Bitcoin

Why is crypto down today? Looking at Bitcoin, FED, and past week’s sell-off effects!

Credit : ambcrypto.com

- Bitcoin maintained a bearish construction on the 4-hour chart

- There was regular promoting recently, however sentiment appeared to level to a worth improve

Bitcoin [BTC] noticed its Christmas rally begin to fade, and an try and climb previous the $100,000 mark was halted on Boxing Day. The 2-day assembly of the US Federal Reserve, which began on December 17, led to a coverage assertion. One which predicted solely two rate of interest cuts in 2025, as an alternative of the beforehand anticipated 4.

Because of this, the Dow Jones fell by greater than 2.5%, or simply over 1,150 factors. These losses have since been recovered, however the market was not so sort to Bitcoin.

The chance standing of property slows restoration

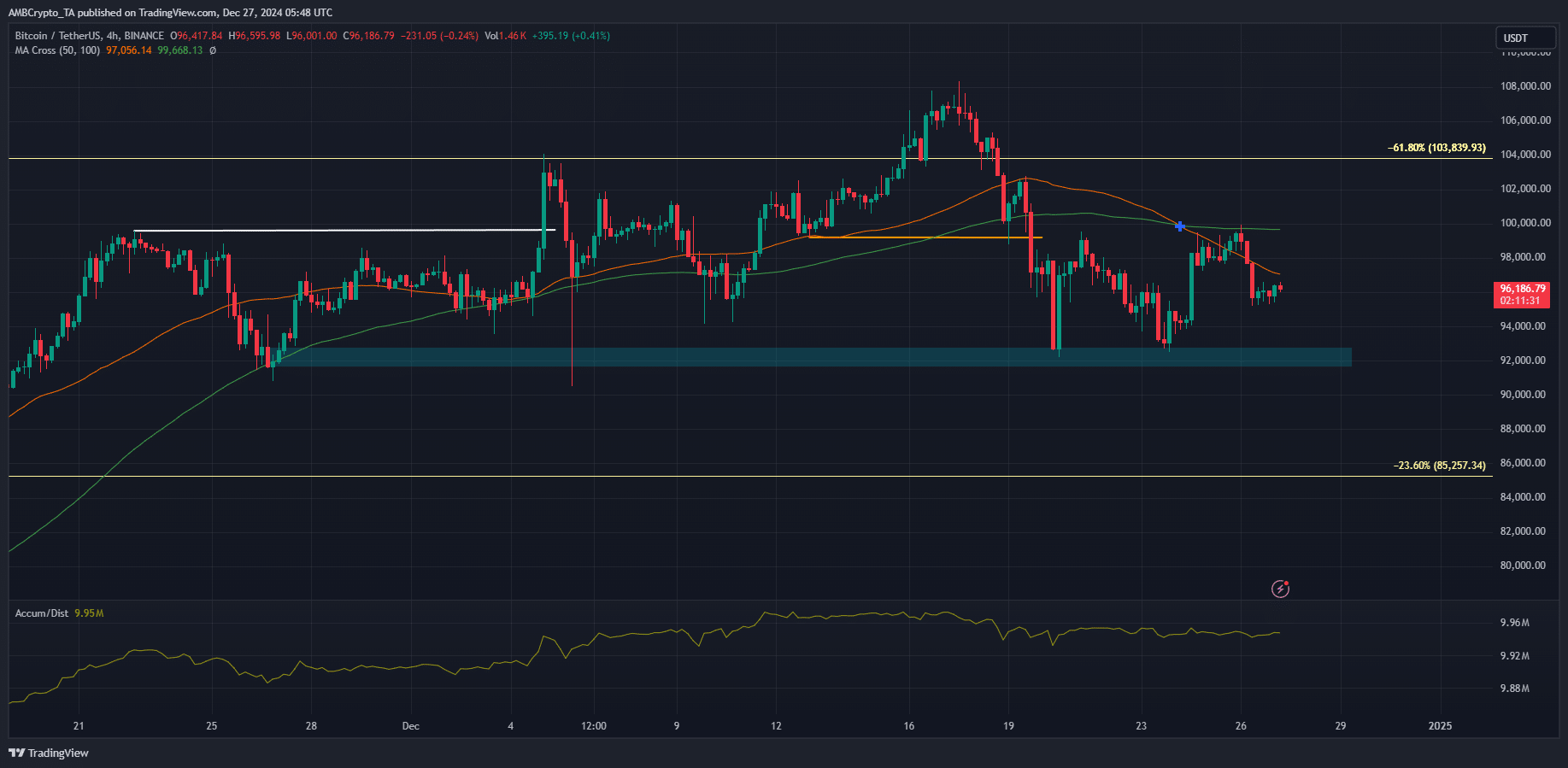

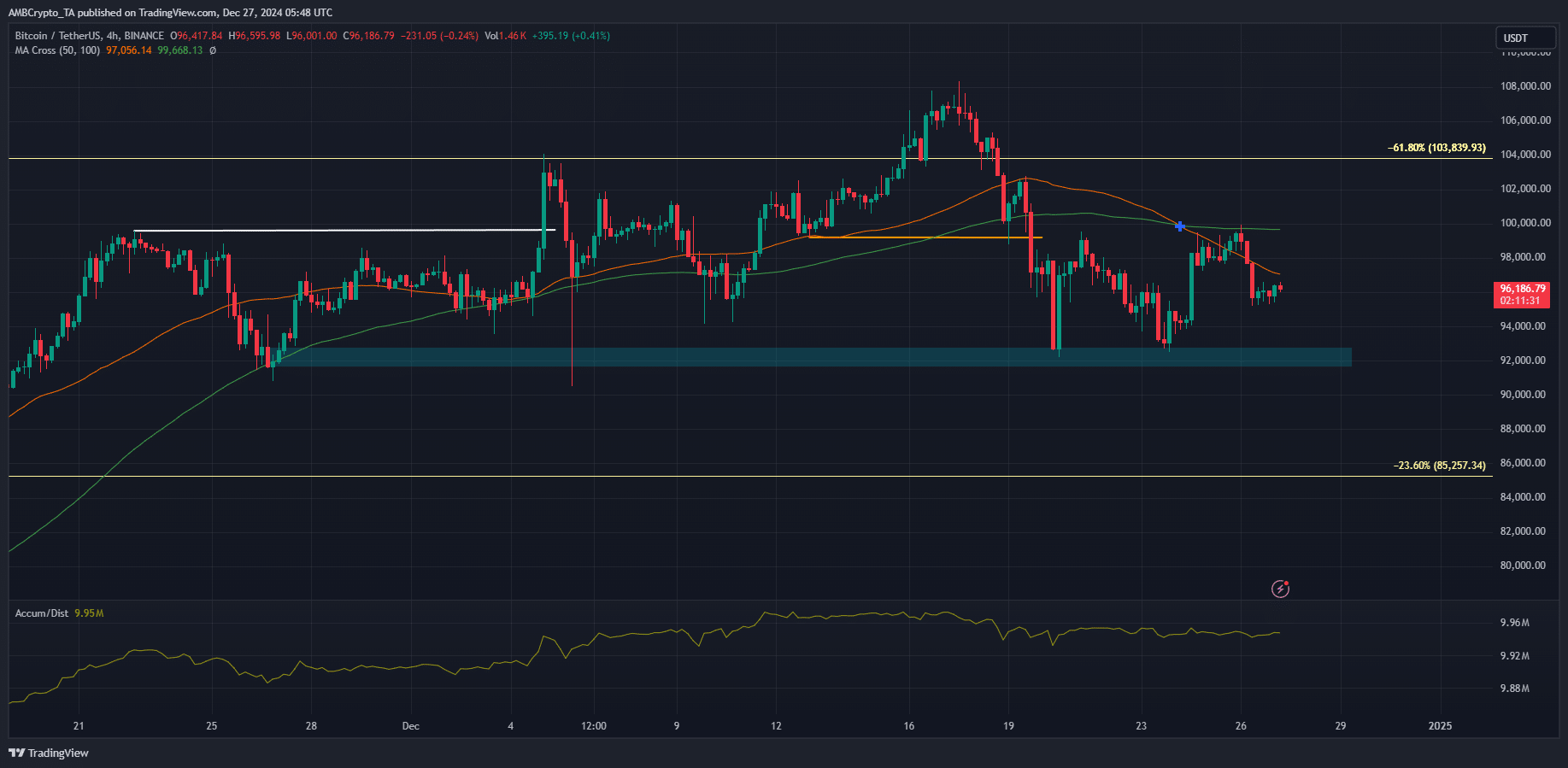

Supply: BTC/USDT on TradingView

The broader crypto market usually follows the pattern of Bitcoin. Up to now 24 hours, BTC fell 2.75% and the altcoin market misplaced 2.31% of its worth. If we study the pattern of BTC on the 4-hour chart, we will see that the bearish market construction was nonetheless at play.

It turned bearish on December 19, highlighted in orange. Since then, the A/D indicator has additionally slowly declined, indicating decreased shopping for stress. The shifting common fashioned a bearish crossover, additional emphasizing the downward momentum of the previous ten days.

Crypto fell at the moment. Will it regain the uptrend subsequent month?

