Altcoin

Why is crypto down today? Market sentiment plays a role

Credit : ambcrypto.com

- Market sentiment deteriorated and liquidity shortages dragged costs down.

- Bitcoin and Ethereum confronted rejections of their respective resistance zones.

On August 26, the entire crypto market cap dropped from $2.216 trillion to $2.041 trillion the following day. This was a lower of $215.87 billion or 9.7% throughout the market.

Sure tokens have been affected greater than others.

Previously 24 hours, market costs have already began to get well. Bitcoin [BTC] and ether [ETH] rose by 3.84% and 6.82% respectively. However what may clarify why crypto has stopped working because the twenty sixth?

Conduct of market members

Supply: USDT.D on TradingView

The Tether dominance chart measures Tether’s market cap as a proportion of the entire crypto market cap. The chart above exhibits that USDT.D is up 10.91% from Monday and has entered a 5.9% resistance zone.

It has declined since then. Tether dominance and crypto value actions are inversely proportional.

When USDT.D rises, it means extra buyers and market members are buying and selling their crypto for Tether, implying a insecurity and a rise in promoting stress.

This has decreased in current hours and a value improve was noticed for the key altcoins and for Bitcoin.

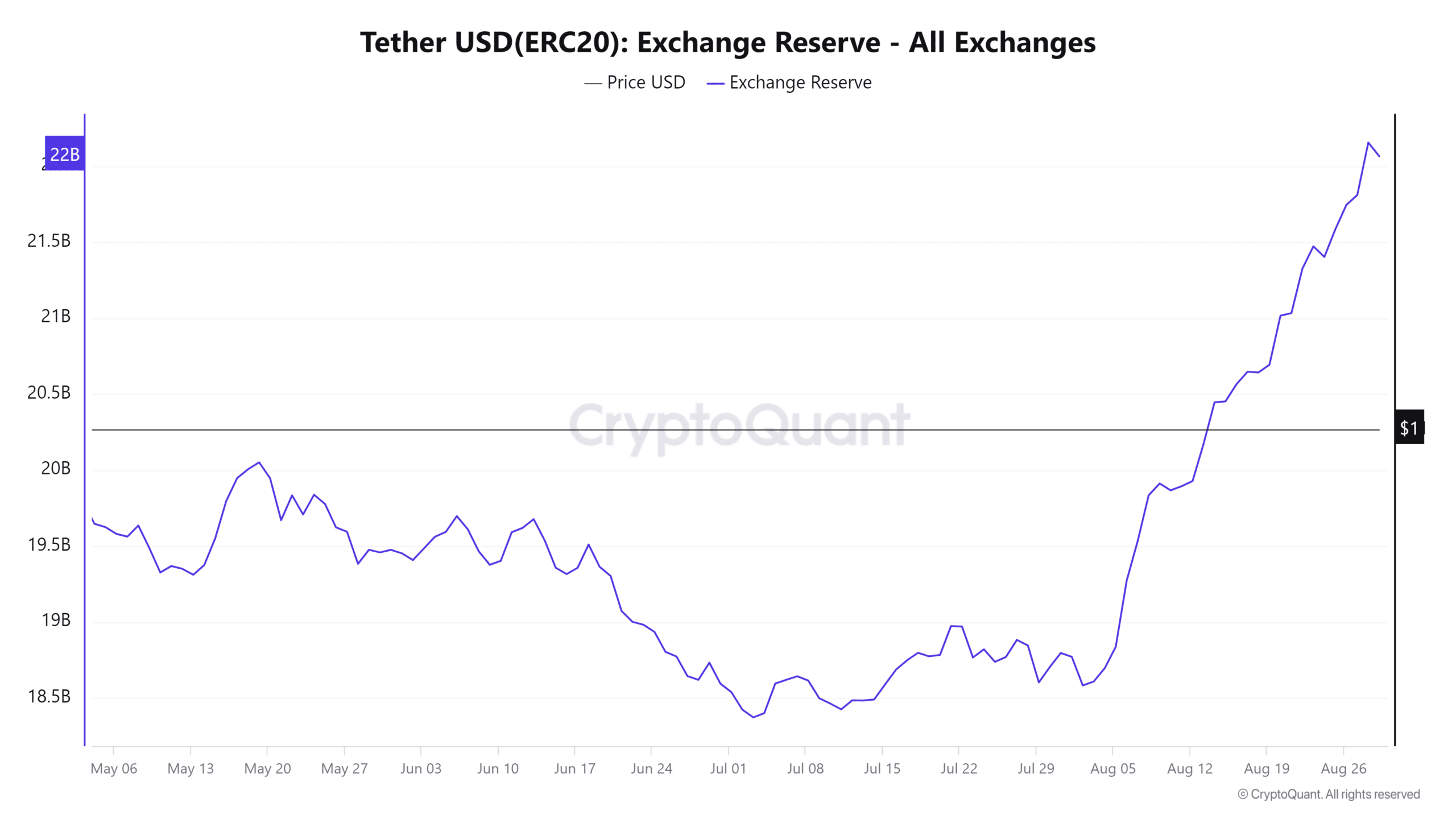

The Tether alternate reserve has been trending larger since early August. It was a sign of the rising buying energy out there.

