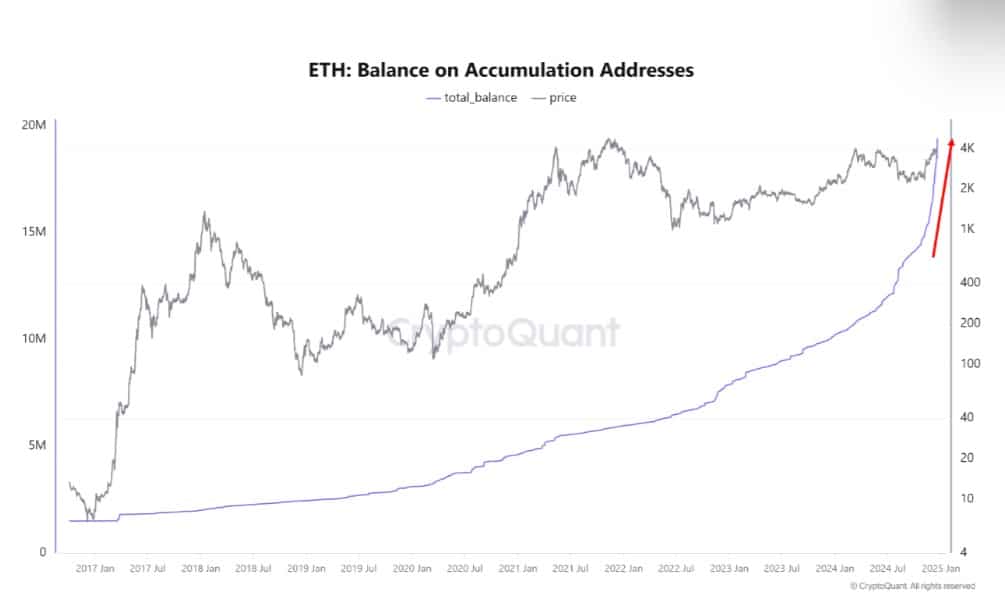

Based on CryptoQuantEthereum accumulating addresses have elevated considerably lately, surpassing earlier cycles.

Supply: CryptoQuant

Based mostly on this evaluation, accumulating addresses recorded a powerful enhance in August, peaking at 16% or 19.4 million ETH tokens of the entire Ethereum provide of 120 million ETH. By way of progress price, this rebound represented a 60% enhance, from 10% in August to 16% in December 2024. Such an enormous enhance was unprecedented in earlier ETH cycles.

This enhance within the variety of addresses holding ETH underscored widespread market expectations about Trump’s pro-crypto insurance policies. Likewise, it advised that regardless of the altcoin’s risky worth, sensible cash will proceed to build up ETH.

Whereas a short-term market correction is very probably as a consequence of macroeconomic components, the long-term upside potential remains to be excessive. It’s because traders proceed to purchase ETH and the variety of addresses is consistently rising.

Affect on altcoin worth

As anticipated, a rise in accumulation has had a huge effect on ETH’s worth chart. For instance, throughout this accumulation interval, ETH rose from a low of $2,116 to a excessive of $4,109.

On the time of writing, Ethereum was buying and selling as excessive as $3,504, having risen greater than 5% prior to now 24 hours.