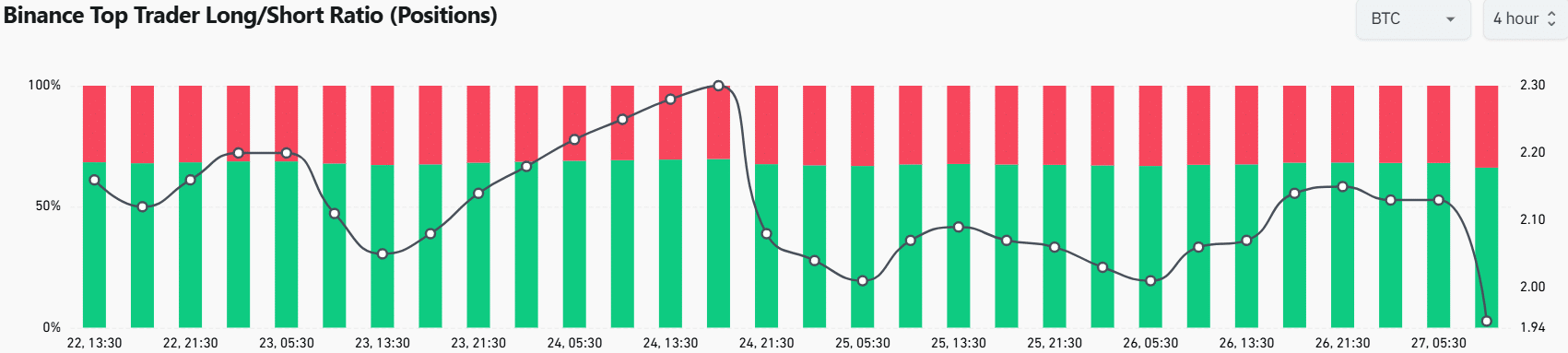

Evaluation of the positions of prime merchants on Binance utilizing Coinglass information confirmed that there’s some hope within the brief time period. AMBCrypto discovered that this metric, which measures the lengthy or brief positions of the highest 20% of merchants, was 1.95.

Lengthy positions accounted for 66.12%, and shorts 33.88% – an indication of bullish sentiment amongst prime merchants.

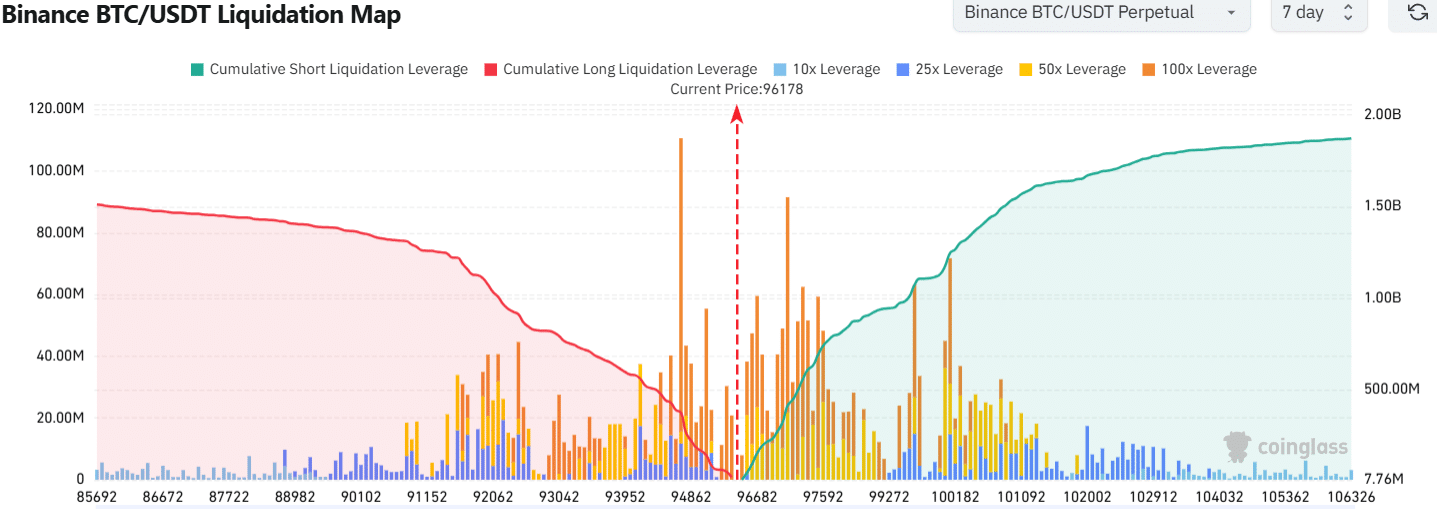

The liquidation chart helped reinforce this bullish short-term thought. Liquidations within the north had been extra quite a few, that means a liquidity rush to the north was extra possible within the coming days.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

Primarily based on final week’s information, AMBCrypto discovered {that a} worth transfer close to $97.6k might be monitored and rejected by sellers. Additional volatility will be anticipated as 2024 attracts to a detailed.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now