Nevertheless, it’s tough to say when costs within the crypto market would begin to rise, however the benchmark confirmed that there’s room for growth.

Liquidity explains why crypto is in hassle

Traders flocking to stablecoins is an efficient gauge of market sentiment. One other technique to gauge the place costs are more likely to go is by trying on the liquidation charts.

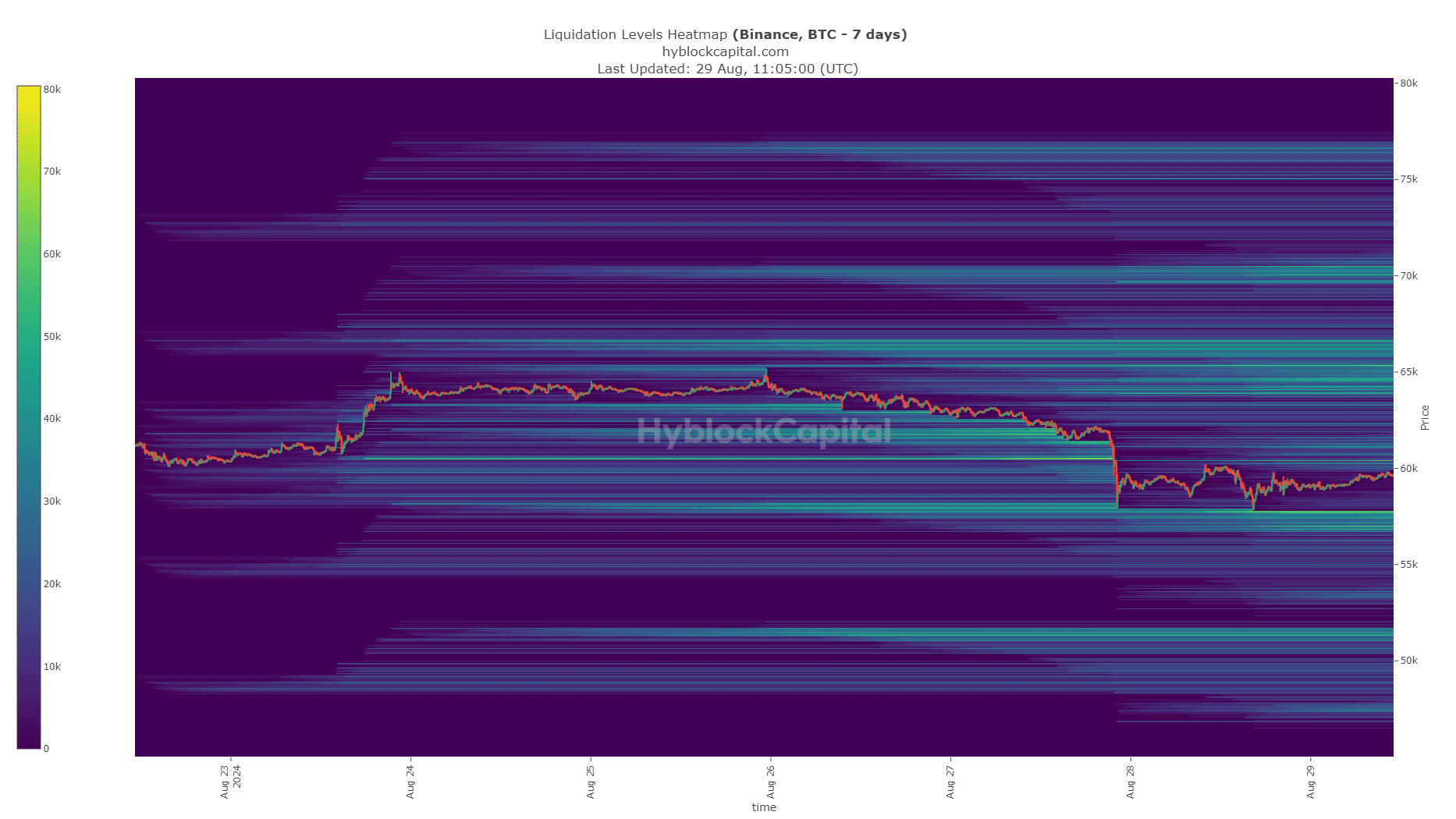

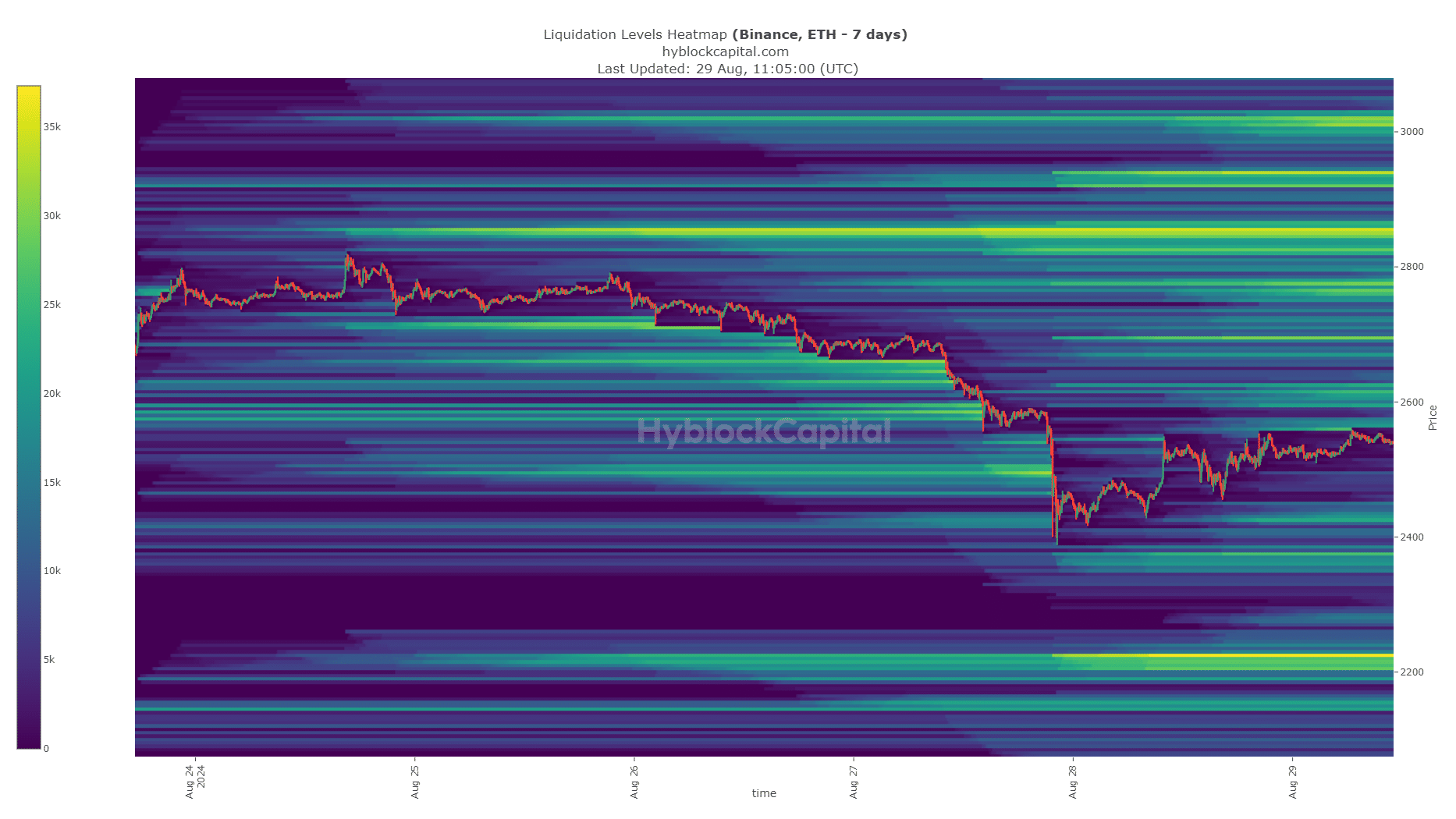

Since Bitcoin and Ethereum are the biggest property and the value efficiency of most main altcoins has a excessive constructive correlation with them, AMBCrypto determined to research their liquidation heatmaps.

On August 27, Bitcoin crashed by means of a number of short-term liquidity clusters and rapidly reached the $58,000 liquidity pool. The scenario has stabilized since then, however liquidity is a key driver of value actions.

Learn Bitcoin’s [BTC] Value forecast 2024-25

Ethereum additionally noticed a dense cluster of liquidation ranges reaching $2490, however ETH continued to say no, hitting the $2415 pocket. On the time of writing, it regarded prefer it was heading in the direction of the $2.6k liquidity margin.

Liquidity and market sentiment have been the primary elements behind crypto’s decline. The transfer triggered tens of millions of {dollars} in liquidations, and the crypto market may consolidate within the coming days.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now