The crypto market continued its current carnage on Wednesday, November 12. Bitcoin (BTC) led the broader altcoin market in elevated promoting stress.

The entire cryptocurrency market cap fell 2%, hovering round $3.42 trillion on the time of writing. BTC value fell beneath $102,000 once more after bullish momentum failed to achieve traction.

Prime Causes Why Crypto Dropped Immediately

Low market demand amid notable fears of additional crypto capitulation

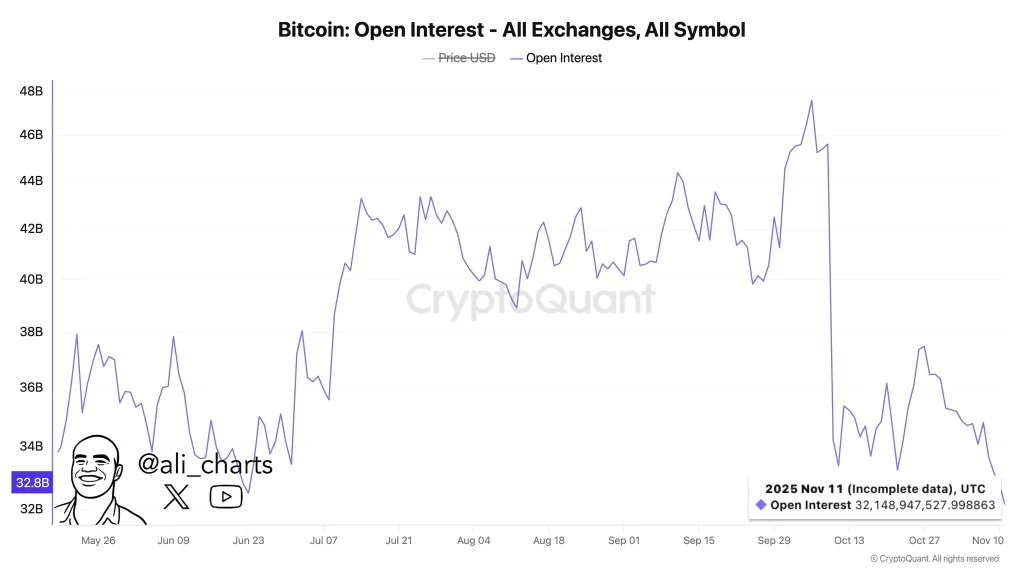

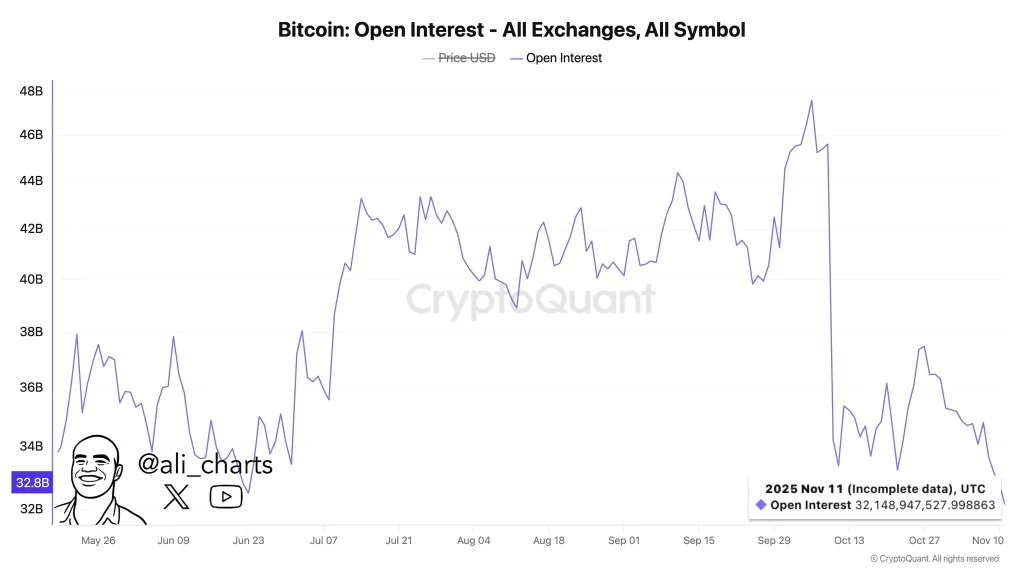

Total capital inflows into the crypto market have declined considerably within the current previous, as evidenced by the spot Bitcoin and Ethereum ETFs. It’s putting that the Open Curiosity (OI) of Bitcoin on all crypto exchanges has fallen to the bottom stage in seven months.

