Bitcoin

Why is crypto up today—FOMC news, ETF flows and…

Credit : ambcrypto.com

- The FOMC assembly, together with the publish of Donald Trump, hinted in a possible finish of QT in April.

- Constructive sentiment was additional fed by vital statistics and noteworthy figures comparable to Brad Garlinghouse that tackles the crypto -top.

The crypto -markets responded positively to the expectations of diminished financial system charges for the medium time period. FOMC feedback have been much less strict than anticipated, and growing exercise in typical monetary markets fed optimism.

Nonetheless, the charges remained unchanged, with no clear indication of doable reductions.

Jerome Powell, chairman of the Federal Reserve, emphasised that prime rates of interest are important to fight inflation. He diminished financial progress projections, which means that improved market circumstances.

Nonetheless, he attributed financial challenges to aggressive coverage that was carried out throughout the federal government of President Donald Trump.

Arthur Hayes, Co-founder of BitMex, noted on x (previously Twitter), which Powell had achieved his aims, which led to an anticipated finish of quantitative tightening on 1 April.

Hayes mentioned that the true bullish shift would in all probability come from a SLR exemption or the return of quantitative leisure (QE) measures.

This was supported by a publish by Trump on Truth Social studying;

“The Fed can be a lot better off, as a result of American charges are switching their method to the financial system (ease!).

Hayes noticed $ 77k because the doable soil for Bitcoin, however predicted that shares may lower additional earlier than it reached Powell’s desired, so buyers needed to stay versatile with ample funds.

Market expectations have been influenced by predictions of rising inflation charges. It was anticipated that intensive excessive charges would have bearish results.

Analyst Benjamin Cowen confirmed on X That quantitative tightening (QT) was underway. He defined in response to Hayes;

“QT will not be” really over “on April 1. They nonetheless have $ 35 billion/MO off the consequences coated by mortgage. They’ve simply delayed QT delayed from $ 60 billion/MO to $ 40 billion/MO”

Crypto and Blockchain Enterprise Investments

Information from a crypto summit with Trump, Michael Saylor, co-founder of technique, and Brad Garlinghouse, the CEO of Ripple Labs fed current market earnings.

The highest emphasizes crypto and institutional adoption. Bullish Sentiment grew after Trump media executives Renaus Tactical, with the intention of amassing $ 179 million through a particular acquisition firm (SPAC) for blockchain investments.

Rising the organizational curiosity in crypto continues to extend belief within the sector. Expectations of extra crypto-friendly authorities coverage have additionally contributed to the market earnings.

Brief liquidations, sentiment and ETF flows

Supplementary, Crypto -markets that have been gained because the demand for brief positions decreased and big brief closures meant that the decision of bearish bets.

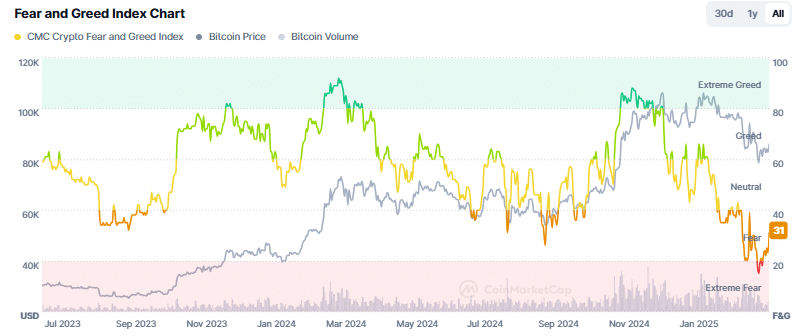

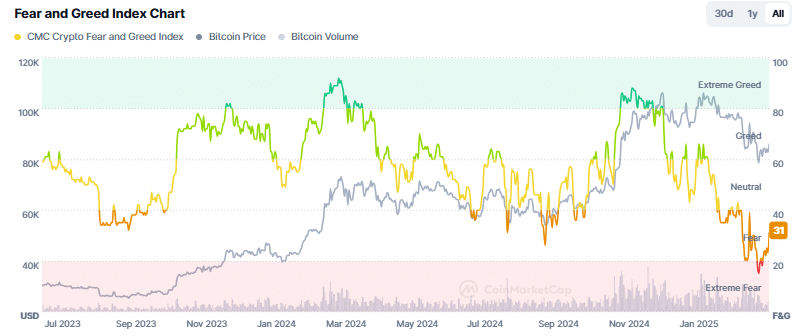

On the time of writing, the Crypto worry and greed index reached 31 factors of its earlier stage of 15 in the course of the previous week, indicating escalating dealer constructive and the event of bullish market sentiment.

Supply: Coinmarketcap

Bitcoin Spot ETFs noticed an influx of $ 11,7984 million, which displays better demand. Ethereum, then again [ETH] Spot ETFs registered their eleventh consecutive day, a complete of $ 11,7459 million.

With Bitcoin that led the crypto markets, this development meant a robust bullish sentiment.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now