Analysis

Why Long-Term Investors Aren’t Selling Despite Drop

Credit : coinpedia.org

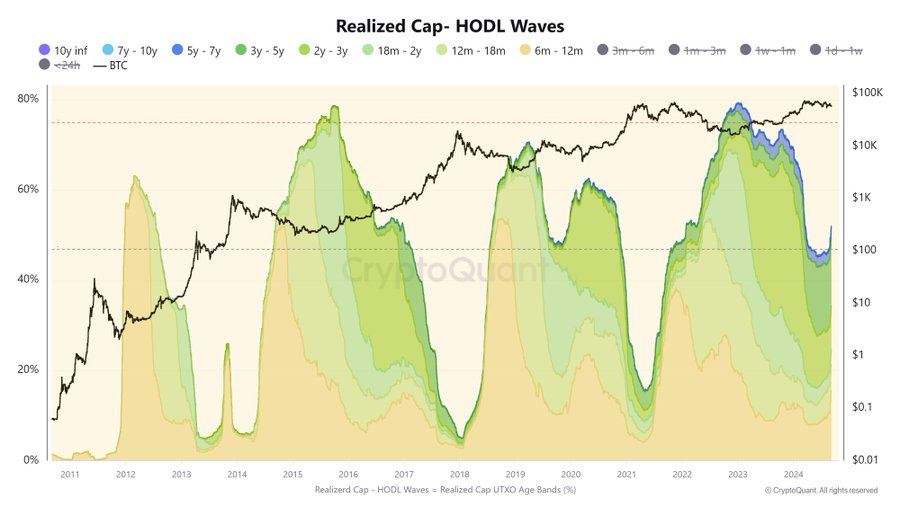

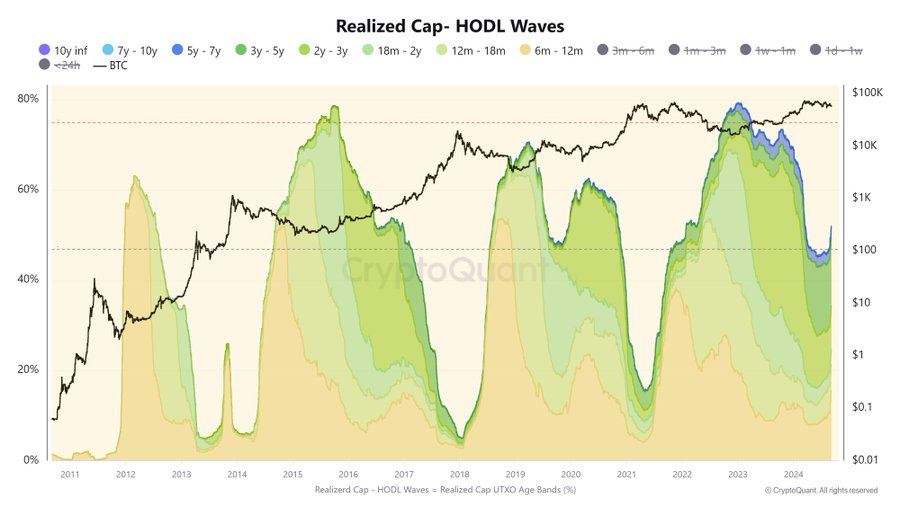

Bitcoin’s value simply hit a month-to-month low of $56,567.10. Within the final 24 hours alone, the value has fallen by greater than 6.2%. If issues proceed like this, the value will possible drop even additional. Lately, there have been studies of Bitcoin traders aggressively exiting the market within the quick time period. Have Bitcoin Traders Fully Misplaced Hope within the Market? Really, not many specialists suppose this manner. A realized Cap-HODL wave chart of Bitcoin, shared in X by Binhdangg, explains the opposite facet of the story very properly. Let’s dive in!

Market Conduct of Bitcoin Lengthy-Time period Holders: What the Chart Reveals

The chart, shared by the cryptocurrency professional on the X platform, exhibits that long-term Bitcoin holders are not concerned with promoting their belongings. What’s its implication? Lengthy-term homeowners at the moment contemplate it extra worthwhile to carry shares than to promote them. Is Bitcoin at the moment in a holding section? Perhaps! The graph definitely helps such an assumption. Plainly long-term merchants are extraordinarily assured in Bitcoin and count on a bull run out there quickly. It’s clear that skilled Bitcoin merchants now have a view of the market that’s the actual reverse of what the overall notion of the market is.

Bitcoin Present Sample Evaluation: What the Knowledgeable Says

The professional believes that the sample we at the moment are seeing in Bitcoin displays what was noticed between mid-2019 and mid-2020. If the present state of affairs could be interpreted as a interval of stability, value momentum is ready to occur within the Bitcoin market. At the least, that is what our previous experiences counsel.

What’s subsequent within the Bitcoin market

The professional predicts that the Bitcoin market will see main value momentum within the fourth quarter of this 12 months and the primary quarter of subsequent 12 months. He emphasizes the unpredictability of the market and factors out that actual market motion occurs when it’s least anticipated.

In conclusion, it’s the long-term merchants who will profit immensely from the Bitcoin market if the scenario develops as prompt by the professional.

Additionally learn: Bitcoin Selloff: Why Main Establishments Promote Bitcoin?

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now