Supply: X

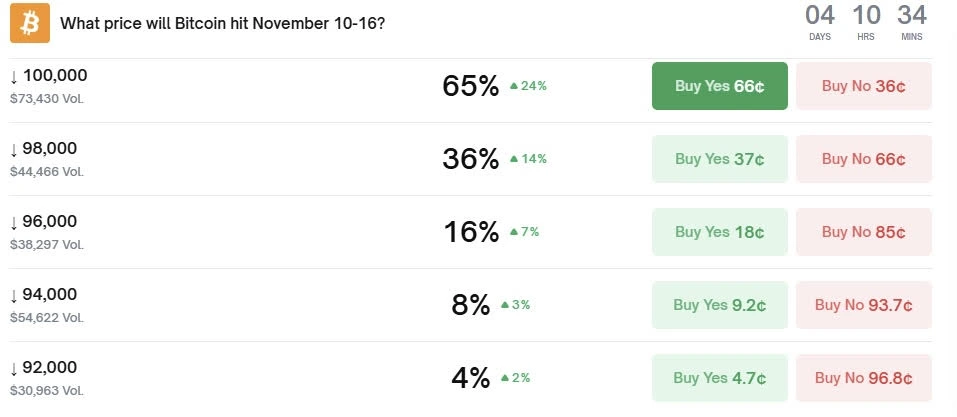

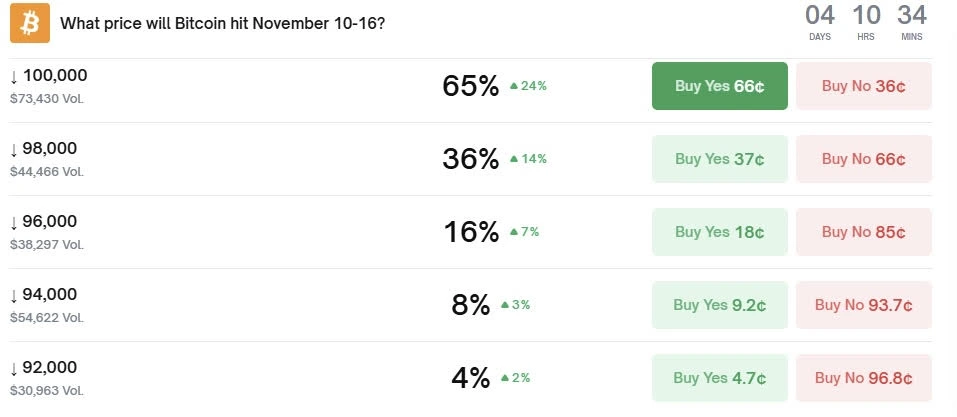

In the meantime, Polymarket merchants are betting that the Bitcoin value will proceed to fall additional within the coming days, presumably beneath $100,000.

Supply: Polymarkt

Heavy Liquidation of Lengthy Crypto Merchants Amid Fears of a Hyperliquid Assault

Following the broader crypto correction, greater than $612 million was raised from leveraged merchants, with roughly $502 million involving lengthy merchants. The crypto market was additionally gripped by fears of a doable assault on Hyperliquid, the most important DEX futures platform.

Technical headwinds from the impression of the sell-the-news ensuing from the US authorities reopening

Bitcoin value has despatched the broader altcoin market into bearish sentiment as gold traders get pleasure from extra earnings. Whereas the broader crypto market confirmed bearish sentiment over the previous 24 hours, gold costs rose 2% to commerce at round $4,200 per ounce on the time of writing.

The technical headwinds within the broader crypto market coincided with the US authorities’s reopening after a 40-day shutdown. Whereas the reopening of the US authorities is constructive for the financial system, the crypto market skilled a possible sell-the-news impression.

Is the bull market over?

The 2025 crypto bull market is prone to resume within the coming weeks, fueled by the Fed’s cash printing. Moreover, the gold value has doubtless peaked and is forming a macro double high, which is bullish for the broader crypto bull market.