Bitcoin

Why the Latest Crash Could Start a Massive Bull Run

Credit : coinpedia.org

The crypto market simply suffered one of many sharpest shocks in months. Bitcoin briefly fell beneath $100,000, wiping out almost $2 billion in market worth inside hours. The sudden drop despatched worry rippling by the neighborhood.

However in response to monetary analyst Shanaka Anslem Pererathis panic may very well be the ultimate shakeout earlier than Bitcoin begins its bull run, a setup he calls the $6 trillion endgame.

A reset, not a collapse

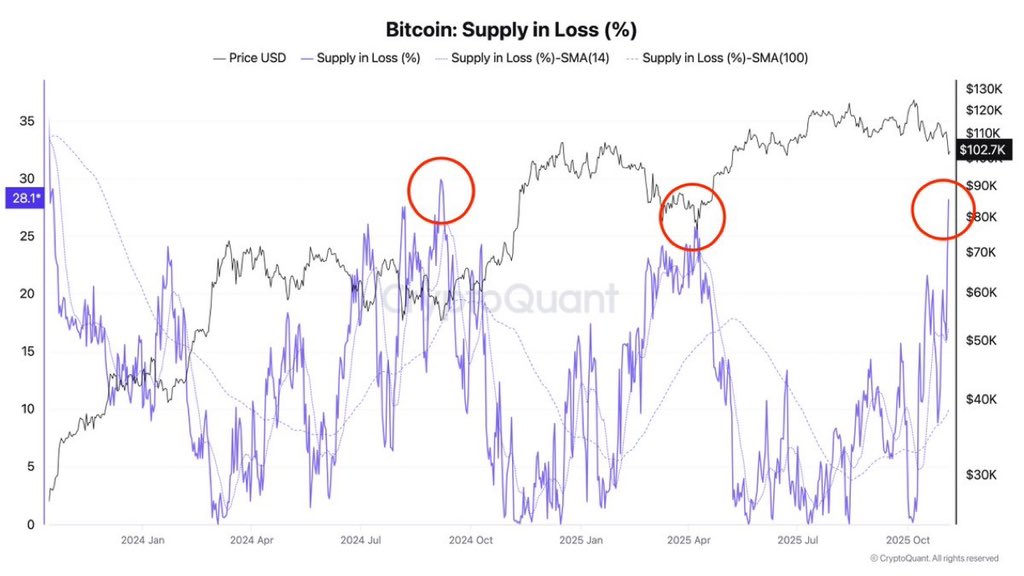

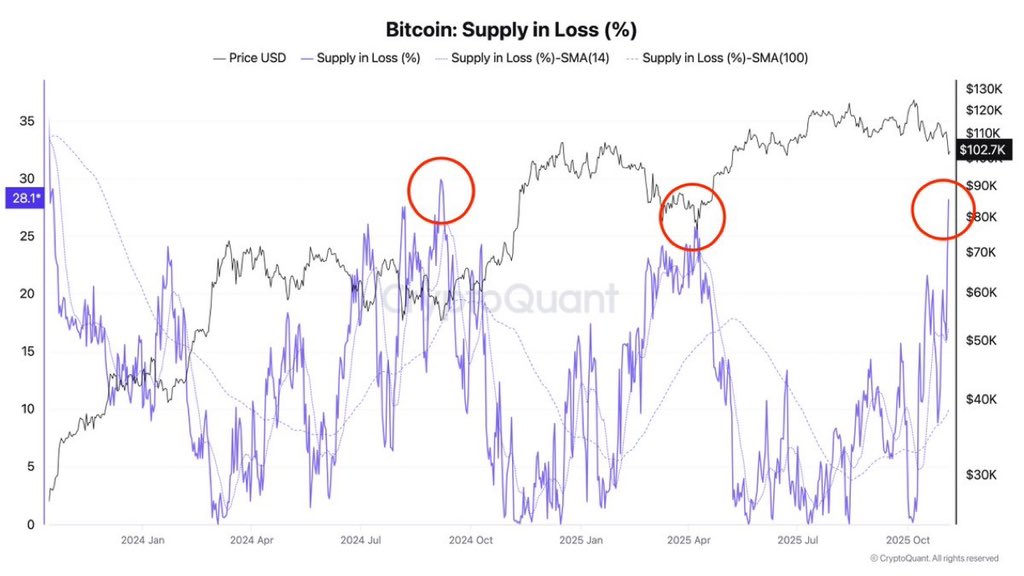

In response to on-chain knowledge, almost 29% of Bitcoin’s provide has now been misplaced, that means these cash have been bought at larger costs. Whereas which will sound bearish, Perera explains that it’s really the identical sign that appeared earlier than each main Bitcoin rally in historical past, together with 2017, 2021 and 2024.

Every time, Bitcoin adopted with features of 150% to 400% inside six months. This proportion represents what analysts name a “mid-cycle reset.” It is the purpose the place newer traders promote in worry whereas long-term holders quietly accumulate. It is not a collapse, it is a clean-up for the subsequent stage up.

Moreover, the analyst explains that whereas some platforms present greater than 97% of wallets in revenue, this doesn’t inform the total story.

Many of those wallets belong to early patrons who bought Bitcoin at a lot decrease costs. This makes the quantity seem larger than it really is, whereas many new traders really undergo losses, a state of affairs that usually happens earlier than main rallies.

The ‘$6 Trillion Endgame’

Perera means that the worldwide monetary system, with greater than $100 trillion in fiat cash (M2) in circulation, is regularly shifting in direction of scarce, onerous property like Bitcoin.

He calls this shift the “$6 trillion finish sport” as a result of he believes that trillions of {dollars} will ultimately transfer from conventional markets, bonds and money reserves to Bitcoin and crypto, doubtlessly making a multi-trillion greenback market cap for Bitcoin alone.

- Additionally learn:

- Crypto information right this moment [Live] Updates on November 6, 2025: Federal Authorities Shutdowns, Bitcoin Worth, Ripple Sewll 2025, XRP ETF, ETH/USD