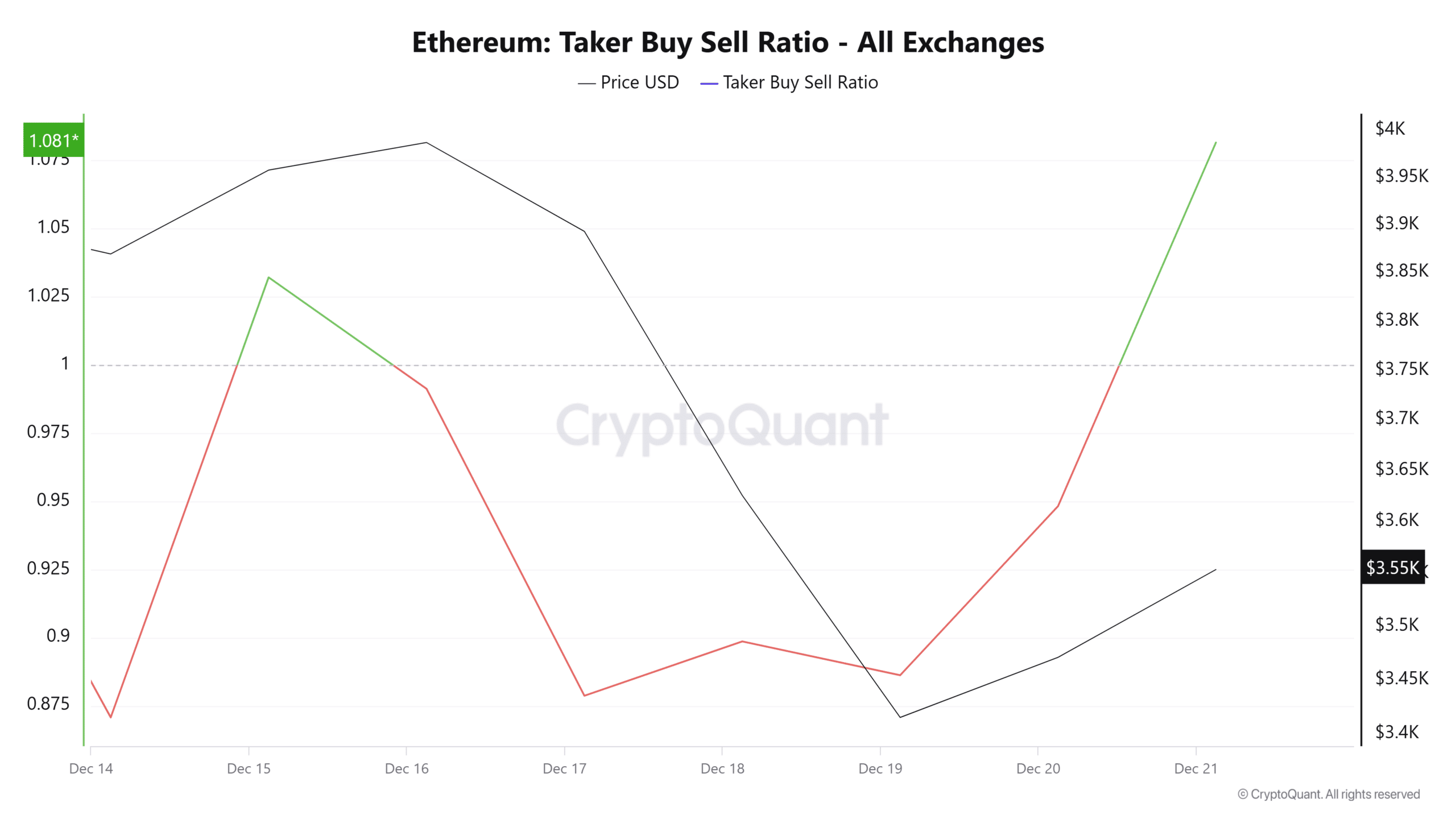

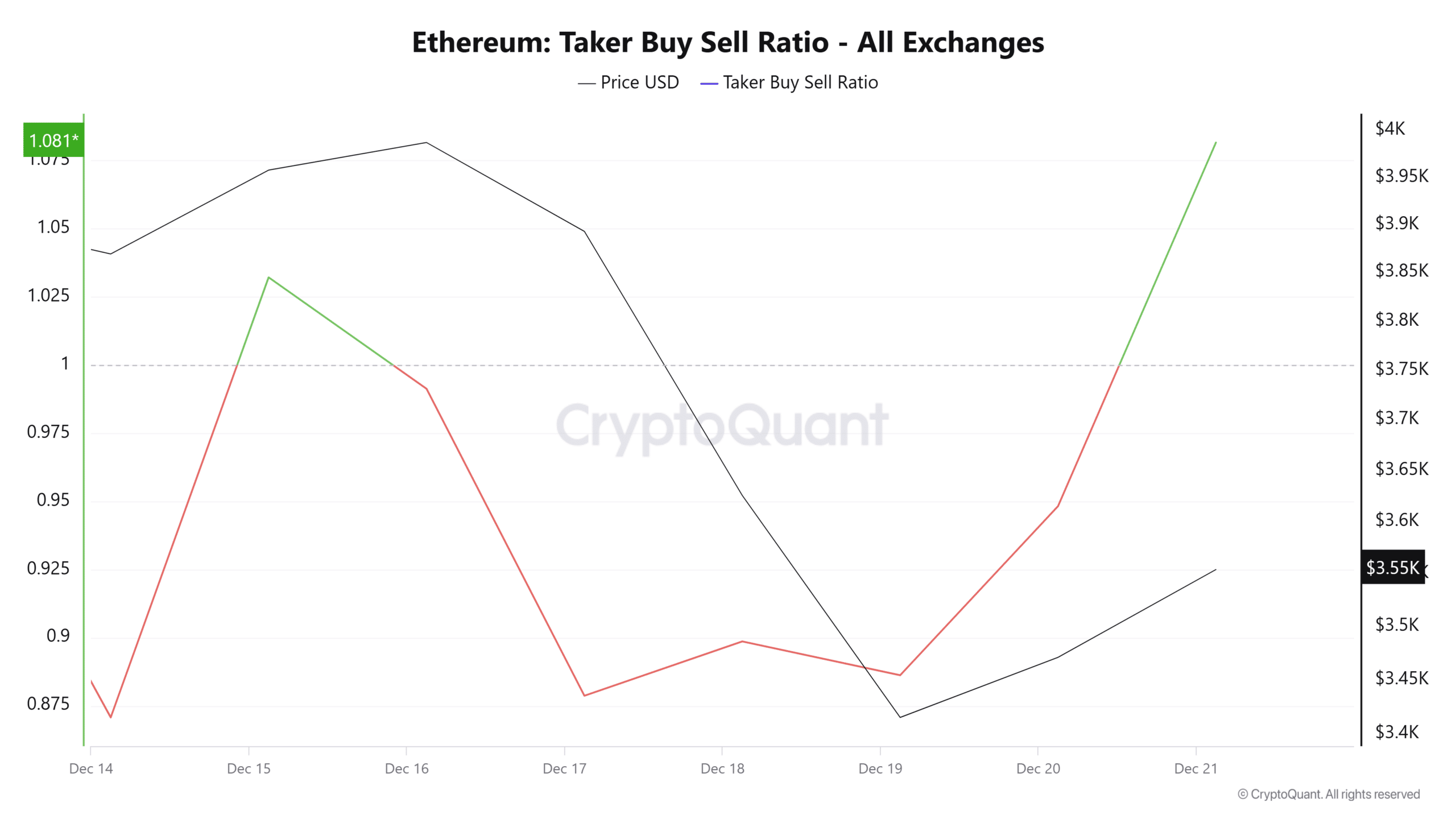

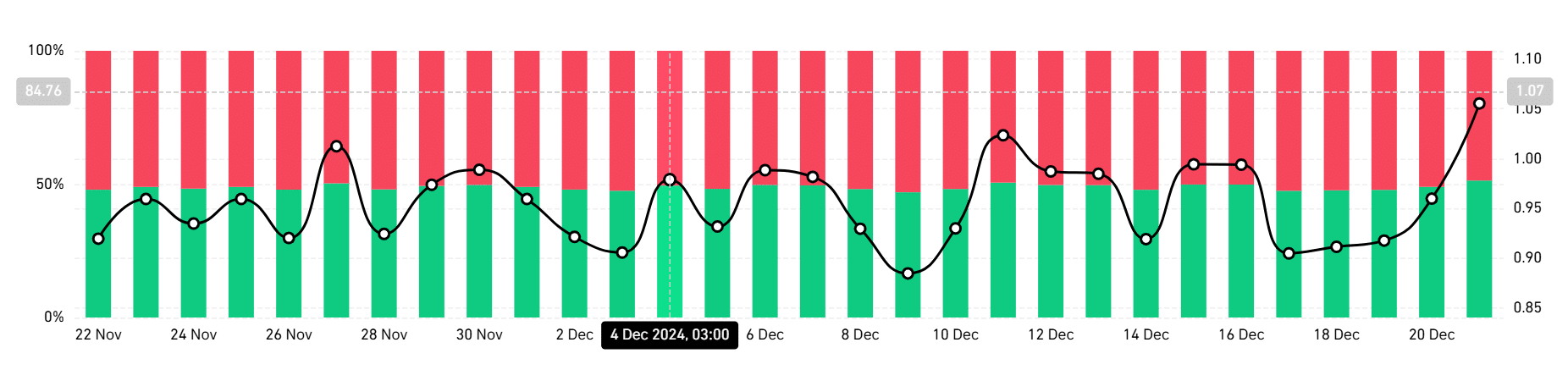

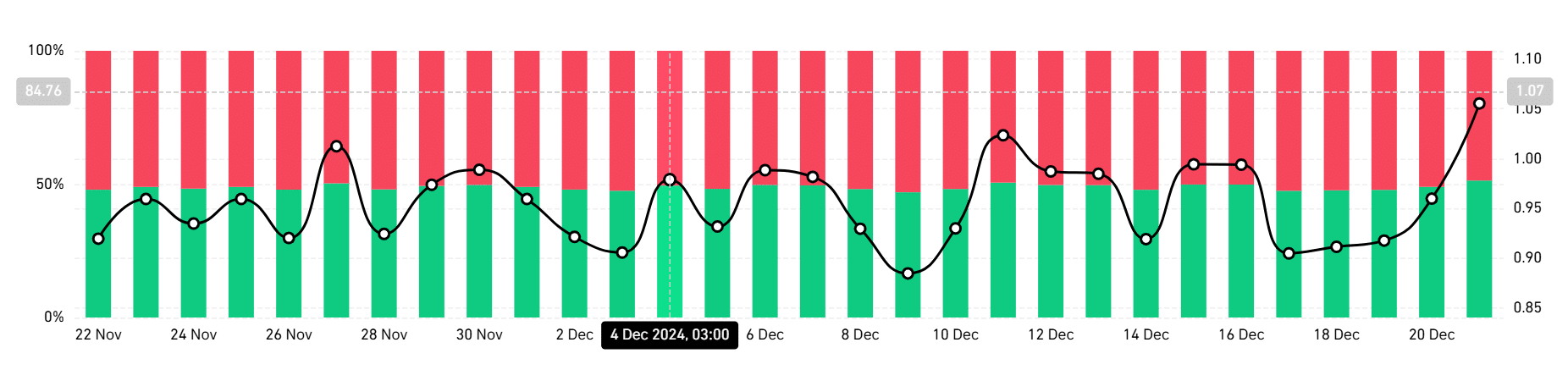

Supply: CryptoQuant

This upward momentum we see right here was largely pushed by a rise in shopping for stress. We will additionally see this phenomenon on the spike within the Taker Purchase to Promote ratio, with the identical enhance to 1.08 on the time of writing.

Such a rise implies that consumers are extra aggressive than sellers. So demand may at the moment be better than provide.

Supply: Coinglass

This shopping for stress may also be interpreted as an indication of the prevailing bullish sentiment. This bullishness was mirrored in traders additionally taking lengthy positions. On the time of writing, those that took lengthy positions dominated the market by 51% – an indication that the majority merchants count on extra earnings.

In conclusion, as traders give attention to accumulating Ethereum, the altcoin could also be nicely positioned for additional progress. As extra traders enhance their positions, shopping for stress will increase, doubtlessly leading to a provide squeeze. Such circumstances put a number of optimistic stress on the value of the altcoin.

Subsequently, if the variety of addresses continues to rise, ETH may recuperate $3,713. Consequently, a drop just like the one seen a number of days in the past would see Ethereum drop to $3,300.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024