Bitcoin

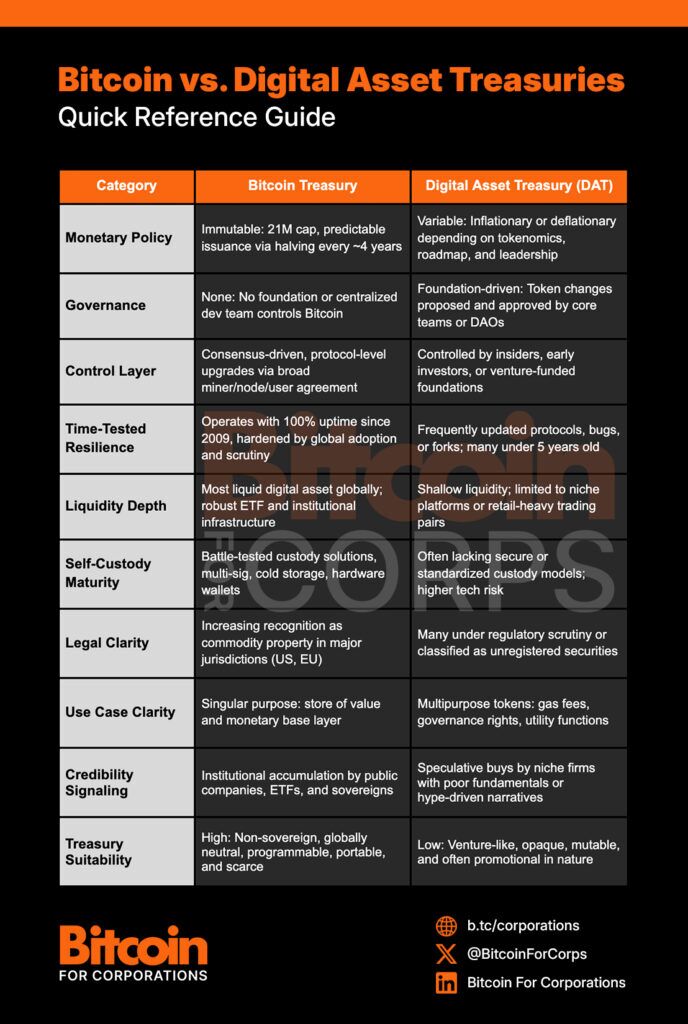

Why Only Bitcoin Belongs On Corporate Balance Sheets

Credit : bitcoinmagazine.com

1. The rise of the: a symptom of shallow idea

Since Bitcoin acceptance by public corporations accelerates, imitators are inevitable. The latest pattern? DATS – “Digital Asset Treasuries” – who attempt to replicate the success of Bitcoin Treasury corporations by assigning reserves to Altcoins corresponding to Ethereum or Dogecoin.

From the surface, the pitch at floor stage could appear comparable: to accumulate a digital property, transfer early, construct a treasury technique, Fairness or Dehttps: //BitcoinMagazine.com/bitcoinfor-cororations/how-bitcoin-ressces-risk-Danger-Danger-Danger-Danger-risk-risk-risk-risk-risk-treasury and reflexive-stromen. However the comparability collapses underneath the floor.

In latest months, varied corporations have taken the headlines to run that fashions:

- CleanCore Solutions Af 60% fell after unveiling a Dogecoin Treasury plan of $ 175 million.

- Bit Digital (BTBT) Bitcoin mining actions are demolished to grow to be an Ethereum-Allen-Inelendend and Treasury firm.

- Spirit Blockchain Capital And Dogecoin Money Inc. DOGE-Centric Treasury methods launched and misplaced greater than 70% YTD.

These actions usually are not solely dangerous – they reveal a basic misunderstanding about what makes Bitcoin uniquely appropriate to function an property of a treasury reserve.

2. Bitcoin is cash. Tokens are enterprise bets.

Bitcoin will not be a technical platform or a product trout map. It’s money-special constructed, impartial, leaderless and most conservative in its evolution. The principles are established in stone, the difficulty schedule of the difficulty is able to locked and the design fiercely resistant to alter.

