Ethereum

Why Is Ethereum (ETH) Losing Ground To Bitcoin? Key Report Explains ETH Struggles

Credit : www.newsbtc.com

This text is accessible in Spanish.

Ethereum (ETH) is at present going through important promoting stress and worry after dropping 23%, sending its value right down to a yearly low of $2,200. A significant concern for traders is the continued underperformance of ETH in comparison with Bitcoin, a pattern that has continued since September 2022. Since then, Ethereum has fallen 44% in opposition to Bitcoin.

Associated studying

This dramatic drop has led traders and merchants to query the explanations behind Ethereum’s struggles. A latest report from CryptoQuant offers some readability and factors out a number of elements that may affect ETH efficiency. As market members proceed to observe ETH’s actions, many are questioning if the asset can regain power or if extra downsides may be anticipated within the coming weeks.

Ethereum Uncovered: CryptoQuant Report Sheds Gentle

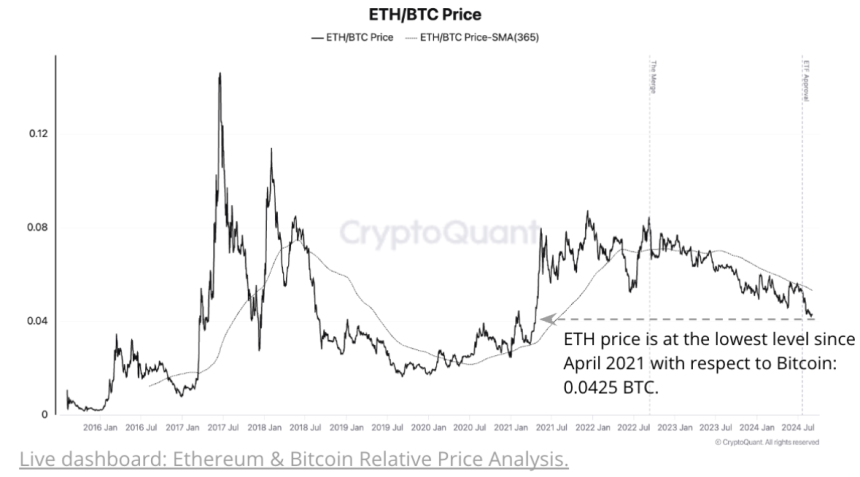

The latest one report from CryptoQuant offers readability on elements at present impacting Ethereum (ETH). Declining on-chain exercise, waning institutional curiosity and the disappointing efficiency of Ethereum ETFs in comparison with Bitcoin are among the many important elements contributing to Ethereum’s woes, with the ETH/BTC pair now at 0.0425, the bottom degree since April 2021.

Ethereum’s underperformance seems to be associated to weaker community exercise dynamics in comparison with Bitcoin. For instance, Ethereum’s total transaction charges have continued to say no, primarily on account of decrease charges following the Dencun improve. The relative variety of transactions has additionally fallen dramatically, from a document excessive of 27 in June 2021 to 11, one of many lowest ranges since July 2020.

Moreover, Ethereum’s provide dynamics don’t help a value enhance. Since early April, the whole provide of ETH has been steadily rising following the Dencun improve. The present provide stands at 120.323 million ETH, the best degree since Might 2023.

Associated studying

Moreover, merchants and traders have proven a transparent desire for Bitcoin over Ethereum, because the relative spot buying and selling quantity of ETH versus Bitcoin has fallen from 1.6 to 0.76 over the previous week. Ethereum’s value has traditionally risen in opposition to Bitcoin when buying and selling quantity outperforms Bitcoin.

Given these elements, Ethereum might proceed to underperform in comparison with Bitcoin for the foreseeable future.

ETH value motion

Ethereum (ETH) is at present buying and selling at $2,262, after a major 23% decline from its native highs. Volatility and uncertainty proceed to drive the market as ETH checks native demand close to annual lows of round $2,200.

The cryptocurrency stays effectively beneath the 4-hour 200 transferring common (MA) of $2,565, a vital indicator that normally indicators market power. For the bulls to regain management, it’s important that the value rises above this transferring common and challenges the native highs of $2,600.

Associated studying

Nevertheless, if Ethereum fails to carry the help on the yearly low of $2,200, the value is more likely to enter a deeper correction part, doubtlessly signaling the beginning of a bear market. This degree is essential for ETH’s near-term restoration as its loss might trigger additional promoting stress. Bulls have to recapture these key ranges to forestall ETH from falling into extended bearish territory.

Featured picture of Dall-E, chart from TradingView

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now