- ,

Market Flush The panic vendor

Greater than $19 billion in leveraged positions have been just lately worn out, inflicting open curiosity to drop 42%. Now that the financing rate of interest is sort of zero, the overheated derivatives market has cooled down fully.

That is necessary as a result of it removes the ‘compelled sellers’, the merchants whose liquidations usually trigger chain reactions. The market is now what Perera describes as “sterilized and secure,” giving Bitcoin a stable basis for natural development.

Whales and establishments purchase quietly

As retail merchants panic, long-term holders now management about 70% of Bitcoin’s circulating provide, with no indicators of promoting off. In the meantime, establishments have been quietly accumulating by ETFs, with inflows of greater than $149 billion.

Even the availability of stablecoins, usually seen as “dry powder” to purchase, has elevated by $50 billion since July, all pointing to robust liquidity ready to return.

As soon as the sample performs out, Perera thinks the subsequent 180 days may very well be the beginning of Bitcoin’s subsequent bull run.

By no means miss a beat within the Crypto world!

Keep knowledgeable with breaking information, knowledgeable evaluation, and real-time updates on the most recent developments in Bitcoin, altcoins, DeFi, NFTs, and extra.

Often requested questions

Bitcoin fell as a result of heavy liquidations and investor panic, wiping out leverage and cooling the market after weeks of overheated buying and selling.

It is a section the place newer traders promote at a loss whereas long-term holders accumulate, a sample seen even earlier than main Bitcoin rallies of the previous.

It means that international capital may slowly shift from fiat and bonds to Bitcoin, doubtlessly pushing its market worth into multi-trillion territory.

Sure. ETFs proceed to see robust inflows, and long-term holders now personal nearly all of the availability, exhibiting confidence regardless of short-term volatility.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on all the pieces crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks could seem on our website. Advertisements are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now