Altcoins corresponding to Ethereum or Dogecoin, alternatively, are higher understood as a enterprise part software program initiatives that happen as cash. They’re:

- Ruled by foundations or small teams of core builders

- Topic to frequent, generally radical, protocol adjustments

- Actively managed to optimize for brand new place -acceptance, not for financial stability

- Intently linked to charismatic founders and basis capital buildings

From the attitude of the capital stewardship, that is the distinction between:

- Assign reserves to a sovereign, apolitical financial instrument

- Speculating concerning the long-term success of a know-how platform in VC model

One is specifically constructed for worth retention. The opposite is a proxy for the chance at an early stage.

3. Time horizon -inversion: Bitcoin strains, altcoins mismatch

The function of a enterprise treasury is to not chase the yield – it’s to keep up the shareholder worth and develop over a protracted period. Public corporations are rewarded for resilience, self-discipline and clear capital frameworks that maintain on Cycli.

Bitcoin’s design is linked to this. Reward the properties conviction in the middle of time:

- Provide has been established: 21 million, with situation halving each 4 years

- Market entry is worldwide and fixed: no trade hours or gatekeepers

- Liquidity is deepened over time because the adoption grows

- Volatility compresses over longer horizon

Altcoins flip this logic. She:

- The provision of supply by unlock schedules and protocol adjustments

- Transfer routine consensus fashions (e.g. ETHs swap to proof-of-stake)

- Rely upon speculative progress tales to keep up curiosity

- There isn’t a for predictable situation and improve paths

This mismatch creates pressure for treasury. The longer you maintain a token, the extra governance, implementation and regulatory danger you construct. It turns into harder – not simpler – to defend the allocation.

Bitcoin, alternatively, turns into simpler to justify over time. It’s the solely digital energetic the place deeper retention doesn’t scale back the chance – doesn’t enhance.

4. What might go incorrect: dangers to construct on Altcoin treasure containers

For public corporations, the capital technique should give precedence to sustainability, auditability and market confidence. Allocation to Altcoins introduces dangers which can be in distinction to these targets.

- Protocol unity: Tokens corresponding to Ethereum endure frequent technical upgrades that may introduce bugs, change financial system or expose validators to new types of slashing or MEV danger. Industrial restrictions require stability – no present protocol experiments.

- Governance and recording danger: Many altcoins are managed by foundations or small groups. Crucial protocol choices can mirror the pursuits of insiders or early traders, not lengthy -term holders. Corporations run the chance of being uncovered to governance forken, route map pivots or consensus drama.

- Regulatory uncertainty: Bitcoin is mostly acknowledged by American supervisors as a merchandise. Most Altcoins occupy a Turkier Authorized Territory – and lots of are actively investigated or awaiting lawsuits. A sudden classification corresponding to safety may cause compelled rejection, authorized fines or repute injury.

- Limitations for guardianship and infrastructure: Though Bitcoin advantages from grownup institutional detention options, many altcoins do not. Inserting contracts, packed tokens and defic -based storage layers add a sensible contract danger and scale back auditability. This weakens the steadiness as a substitute of strengthening it.

- Narrative vulnerability: When the worth valuation slows or reverses, the underlying thesis of an Altcoin Treasury typically deposits. With out financial primary ideas to fall again, the “strategic” story will likely be transferred to a speculative story and indicators, auditors and shareholders begin to ask arduous questions.

Constructing a enterprise treasury on high of tokens with malleable guidelines, weak settlement insurance coverage insurance policies and governance protection will not be daring – it’s reckless. Bitcoin will not be solely the exception as a result of it got here first, however as a result of the structure is the one one constructed to final for a very long time.

5. Bitcoin is the idea

Public corporations that take Bitcoin don’t make any guess on crypto. They improve the idea of their capital construction with an energetic that’s:

- Non-sovereign: Immune for political interference or financial de -based

- Finite: Coated at 21 million, with out centralized authority to explode the provide

- Verifiable: Each unit auditable, any unchanging transaction

- Accessible: Liquid and tradable in any vital jurisdiction

- Examined by the struggle: Greater than 15 years of working flawlessly with out rescue operations or downtime

Bitcoin’s uniqueness will not be ideological – it’s structural. And that construction is what it allows to function a contemporary steadiness anchor in a time of forex dratility, debt saturation and institutional mistrust.

Safeguard: This content material is written on behalf of Bitcoin for companies. This text is barely supposed for informative functions and might not be interpreted as an invite or request to accumulate, purchase or subscribe.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now